- Most ADA trades ended in losses, sparking speculation that prices could fall again.

- Price-DAA is below 0.50 which indicates it is time to buy the token.

A loss of 5.42% of its value over the past seven days makes Cardano (ADA) one of the market’s top 20 worst performers. Now, the token may not be new to this tag, but some market participants are telling us that now could be a good time to buy the token.

To provide further insight into this, AMBCrypto considered in-depth on-chain analysis. At press time, the price of ADA was $0.45. The recent depreciation has impacted P&L trading on the Cardano network.

Cardano will stop giving and keep taking

According to Santiment, at press time, the P/L ratio for daily on-chain trading volume was 0.827. If this ratio is greater than 1, it means that more participants are realizing profits than losses.

In this case, ADA’s trend would have been optimistic. However, the above reading shows that compared to all on-chain transactions that realized losses, only 0.827 transactions ended in profits.

Historically, this indicator appears to be correlated with price. For example, this ratio hit 0.722 in February. At that time, the price of ADA was $0.57. A few weeks later, the price soared to $0.73 on the charts.

Source: Santiment

A similar situation occurred on April 13th. At that time, the rate drop caused ADA to rebound from $0.43 to $0.52. Considering past performance, there is a possibility that Cardano will decline further.

In this case, the value of the cryptocurrency could fall to $0.42. However, the ADA is also likely to receive a 20% increase. This means that it will likely increase to $0.50 within a few days.

