- LINK price surged 18% in just three days after retesting a critical support level near $19.

- With more than 1.4 million LINK accumulated, token whale activity further intensified, signaling the possibility of further rallies.

Chainlink (LINK) has been at the center of attention from cryptocurrency investors following its recent surge. In the past three days alone, LINK has surged about 18% after bouncing from a key support zone around $19.

A rebound signals strength for an asset despite volatile markets.

Source: TradingView

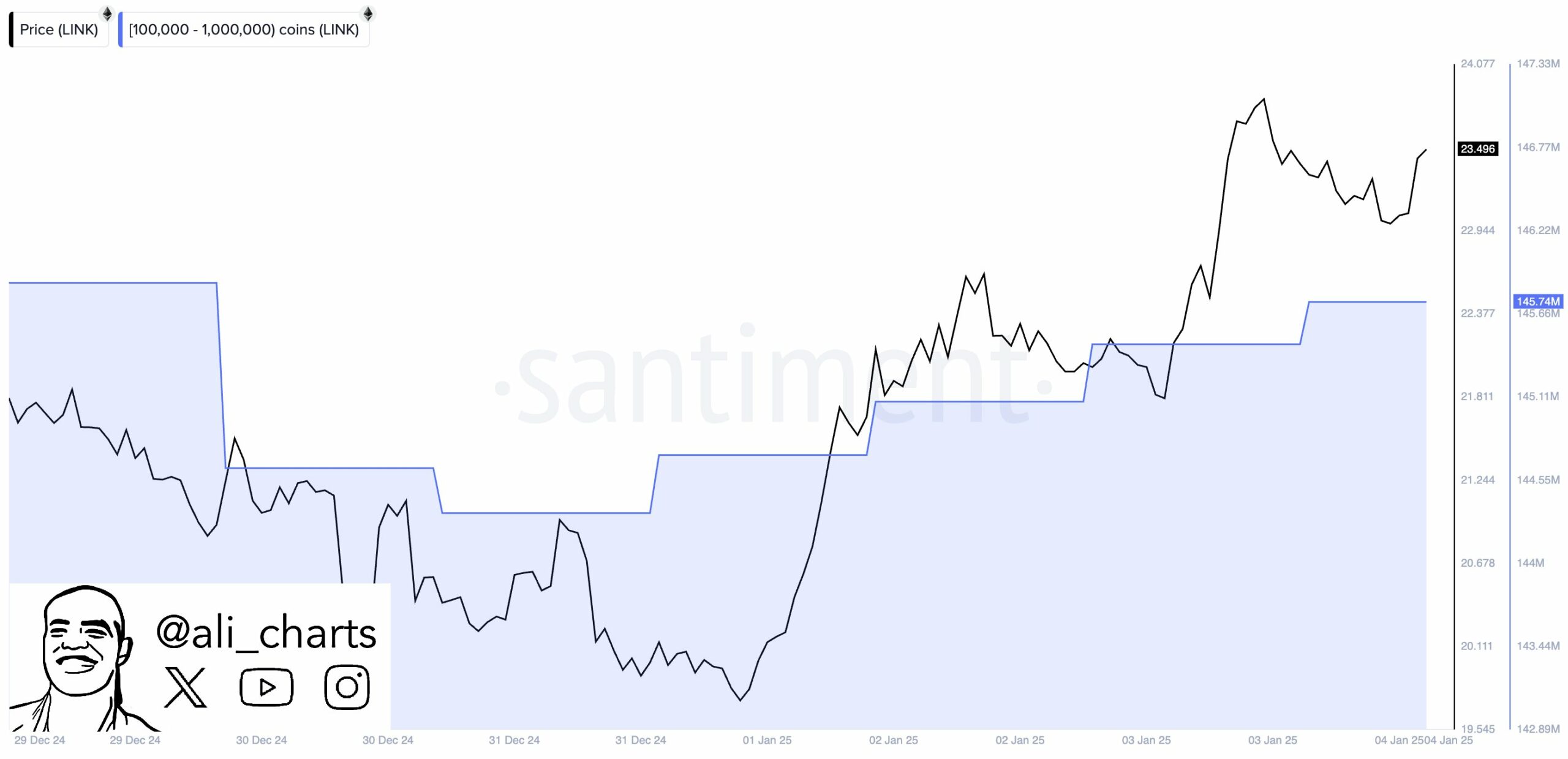

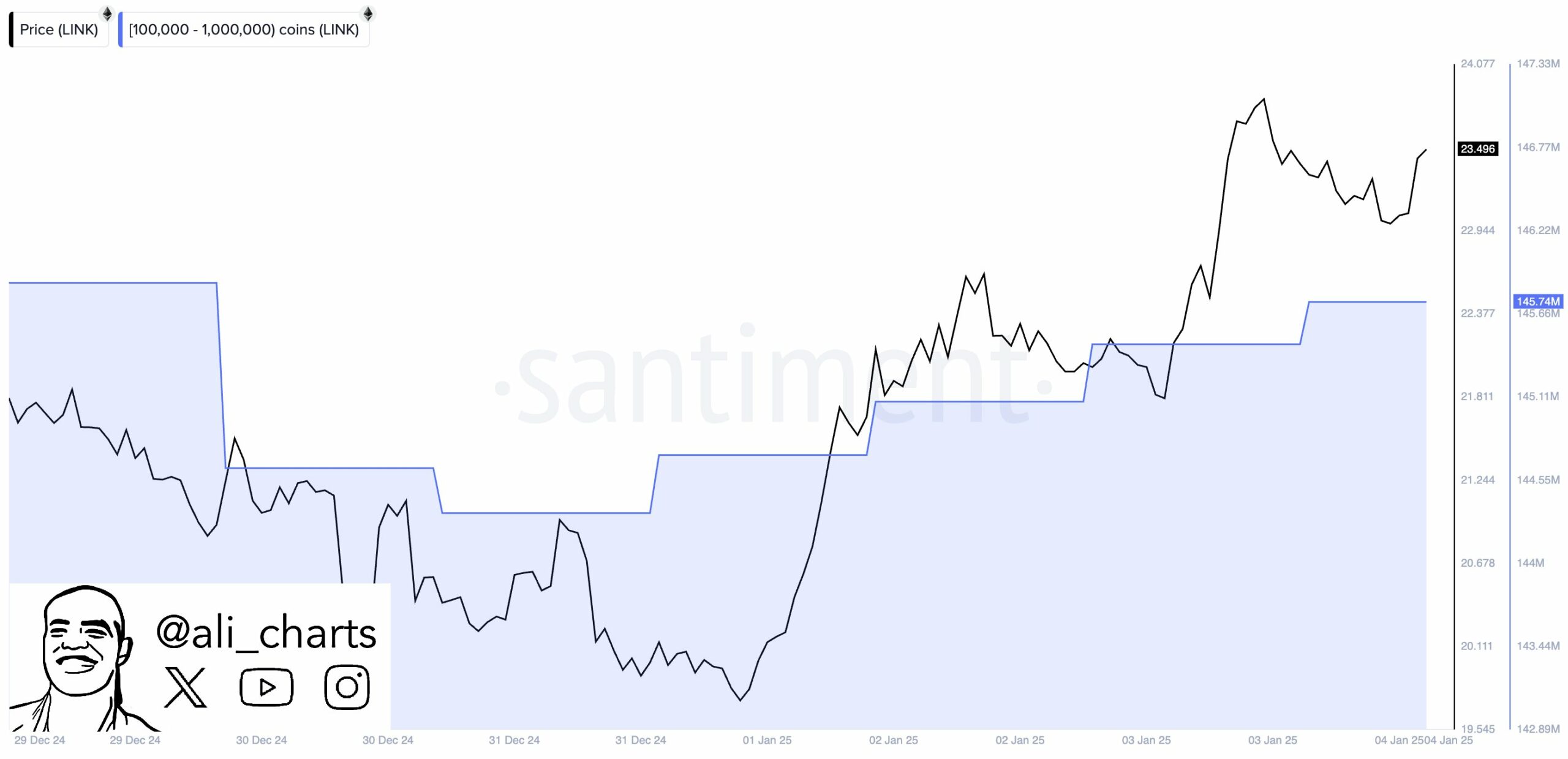

Adding fuel to a rally causes a noticeable increase in whale activity. According to a prominent analyst at X (formerly Twitter), large holders purchased over 1.4 million LINK in the last 96 hours.

