- Whale accumulation highlighted a potential breakout as LINK battled key resistance levels.

- Declining foreign exchange reserves and increased trading have created bullish conditions.

Chainlink (LINK) 30 newly created wallets gained attention after withdrawing 1.37 million LINK worth $34.1 million from Binance in just 5 days.

This accumulation coincided with a 4.01% price increase, pushing LINK up to $24.93 at press time.

According to Lookonchain by X (formerly Twitter):

“Suspicious $LINK accumulation detected! In the last 5 days, 30 newly created wallets withdrew 1.37 million $LINK ($34.1 million) from #Binance.”

This whale activity often fuels speculation about a potential breakout, leaving traders wondering if LINK could be ready for the next big move in the market.

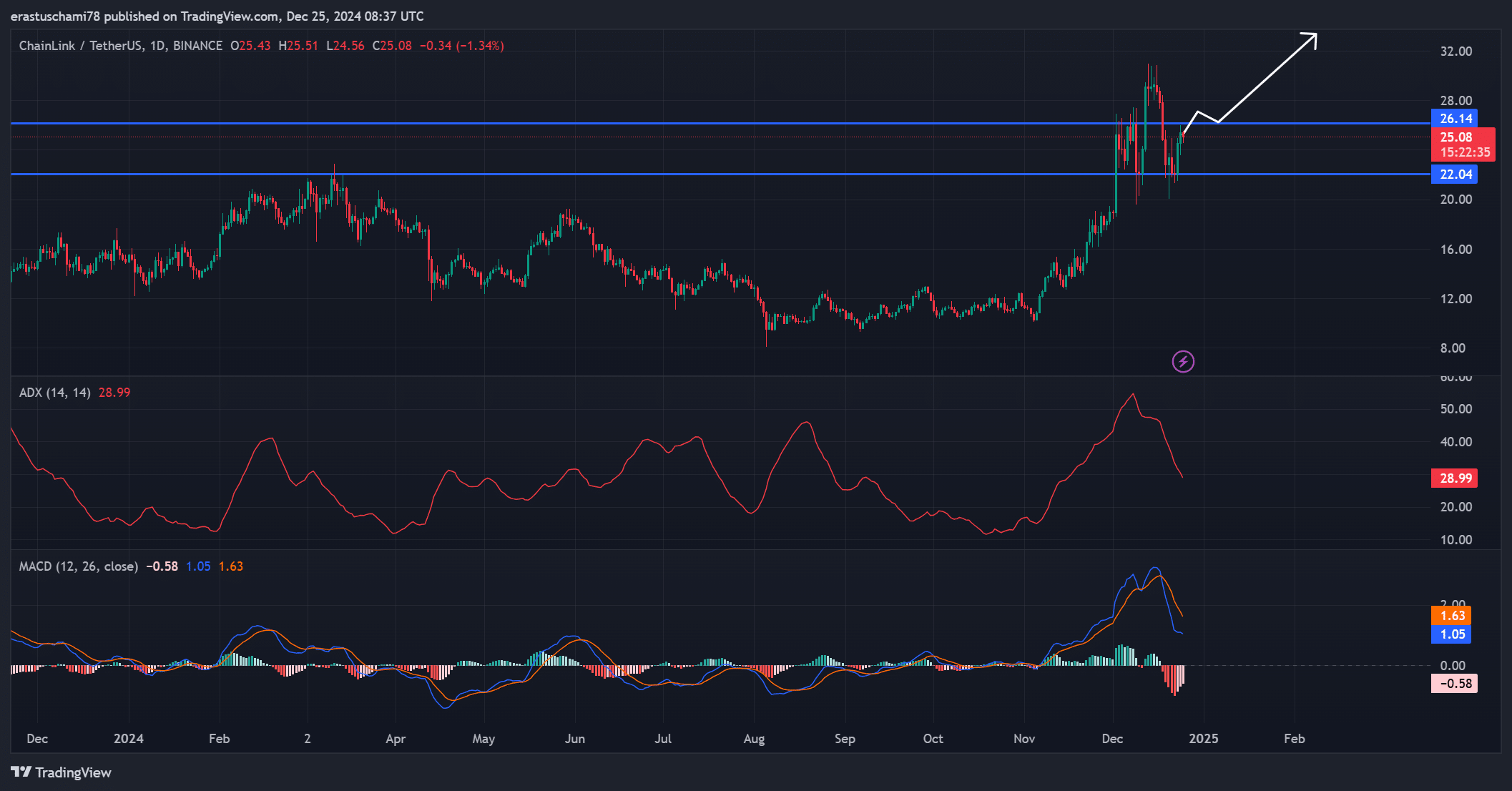

LINK price momentum faces resistance

On the technical side, LINK was fighting important resistance at $26.14, while $22.04 served as a stable support area.

