- The daily volume indicator showed that the sales pressure is not overwhelming.

- Cardano did not guarantee that it popped out of the lowest point, and traders should be careful about the price movement of the BTC.

Cardano (ADA) faced rejection in the $ 0.75- $ 0.76 region before the press time. Bitcoin (BTC) decreased 2.38% over 7 hours, reducing ADA by 4.68%. According to the initial report, the price response in the $ 0.8 resistance area will be said.

The bull was rejected before the BTC witnessed the volatility of the weekend. But the higher the bias was maintained.

As long as the range formed, ADA investors had a chance to buy with clear and nearly invalidation.

Cardano bulls time to bid for deep

Source: There is/USDT in TradingView

Market sentiment was shot. Fear and greed index were afraid of 30 years old. It showed fearful feelings throughout March.

According to recent online activities and price behaviors, the ADA can struggle to maintain $ 0.6 support. However, in the case of a swing trader, the risk ratio seems to be advantageous.

The Low range, which is emphasized at $ 0.682, is located at $ 0.58 with a recent fluidity of ADA. This can potentially lower prices.

Nevertheless, last week’s minimum $ 0.647 offers a chance for a long entrance, 3% -5% compared to this level. This opportunity is caused by the lack of significant weakness in the joining of low -range support and technical indicators.

At the time of writing, the A/D line has regained profits since early March, but did not collide below the local low. Similarly, the CMF was in the neutral territory, and capital leaks were important according to the indicators.

The amazing oscillator also showed weak weak momentum. All of these factors have a price bounce candidate for $ 0.65- $ 0.68.