This significant accumulation often suggests growing confidence among Chainlink’s key investors, possibly indicating long-term bullish sentiment.

Source: X

Exchange outflows decline, but LINK whales show confidence

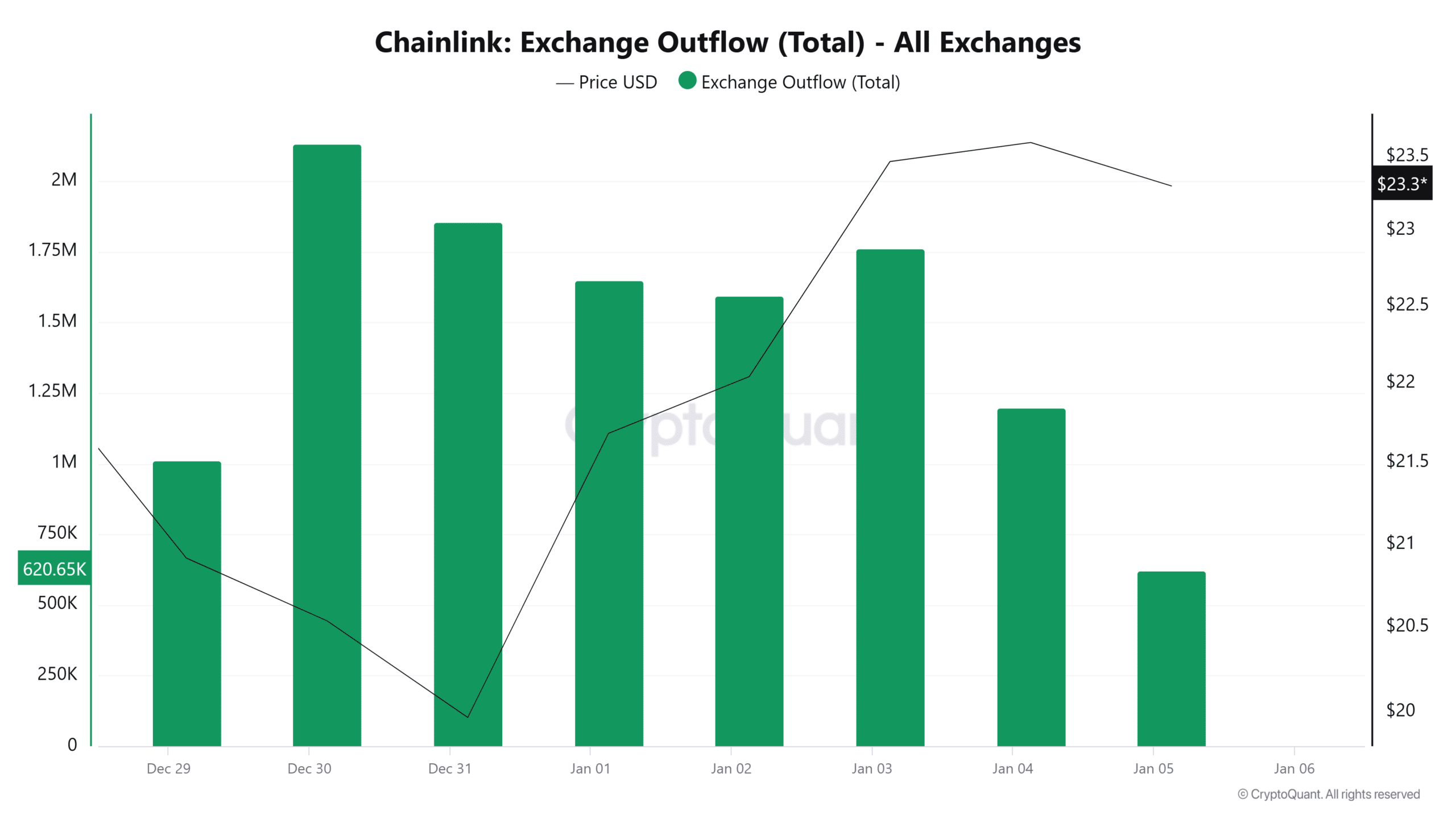

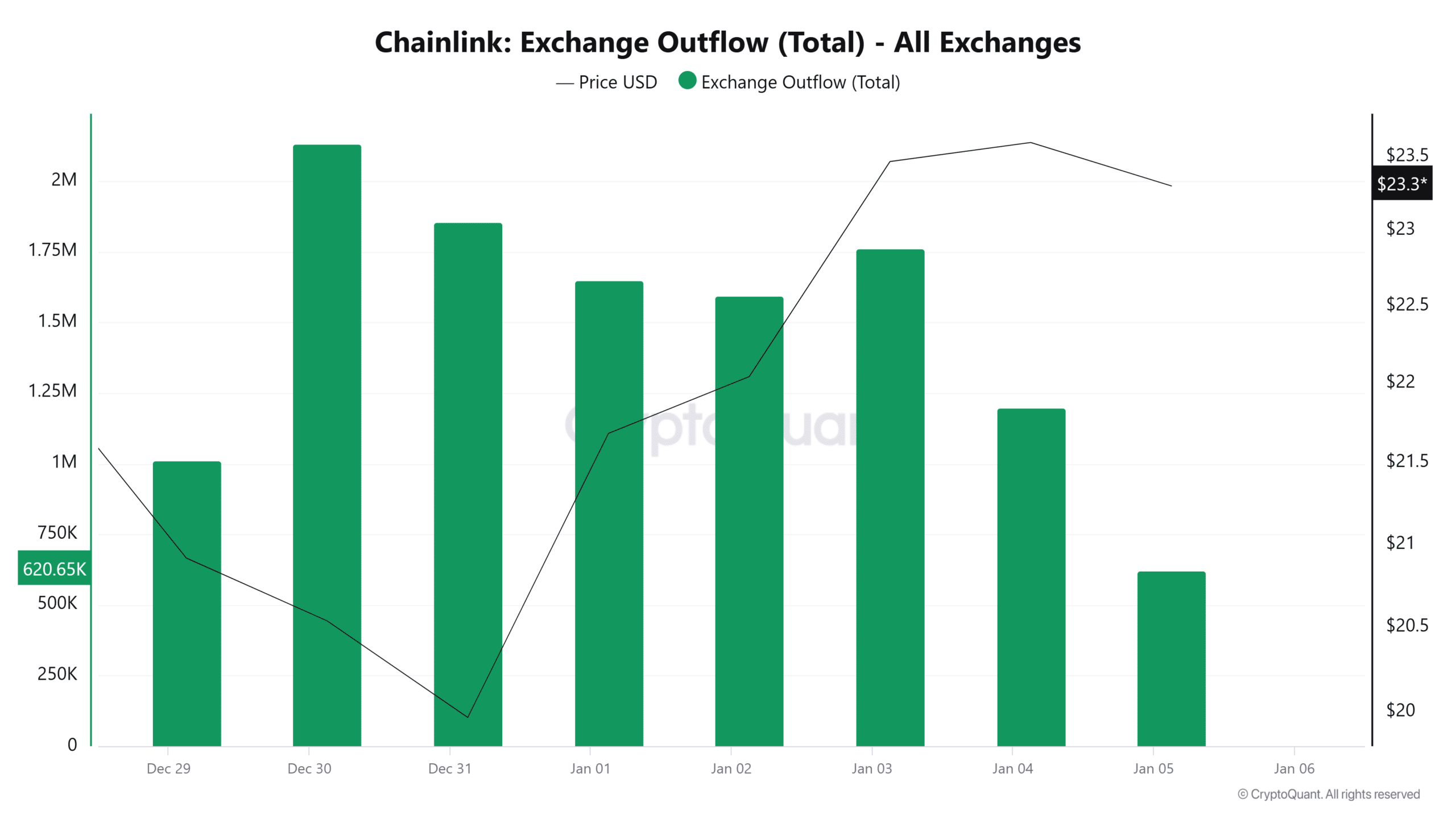

AMBCrypto’s closer examination of LINK’s on-chain metrics revealed positive trends for the token.

