- LINK’s price has increased by 4% in the last 24 hours.

- Some indicators showed strength, while others showed weakness.

Chainlink (LINK)Like many other cryptocurrencies, it faced the wrath of the bears last week as its price chart turned red. According to the latest data, the token may be testing the support of the bearish pattern.

But recent market trends have changed.

Chainlink bulls enter

AMBCrypto was previously Reported A sell signal has appeared on the token’s 4-hour chart. There is a possibility that LINK could register a few more red candlesticks on the 4-hour chart on July 7th.

Ali, also a popular cryptocurrency analyst, recently wrote: Twitter A head and shoulders pattern appears to have appeared on LINK’s daily chart.

At the time of the tweet, the token was testing the pattern’s support, below which a plunge could see LINK drop to $7.

Source: X

Fortunately, Chainlink bulls have taken over the market, and LINK has successfully tested support at the time of writing. CoinMarketCapLINK is up more than 4% in the last 24 hours.

The token is trading at $13.38 and has a market cap of over $8.138 billion, making it the 15th largest cryptocurrency.

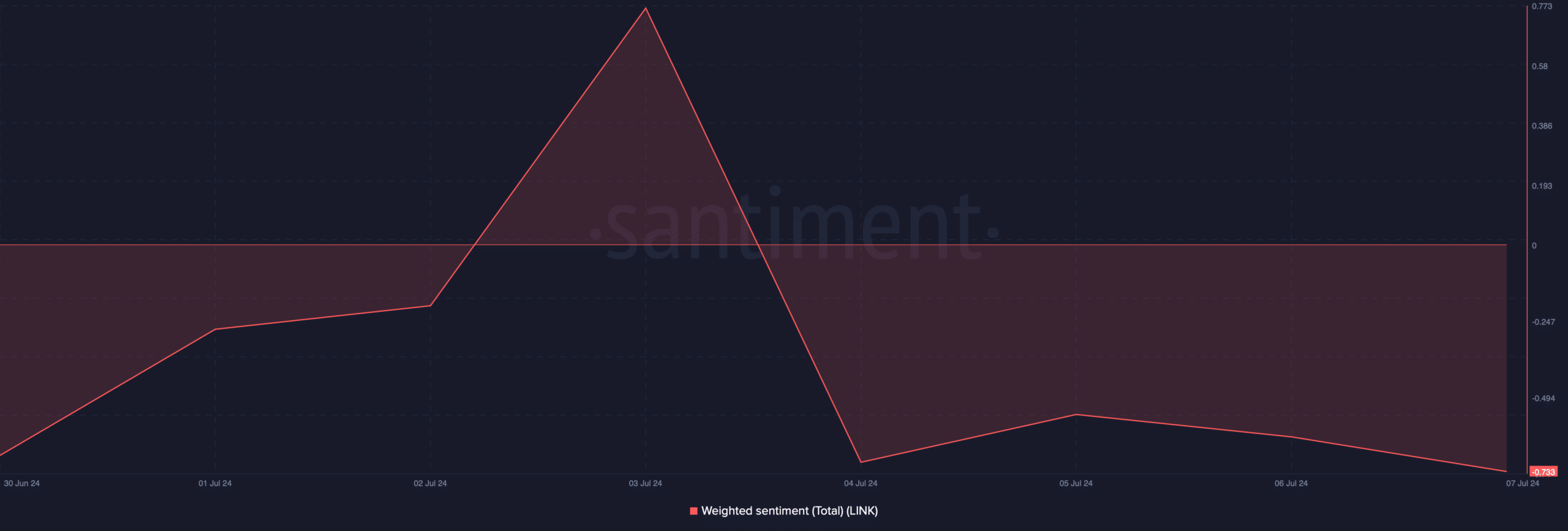

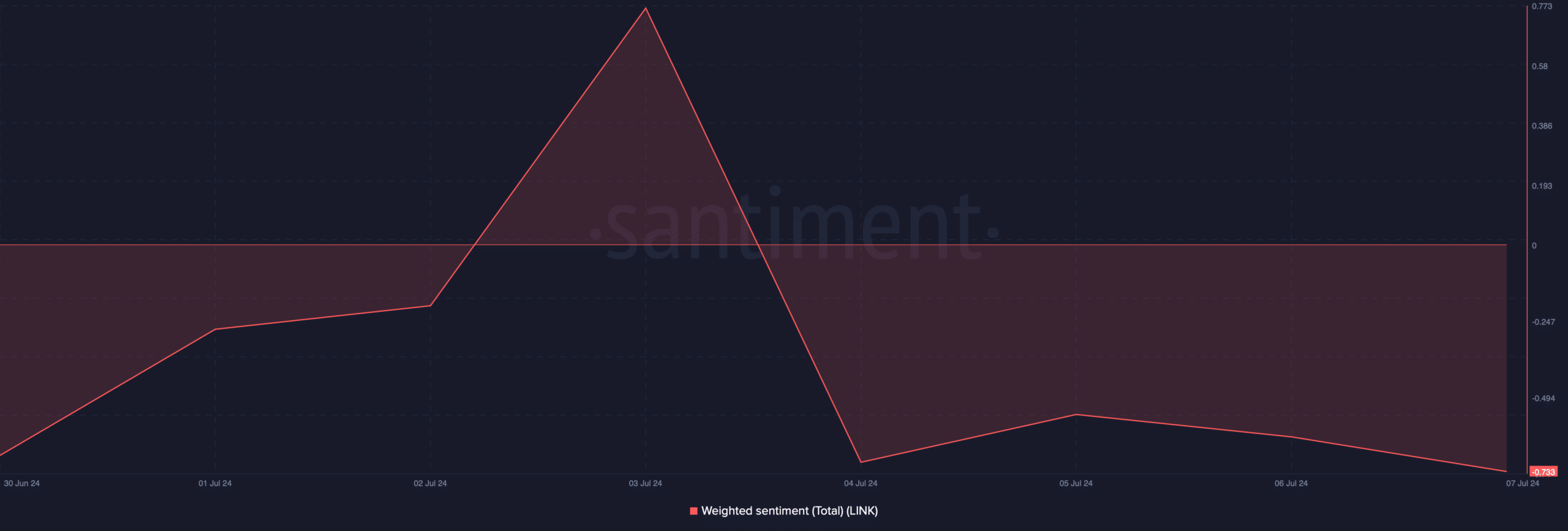

However, what was surprising was that despite the recent price rally, market sentiment remained bearish, as evident in the decline in Weighted Sentiment.

Source: Santiment

Will LINK’s bullying rally last long?

With market sentiment looking bearish, AMBCrypto looked to other on-chain data to see if LINK is likely to continue its recent gains.

