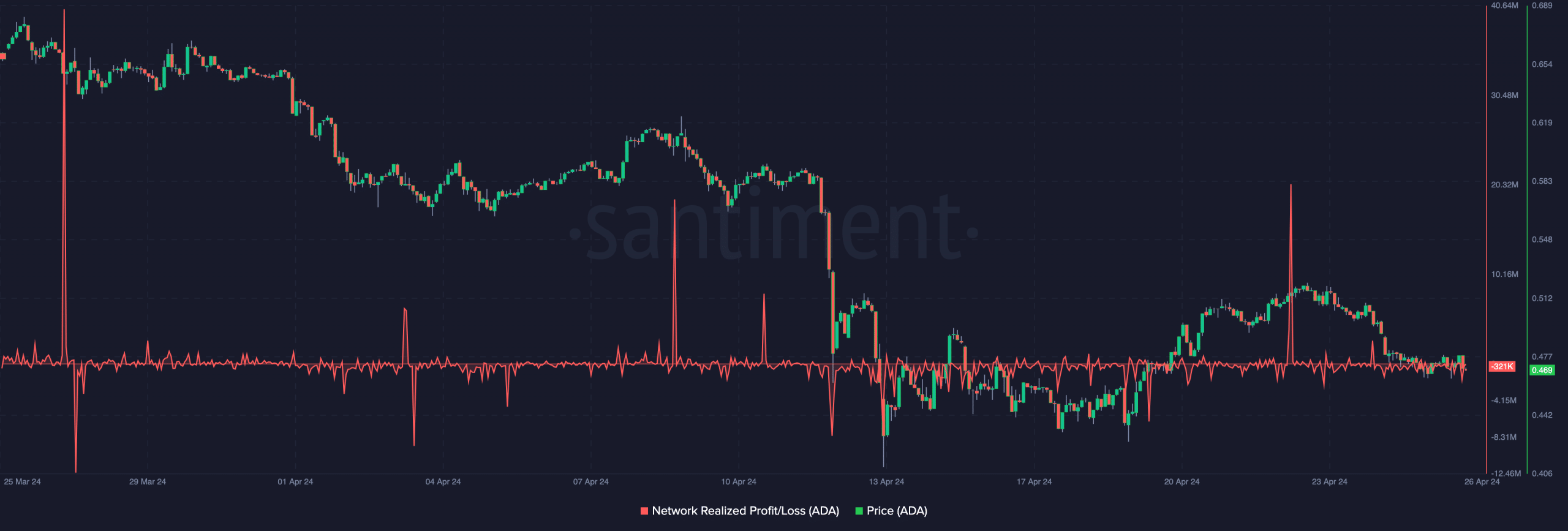

- Since April 22, almost all ADA trades have recorded realized losses.

- Cryptocurrency items ranged from $0.40 to $0.44.

AMBCrypto confirmed that participants suffered losses on almost every Cardano (ADA) transaction this week. Before coming to this conclusion, we looked at the network realized profits/losses.

This metric measures the USD value of profits or other transactions within a specific time period. According to our analysis, the last time the ADA made a significant payment to participants was on April 22. At the time, there was no need to sell $19.78 million worth of tokens at a loss.

However, as of this writing, $321,000 worth of ADA tokens have realized losses over the past month. This action is a reflection of the cryptocurrency’s price action.

Source: Santiment

I have no money now

5 days ago the price of Cardano was $0.52. At press time, its value had decreased to $0.46, indicating that it has been difficult to make money through spot trading of the token.

