- Cardano co-founder Charles Hoskinson has come out in support of ADA, arguing against those labeling it “dead.”

- Despite the support, ADA continued to decline and bearish market sentiment persisted.

Cardano (ADA) co-founder Charles Hoskinson has recently been involved in a heated debate with cryptocurrency analysts. It all started when cryptocurrency analyst Ben Armstrong claimed that Cardano was dead.

He claims in a YouTube video that ADA has indeed disappeared, adding that this time things are different and investors should not watch their investments take a hit.

He continued this discussion on his X (formerly Twitter) page, which sparked a backlash from other analysts and ADA holders.

Armstrong commented:

“I recently said that both $DOT and $ADA are dead to the institutions. Ultimately, they will lead to their death as legitimate investments. That doesn’t mean they won’t pump and deliver returns to investors in this bull market. They will. The returns will just be mediocre.”

The statement received widespread attention, with many stakeholders sharing conflicting views and others criticizing his analysis of the ADA’s prospects.

Responding to Ben, another cryptocurrency analyst, Dave, said:

“But that’s just your opinion, and I don’t think there’s any good reason for that right now. I haven’t seen any technical facts presented to support that view. What’s crazy is your opinion that institutions don’t care about 6.9 years of uptime.”

In addition to other analysts, one prominent figure who has criticized these remarks is Cardano co-founder Charles Hoskinson.

Hoskinson took to his official X page to argue that Armstrong’s position was flawed and against the core principles of cryptocurrency.

“I remember when the point of crypto was to replace institutions instead of acting as a redemption scene. I think I learned to play the banjo to make Ben happy.”

Ultimately, most investors and ADA holders agree that cryptocurrencies were not created to beg for institutional investment. Cryptocurrencies are intended to decentralize financial markets and belong to the people.

What does the price chart show?

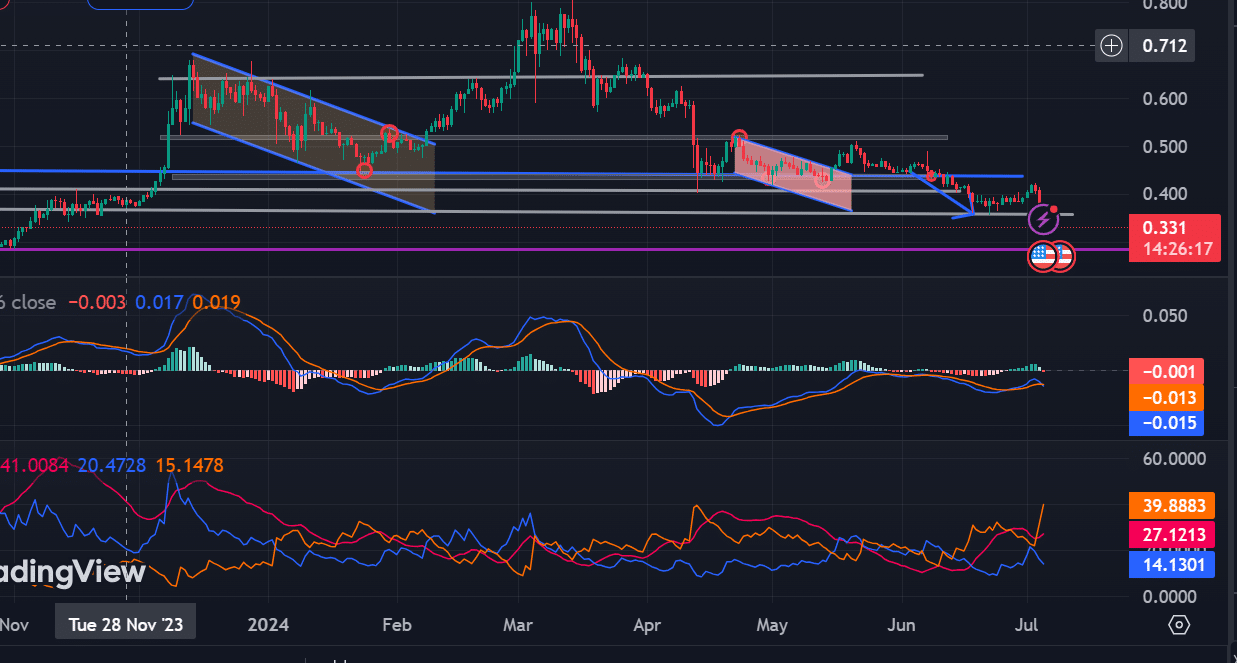

But how can we see ADA’s current trend on the price chart?