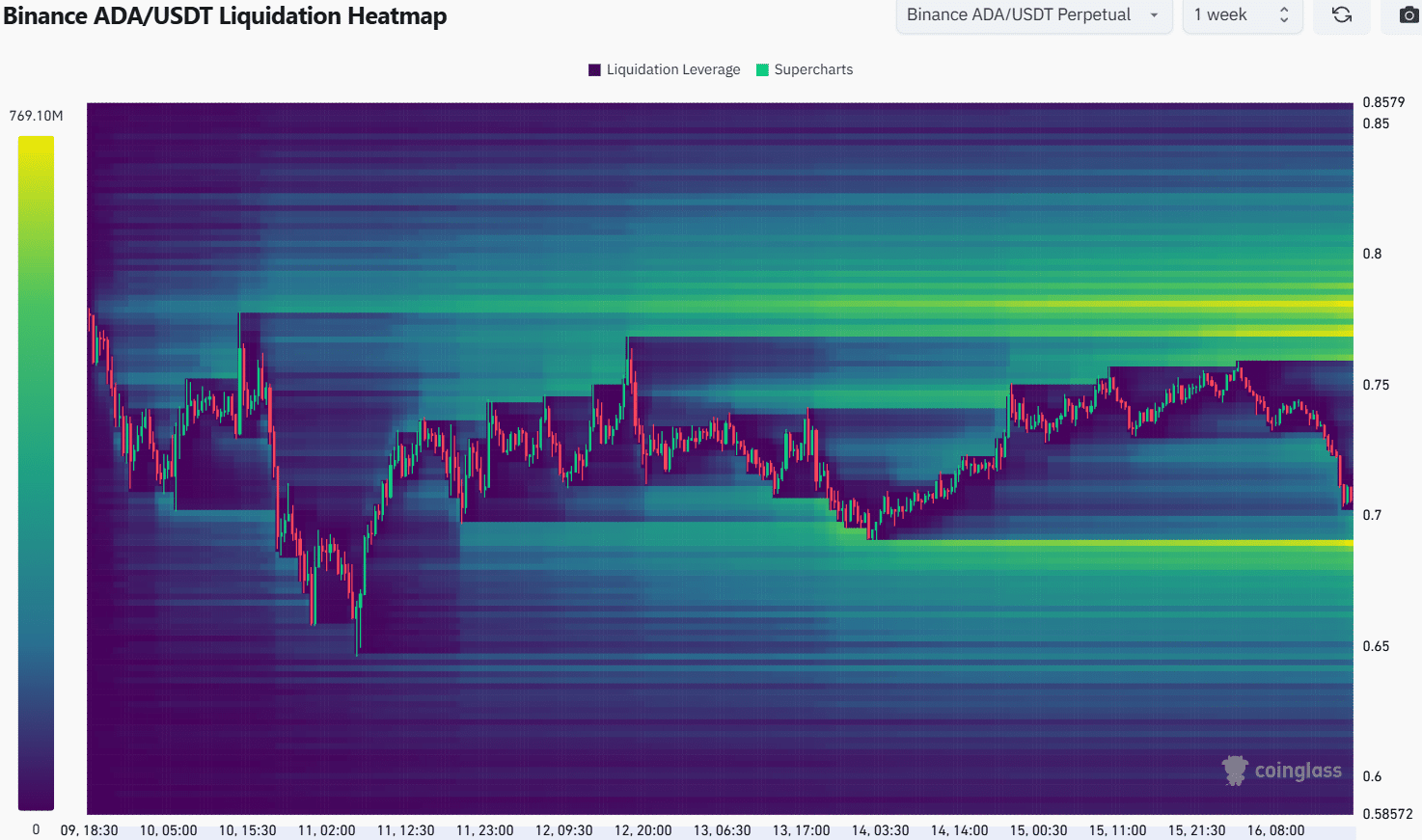

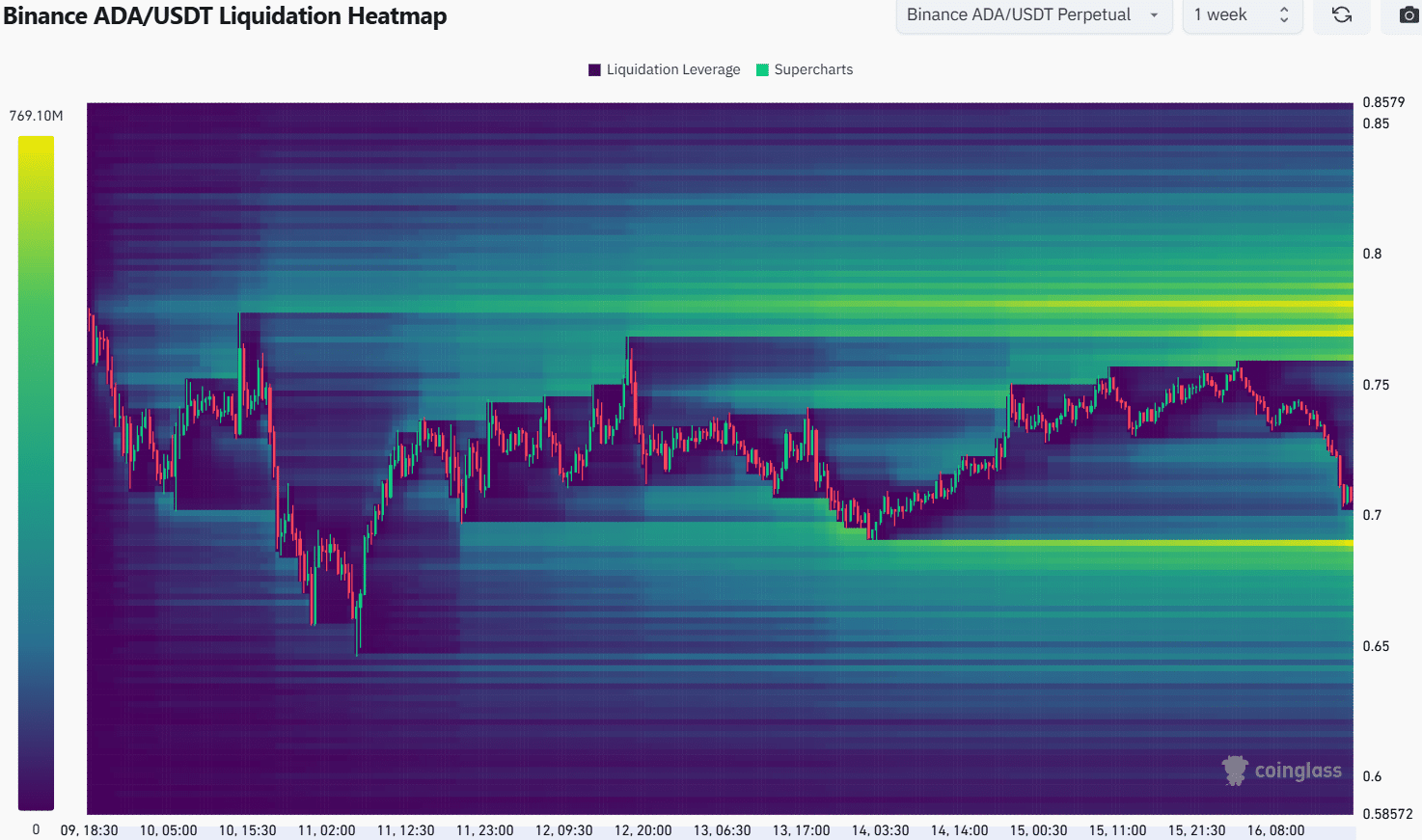

Source: COINGLASS

For one week, the liquidation heat map showed that the lowest level of $ 0.68- $ 0.69 is a liquidity pocket near the price. The price was likely to be lower before the price bounce.

But it was not guaranteed that Cardano would pop out here. It will rely greatly on the BTC trend within the next 24-48 hours.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.