- LINK rises to its highest price in 6 weeks.

- Most LINK trades continue to return profits.

Chainlink (LINK) is leading the altcoin rally after its price rose to a six-week high. st tly showed it

According to the on-chain data provider, during the intraday trading session on May 23, the altcoin briefly traded at $17.53 before witnessing a slight pullback. all

At the time of this writing, LINK was trading at $17, according to data from CoinMarketCap.

LINK holder profits

The recent price surge of LINK has made it a quite profitable investment for LINK holders.

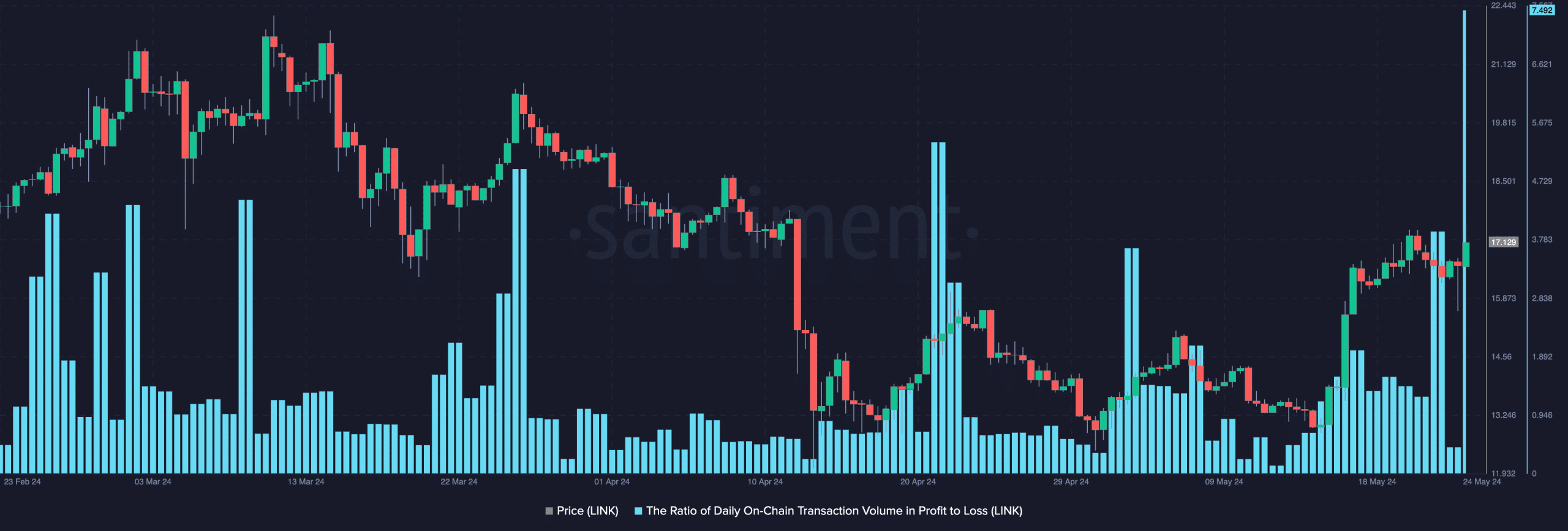

AMBCrypto evaluated LINK’s daily trading volume by P&L and found it to be 11 on May 23. This indicates that for every LINK trade that ended in loss during that trading period, 11 trades returned a profit.

At the time of this writing, the value of this metric is 7.49, indicating that profitable trades remain high.

Source: Santiment

Additionally, the market value (MVRV) ratio of the token was 71.56%. This means that the market price of LINK is much higher than the average acquisition price of all holders.

Although this is a sign that the token is overvalued, it also means that LINK holders are guaranteed a profit if they sell.

