Bitcoin (BTC) ETF sees record weekly inflows of $2.4 billion, led by BlackRock’s IBIT: CoinShares

CoinDesk, a well-known media outlet for cryptocurrency news, has updated its privacy policy, terms of use, and cookies and now offers the option to not sell your personal information. In November 2023, CoinDesk was acquired by Bullish Group, which owns a regulated digital asset exchange. Bullish Group is the majority shareholder of Block.one and both have interests in blockchain and digital asset businesses. CoinDesk operates as an independent subsidiary and maintains high journalistic standards through an editorial board chaired by a former Wall Street Journal editor. This acquisition expands CoinDesk’s resources and expertise in the cryptocurrency and digital asset industry.

Bitcoin (BTC) ETF sees record weekly inflows of $2.4 billion, led by BlackRock’s IBIT: CoinShares

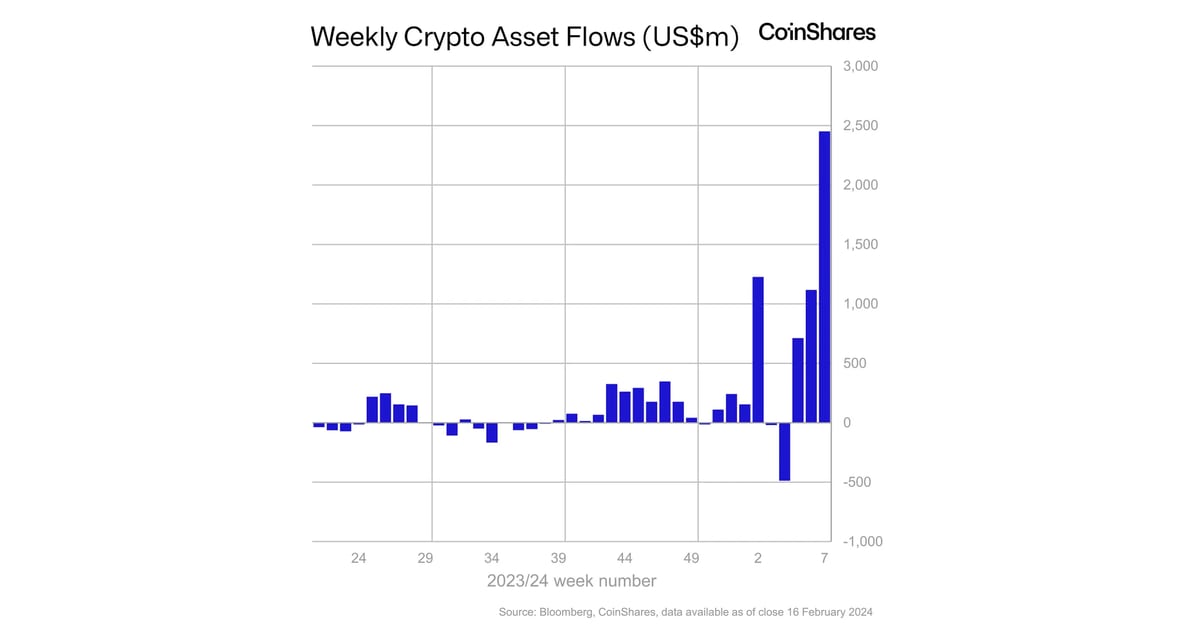

In a major development in the cryptocurrency market, Bitcoin (BTC) exchange-traded funds (ETFs) recorded record weekly inflows of $2.4 billion, with BlackRock’s IBIT leading the way, according to data from CoinShares.

The surge in inflows comes as institutional investors continue to show growing interest in Bitcoin and other cryptocurrencies as a hedge against inflation and as a potential store of value.

According to CoinShares, BlackRock’s IBIT was the best performer in weekly inflows, attracting $830 million, followed by Purpose Bitcoin ETF with $620 million and 21Shares Bitcoin ETF with $580 million. This figure represents a significant increase compared to the previous week and indicates a growing appetite for Bitcoin exposure among institutional investors.

The surge in Bitcoin ETF inflows is clear evidence that institutional investors are looking for new ways to gain exposure to cryptocurrency markets, with ETFs emerging as a popular choice due to their ease of access, regulatory oversight, and familiarity with traditional investors. .

As institutional interest in Bitcoin ETFs grows, BlackRock’s IBIT has gained traction, quickly becoming the choice of many institutional investors seeking exposure to Bitcoin. BlackRock is the world’s largest asset manager, and its decision to launch a Bitcoin ETF was seen as an important validation of the cryptocurrency as an asset class.

The recent surge in Bitcoin ETF inflows coincides with a period of strong price performance for Bitcoin, which has seen its price surge to all-time highs in recent weeks. The combination of strong price performance and growing institutional interest has catapulted Bitcoin to new heights, with many analysts predicting that the cryptocurrency could continue to gain further gains in the near future.

The strong inflows into Bitcoin ETFs come at a time when the regulatory environment for cryptocurrencies is rapidly evolving. The U.S. Securities and Exchange Commission (SEC) is currently reviewing several applications for Bitcoin ETFs, and a decision to approve one of these applications could further drive Bitcoin adoption at the agency.

The growing popularity of Bitcoin ETFs has also had a major impact on the overall cryptocurrency market, as increased institutional interest has helped fuel a broader bull market. In addition to Bitcoin, many other cryptocurrencies have seen significant gains in recent weeks as institutional investors look to diversify their portfolios and gain exposure to the broader cryptocurrency market.

The surge in Bitcoin ETF inflows is expected to have a positive impact on Bitcoin’s long-term price outlook as increased institutional investment is likely to provide strong support for the cryptocurrency. With institutional investors now seeking exposure to Bitcoin through regulated ETFs, the cryptocurrency is likely to become a much more attractive option for traditional investors in the future.

The surge in Bitcoin ETF inflows reflects a broader shift in the investment landscape as traditional investors increasingly look to cryptocurrencies as a new asset class that can offer diversification and potential returns in a low interest rate environment.

As the cryptocurrency market continues to evolve, it is clear that Bitcoin ETFs have quickly emerged as a major gateway for institutional investors to gain exposure to the market. It is clear that institutional interest in Bitcoin continues to grow, with record weekly inflows and strong performance by major ETFs such as BlackRock’s IBIT.

With the cryptocurrency market poised for further growth and the regulatory environment rapidly evolving, Bitcoin ETFs will likely continue to play a key role in attracting institutional investors to the market while exposing traditional investors to the potential of cryptocurrencies. We will provide you with a possible path. In a regulated and familiar way. As a result, the recent surge in Bitcoin ETF inflows is likely just the beginning of a new era of institutional adoption for cryptocurrency markets.

I do not own any rights to this content and no infringement is intended. Source: www.coindesk.com