Cardano (ADA), which has seen a remarkable rise of over 150% in 2023, broke its annual high by hitting a second high of $0.67 last month.

Notably, this increase coincides with an impressive increase in important Cardano ecosystem components. Leading decentralized exchange (DEX) Minswap witnessed an incredible 26,000% increase and attracted a significant influx of new users.

Cardano, the 8th largest cryptocurrency by daily market cap and currently trading at $0.61, is now showing bullish signs. The digital currency’s trajectory indicates that a retest of the dollar threshold could occur soon, despite a modest growth of 1.28% over the past week.

Monthly stats are here!

highlight

Volume this month increased BIG (+166.80%) to $300 million. $ snack and $ break.

Actual return rewards of 252,963 $ADA to distribute to $MIN Stakers (2.5x last month!)

$MIN Daily emissions decreased by 5%. pic.twitter.com/ji54mF3jNE

— Minswap Labs (@MinswapDEX) January 1, 2024

Renowned analyst Dan Gambriello highlights how Cardano has made significant profits by relying on the dynamics of the Bitcoin market. He points out that ADA has emerged from an important symmetrical triangle and suggests $0.80 as a possible target.

Despite these optimistic predictions, he cautions about the barriers presented by the 200-week moving average, which could either be a hindrance or a reassuring factor in Cardano’s upward journey.

Cardano faces resistance and the struggle continues

According to cryptocurrency expert LuckSide, Cardano’s critical resistance zone is between $0.60 and $0.67. There are two situations that can occur: It is likely to increase to $0.70 or decrease to $0.40.

Despite regulatory hurdles such as monitoring by the SEC, analysts continue to make optimistic predictions for Cardano in 2024.

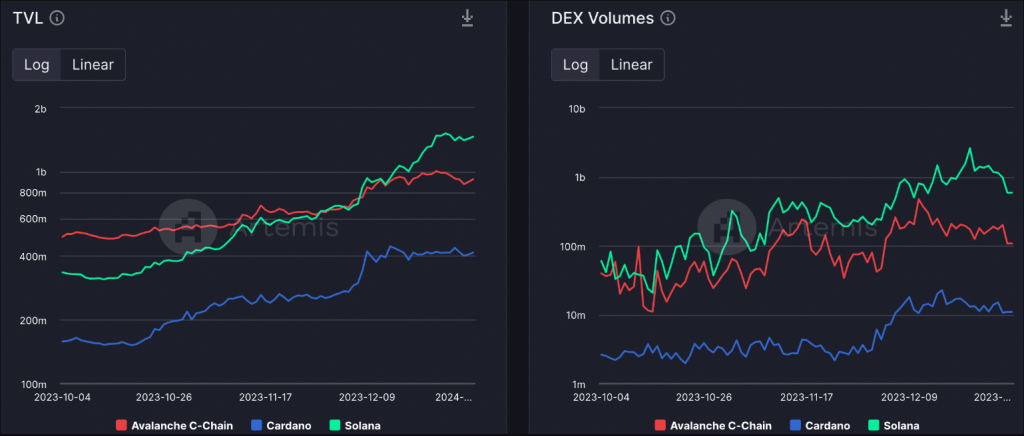

Meanwhile, when comparing Total Value Locked (TVL) and Decentralized Exchange (DEX) trading volumes, we find that Cardano lags behind major platforms such as Solana (SOL) and Avalanche (AVAX).

Despite a significant increase in TVL and DEX trading volumes in recent months, Cardano continues to face the challenge of achieving parity with other layer 1 blockchains. Although progress has been made, there remains ongoing work to reach similar levels in the Cardano ecosystem.

According to the Total Value Locked (TVL) chart, Avalanche C-Chain has the highest TVL, followed by Solana and Cardano. However, all three blockchains have seen their TVL increase in recent months. Cardano’s TVL grew the most from approximately 200 million on October 4, 2023 to approximately 800 million on January 1, 2024.

DEX volume charts show similar patterns. Avalanche C-Chain has the highest DEX volume, followed by Solana and Cardano. However, the increase in DEX trading volume was less pronounced than the increase in TVL. Cardano’s DEX trading volume increased from approximately 10 million on October 4, 2023 to approximately 40 million on January 1, 2024.

Overall, the chart shows that Cardano’s TVL and DEX trading volumes have increased in recent months, but still lag those of Avalanche C-Chain and Solana. This means that Cardano is still making progress in the DeFi space, but has not yet caught up with its competitors.

Cardano (ADA) Price Analysis

The current price action of Cardano (ADA) is supported by an upward trend line. If a collapse occurs, it will give buyers who have been waiting an opportunity to raise more money. However, a breakout over a serious hurdle could push ADA to higher levels.

Cardano’s sloping trendline indicates that buyers stepped in to prevent a serious collapse as the price fell towards the trendline.

A break below the trendline could signal a bearish period for Cardano, potentially leading to further declines. This could be an entry point for “side buyers” who have not yet purchased ADA to accumulate coins at a discounted price.

Conversely, a break through a major hurdle could lead to a surge in buying pressure, sending Cardano’s price higher. It is important to identify this major obstacle on the chart to understand the potential upside.

Featured image from iStock