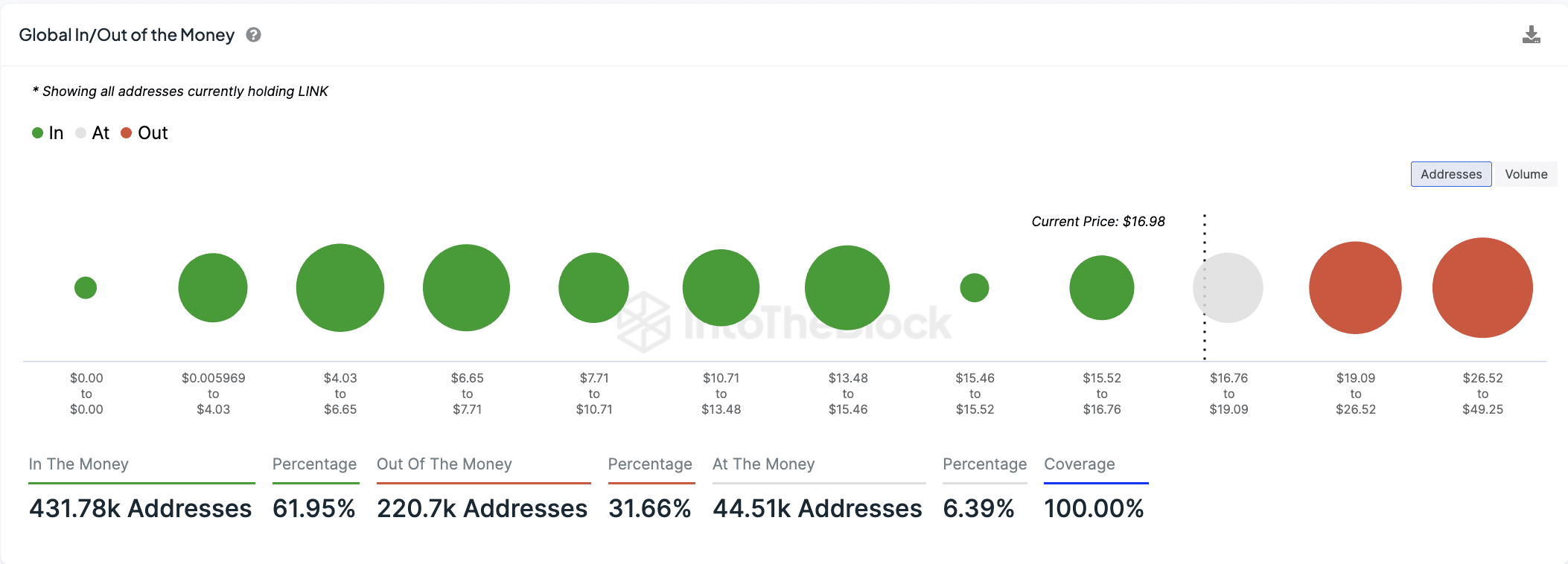

According to IntoTheBlock, 432,000 wallet addresses are currently “in the money,” accounting for 62% of all LINK holders. These are investors who hold altcoins for profit.

Conversely, 221,000 addresses, or 32% of all LINK holders, are “out-of-the-money” and therefore holding the token at a loss.

