- Visa said Coinbase users can deposit funds into their Coinbase accounts using their Visa debit cards.

- The announcement comes as the price of Bitcoin was trading near its March all-time high on Tuesday.

Coinbase and Visa are teaming up to offer real-time account funding to customers, giving them more flexibility in the cryptocurrency space.

The announcement from Visa, which is available to customers in the U.S. and Europe, comes as the price of Bitcoin nearly reached its March all-time high of $73,700 on Tuesday. At the time of publication, Bitcoin is trading at $72,500, according to data from CoinMarketCap.

Integration with Visa Direct allows Coinbase customers to fund their Coinbase account using eligible Visa debit cards. According to Visa, this integration will give Coinbase users more flexibility in a “dynamic crypto environment.”

“Offering real-time account funding using Visa Direct and eligible Visa debit cards means Coinbase users with eligible Visa debit cards will know they can take advantage of trading opportunities day or night,” said Yanilsa Gonzalez Ore, Head of Visa Direct. .” he said. , North America for Visa.

In addition to real-time deposits, Coinbase users can use their Visa debit cards to cash out money from their Coinbase account in real time.

Expand your reach

The addition of real-time deposits adds to Coinbase’s Visa debit card, which is available to U.S.-based customers.

In October 2020, the cryptocurrency platform announced the launch of a Visa debit card for users to make purchases online and in-store. Users can also make ATM cash withdrawals.

The launch of the US Coinbase card follows the launch of the Coinbase Visa debit card for UK and EU customers in 2019.

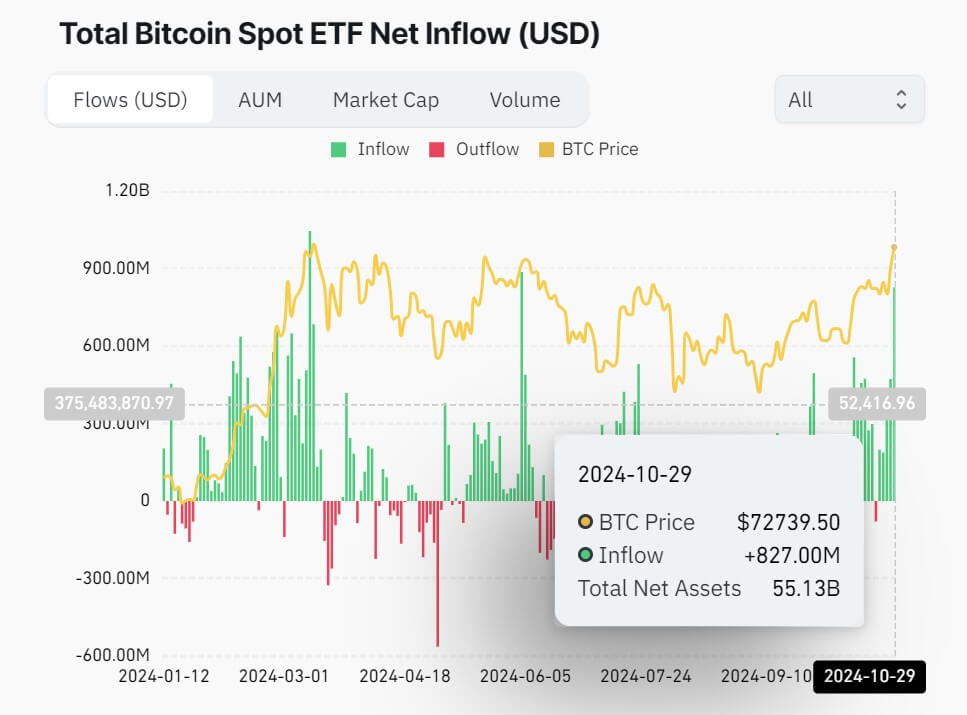

Bitcoin ETF Inflows

Real-time deposits were made as the spot Bitcoin exchange-traded fund (ETF) reached $827 million yesterday, according to data from CoinGlass.

“FOMO confirmed,” Bloomberg ETF analyst Eric Balchunas said in a post on

FOMO confirmed (and this is just from Monday activity. Today won’t show up in flow until tmrw night) https://t.co/jc0kyHJuqc

— Eric Balchunas (@EricBalchunas) October 30, 2024

“It’s by far the most, not just IBIT, because all the major BTC ETFs saw increased volume over the two days,” Balchunas added.