- Conflux has had a bullish daily structure since Monday.

- If volume increases, a breakout could reach the May resistance level.

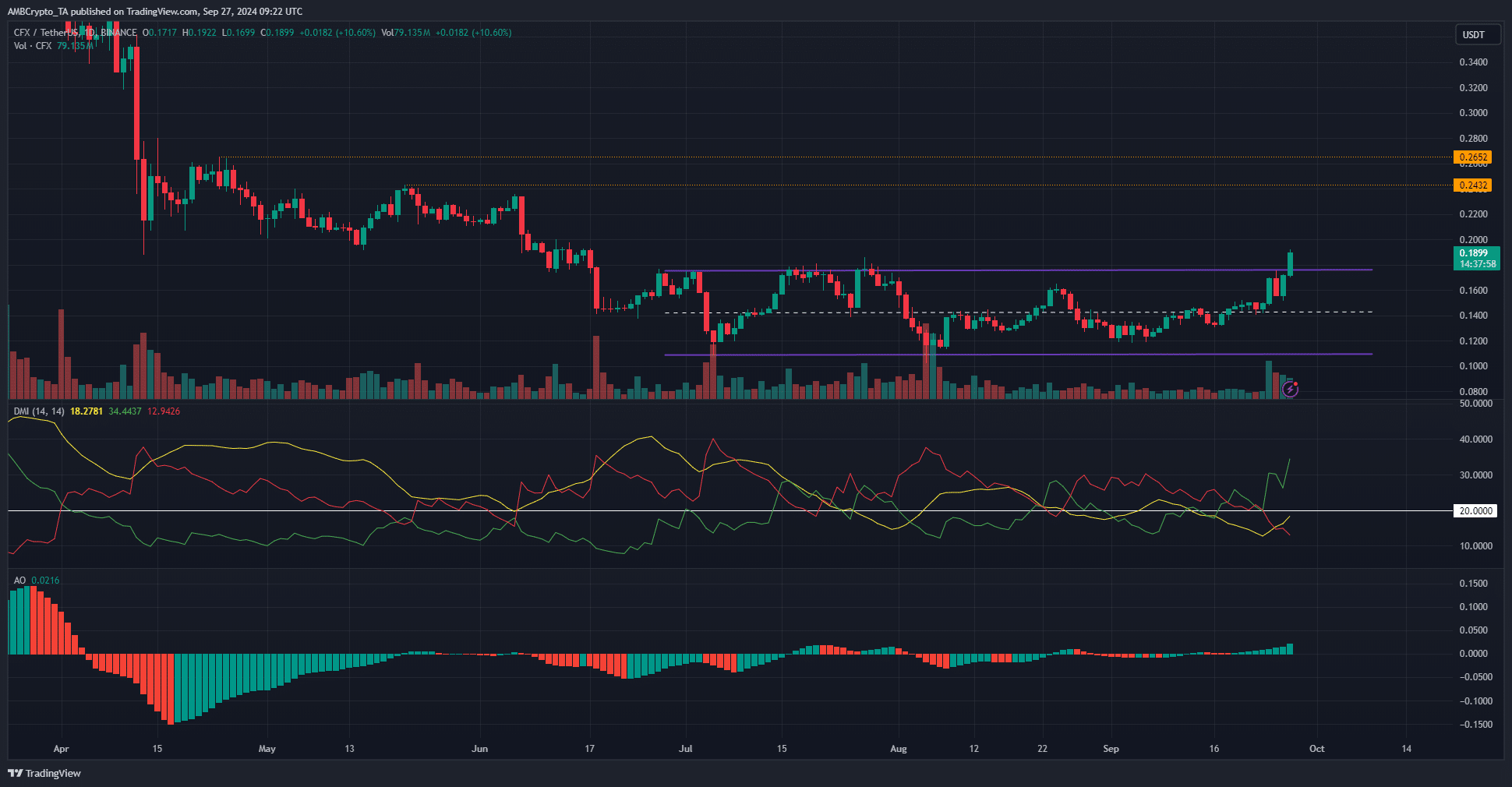

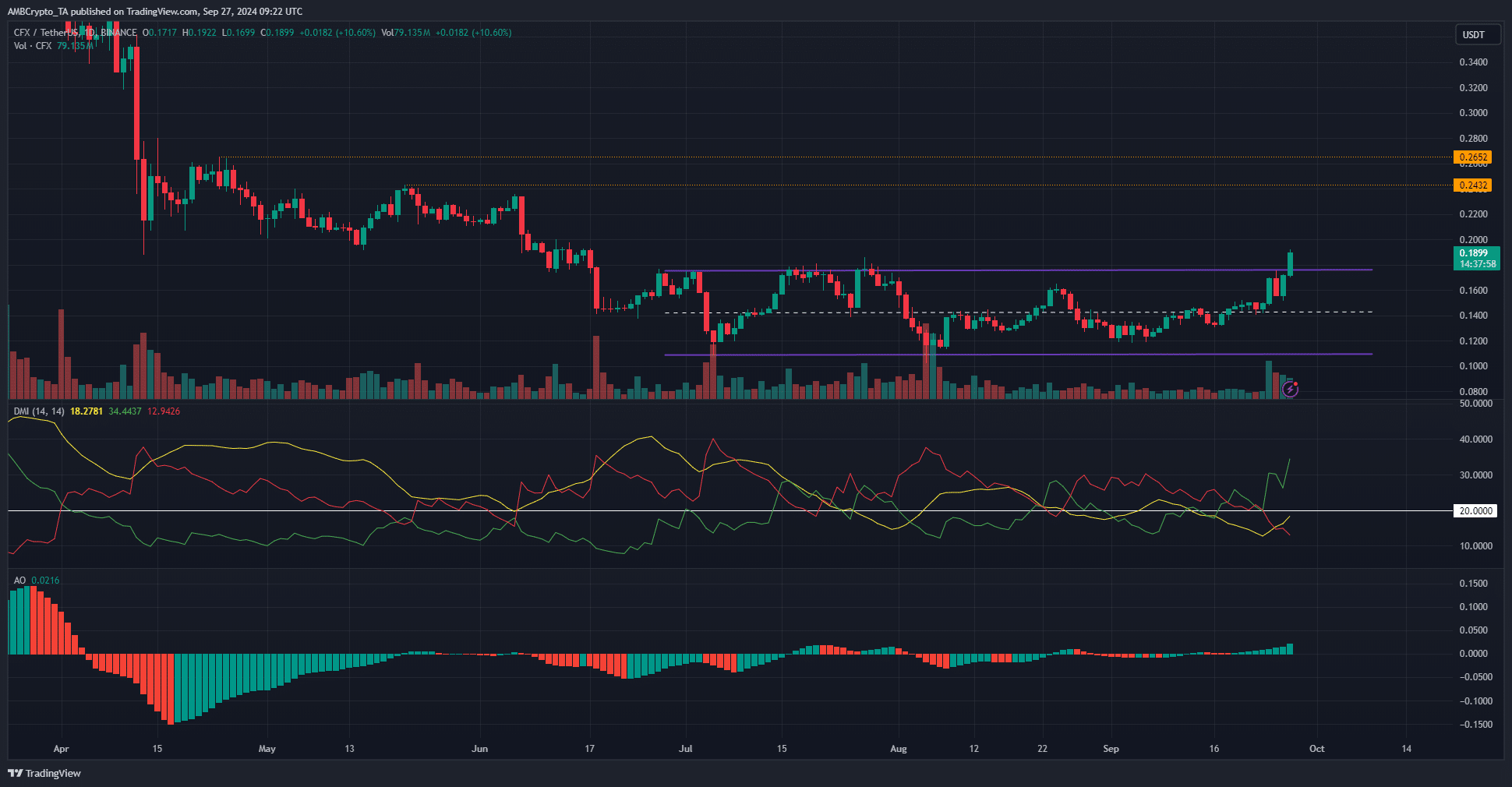

Conflux (CFX) has been trading in a range since late June. After threatening to break out of range in July and early August, the bulls fought hard and recovered with a 33% gain in four days.

Breaking the three-month resistance level of $0.176 means that a move above $0.2 is imminent. The sideways trend was shaken and the bulls targeted a 40% rise.

Range Breakthrough Target

Source: CFX/USDT on TradingView

A consolidation phase, typically lasting several months following a bear market, is common for assets following a bear market. This range formation provided a buying opportunity for long-term investors, but it also required high confidence to hold despite short-term volatility.