Source: IntoTheBlock

Don’t get carried away

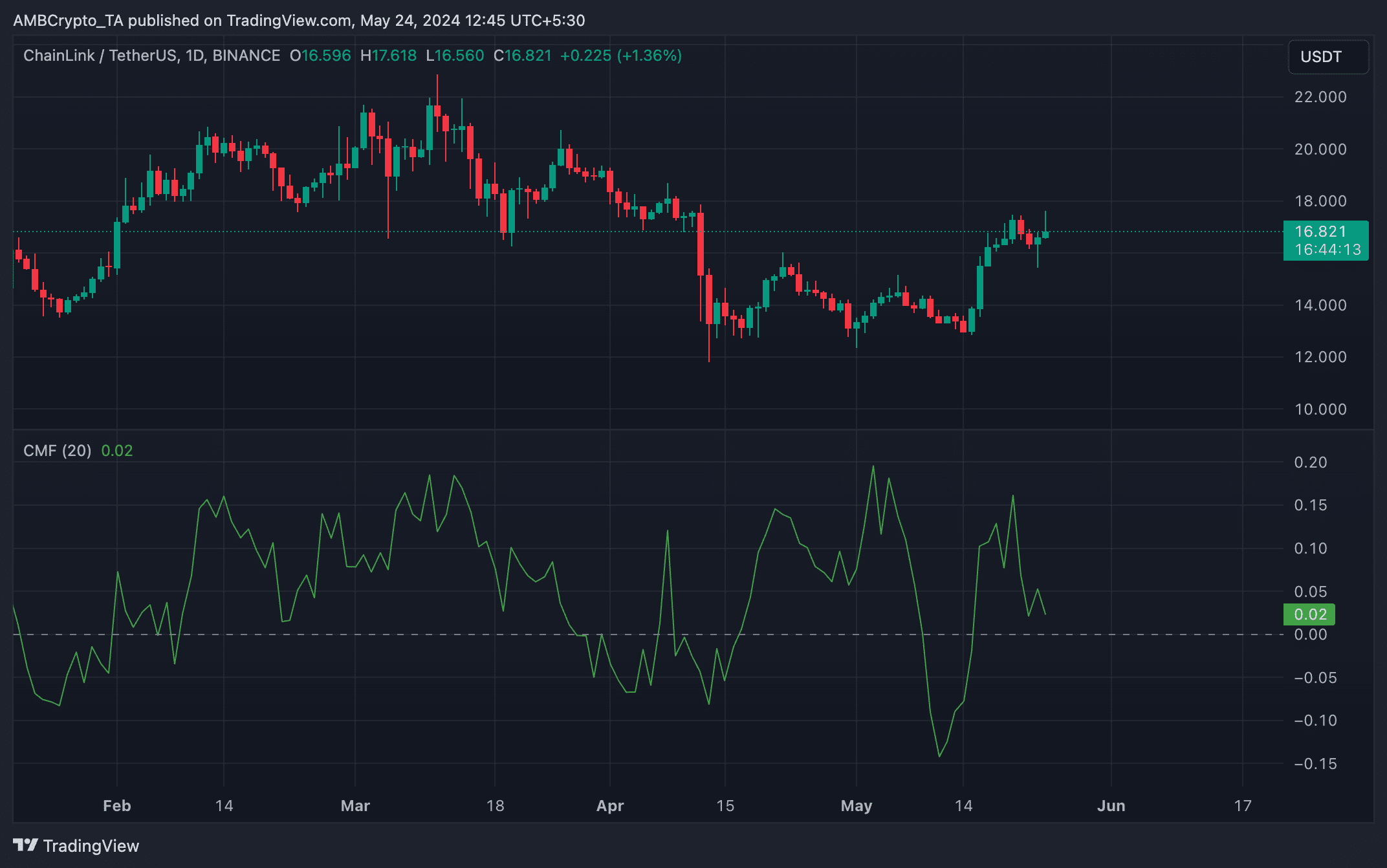

Despite LINK’s price rally last week, key technical indicators have trended downward, forming a bearish divergence.