The MACD indicator showed bearish momentum, but the ADX reading indicated a bullish trend at 28.99.

Additionally, the price action suggested that buyers were accumulating near support, which could trigger a breakout if momentum builds.

A rise above $26.14 would set the stage for a rise above $30, making it more interesting for bullish investors. However, failure to maintain these levels may result in further consolidation.

Source: TradingView

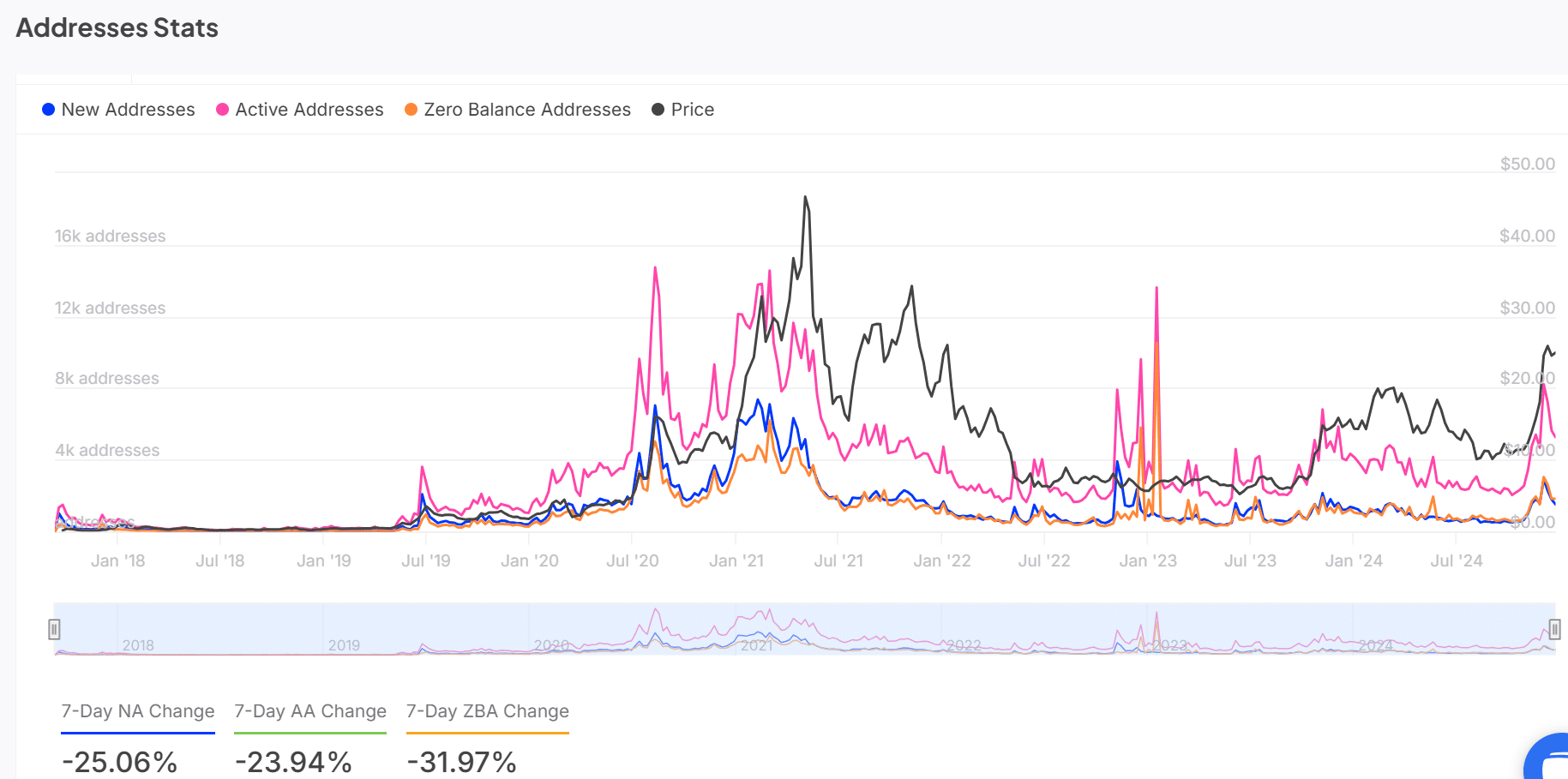

Address statistics reflect mixed on-chain activity.

