- At the time of writing, Cardano was range bound but overcame significant resistance in the short term.

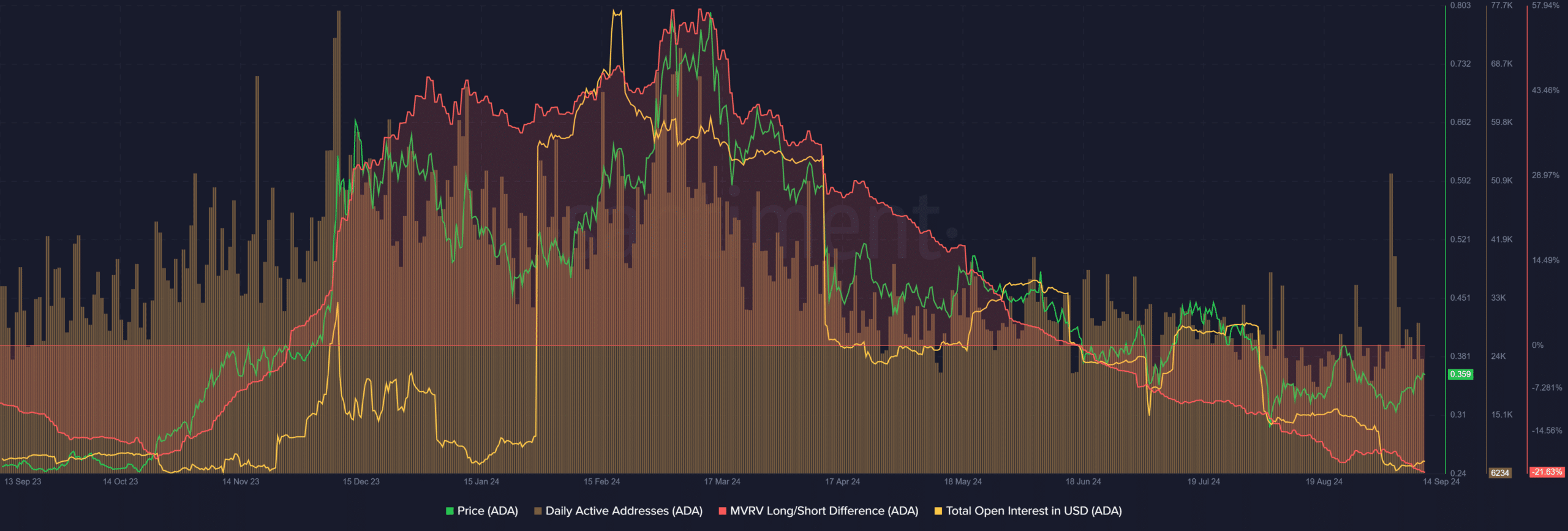

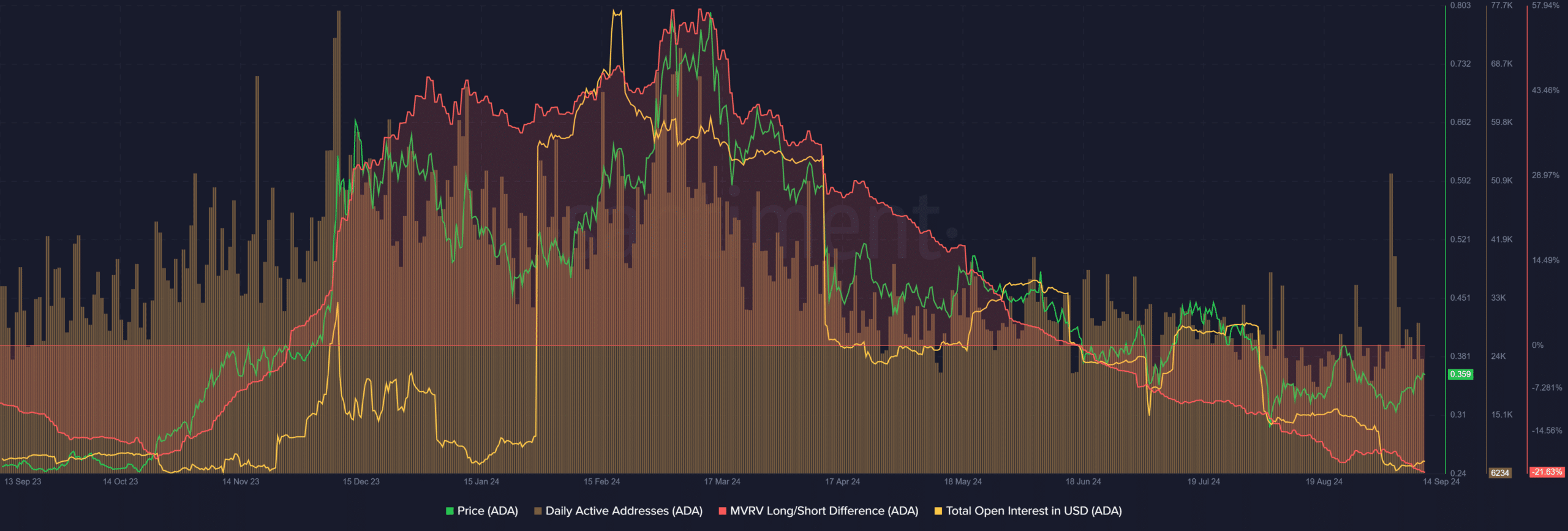

- Despite the downward price trend since April, daily active addresses have remained well maintained.