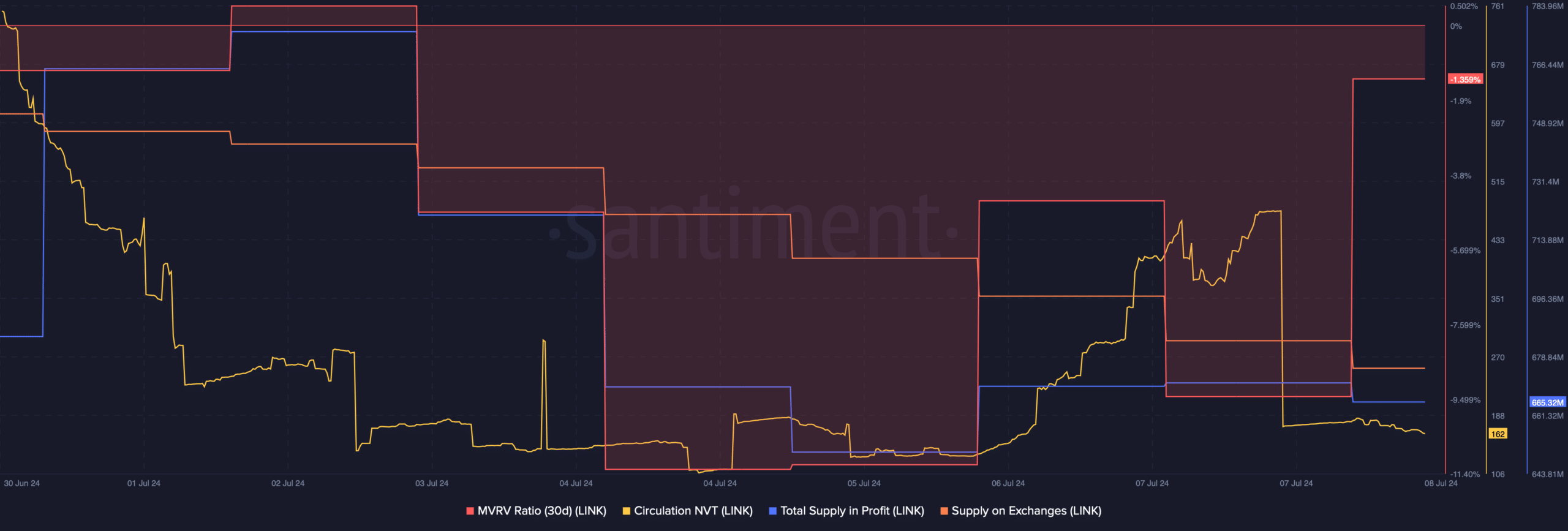

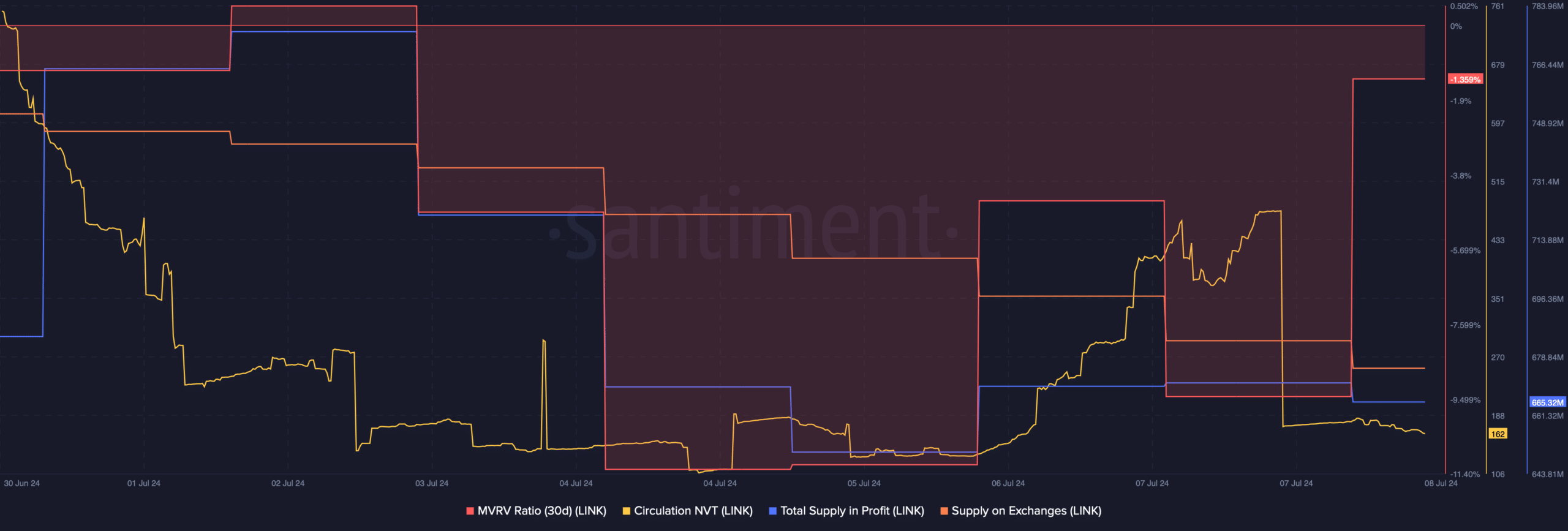

Last week, we noticed a sharp drop in the supply of LINK on exchanges, indicating that there was a lot of buying pressure on the token. Also, Chainlink’s NVT ratio dropped significantly.

Generally, a decline in this indicator means that the asset is undervalued, indicating that the price is likely to rise.

Source: Santiment

However, not everything was in favor of LINK. For example, the token’s MVRV ratio dropped, which could be interpreted as a bearish signal. What’s interesting is that even though LINK’s price has been rising, its total profit supply has remained low.

