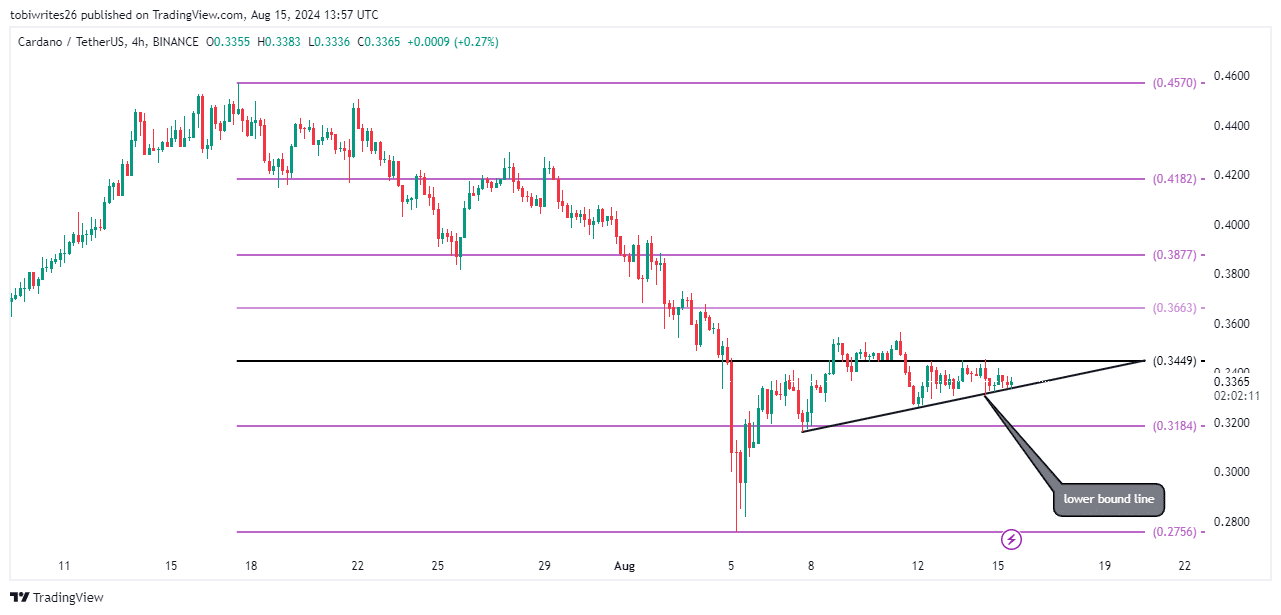

- What was previously a solid support level has now become a major resistance level for ADA.

- However, markets remain divided and uncertainty is the dominant sentiment.

Cardano (ADA) has not been affected by the broader market downturn like many other cryptocurrencies. In fact, at the time of writing, ADA is trading within a margin of $0.3348 after a 1.8% drop in the last 24 hours.

Can ADA Break $0.3449 Resistance?

ADA attempted to break above the resistance level of $0.3449, which was its support level before crashing on August 11, but failed.

However, after three failed attempts, a bearish continuation flag (highlighted in black) appeared on the chart, indicating the possibility of more selling pressure, which could push the price down to the $0.3184 support level.

Source: TradingView

If the daily ADA candle closes below the lower boundary of the bearish flag, we can expect a full bearish dominance. Conversely, if it closes near or above the $0.3449 resistance level, it means that the bulls are likely to take the lead.

But that’s not all. AMBCrypto’s analysis of various on-chain metrics has given mixed signals. So where does ADA go now?

Retailers prefer sales.

ADA Daily Active Address Review Saintly Highlighted A significant decline. From a peak of 36,657 on August 8, it has fallen to the 10,000s at the time of writing.

Source: Santiment

A decline in active addresses is a sign of declining retail participation, which means there is growing bearish sentiment that could push the ADA price lower further.

Also, data Coinglass Long position holders suffered the biggest losses of $649,100 liquidated over the past 24 hours, with a total loss of $549,810.

The forced liquidation of long positions highlights the bearish sentiment and could lead to further selling as large amounts of ADA are liquidated to cover these positions.

However, despite the current market struggles, AMBCrypto found that long-term holders are willing to bet on ADA’s recovery.

Optimism is spreading among long-term holders

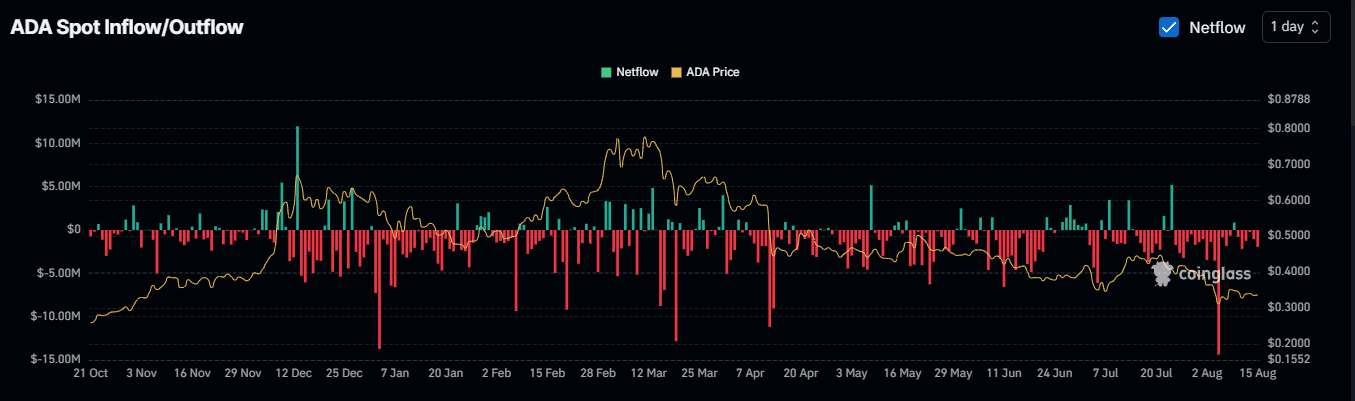

According to CoinglassDaily net inflows represent the net amount of ADA deposited and withdrawn from the exchange in USD, and the exchange recorded significant outflows, resulting in a total loss of $1.75 million.

Source: Coinglass

Last week, the net outflows from major exchanges including Binance, Coinbase, and Bitfinex totaled a net loss of $4.87 million, with Bitfinex alone seeing a net outflow of $1.77 million.

This mostly negative netflow suggests that long-term holders are moving their ADA to their personal wallets for safekeeping. This move is generally considered bullish, reducing the available supply of ADA on exchanges.

finally, Dephilama We have reported that ADA’s total value locked (TVL) on DeFi protocols is gradually increasing, which further supports the bullish outlook, especially as more assets are staked, lent, or committed to DeFi initiatives.

Cardano’s future trajectory remains uncertain, but as new trading levels develop over the next few days, it is likely that a bullish or bearish wave will emerge first.