Celestia (TIA) has been in the market spotlight as one of the best performing altcoins over the past seven days, rising 14.5% to trade at $5.57.

However, despite the recent surge, the modular blockchain project’s native token is likely to struggle to sustain its upward momentum, according to on-chain data.

Celestia Rally, in jeopardy due to these factors

One indicator that points to a potential decline in the price of Celestia is its social dominance, which measures the rate at which an asset is discussed compared to other top 100 cryptocurrencies.

For example, if a project has 30% social dominance, it means that 30% of social media posts or messages about the top 100 cryptocurrencies are focused on that project. An increase in this metric indicates increasing market interest, which in the case of TIA, was until it reached a weekly high of $6.20 on August 9.

However, TIA’s social dominance has now fallen to 0.07%. If this decline continues, the price of TIA may fall.

Read more: Best Airdrops of 2024

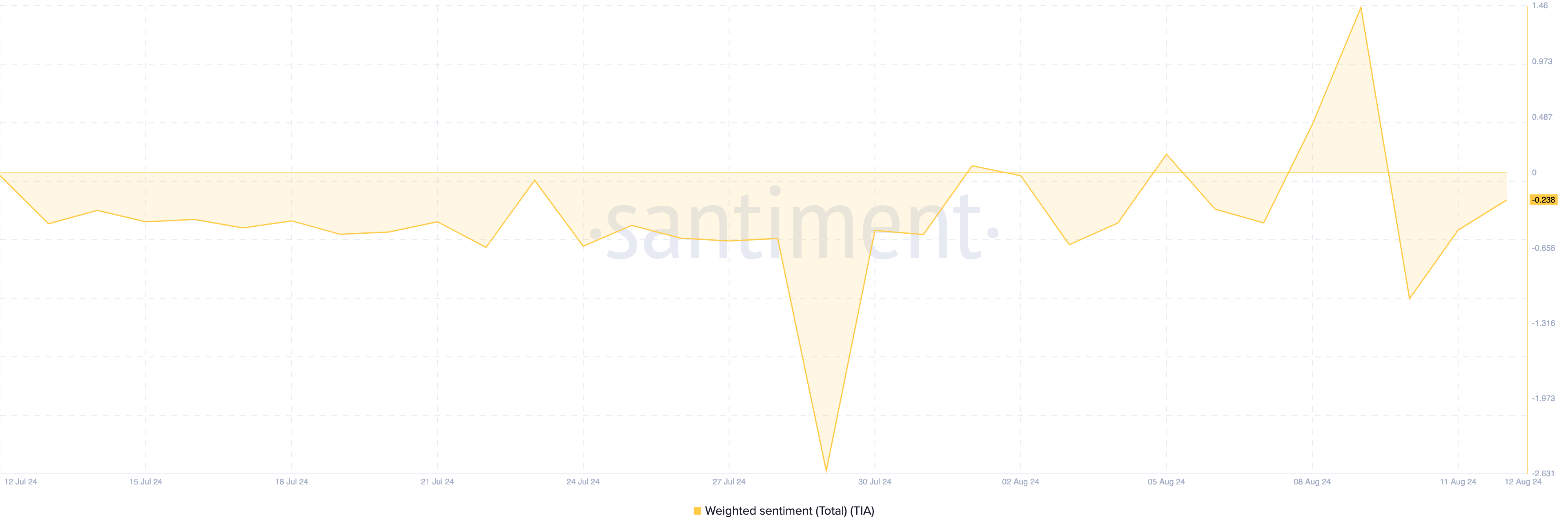

Despite the potential downside, sentiment towards TIA appears to be improving. According to Santiment, the weighted sentiment towards TIA is currently at -0.238. This indicator measures whether online comments about the cryptocurrency are generally optimistic or pessimistic.

A negative reading is more pessimistic, while a positive reading indicates bullish sentiment. Previously it was -1.069, which shows that sentiment is still negative but has improved.

If the weighted sentiment turns positive, demand for TIA may increase. However, as long as the sentiment remains negative, it may be difficult for the token price to maintain an upward trend.

TIA Price Prediction: Is Consolidation Coming?

From a technical perspective, despite the price increase, the price of TIA has not broken through the downtrend line. Typically, when a cryptocurrency price breaks through a trend line, it can act as a signal for continued strength.

However, if this is not done, the price of TIA may get stuck below the trend line. Also, the Accumulation/Distribution (A/D) indicator shows that TIA lacks the buying pressure needed to maintain the uptrend.

The A/D line measures whether there is more buying or distribution in the market. An increase in the indicator indicates increased buying pressure, while a decrease indicates more distribution. For TIA, the A/D indicator remains relatively flat, suggesting that spot trading volume around TIA is not particularly high.

Read more: What are the best altcoins to invest in August 2024?

If this trend continues, the price of TIA may consolidate between $4.67 and $5.71. In a very bearish scenario, the price may drop to $4.07. Conversely, if demand increases, the price of TIA may retest $5.93.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without prior notice. Always conduct your own research and consult with a professional before making any financial decisions. Please be advised that our Terms of Use, Privacy Policy and Disclaimer have been updated.