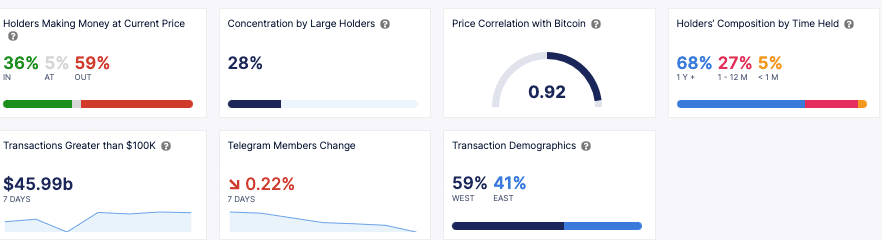

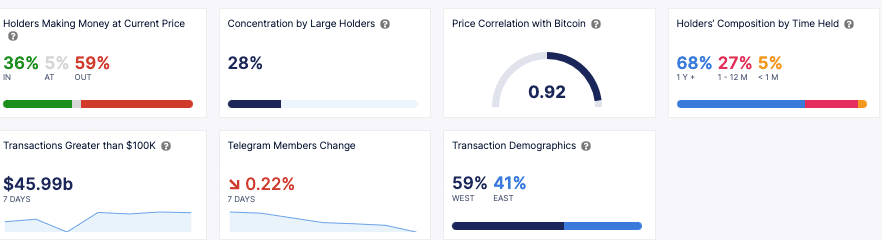

But short-term holders aren’t the only ones affected by the ADA move. A few weeks ago, less than 50% of holders suffered losses. According to press time data from IntoTheBlock, 59% of all holders lost money.

On a broader scale, this could present a buying opportunity given that many holders may not want to liquidate their holdings without a profit.

This could lead to further accumulation, which could give Cardano a potential upside. On the other hand, if some of the holders decide to forfeit what is left, the price of ADA could fall to $0.44.

