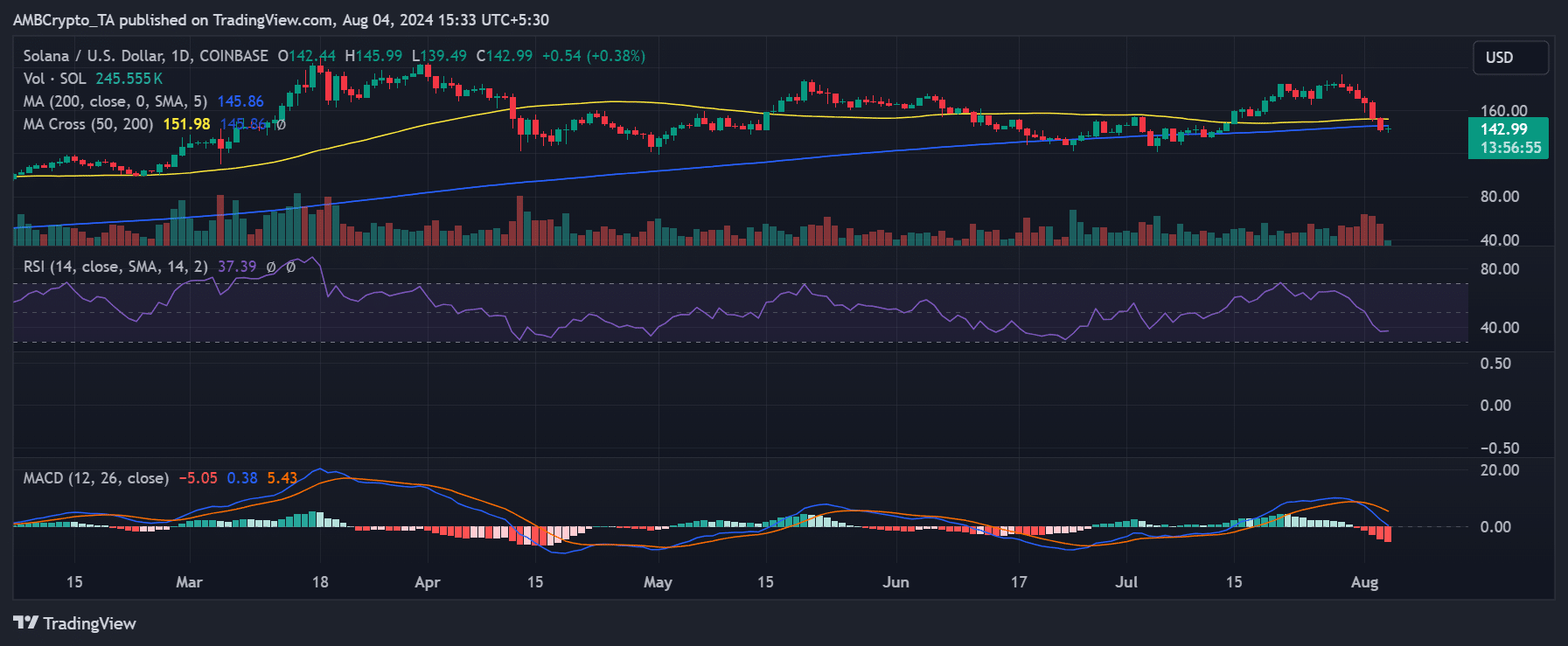

- SOL RSI currently shows below 40.

- SOL has fallen more than 22% over the past seven days.

