- Cardano fell 17% in 7 days as its bearish trend deepened.

- The network recorded a decline in DeFi TVL and active addresses, triggering the decline.

Earlier this month, Cardano (ADA) Market capitalization exceeded $40 billion for the first time since 2022. This growth came amid a massive rally that pushed ADA to a multi-year high of $1.32.

Cardano’s rally has since cooled, considering it was trading at $1.02 at press time, down 17% in seven days. The market capitalization also fell to $35 billion. This bearish reversal can be attributed to several factors.

Cardano’s DeFi TVL falls from all-time highs.

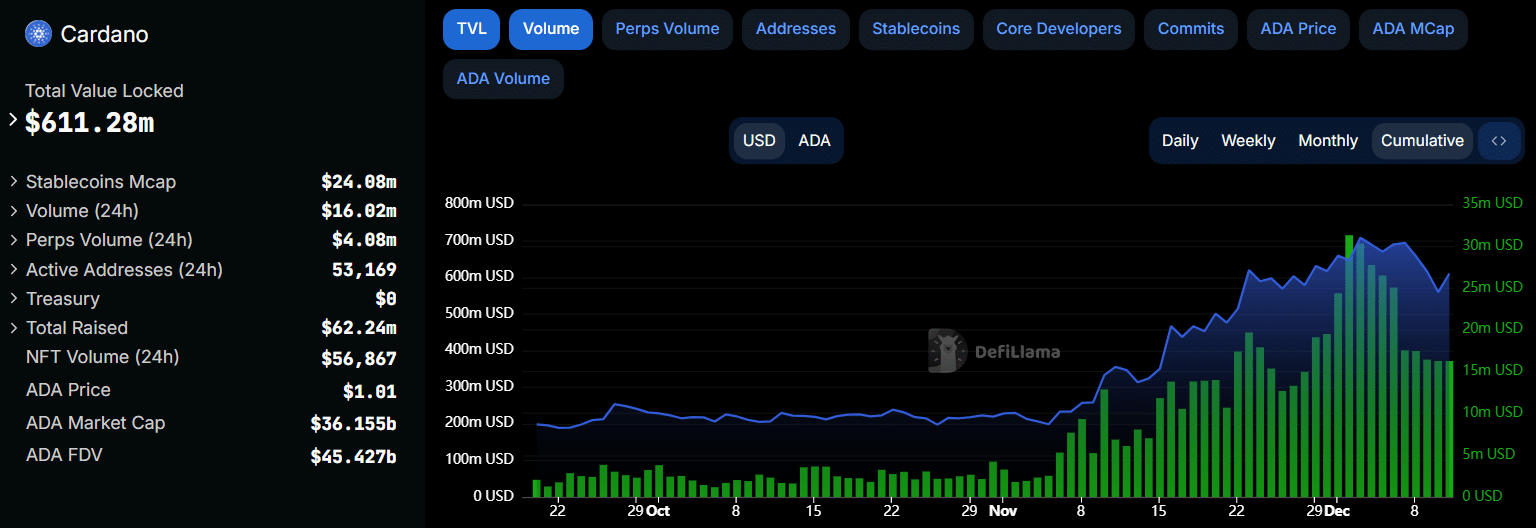

Cardano’s decentralized finance (DeFi) Total Value Locked (TVL) hit an all-time high of $708 million on December 3, coinciding with ADA hitting a multi-year high. sugar DeFiLlamaThis TVL has since fallen sharply in price to $611 million.

Cardano’s DeFi trading volume also decreased from a peak of $31 million to $16 million, indicating a decline in network usage in the DeFi sector.

Source: DeFiLlama

Cardano’s largest DeFi protocol is the Liqwid lending platform, which saw its TVL decline by 16% in one week. Minswap decentralized exchange (DEX) also recorded a similar decline.

Looking at past trends, ADA’s rallies tend to coincide with increases in DeFi activity. Therefore, as usage declines, the price outlook may continue to weaken.

Active addresses hit weekly low.