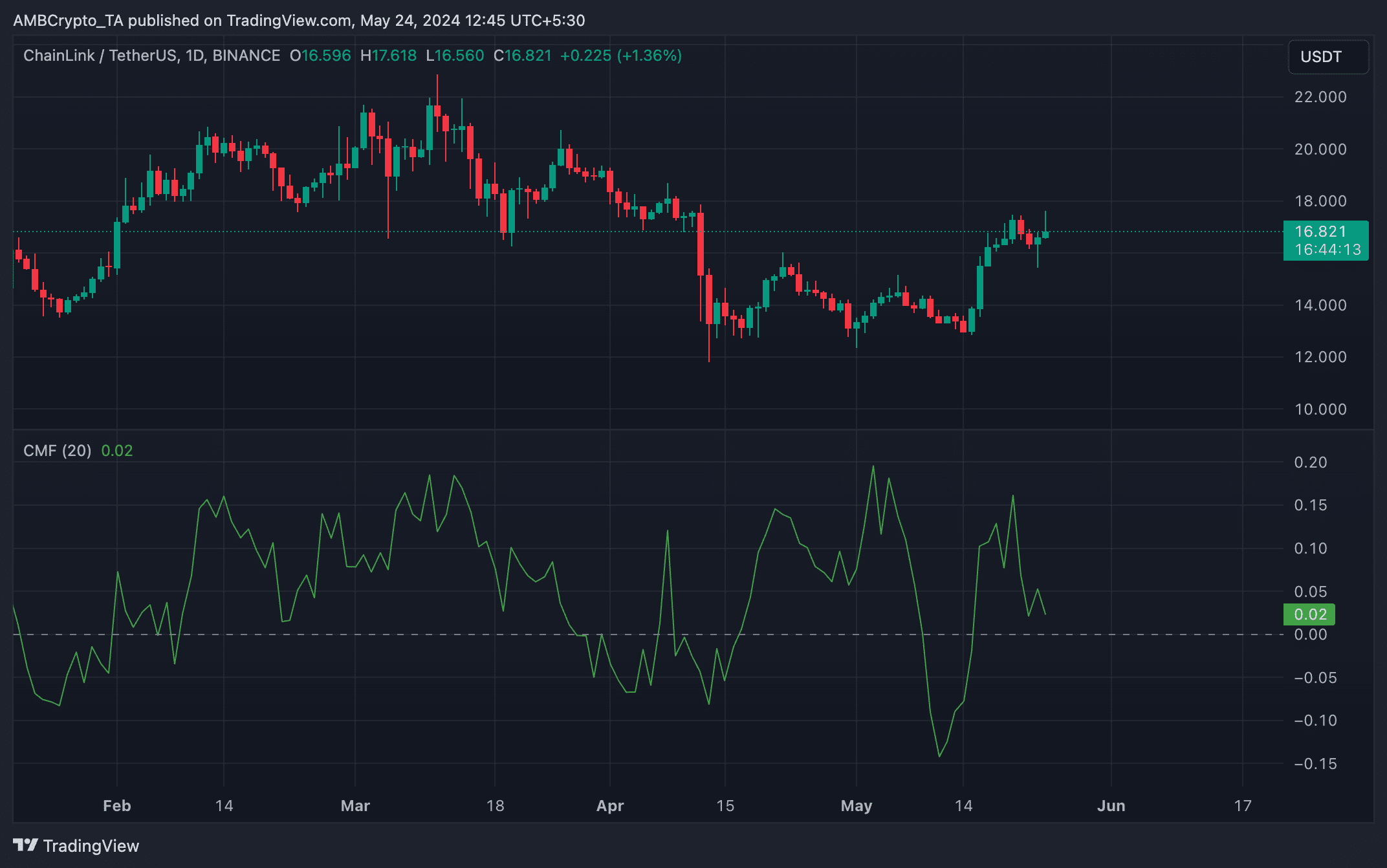

Looking at LINK’s daily chart, we see that Chaikin Money Flow (CMF) has declined despite the price surging over the past seven days. This indicator measures funds entering and leaving the LINK market. At press time, LINK’s CMF was 0.02, almost at the zero line.

Source: LINK/USDT on TradingView

Is your portfolio green? Check out the LINK Profit Calculator

A bearish divergence forms when the price of an asset is rising while the CMF is trending downward. This means that despite asset prices rising, purchasing volumes are not as strong as expected.

This suggests to market participants that price increases may not be sustainable.