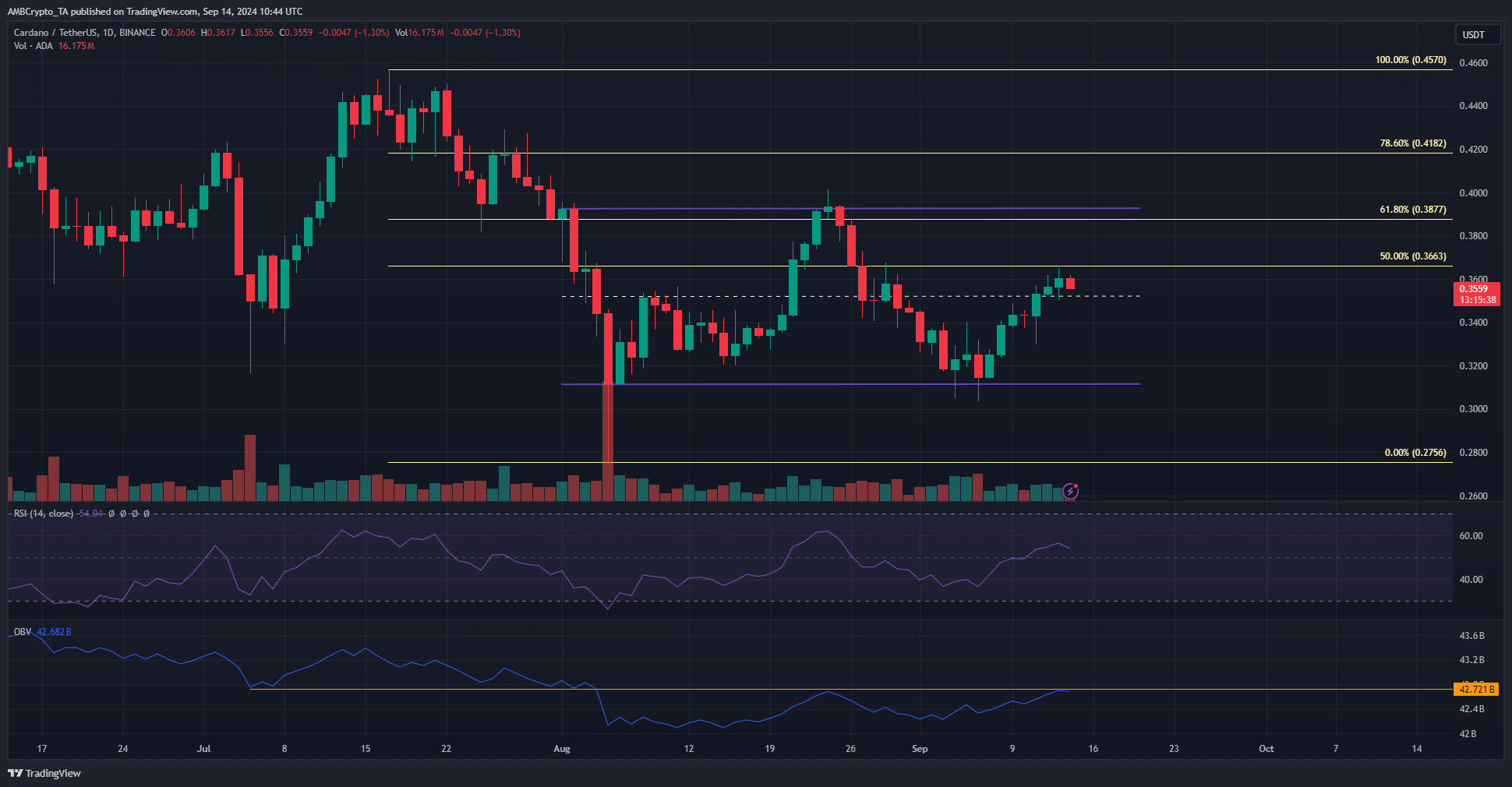

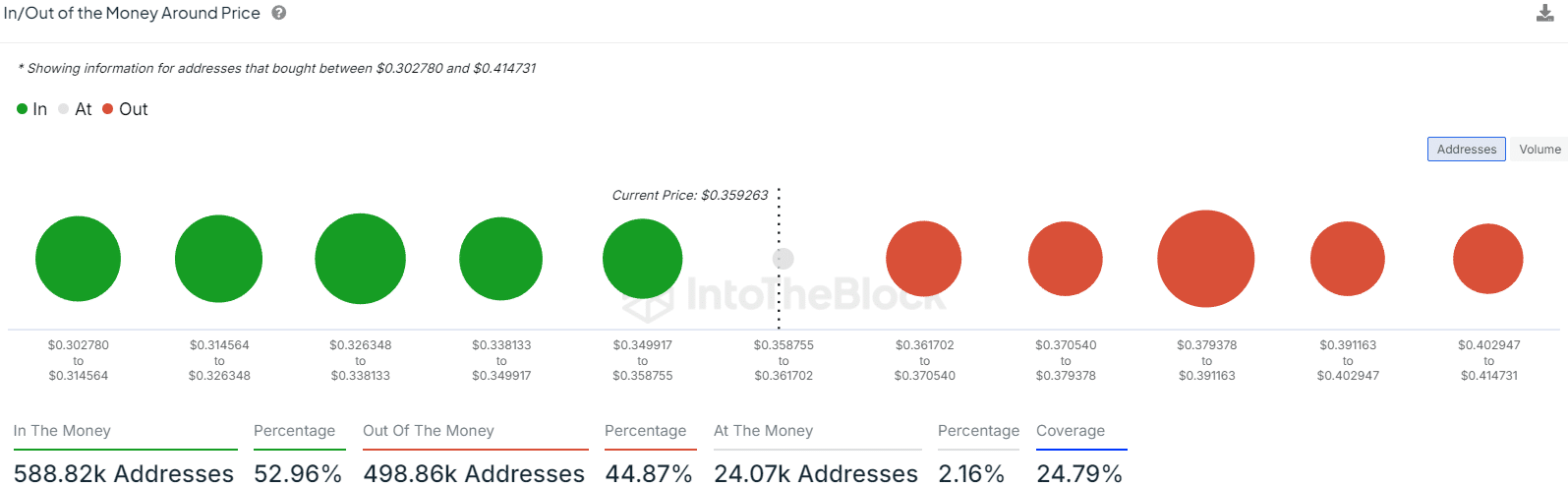

A previous report stated that 76.59% of Cardano (ADA) holders lost money. This statistic looks healthier when looking at holders around the market price at the time of writing.

