- The price of ADA appears poised to reach $0.50, which would reduce the percentage of losing holders to less than 55%.

- Whale concentrations are above 2021 levels, which suggests prices could move closer to $3 later.

Surprisingly, Cardano (ADA) has become the best-performing asset among the top 10 cryptocurrencies. At press time, ADA was changing hands at $0.48, up 7.28% over the last 24 hours.

Previously, AMBCrypto reported how Cardano could soon exit the top 10 by market capitalization. However, the token seemed to have other plans as its price helped it gain a solid position in the rankings.

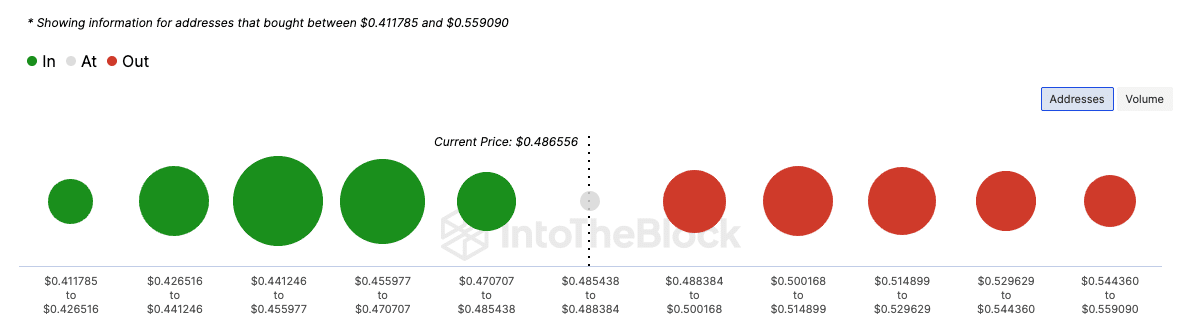

But there was one thing that could change. It is the ratio of currency holders. At press time, data from IntoTheBlock showed that only 40% of ADA holders were making a profit.

On the other hand, 55% of token holders were “short of money.”

Source: IntoTheBlock

Many addresses are ready to provide assistance.

However, if the price of Cardano continues to rise, this ratio may change. To do so, the token price must reach an average of $0.49.

At this point, 792.58 million tokens were pumped out from 65,590 addresses while the price was between $0.48 and $0.50.

Current market sentiment suggests that this large cluster of addresses could provide support for the token. However, traders may need to be careful.

This is because when tokens reach the average cost standard, the accumulation may become highly concentrated, causing selling pressure. In this case, the price of ADA can be rejected at $0.50.

