|

We round up the weekly news from across Asia, highlighting the most important industry trends.

Chinese Investors Fooled by Point Running and Crypto Laundering Schemes

A new type of cryptocurrency scam is on the rise in China, with local residents losing money to a scam known as “point running,” according to a warning posted by the Public Security Bureau on September 10.

The term “point running” refers to the practice of moving cryptocurrencies between different accounts. Often victims who are not familiar with digital assets claim that they are processing transactions and earning rewards or fees by moving these cryptocurrencies.

Typically, this scam is marketed as a side hustle, with participants manually moving cryptocurrencies between accounts, falsely promising that these transactions will generate profits. In reality, victims may unknowingly act as money mules, laundering funds for illegal operations.

The latest version of the scam tricks victims into depositing cryptocurrency into a platform that claims to automatically process “points runs,” making the process seem easy. Victims are lured into investing more by the promise of small initial returns.

In the case highlighted by the police, a local resident named Wang joined a WeChat group after being introduced by a friend. The offer was simple: Invest in USDT (the “U” coin) and watch your money grow. Wang installed the app and initially invested 8,000 yuan (about $1,125), then increased his investment after seeing small profits. By August, he had invested more than 300,000 yuan (about $42,112). When Wang tried to withdraw the funds later that month, he received a screenshot confirming the transaction, but the money never arrived and his “U” balance disappeared from the app.

The king received 2,000 yuan ($280) in “fees” and ultimately lost 280,000 yuan ($39,305).

Authorities have warned that such scams are becoming more common as more and more locals are exposed to cryptocurrencies in China. China has banned several activities related to digital assets, including mining and trading.

Victims are often lured by promises of high returns with little effort, but authorities say such scams not only result in financial losses, but are often linked to money laundering, further complicating matters for those involved.

Hacked Indian Dox Launches Instagram Campaign for Damage Control

Indodax took a unique approach to addressing customer concerns after losing $22 million in a September 11 hack, launching a giveaway campaign on its Instagram account.

The campaign claims to offer 3 million rupiah (about $200) every hour to three winners chosen from those who participated in a comment contest responding to posts by the exchange and its CEO, Oscar Dharmawan, but the platform is currently closed for an “investigation.”

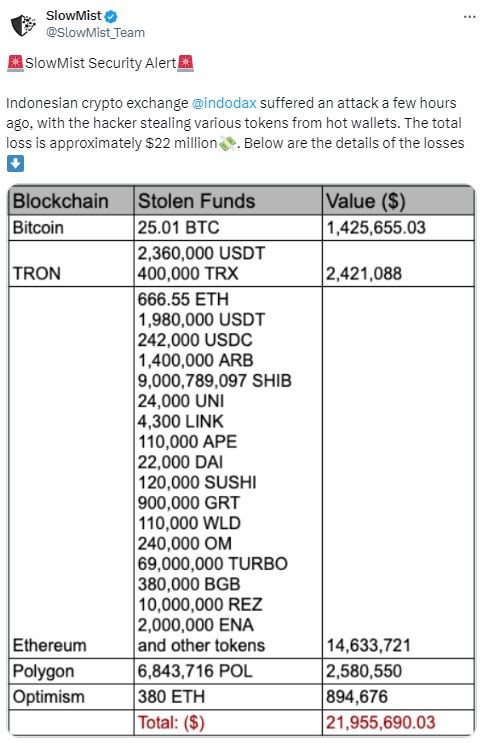

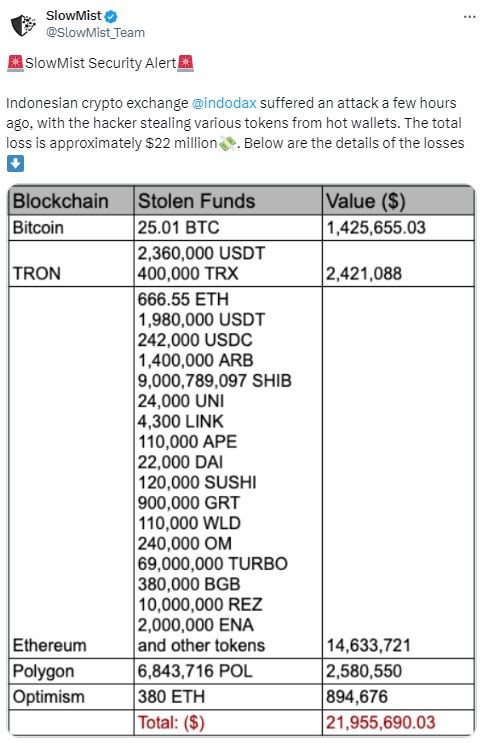

According to a report by security firm SlowMist, those customers are awaiting the results of an investigation into a $22 million exploit targeting Bitcoin, TRX, POL, and other ERC-20 tokens.

