- Chainlink is down 0.49% in the last 24 hours due to the weak outlook.

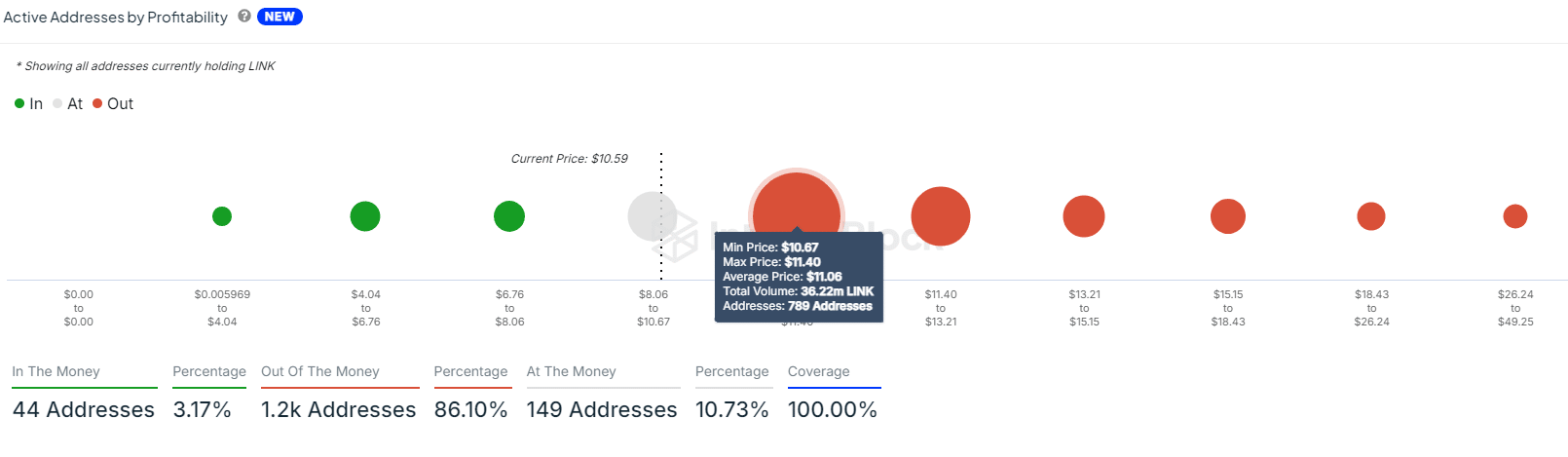

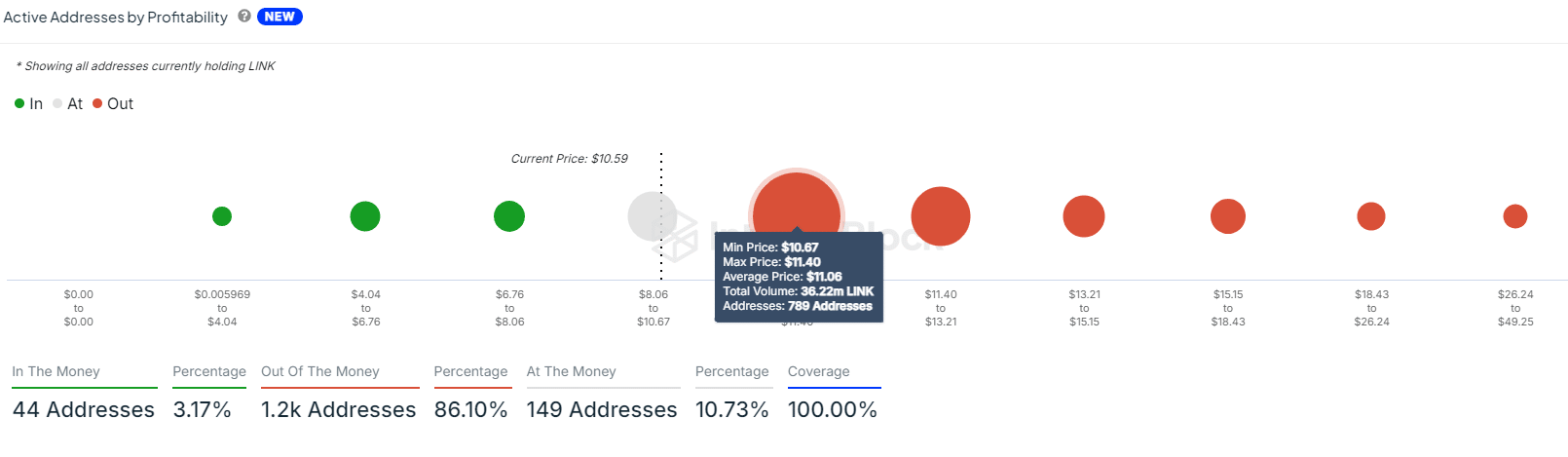

- Most LINK active holders are red.