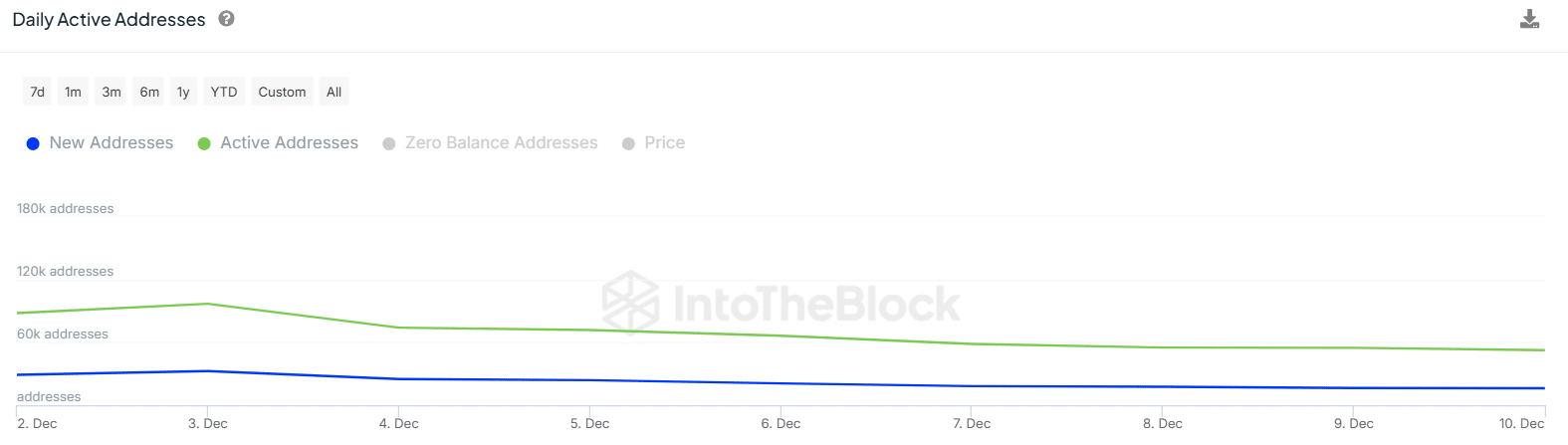

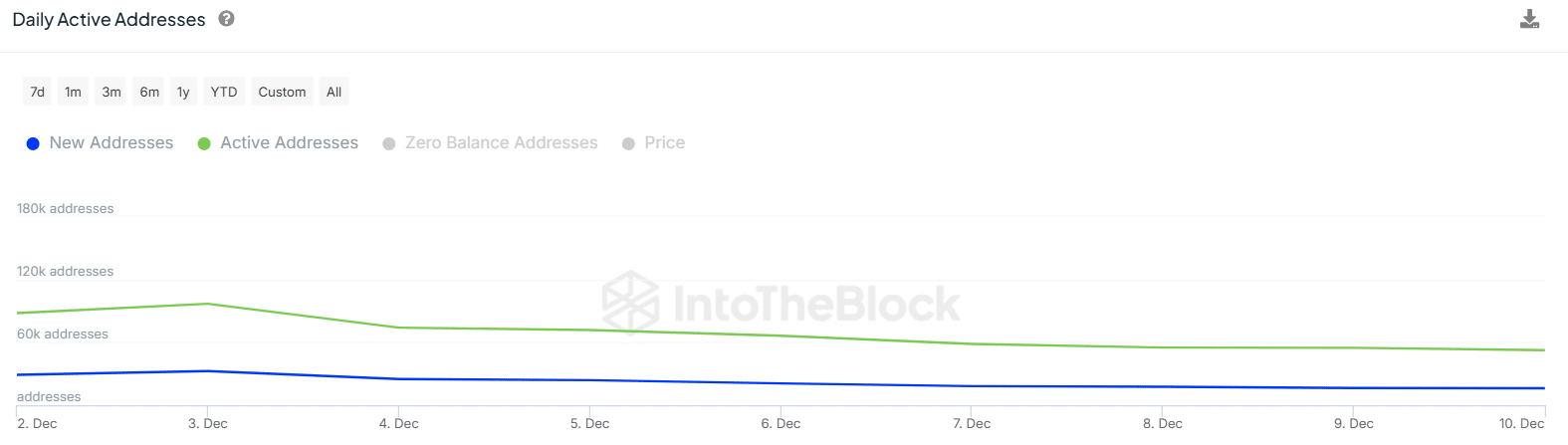

Usage on the Cardano network has also decreased significantly, with the number of daily active addresses falling to its lowest level in seven days.

In just one week, Cardano’s active addresses fell 45%, from 96,740 to 52,380, according to data from IntoTheBlock. New addresses created on the network recorded a similar decline, from 32,590 to 16,190.

Source: IntoTheBlock

A decline in active addresses is a sign of declining interest in ADA and weak demand. This also indicates that investor confidence may be declining, leading to bearish sentiment.