Exchange outflows, which typically indicate the movement of tokens across trading platforms, have steadily declined over the past three days.

This suggests market optimism as fewer LINK holders are moving their assets to exchanges for potential selling.

Source: CryptoQuant

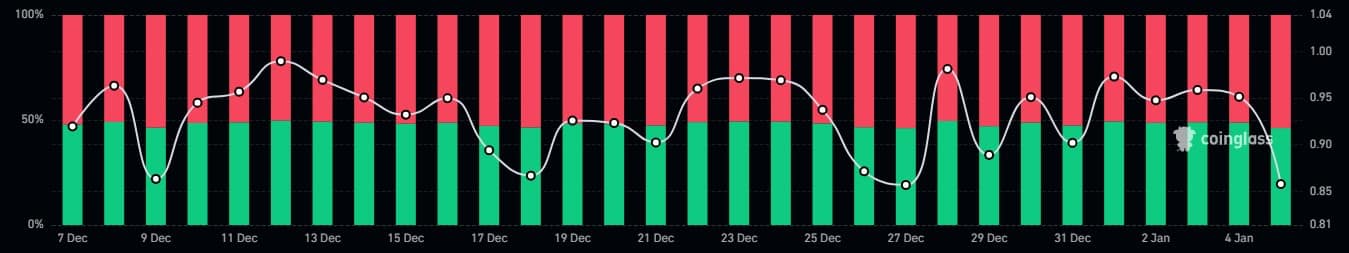

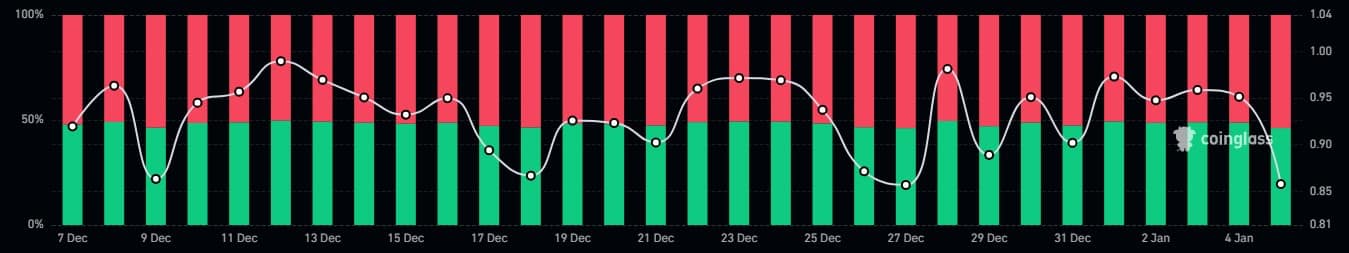

Interestingly, while the long/short ratio has been trending downward, short positions have been slowly declining, as shown in Coinglass data. This trend may be due to profit taking after the recent rally.

But the steady accumulation of whales suggests they are focused on long-term profits rather than short-term speculation.

Source: Coinglass

Could whale activity cause prices to rise?

Continued accumulation of whales could be a signal for higher prices. Historically, increases in whale activity have often outpaced bullish rallies in the cryptocurrency market.

If this trend continues, LINK could experience stronger upward momentum in the future.

Read Chainlink’s (link) 2025-2026 price prediction

Additionally, the sluggish decline in the buy/sell ratio supports the possibility of reduced selling pressure.

This scenario, combined with the whale’s confidence, could pave the way for LINK to test higher resistance levels.