Patrick Hansen, Circle’s European Strategy Director, predicted a major leap forward in the EU’s cryptocurrency and stablecoin markets by the end of 2025.

Speaking at the European Blockchain Convention in Barcelona, Hansen shared his expectations for the development of cryptocurrency market structures across the European Union. The block’s regulated market for crypto assets, known as Crypto Asset Regulated Markets, will be a key catalyst for this growth, Hansen said during a panel titled “What’s Happening Behind the Scenes – Post-MiCA?”

MiCA signals a shift in the EU’s cryptocurrency regulatory strategy, providing comprehensive guidance to governments, institutions and investors regarding digital assets.

In fact, MiCA outlined requirements for cryptocurrency exchanges and thresholds for stablecoin reserves. Circle (USDC) was one of the first stablecoin beneficiaries of this new regime, snatching up MiCA’s first stablecoin license.

Hansen said MiCA compliance and final regulatory approvals require different processes than those in other regions. For example, the issuer of USDC was in contact with regulators for up to 24 months before receiving approval.

Circle has also applied for a French electronic money institution license, approved by France’s banking watchdog, Autorité de Contrôle Prudentiel et de Résolution.

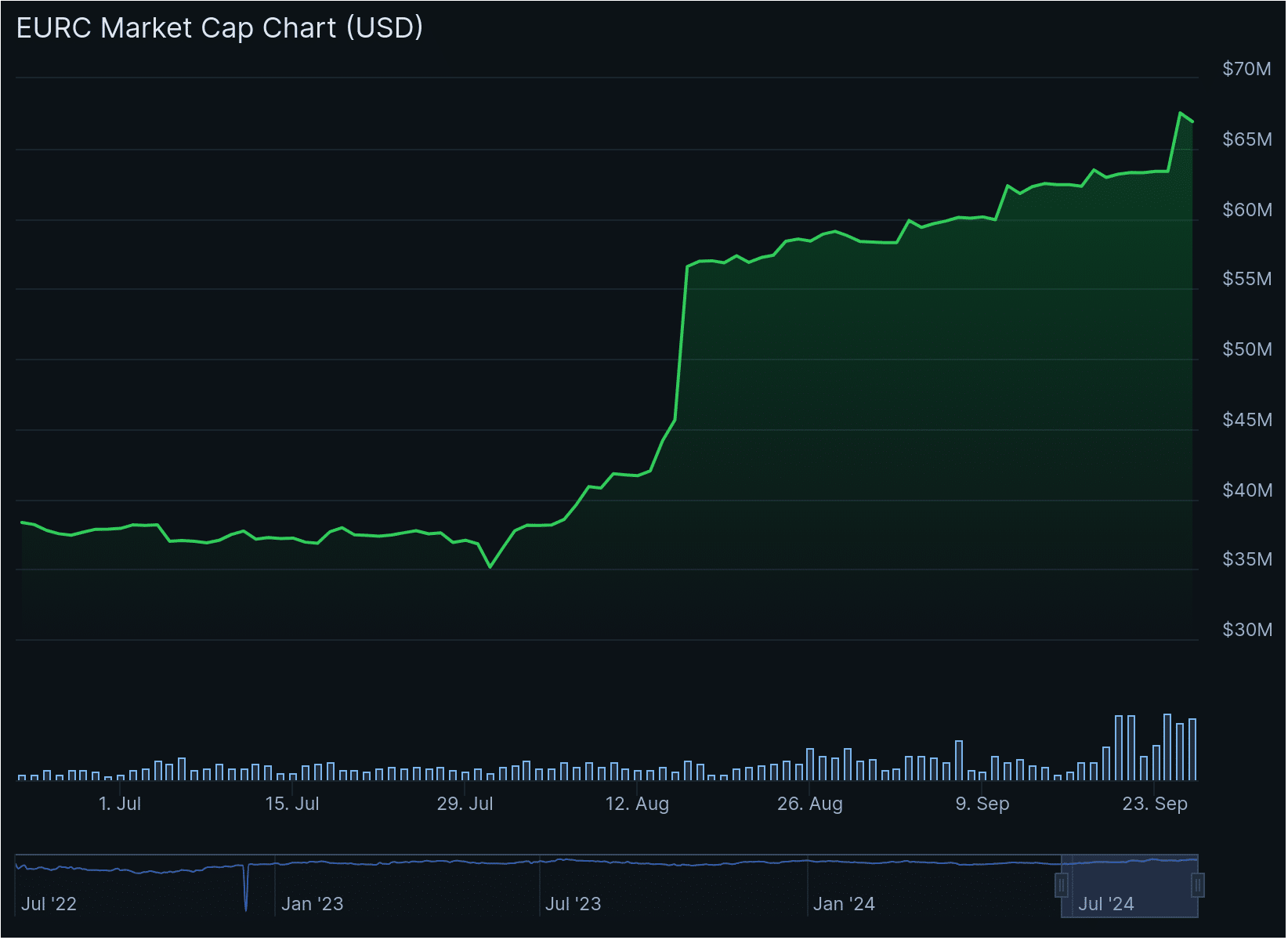

According to Hansen, the company’s euro-pegged stablecoin, EURC, has risen 60-70% since July, when approval was given. The token’s current market capitalization is over 67 million euros. Hansen expects EURC and other stablecoins in the EU to continue to grow under MiCA’s rules.

We believe that we can expect at least significant growth over the next 12 months, not only for Euro stablecoins in the European Union, but for Euro stablecoins overall.

Patrick Hansen, Senior Director EU Strategy and Policy at Circle

As the USDC operator solidifies its European foothold, CEO Jeremy Allaire has pushed ahead with plans for an initial public offering (IPO) in the United States. The digital payments provider has moved its global headquarters to central New York City as part of its roadmap to an initial public offering. Circle’s new office is located at One World Trade Center, alongside some of Wall Street’s biggest names, such as Goldman Sachs.