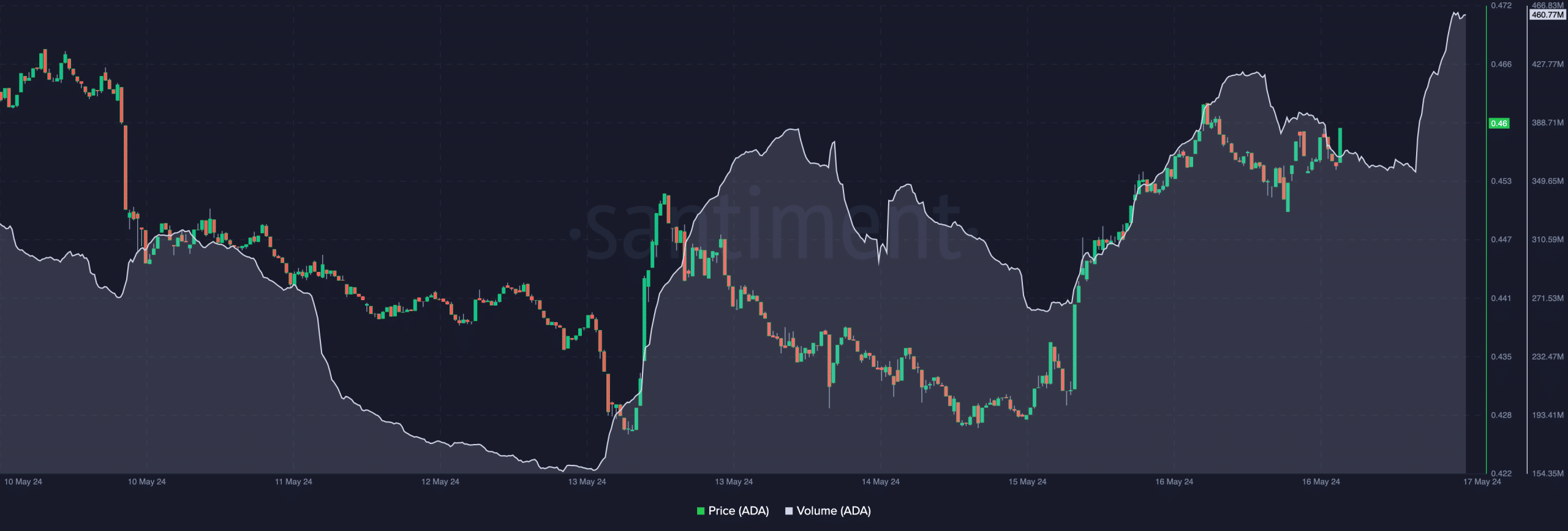

Looking on-chain, ADA could overcome potential resistance at $0.50. One of the reasons for this was Cardano’s trading volume.

Cardano’s trading volume surged to a weekly high of $460.77 million, according to analysis by AMBCrypto using Santiment. Increasing trading volume means growing interest in ADA.

Moreover, if volume continues to increase along with price, the predicted $0.50 move could materialize within a short period of time.

Source: Santiment

This may increase belief in the token’s potential. Therefore, $0.50 could be a new support for ADA while the token is targeting higher values.

Can ADA reach $3 again?

Moreover, the long-term potential of the token looks promising. However, this is only true unless the current market cycle peaks, as mentioned in some corners.