Source: IntoTheBlock

The +0.86 correlation to Bitcoin (BTC) means that ADA traders should also pay attention to the king coin. The correlation with Ethereum (ETH) is positive but weak, which is slightly good news since ETH has been underperforming recently.

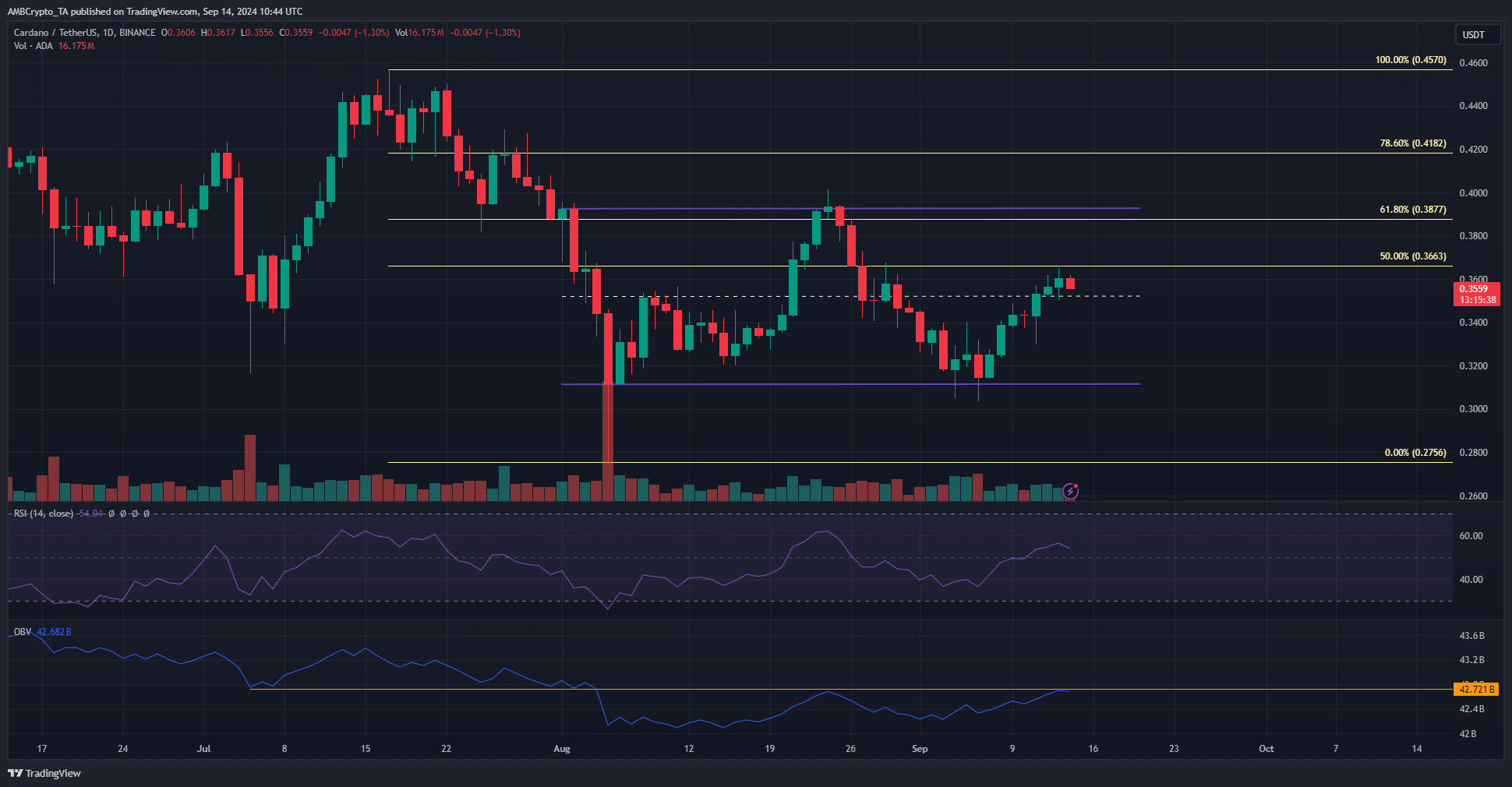

Overview of Cardano’s Key Levels

Source: ADA/USDT on TradingView

Cardano’s price action has also been uninspiring lately, with a range formation of $0.311-$0.393 in play since early August. The middle range level of $0.352 was broken a few days ago, and bulls could defend the retest as support.

OBV has been trending up slowly over the past month and seems to be on the verge of making a new high. The daily RSI has also signaled a bullish turn in momentum. Therefore, ADA traders can expect a rally to $0.39-$0.4 on the chart.

Source: IntoTheBlock

Looking at the entry/exit statistics around the price, $0.326-$0.338 and $0.35-$0.358 are the major short-term support zones. Meanwhile, $0.379-$0.391 levels are the tight supply zones. These results are in pretty good agreement with the price action chart.

On-chain indicators show a potential market bottom.