On-chain data reveals a mixed picture for ChainLink addresses. Last week, new addresses and active wallets decreased by 25.06% and 23.94%, respectively.

Zero balance addresses also decreased significantly by 31.97%, indicating a decrease in retail participation.

However, this contrasts with notable whale activity, which suggests large holders may be bracing for a potential price surge.

These differences between retail and whale behavior may represent the early stages of the strategic accumulation phase.

Source: IntoTheBlock

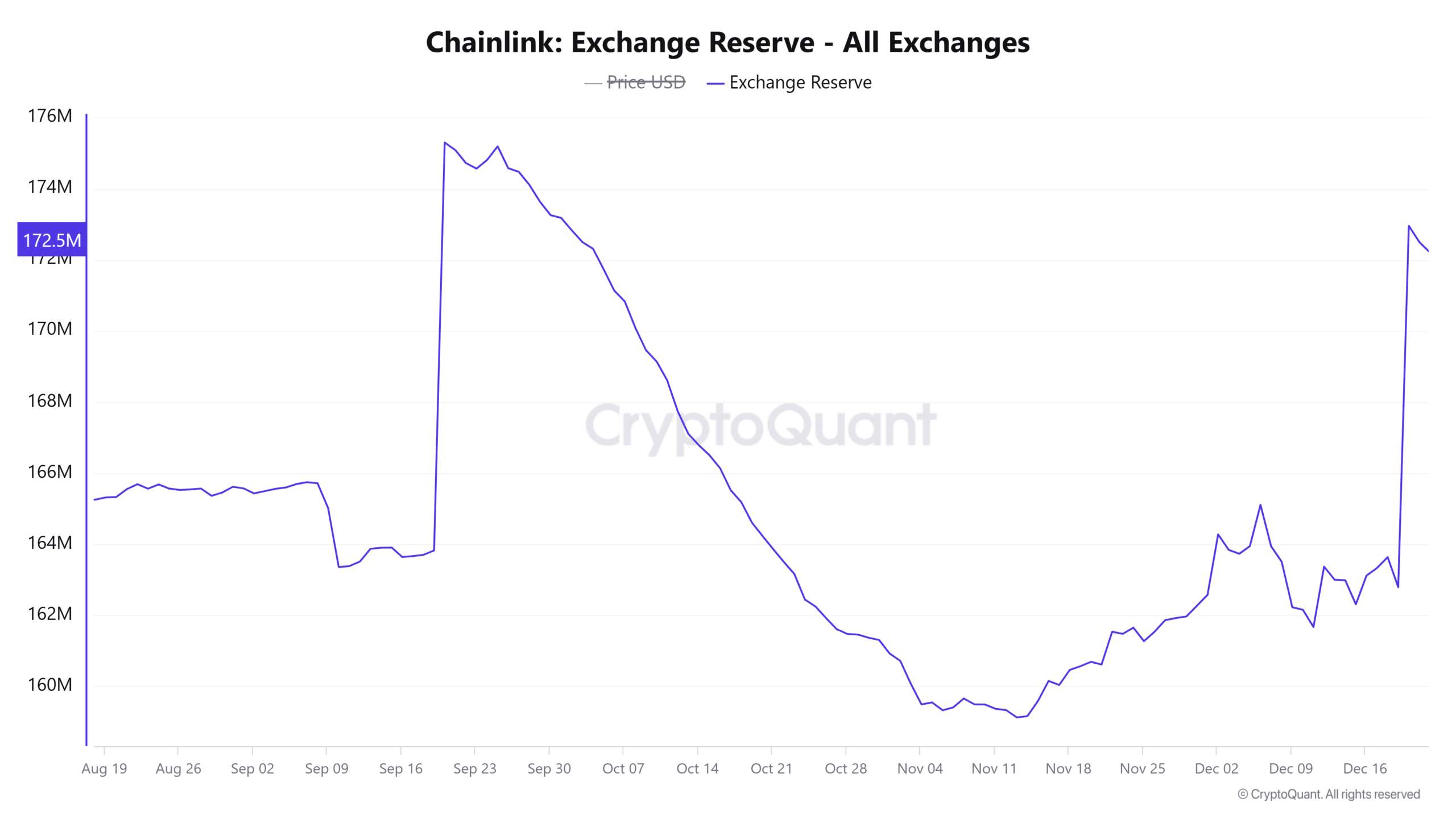

Link: This strengthens optimism

According to CryptoQuant analysis, the number of daily transactions on LINK increased by 1.05%, surpassing 11,466 transfers. This increase in activity potentially suggests increased interest in ChainLink due to recent whale movements.