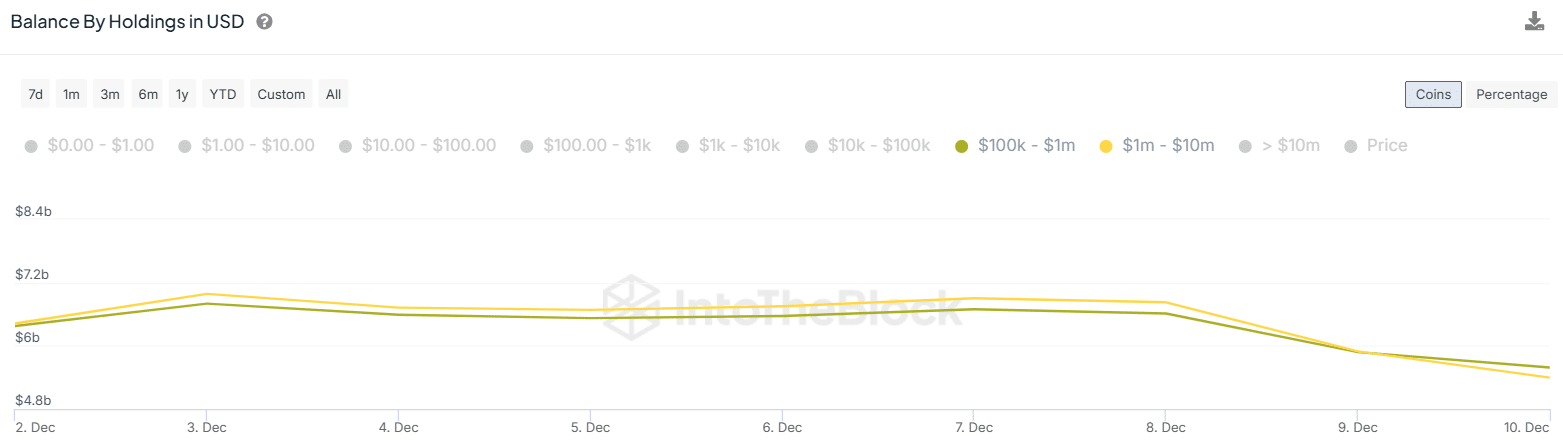

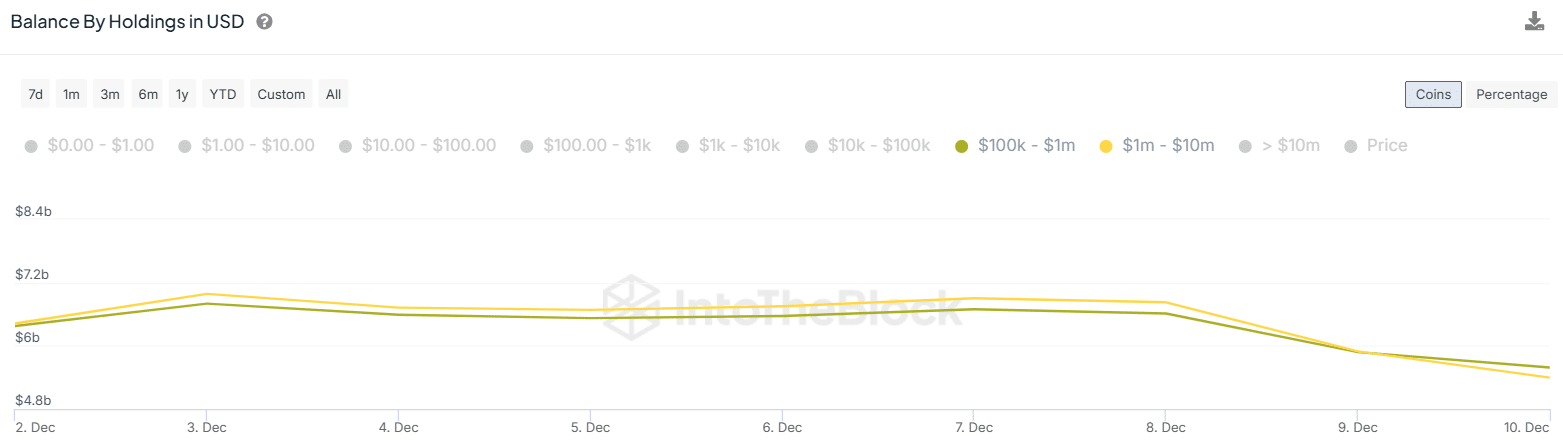

Cardano whale balance falls

Large Cardano addresses may see their holdings significantly reduced per IntoTheBlock, forcing whales into the distribution phase.

The balance of addresses holding between $100,000 and $1 million worth of ADA decreased from $6.61 billion to $5.59 billion.

At the same time, addresses holding between $1 million and $10 million in tokens also saw their holdings fall by more than $1 billion.

Source: IntoTheBlock

This decline does not necessarily mean whales are selling. Instead, this means that the value of the assets held may fall, leading to profit-taking activities.

Realistic or not, the market cap of ADA in BTC terms is:

Can ADA break out of this bearish trend?

If the Cardano network fails to record an increase in activity, ADA may continue its bearish trend. Moreover, the downtrend can accelerate if there is not enough new demand to absorb the coins sold by traders trying to minimize their losses.

Traders should watch for increases in active addresses, DeFi activity, and whale accumulation. This is because it may precede an upward recovery. Moreover, a recovery in the broader market may support a bullish reversal in ADA.