Source: IntoTheBlock

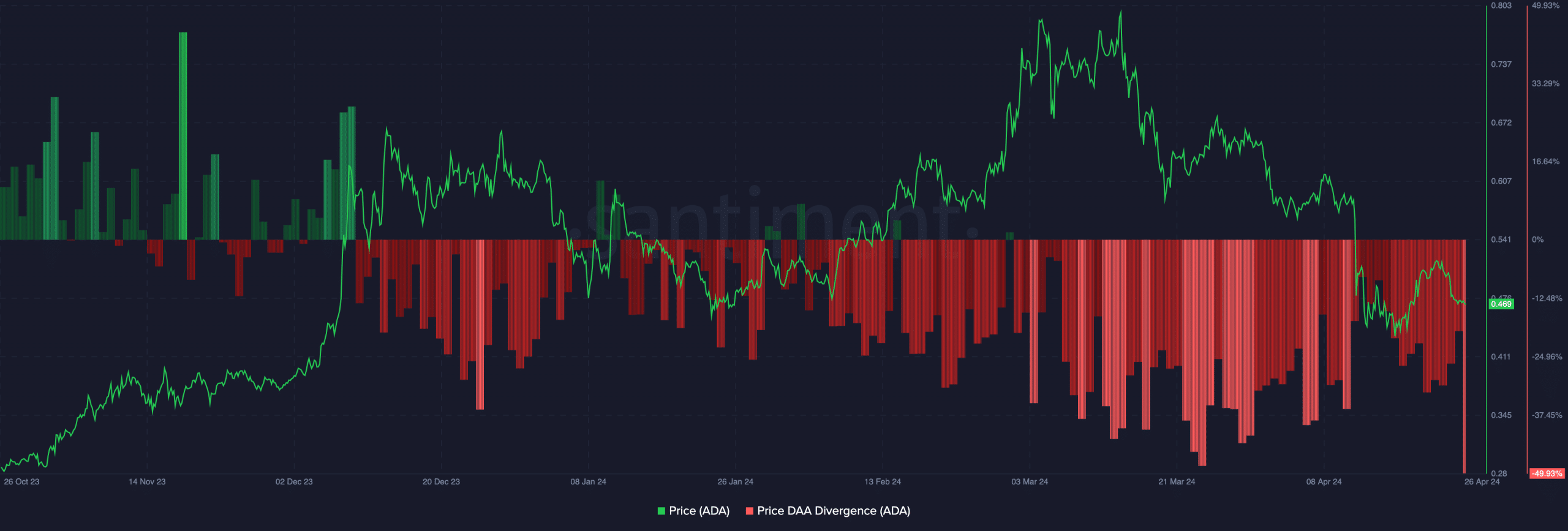

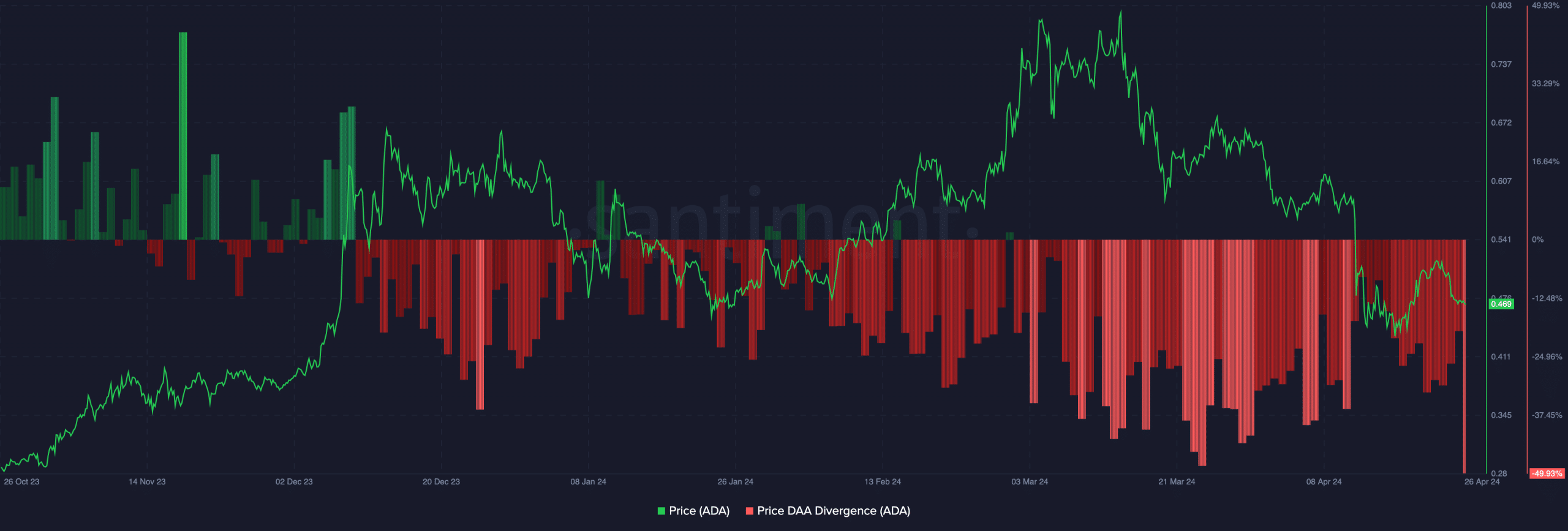

But is now a good time to consider purchasing ADA? AMBCrypto’s analysis of the price-DAA differential gives an idea about this. If you’re unfamiliar, DAA stands for Daily Active Addresses. It shows the level of daily user activity on the blockchain.

Signal scream: Prepare another exit!

Using data from Santiment, we observed that the price-DAA difference is -49.99%. Using this indicator, traders can develop trading strategies that have historically proven to be effective.

In past cycles, when the price rises more than DAA, it means it is time to buy. On the other hand, if the price falls more than DAA, there is a strong exit signal.

One thing we have noticed is that Cardano’s DAA has surged over the past few days as the price of ADA has fallen. Therefore, it can be concluded that a clear buying opportunity has not yet emerged.

Source: Santiment

Regarding the price, ADA may fall below the $0.45 psychological support in the near term. In this case, market participants may need to find another entry point between $0.40 and $0.44.

Is your portfolio green? Check out the Cardano Profit Calculator

Despite the potential downside, a rebound for Cardano may still be possible in the medium term. But that depends on the performance of the altcoin.

If the cryptocurrency price rebounds in the same period, ADA could rise once more and surpass $0.60.