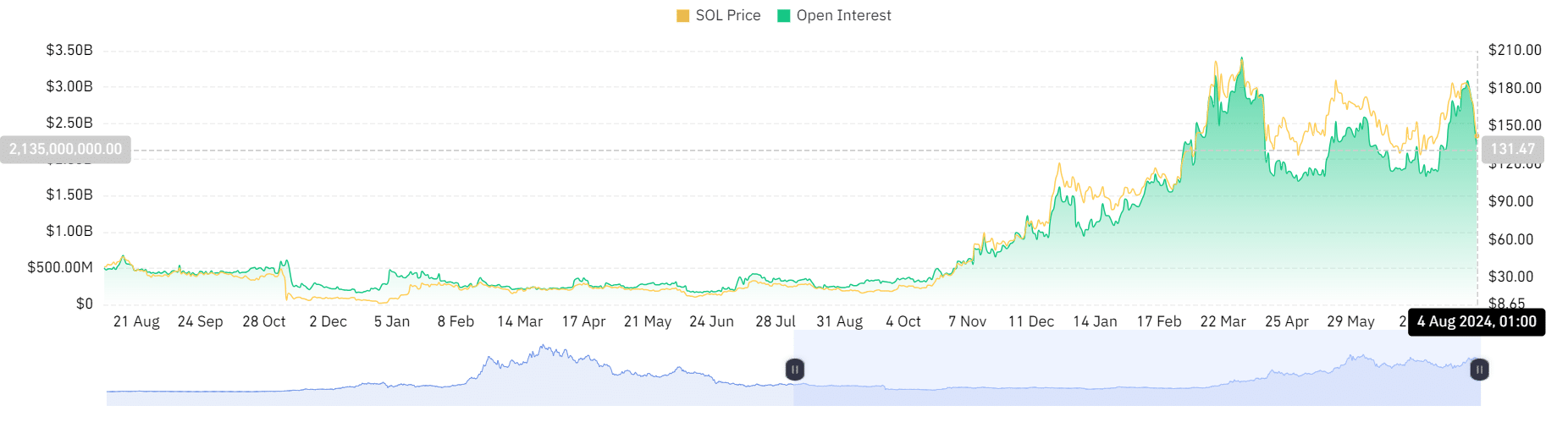

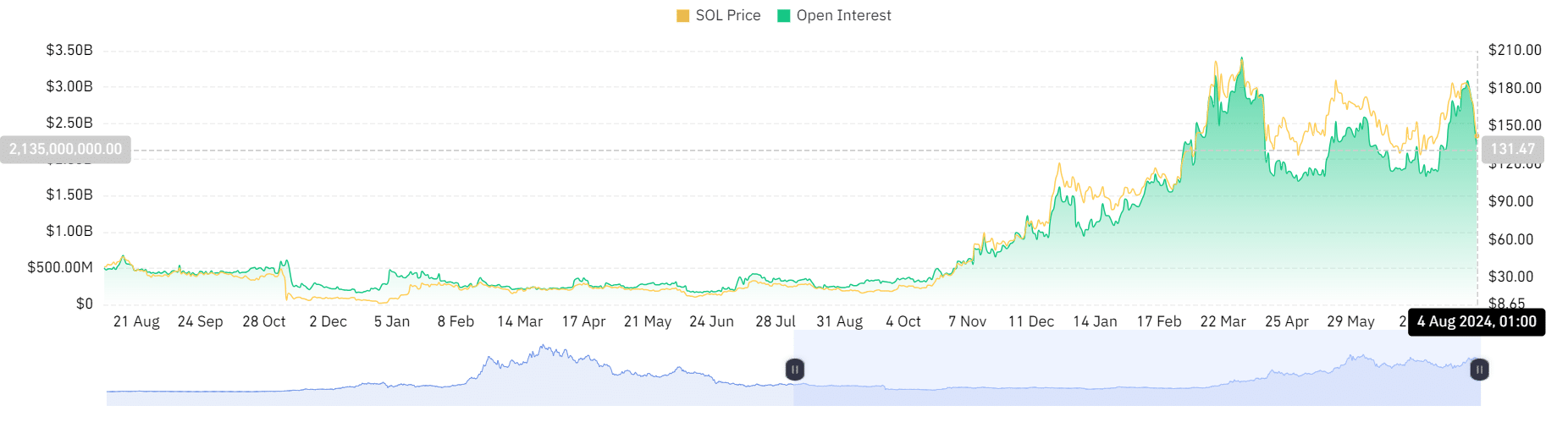

Recent data shows that Solana (SOL) has been particularly hard hit in a week that has seen a significant downtrend in the cryptocurrency market. Open interest for Solana has been falling for the past few weeks, reflecting the negative sentiment among investors.

Solana records double-digit decline

According to data from CoinMarketCap, Solana has seen the biggest decline among the top 10 cryptocurrencies over the past seven days, falling over 22%.

The only other asset to see a similar decline was Dogecoin, which fell 18% over the same period.

Further analysis shows that Solana is one of the biggest losers of the past week. According to the latest data, SOL has a trading volume of around $3.3 billion, but it has fallen by more than 20% in the last 24 hours.

Solana’s Trends

Analysis of Solana (SOL) on a daily basis shows a continuous downward trend, with a decline for 6 consecutive days and a greater decline than before.

According to AMBCrypto, the downtrend began on July 29 with a 1.29% drop, which took the price from around $184 to $182.

The biggest drop occurred on August 2nd, when the price fell 8.76%, from around $167 to $152. This drop brought SOL below its short-term moving average (yellow line), which was a support level.

Source: TradingView

On August 3, SOL experienced another significant decline of 6.6%, dropping the price to around $142. This move brought the price below the long-term moving average (blue line), which acted as another support level.

At the time of writing, Solana was trading around $142. The previous support levels, marked by the yellow and blue moving averages, have now become resistance levels.

Declining interest in SOL

Solana’s analysis of open transactions on Coinglass shows a significant decline over the past few days. Open transactions were around $3 billion on July 31, but have since fallen to around $2.2 billion.

This decline reflects reduced cash inflows into Solana, reflecting declining investor interest and increasing negative sentiment.

Additionally, analysis of Solana’s funding ratio showed that it had fallen below 0, indicating that sellers were dominating the trade and short positions were rampant.

Source: Coinglass

Read Solana(SOL) Price Prediction 2024-25

However, as of this writing, the funding ratio has surged back into positive territory and is now around 0.0051%. This change could primarily indicate a change in market sentiment, which could lead to a move away from short positions.

A positive funding ratio suggests that buying interest may be resuming, which could help stabilize Solana’s price in the short term.