Entry level has appeared

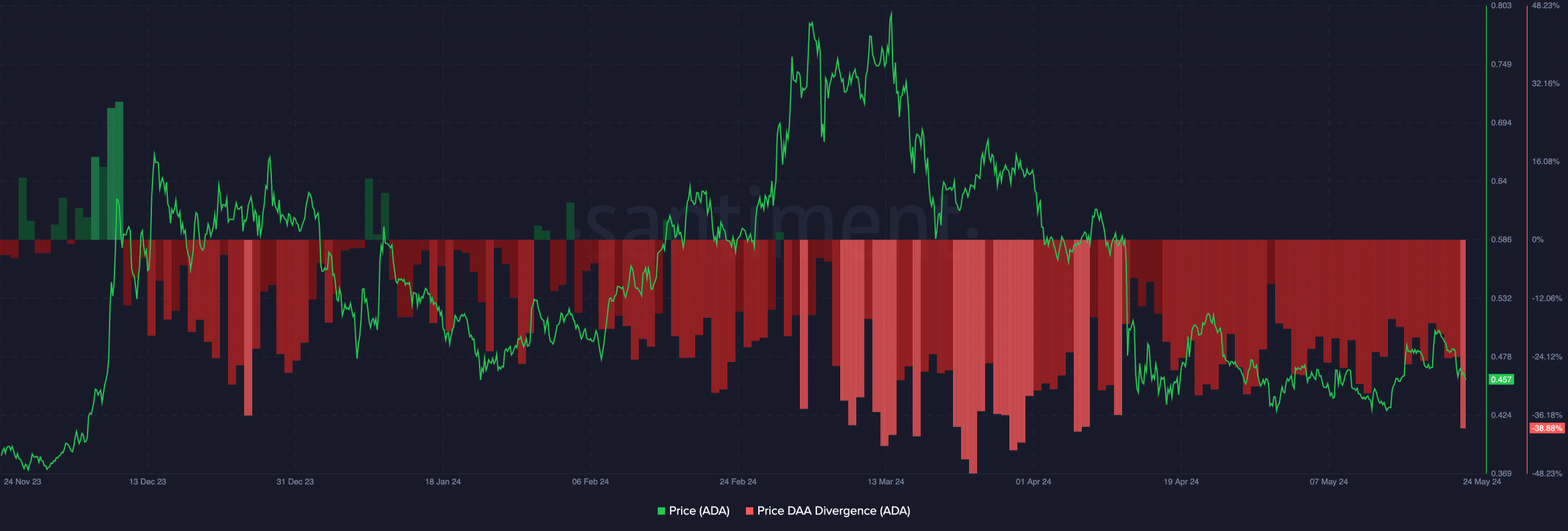

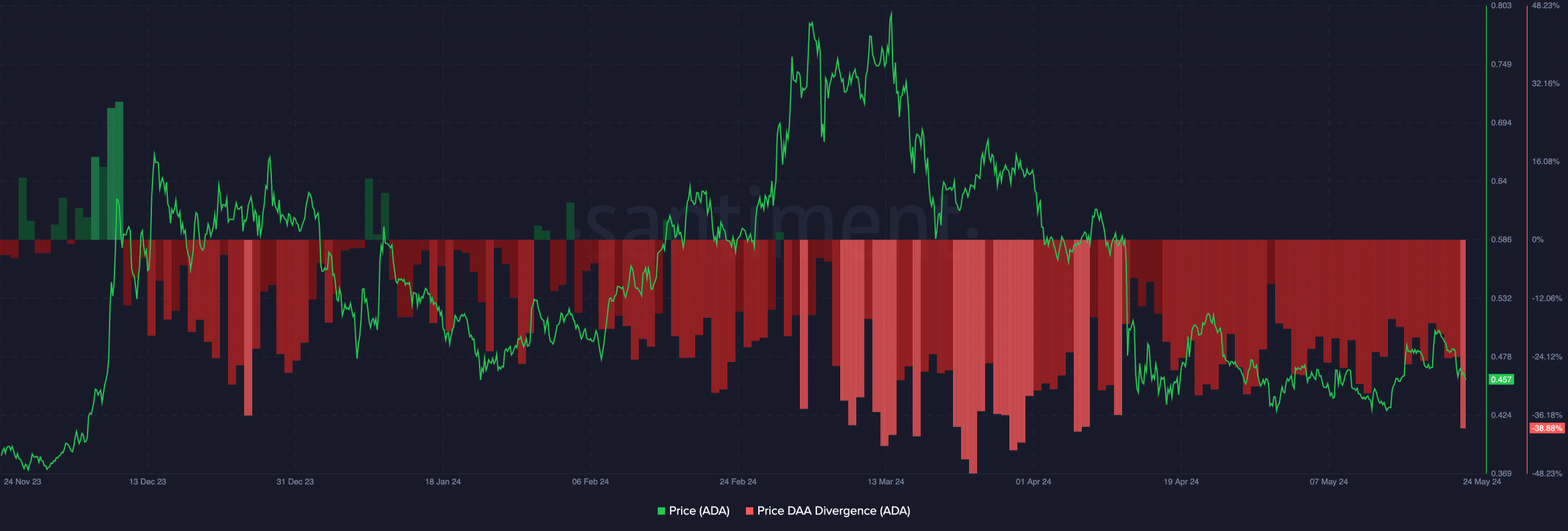

Additionally, price-DAA divergence is an indicator that can predict the value of ADA. DAA stands for Daily Active Addresses and is used to measure the overall level of network activity.

When combined with price, the metric can help you identify potential exit and entry points. At press time, price-DAA was -38.88%. From a trading perspective, a buy signal occurs when the metric is below 0.50.

On the other hand, a sell signal appears when the divergence is above 0.90. Since the ratio was 0.388, it seemed to be a signal that it was time to launch Dollar Cost Averaging (DCA) Cardano’s native token before the price rose.

Source: Santiment

However, it is important to note that this indicator alone cannot determine where Cardano is headed.

Evaluating the same using the volume of on-chain data, we found that the indicator was rising on the charts. This indicates there will be more buying and selling. However, if you look at the price movement, you will see that there were more sales than accumulations.

Read Cardano (ADA) price prediction for 2024-2025

As long as this continues, ADA could face another decline as mentioned above. However, if the decline becomes too severe, the token could rise back to its annual highs.