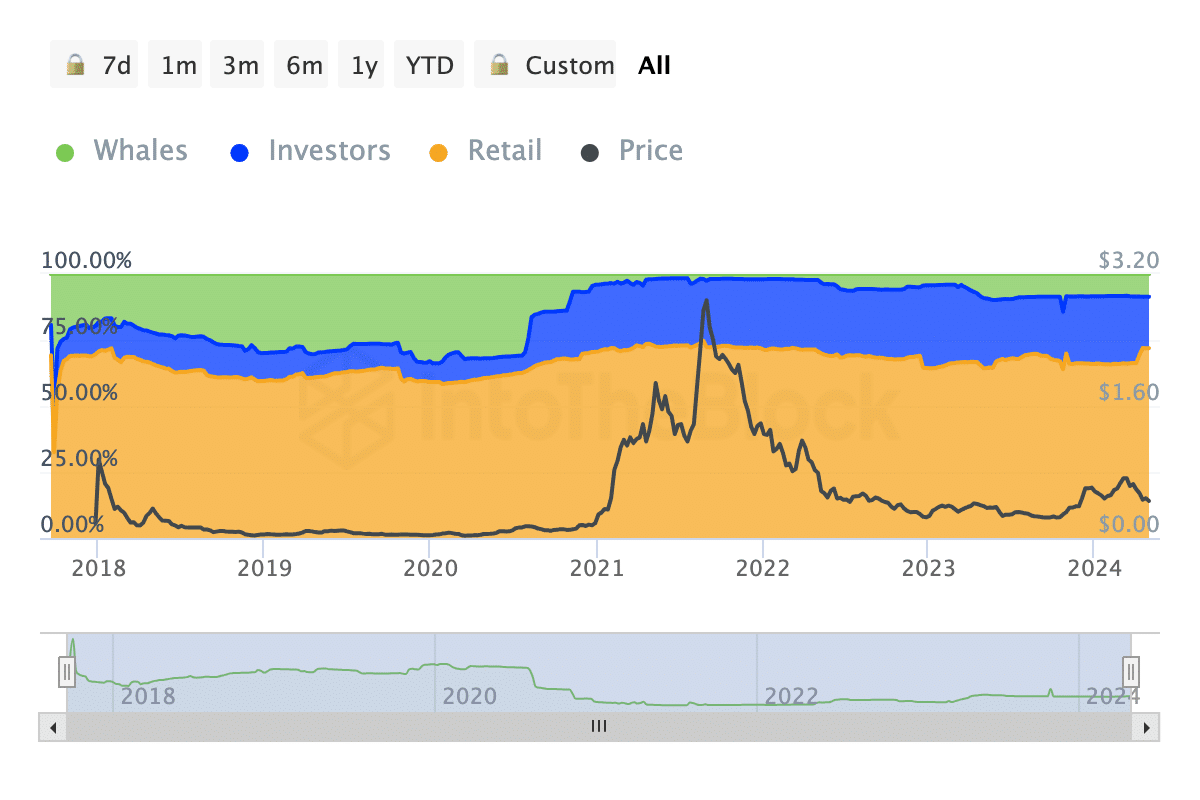

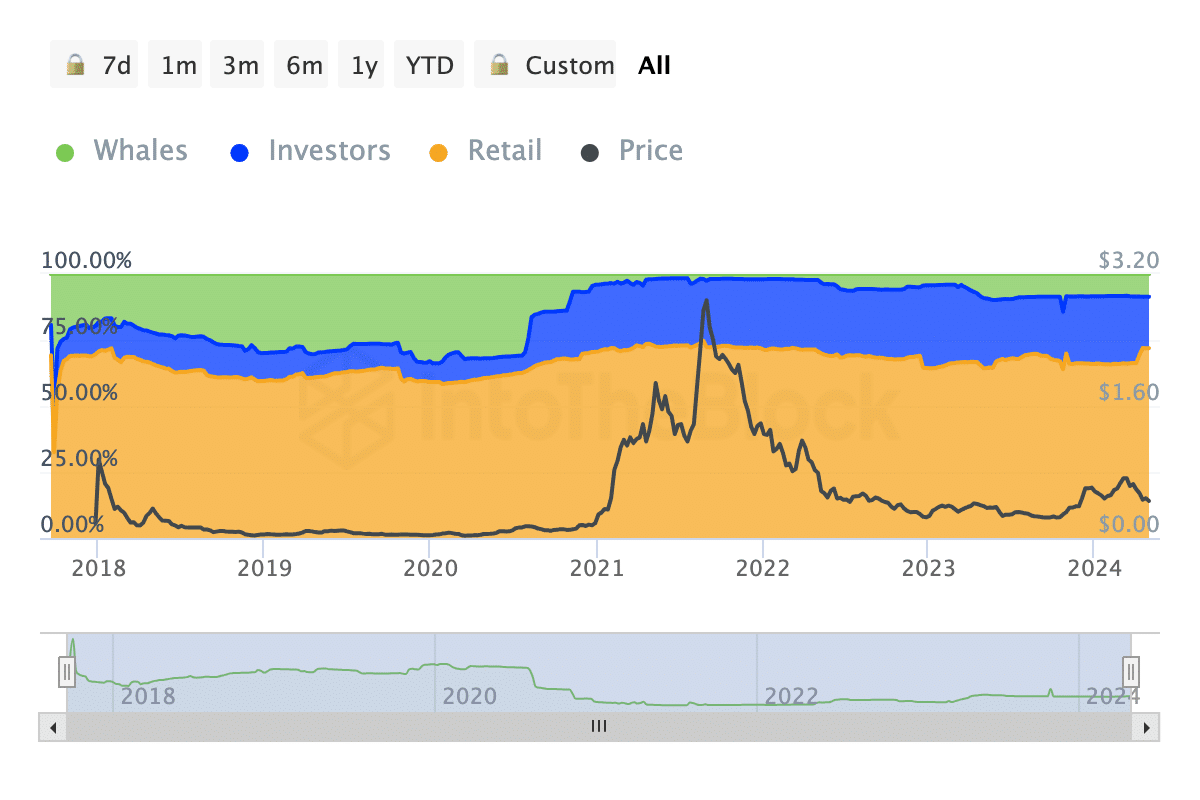

AMBCrypto was also able to back this up by looking at this historical concentration. At press time, retail accounted for 71.91% of total ADA supply.

Investors with a reasonably average position in the cryptocurrency held 19.47% of the supply. Lastly, ADA Whale owned 6.82%.

Read Cardano (ADA) price prediction for 2024-2025

The last time whales held a stake close to 8% of total Cardano circulation was in 2021.

Source: IntoTheBlock

It was also around this time that the price of ADA reached $3.09. By 2022, a bear market would have forced most of these whales to liquidate their assets. However, as mass accumulation increases, ADA may attempt to revisit the highs.