- With some profits, Cardano Whale raised the amount accumulated in 190m ADA a day.

- Cardano’s price measures have been in the tight range of 0.65 and $ 0.75 over the last 10 days.

Whales are quite made Cardano (there) Purchase from March 16 to 19, 2025. The ADA fell to $ 0.669 after achieving normal from $ 0.65 to $ 0.75.

The Whale Community purchased 50 million ADAs within two days after the media time, as the ADA Price was integrated.

After the ADA price rose slightly to $ 0.716, the whale carried out aggressive purchase activities with a total of 190 million ADAs in a day and raised the price to $ 0.78.

Source: Santiment

Synchronous whale purchasing activities depicted deep whale confidence that enhanced the price of ADA.

This is due to the increase in market demand, while further rising potential prices depended on the sustainability of this trend.

How does the price react to integration?

Cardano ‘s The daily price range has changed from $ 0.65 to $ 0.75 in the 10 -day integration stage. This stage followed intense sales pressure in the downtake trend resistance.

The price first came from the trend line, but false failure occurred before resuming the steep decline. The trend line ultimately served as a strong resistance level after the price rejection.

The ADA maintained a limited range, lowering the swing height within a flat trend and increasing the swing minimum. Exceeding $ 0.75, the price increase can be seen in the strong momentum, and if the rising trend is strong, the following resistance area can be targeted between $ 0.90 and $ 1.00.

Source: TradingView

If the ADA does not maintain more than $ 0.65, you can test the support level of less than $ 0.58. This is due to the negative reading of the MACD that reflects weak momentum and reduces the histogram bar through the falling signal line.

The current market conditions do not inform the immediate strong momentum, so it is essential to clear ride. The market structure only moves if the ADA achieves a strong strength in the 10th.

Keeping less than $ 0.65 indicates that there is an additional tendency according to the channel pattern that reduces the possibility of the upward trend.

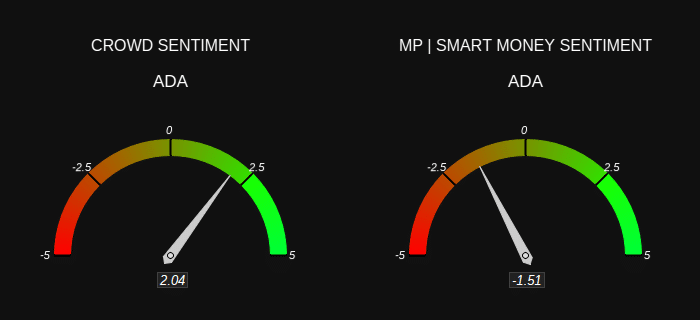

Participants’ feelings of ADA

In other observations, the smart money sentiment stood at -1.51 and the crowd sentiment showed 2.04. This showed that retail investors strongly believed the optimism of the ADA, but the agency had a negative prospect of assets.

The current connection between public investment sentiment and expert investment evaluation indicates that prices are rising due to retail demand.

But institutional investors have shown concerns that the rise can be short.

Source: Market ProPhit/X

If the Smart Money sentiment does not fit the retail investor feelings, the price of ADA can experience the pressure caused by sales. But wider market trends and large -scale investor movements can prevent such prices.