The break above $0.176 occurred on relatively high volume. The DMI shows a strong upward trend forming, with +DI well above 20, and it would be a good signal for buyers if ADX moves higher.

Awesome Oscillator was also above neutral zero. These range formations typically rally at least the width of the range. This implies a conservative target for CFX bulls around $0.242.

This target coincides with May resistance. Further north, $0.265 is a significant resistance level from April.

short-term optimistic beliefs

Source: Coin Analysis

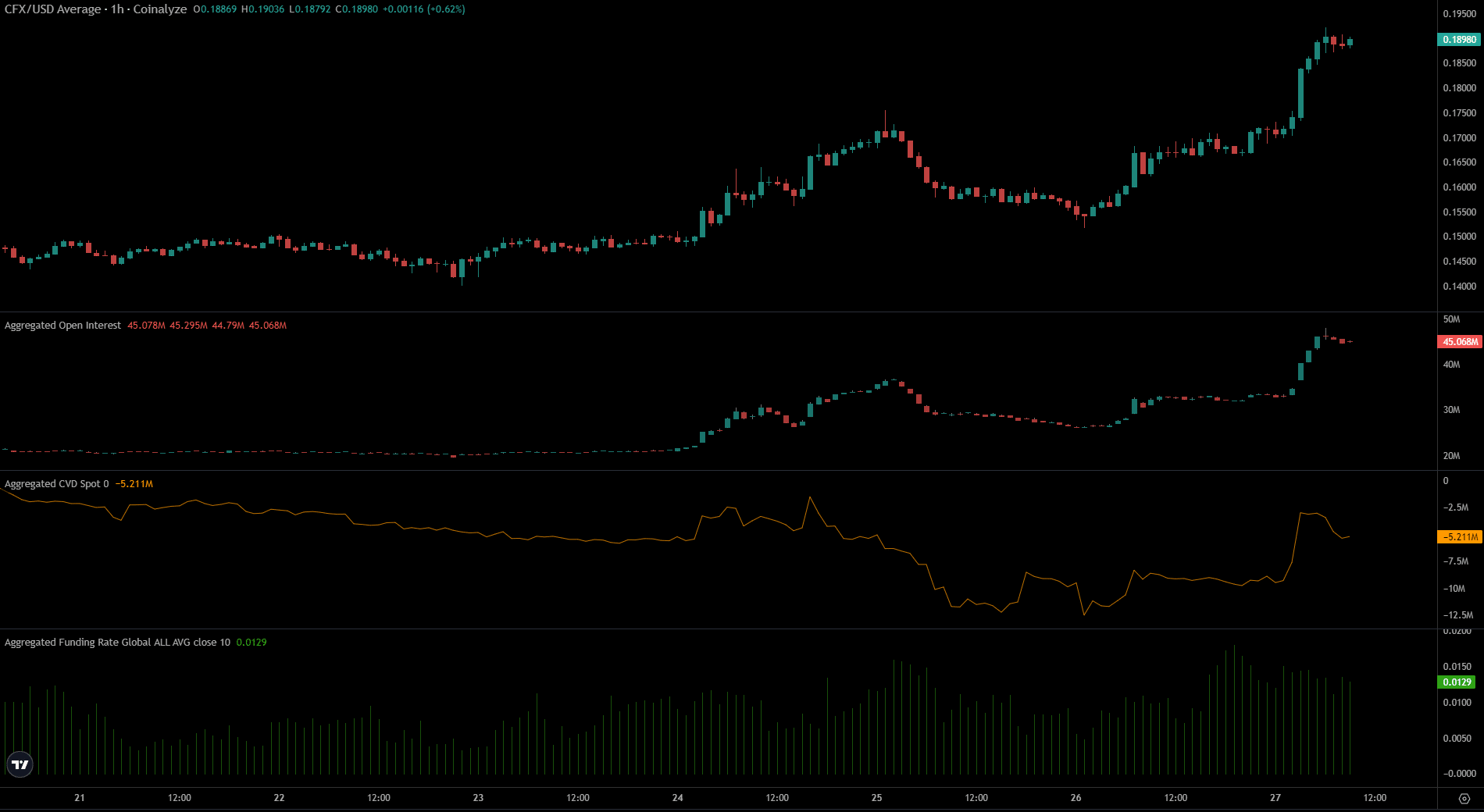