Chainlink (LINK) has seen modest gains over the higher period, with its price up 1.35% for the month and 0.69% for the week as of press time, according to CoinMarketCap.

However, despite this gain, LINK’s current price of $10.64 reflects a slight 0.49% decline, highlighting that it is struggling from a broader downtrend that began after the end of the last bull market.

This decline continued with some brief ups, but then an overall decline like the rest of the cryptocurrency market.

The price action of the LINK/USDT pair was bearish as the price consolidated within a symmetrical triangle and broke the already lower trend line.

If LINK breaks below this trend line and holds, it could be a clear signal for further declines. LINK’s next price target would be the $8 level, where some support and potential recovery could be found.

Source: TradingView

The MACD indicator suggested that sellers were gaining strength as the momentum bar darkened, reflecting growing bearish pressure.

Additionally, Stochastic RSI indicates that LINK is oversold, which is a sign that sellers are controlling the market.

Oversold conditions do not always lead to a bounce, but they strengthen the possibility of a continued decline to $8 despite the cryptocurrency industry’s hopes for a strong fourth quarter.

LINK fund input/output

Examining Chainlink’s on-chain metrics reveals more reasons for concern. At press time, about 86% of active addresses were “out of the money,” meaning most holders had suffered losses.

Only 3% of active addresses are profitable and 10% have reached breakeven. These negative balances have created additional selling pressure as traders may try to offload tokens to avoid larger losses.

Source: IntoTheBlock

Due to the high percentage of addresses in red, the outlook for LINK in the near term points to further declines, with a drop to $8 becoming increasingly likely.

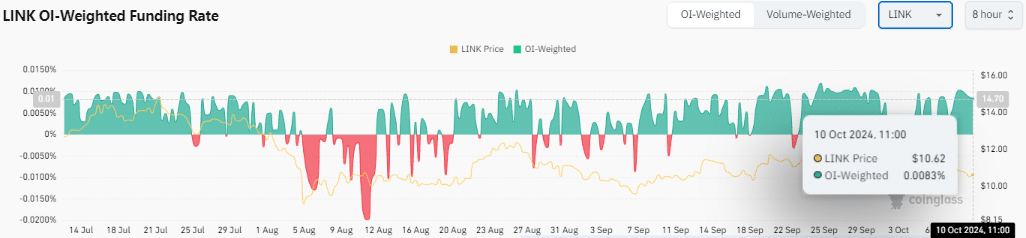

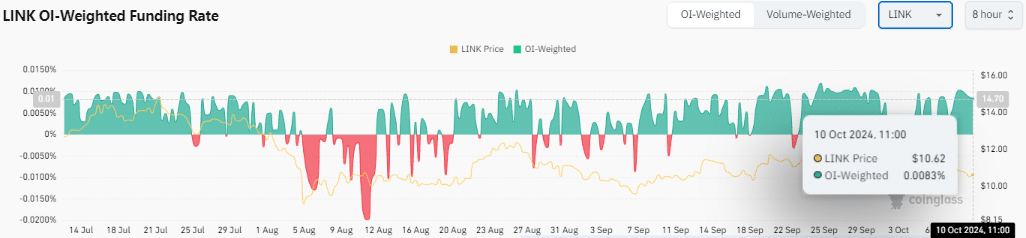

LINK OI Weighted Funding Rate

However, there is a positive bullish outlook for the open interest weighted funding rate at 0.0083%.

Read Chainlink’s (link) price prediction for 2024-2025

This indicates that long-term traders are paying short-term traders, which may indicate hopes for a reversal. However, this factor alone may not be enough to counter the overall bearish momentum in the market.

Source: Coinglass

While Chainlink’s long-term outlook remains positive, it seems more likely that LINK will move towards $8 in the near term before recovering and moving higher.