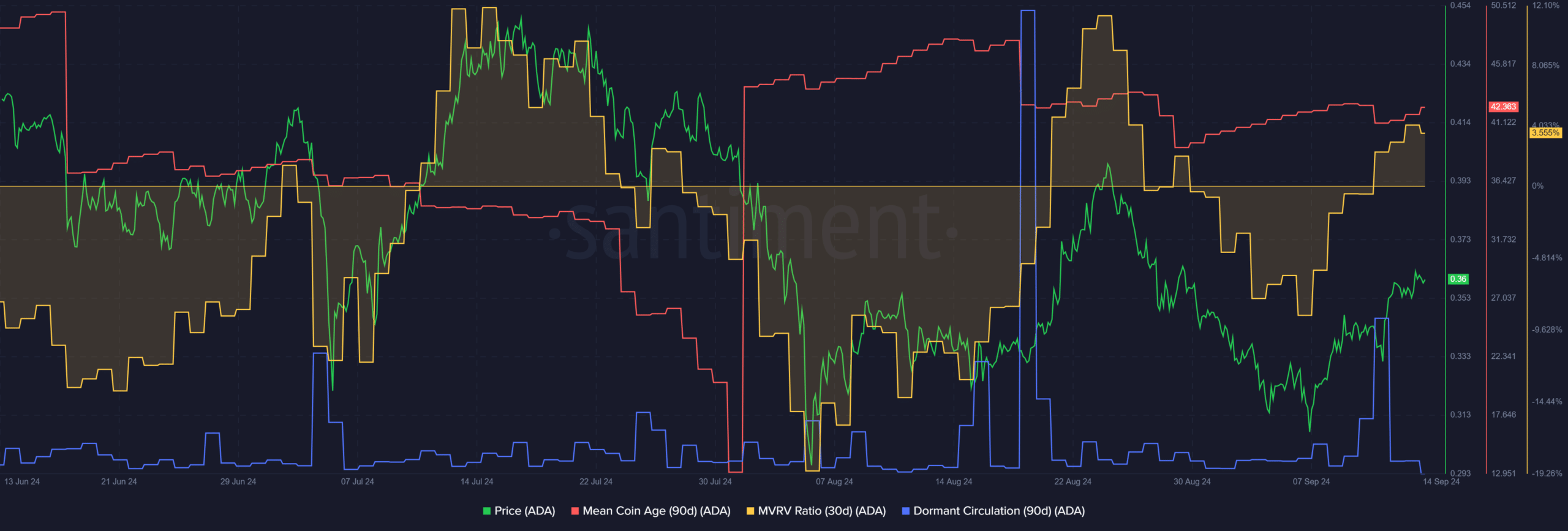

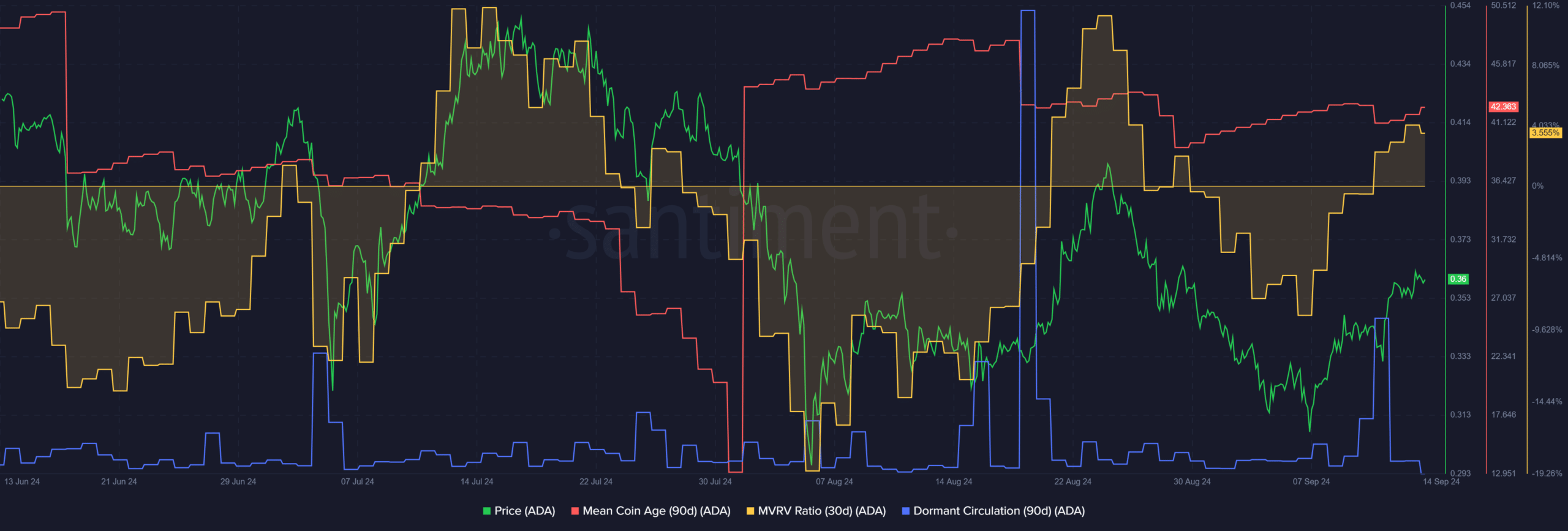

Source: Santiment

The MVRV long/short difference is the difference between the 365-day MVRV and the 60-day MVRV. Therefore, a negative value means that long-term holders have suffered greater losses than short-term holders.

This indicator has fallen below the low set in October 2023, meaning that a potential market bottom for Cardano may now be in progress. At the same time, the daily active addresses indicator has remained relatively stable since April, despite the downward price trend.

In short, if market sentiment and price trends turn bullish, there is a possibility that network participation will increase. Also, the declining open interest shows that speculators are not yet convinced of a strong rally.

Source: Santiment

While Cardano may be near the bottom of the market in the long term, the token could be interpreted as slightly overvalued in the short term. At the time of writing, the 30-day MVRV was positive, indicating that there may be selling pressure due to profit-taking.

Is your portfolio green? Check out the Cardano Profit Calculator

Also, the average coin age has not shown any significant trend, but has been increasing over the past three weeks. There was a short-term price drop on September 11 due to a surge in dormant circulation, but ADA recovered quickly thereafter.