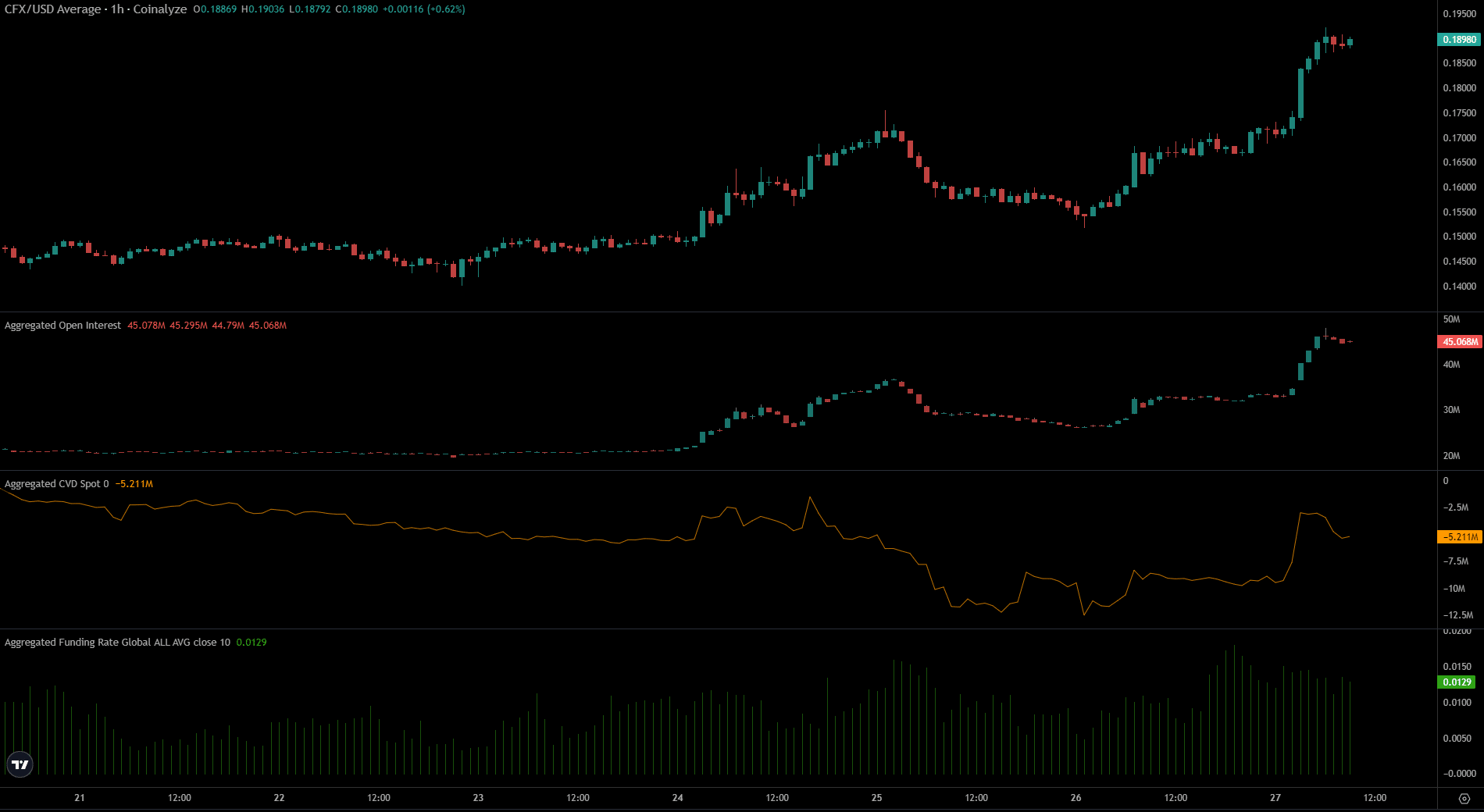

On September 23, open interest in the CFX contract hit a high of $20.9 million. It has surged to $45 million in the past four days.

Spot CVD declined significantly a few days ago but has since recovered, encouraging worried bulls.

Realistic or not, the market cap of CFX in BTC terms is:

The funding rate was also high. Together, they signaled that Conflux’s near-term outlook was optimistic. Another 30-40% rise is likely.

Beyond that, it can be tricky and may require more time for the buyer to move on.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.