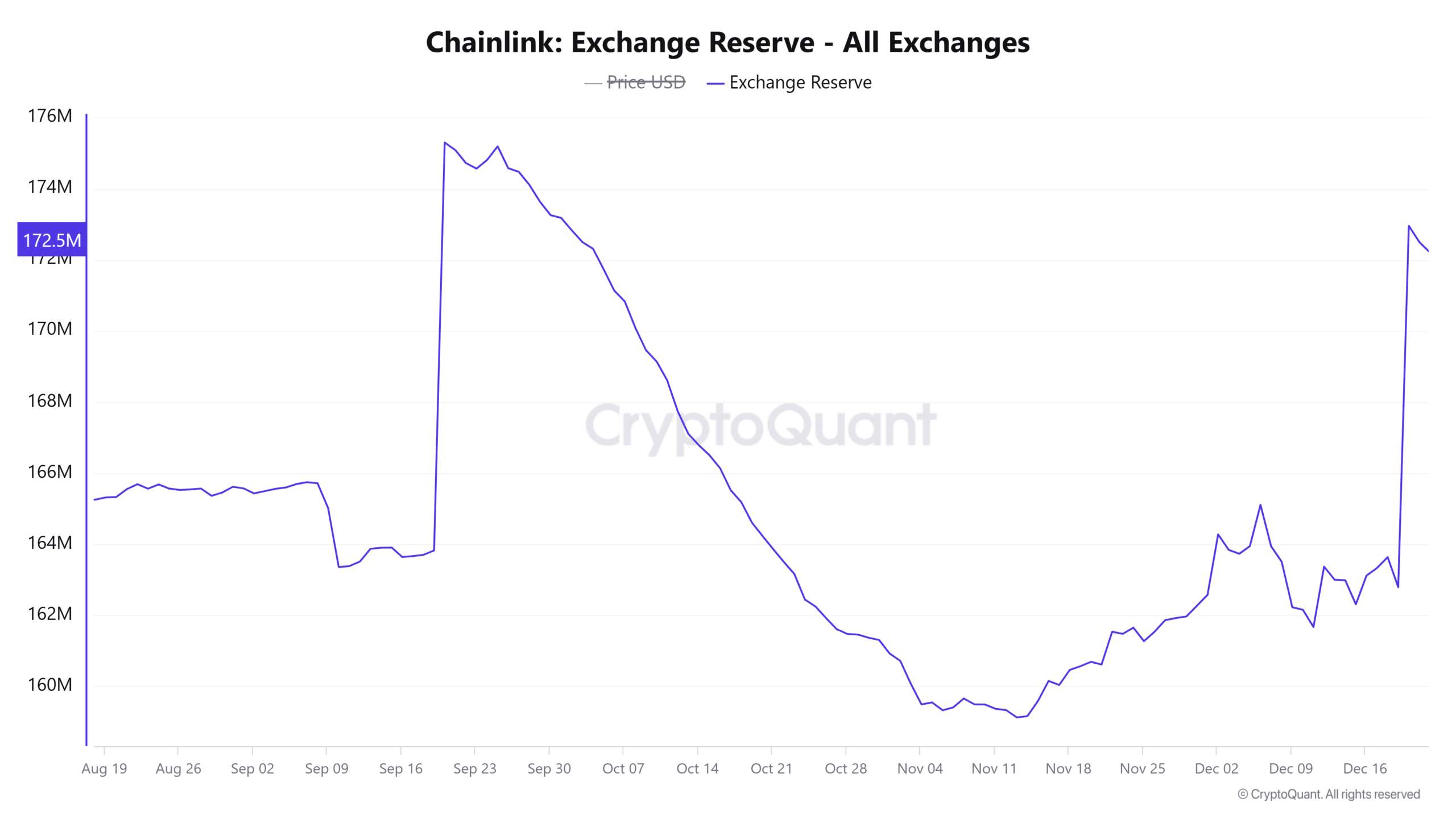

Additionally, foreign exchange reserves decreased 0.06% to $172.5 million, reflecting decreased sell-side liquidity.

Low reserves often mean tight supply, which can create upward pressure on prices if demand remains stable. Therefore, these factors together point to an environment conducive to optimistic outcomes.

Source: CryptoQuant

Is your portfolio green? Check out the LINK Profit Calculator

Conclusion: Are rallies inevitable?

All signs point to LINK being on the cusp of a significant breakout, with whale accumulation, dwindling foreign exchange reserves, and increased trading creating bullish conditions.

If LINK can break above $26.14, a rise to $30 seems likely, presenting a promising opportunity for investors.