- Coinbase Ventures secured over $20 million in AERO.

- Will DEX growth and Coinbase’s moves spark the next bull run for AERO?

Coinbase Ventures, Coinbase’s investment arm, doubled its investment in Aerodrom Finance. aeroIt’s a move market experts consider a bullish signal.

Coinbase Ventures has secured $20 million worth of AERO, the largest ever for the token, according to Arthur Cheung, founder of cryptocurrency VC DeFiance Capital. that stated,

“And now we, along with all other market participants, have made our largest ever investment in liquid tokens (over $20 million) purchased on the open market. Think about why they are so optimistic and still buying more.”

Aerodrome Finance’s Moat

Cheung added that Coinbase’s bullish confidence could be linked to Aerodrome Finance’s increasing dominance in the Base ecosystem.

For context, Aerodrome is Base’s largest liquidity provider and decentralized exchange (DEX). Ethereum (ETH) L2 has received tremendous interest and attention from institutional investors.

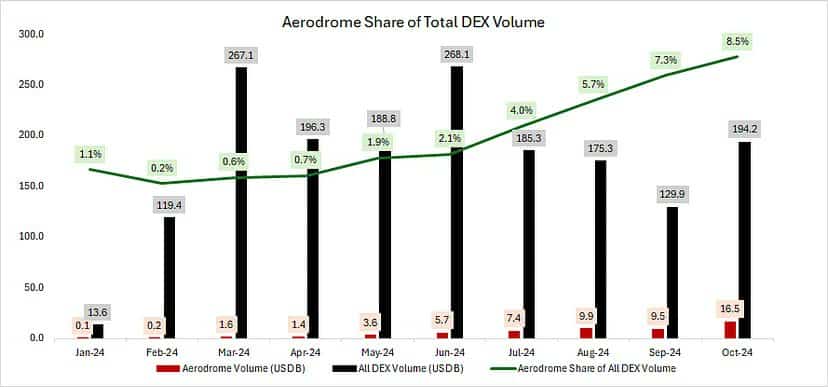

In less than a year, Aerodrome’s DEX volume dominance has skyrocketed from 0% to over 8% at press time.

Source: X

Since then, its incredible growth has led to it accounting for nearly half of Base’s total value locked (TVL), said Coinbase analyst David Han. that stated,

“Airfields accounted for 47% of Base TVL ($3.2 billion out of $1.5 billion) and 58% of Base DEX volume ($12.2 billion out of $7.1 billion) over the past seven days.”

Interestingly, the token’s price action has benefited from its growth. AERO has surged 1400% year over year and was valued at $1.39 at press time.

Will the expected increase in DEX trading volume and Coinbase’s move bring additional upward traction?

AERO Price Action

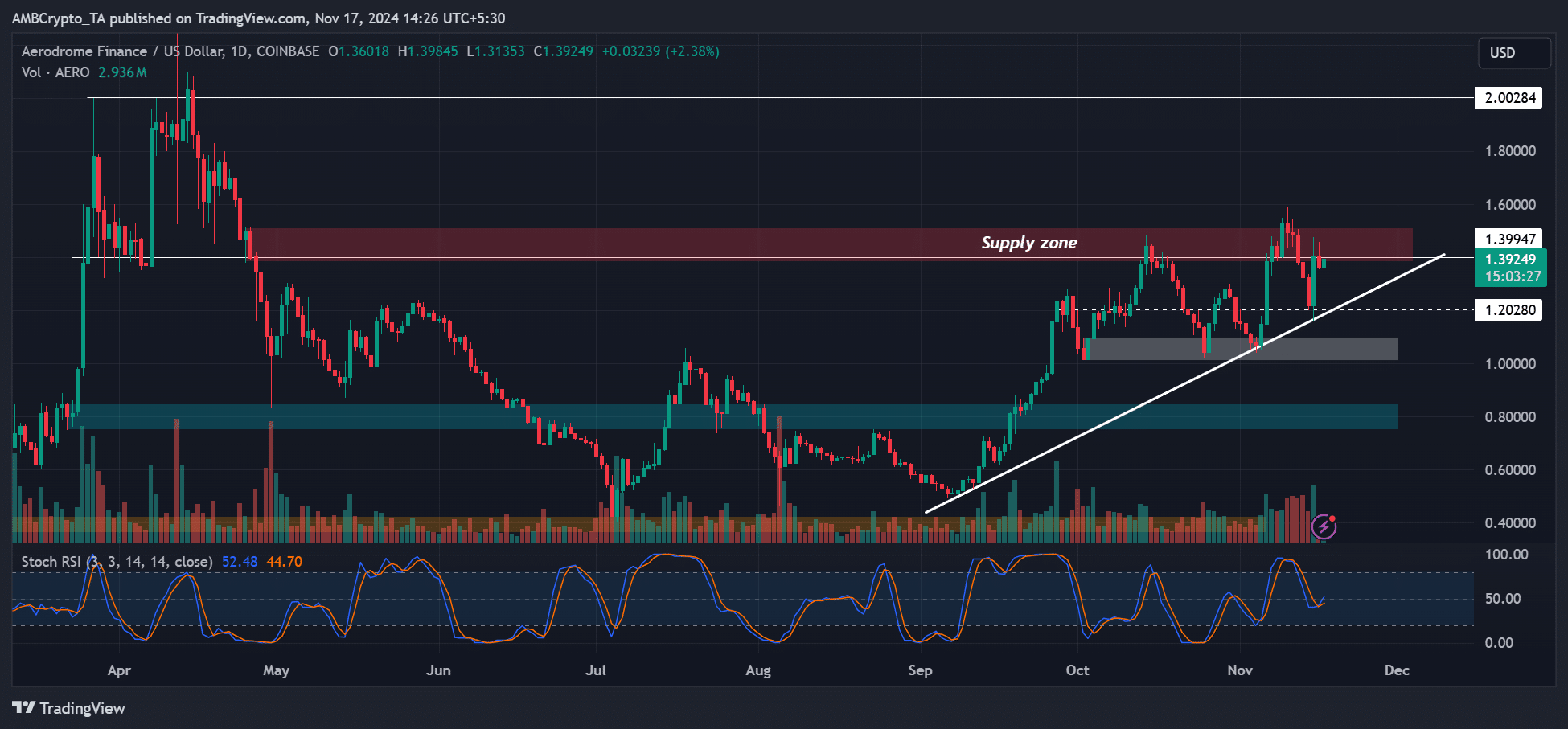

Source: AERO/USD, TradingView

On the daily price chart, AERO remained above the trendline support (white line) and the Q4 support area remained above $1.

$1.4 has served as a strong supply area (red) since October, but removal of resistance could see the token hit $2 and all-time highs.

If AERO reaches $2, it could offer a high risk-reward (RR) ratio and potential profits of over 40% from current levels.

read Aerodrome Finance (AERO) Price Prediction From 2024 to 2025

In other words, a break below the trend line and Q4 support could damage the bullish outlook. These levels can act as stop losses for swing traders looking to buy AERO.

But for investors, the potential further hemorrhaging could still offer a discounted buy for long-term holding.