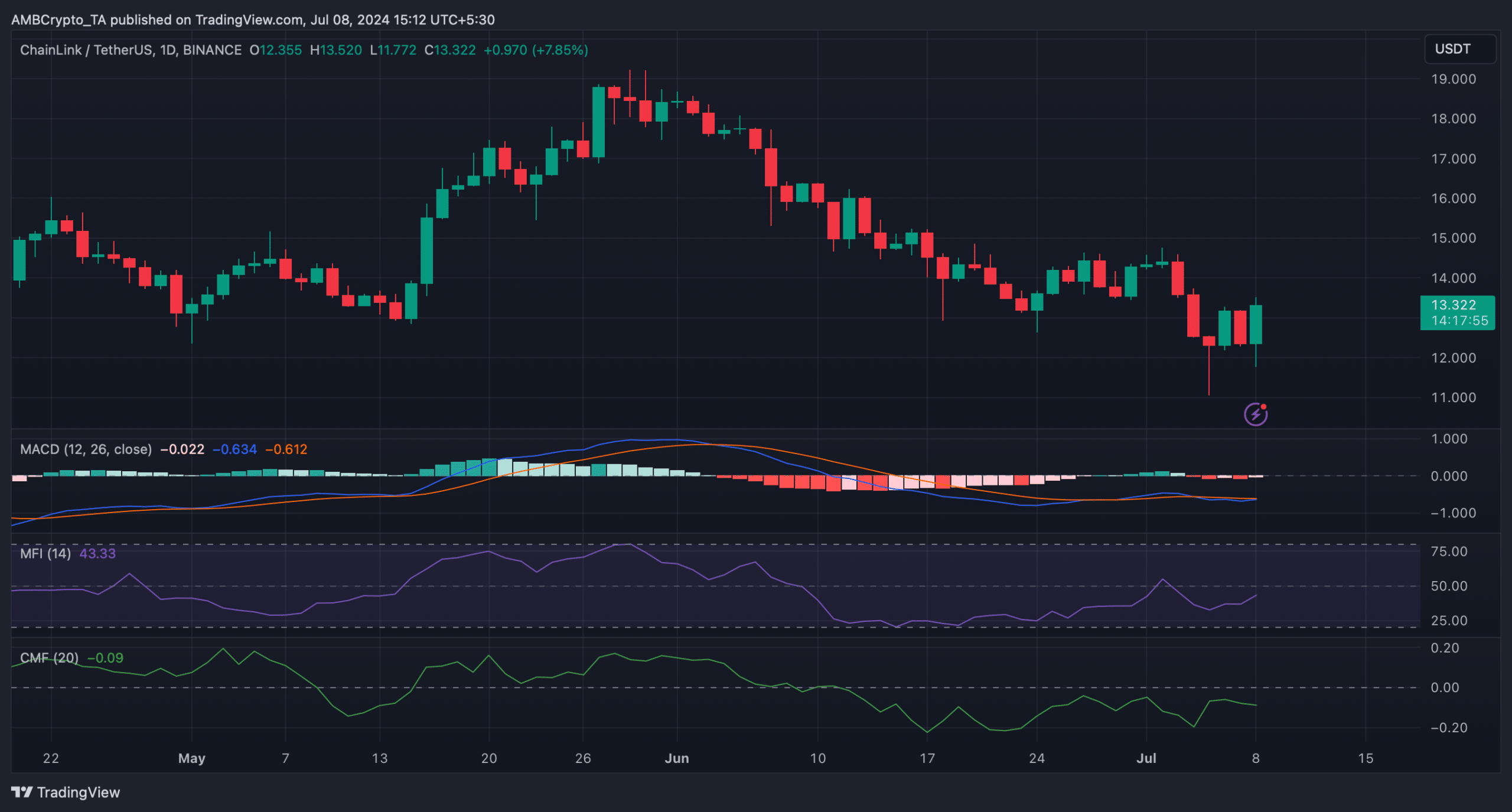

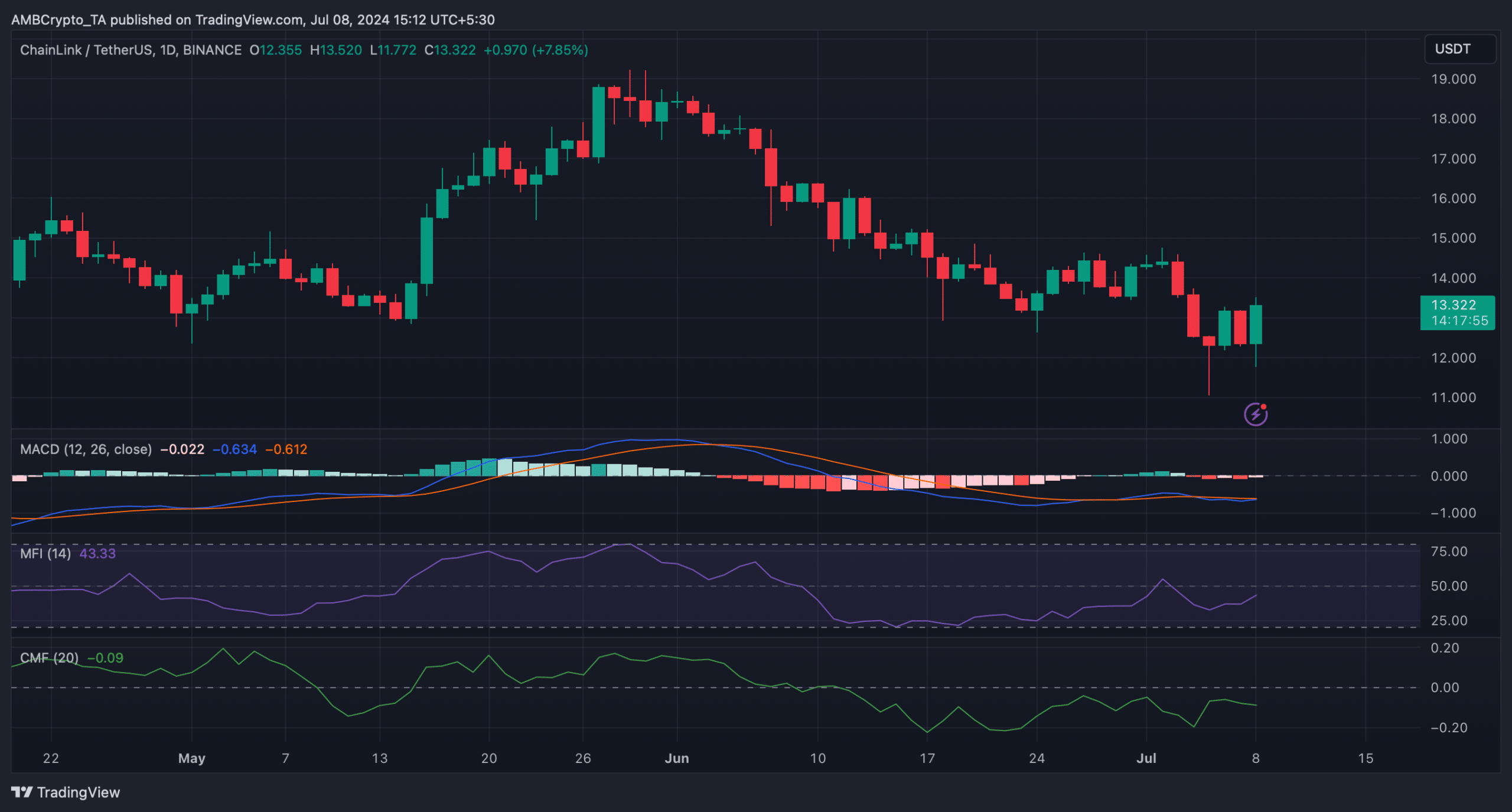

Then let’s take a look at LINK’s daily chart to get a better idea of what to expect. According to MACD, bulls and bears were competing to gain an advantage over each other.

Realistic or not, here it is. LINK market cap in terms of BTC

Meanwhile, the Money Flow Index (MFI) was moving northward and heading towards neutral levels, indicating that bulls are likely to prevail.

On the other hand, Chaikin Money Flow (CMF) was in a downtrend, suggesting that LINK’s bullish rally may be short-lived.

Source: TradingView