The IndoDax hack comes nearly two months after neighboring India’s major exchange WazirX suffered one of the biggest hacks of the year, which resulted in losses of $230 million.

WazirX, operated by Singapore-headquartered Zettai Pte and its Indian subsidiary Zanmai India, had asked the Singapore High Court in late August for a six-month reprieve, allowing the exchange to restructure its debt while also gaining temporary protection from creditor claims.

Like WazirX, the North Korean state-sponsored hacking group Lazarus has been blamed for the cyberattack on Indodax.

At the Seoul Defense Dialogue held on September 11, Prime Minister Han Duck-soo pointed out that North Korea’s theft of cryptocurrency for nuclear development is a global security threat.

In his speech, the prime minister said the South Korean government is in the process of developing “core strategic technologies” to prevent such cyberattacks in advance.

Also read

characteristic

DeFi’s Billion Dollar Secret: The Insiders Who Were Responsible for the Hack

characteristic

Doctor Who comes to Web3: Tony Pearce’s journey through time and space

Human trafficking linked to Southeast Asia pig slaughter scam

According to cryptocurrency compliance and investigations firm AMLBot, pig slaughter scams are on the rise in Southeast Asia.

In August, the firm handled an investigation that found victims lost $3.2 million to the pig slaughter scam, a type of romance scam where the scammer slowly gains the victim’s trust and then manipulates their emotions to steal their money, up $1 million from July.

“Based on our investigation and findings, a large-scale pig slaughtering network is currently concentrated around Cambodia, Myanmar, and the Philippines, with the Cambodian network being run by a Chinese crime syndicate boss,” AMLBot said in a statement shared with the magazine.

They added that there is also an aspect of human trafficking, with children being kidnapped from India and Nepal and taken to facilities in Laos, where they are held captive and tricked into sending cryptocurrency.

According to AMLBot, in the past, criminal proceeds were mainly laundered through cryptocurrency exchanges, but these days, funds are flowing through Huione Pay.

Huione Pay is a foreign exchange business owned by Huione Group, which also operates Huione Guarantee, a multi-billion dollar market.

In July, crypto forensics firm Elliptic reported that Huione Guarantee had evolved into an online marketplace favored by Southeast Asian pig slaughter scammers, with merchants on the platform transacting more than $11 billion.

AMLBot’s August findings are consistent with those of forensics firm Chainalysis.

Chainalysis recently told Cointelegraph that scammers are increasingly moving from sophisticated Ponzi schemes to faster-moving scams, such as pig slaughters that target individuals on social media.

Also read

characteristic

You can now clone NFTs as ‘Mimics’. Here’s what that means:

characteristic

Peter McCormack’s Real Bedford Football Club put Bitcoin on the map.

Philippine Science High School Deploys Blockchain to Manage Student Records

A prestigious public high school in the Philippines is planning to use blockchain technology to manage and verify students’ academic records, local broadcaster ABS-CBN reported.

The Philippine Science High School (Pisay) highlighted how blockchain technology can streamline the process of accessing and managing student records. Traditionally, students and parents had to visit the school in person. By implementing blockchain, the new system eliminates this bottleneck and allows records to be accessed online, safely and conveniently. This approach ensures faster and more efficient service while maintaining the integrity and authenticity of academic documents.

The initiative is being developed by the Ministry of Science and Technology and aims to demonstrate how blockchain can be used beyond cryptocurrencies and to unleash its potential in public sector applications.

PISA’s digital certificate is scheduled to begin trial operation in late 2024 and be fully launched by 2025.

Several academic institutions have explored blockchain-based certificates to enhance the security and authenticity of academic records. One of the earliest examples dates back to 2017, when the Massachusetts Institute of Technology (MIT) launched the Blockcerts initiative, which allows graduates to receive their degrees in a digital format secured by blockchain technology.

Also in 2017, the University of Melbourne in Australia began issuing blockchain-based microcredentials to help employers verify student achievement.

Subscribe

The most interesting articles on blockchain, delivered once a week.

Yoon Yohan

Yohan Yoon is a multimedia journalist covering blockchain since 2017. He has contributed as an editor to Forkast, a cryptocurrency media outlet, and has covered Asian technology stories as an assistant reporter for Bloomberg BNA and Forbes. In his free time, he enjoys cooking and experimenting with new recipes.