In particular, according to AMBCypto’s analysis, ADA was experiencing a strong downtrend. The MACD line also crossed below the signal line, which strongly confirmed the downtrend.

Source: TradingView

Likewise, the Directional Movement Index showed a continued downward trend with the positive index (14) being lower than the negative index (27).

Source: TradingView

Also, the RSI 29 is below the overheated selling zone of 30, which suggests that ADA is under extreme selling pressure.

Although oversold volume precedes a trend reversal, the altcoin may remain in oversold volume for an extended period of time.

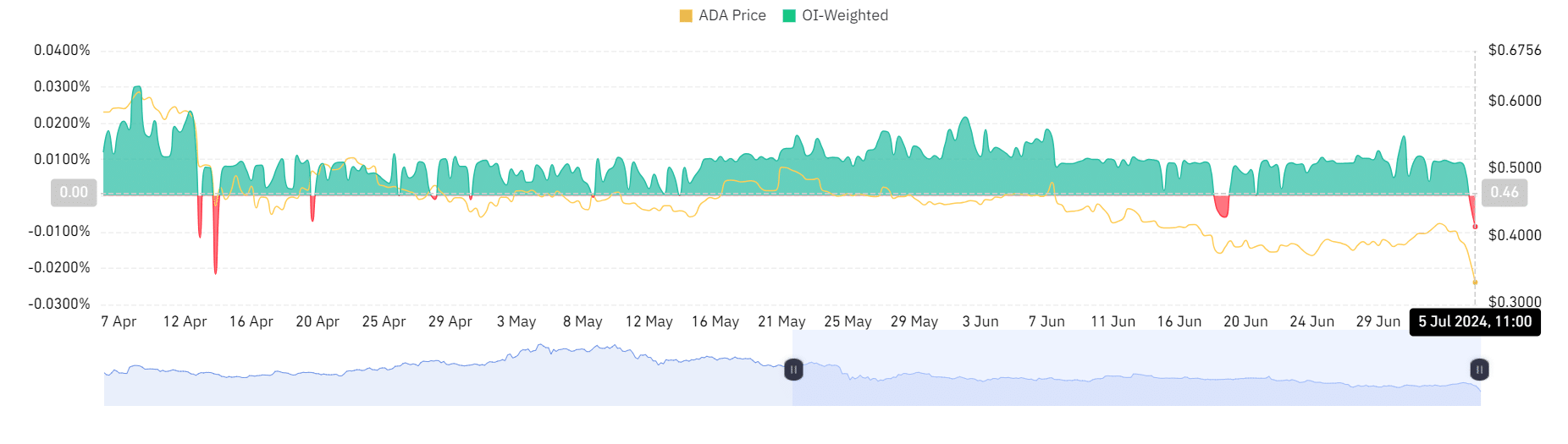

Source: Coinglass

Looking more closely, according to Coinglass, ADA had a negative Ol-Weighted Funding Rate of -0.0085%, which showed bearish sentiment as various investors were looking to short the altcoin in anticipation of further declines.

Source: Santiment

Finally, ADA’s open interest per exchange has decreased from $64 million to $55 million over the last 24 hours, indicating a decrease in interest and lack of enthusiasm as investors appear to be unsure about ADA.

Is your portfolio green? Check out our ADA yield calculator

Can Cardano Recover?

At the time of writing, ADA was trading at $0.3266 after a 24-hour drop of 17.23%. It was also down 15.33% over the last 7 days.

If the downtrend continues, ADA will fall to a new support level around $0.290. Since oversold conditions precede a bounce, a reversal will likely lead to a return to the previous support level around $0.368.