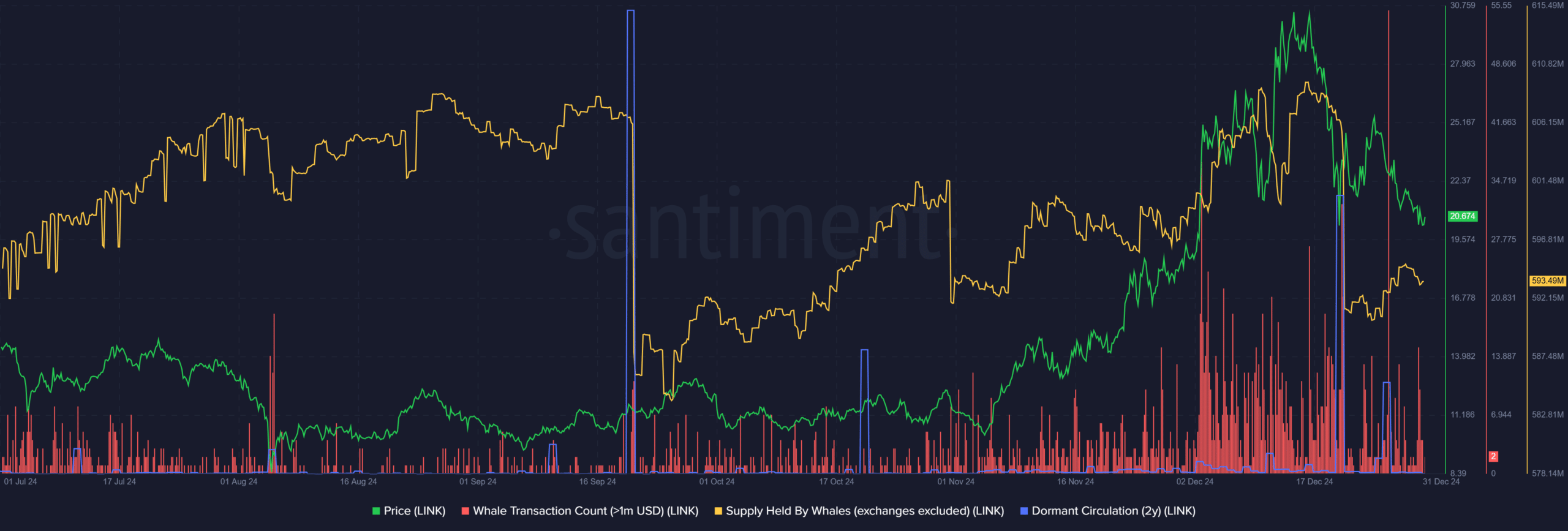

- Chainlink has seen a surge in dormant circulation among long-term holders following the $30 rejection.

- A lack of confidence among major shareholders meant the rally was unlikely to continue.

Chainlink (LINK) experienced a “Trump pump” earlier this month, posting a one-day gain of 21% following the purchase of $1 million worth of LINK tokens by Trump-affiliated World Liberty Financial (WLF).

Over the past two weeks, some on-chain indicators have shown increased selling pressure on whales. A price movement to $30 was used to lock in profits.

Can we expect Chainlink accumulation above $20 and a renewal of upward momentum?

Whale trade soars, sparking fears

Source: Santiment

Around the end of November, as the price of LINK exceeded $20, the trading volume of whales worth more than $1 million began to increase.

This increased whale trading activity continued while Chainlink was trading above $22.

Although it started to decline over the past two weeks, it has had two of its second and third highest trading days in the last three months.

It happened on December 20th and 26th.

The latter occurred when LINK saw the price rebound from $25 rejected. This indicates increased panic and increased selling pressure among large holders over the past 10 days.

The increase in daily trading activity in whales supported the idea of taking profits from whales if the rally does not continue on the same scale as in the second half of 2021.

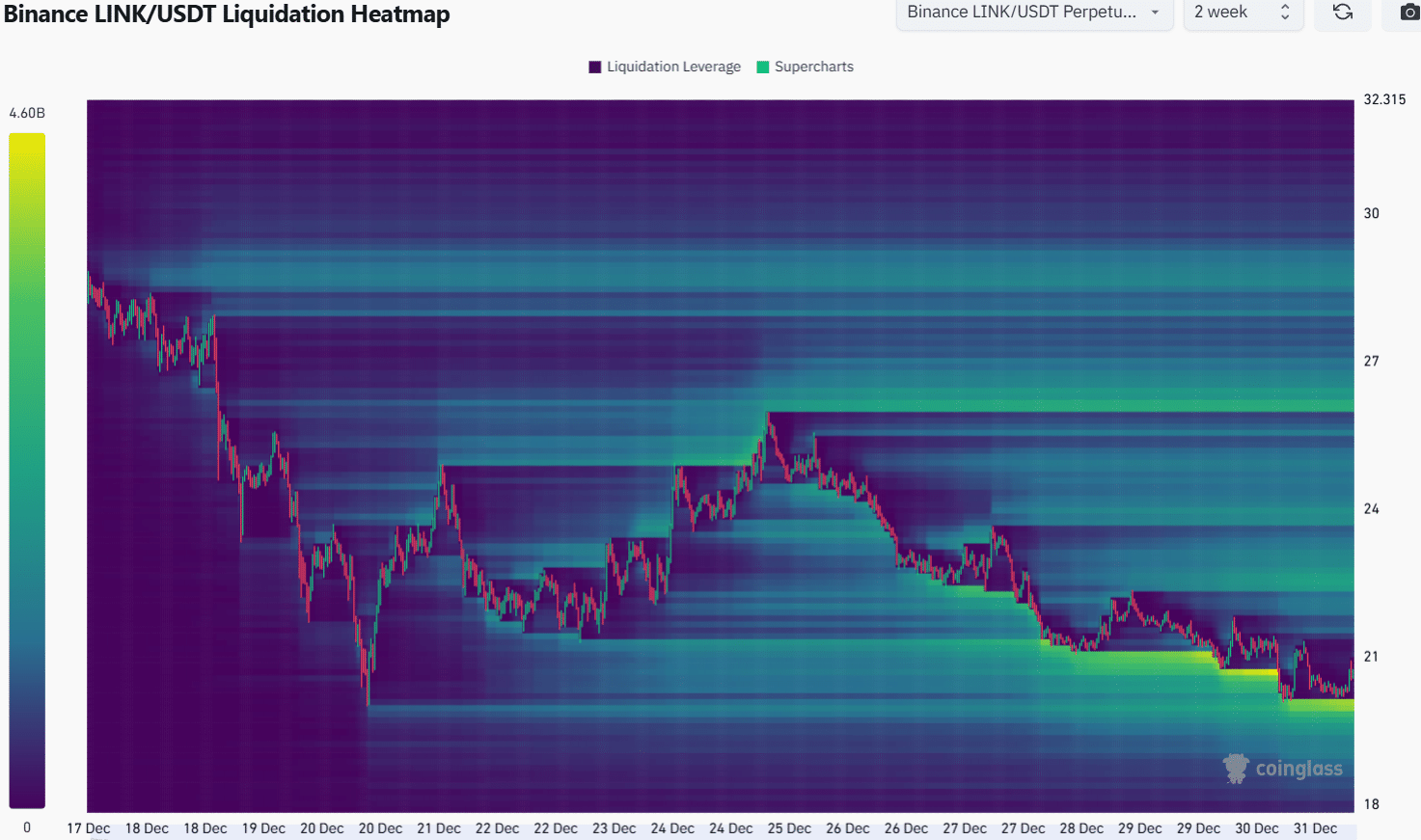

Chainlink continues to find pockets of liquidity in the south.

Source: Coin Analysis

The liquidation heatmap over the past two weeks highlights the steady decline in LINK price. In particular, it continued to decline last week.

Realistic or not, LINK’s market cap in BTC terms is:

A pocket of liquidity formed below the short-term support zone, but it could not halt the downtrend for long.

If this pattern continues, the $20 level that rebounded on December 30 may find liquidity and push the price down, fueling another decline.