Despite a market-wide liquidation and the U.S. SEC delaying a decision on the filing of the Blackrock and Fidelity ETH ETFs, the price of Ethereum continues to rise towards $4,000.

Ethereum traders doubled their bullish positions despite major disruptions to institutional participation in the pioneering smart contract network and extreme market volatility recorded on March 6.

Our market analysis explores how this confidence from speculative traders could impact the ongoing ETH price rally in the near term.

Ethereum price recovered $3,900 despite bearish headwinds.

Ethereum price rose 9% during the daily period on March 6, from $3,500 to a high of $3,900. The recent wave of ETH price rallies is noteworthy as ETH has withstood downward pressure from two major bearish events.

Cryptocurrency markets experienced extreme volatility on March 5 when investors who took profits when BTC hit an all-time high inadvertently triggered the liquidation of more than $1 billion.

Previously, crypto.news also reported that the US SEC had postponed a decision on the launch of Blackrock and Fidelity’s Ethereum ETF product.

Despite the two significant events, ETH added $48 billion to its market capitalization during the one-day period on March 6, surpassing $3,900 for the first time in three years.

The SEC was previously expected to issue a ruling as early as April 2024. Nonetheless, recent developments mean that Vanguard’s application deadline of May 7 is now the most important date for a possible ETH ETF approval ruling.

The launch of the Ethereum ETF is expected to open the floodgates of institutional demand, as observed in the Bitcoin market over the past month.

Typically, news of such a delayed ruling from the SEC could put immediate downward pressure on the price of the underlying asset. Surprisingly, ETH shrugged off the bearish 9% surge within 24 hours of the smoke appearing in the newsreel.

Bullish traders continued to increase ETH funding rates.

The prevailing bullish expectations and positive buzz surrounding the Ethereum ecosystem ahead of the upcoming Dencun upgrade were important catalysts for ETH’s resilient price performance on March 6.

Market data shows that ETH speculative traders have maintained their bullish conviction even as BTC and other large altcoins have experienced massive liquidations.

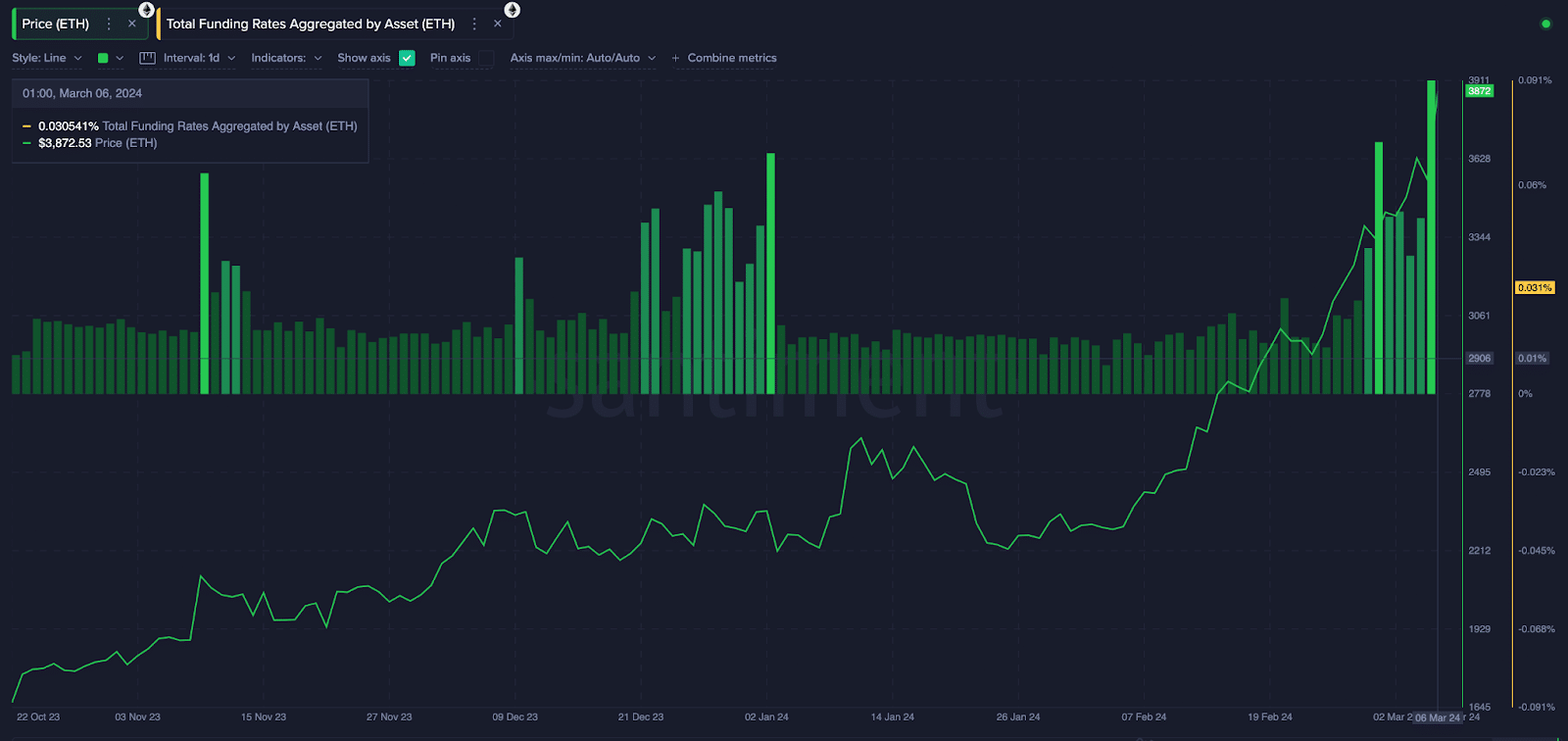

Santiment’s Funding Rate Indicator represents the sum of daily fees paid between holders of perpetual futures contracts for a specific crypto asset. Fluctuations in funding rate trends provide insight into speculative traders’ propensity for short-term price movements.

The chart below shows that the ETH funding rate has remained at a high positive value of over 0.05% since February 27th, when the price of ETH broke the $3,500 milestone price for the first time.

Despite the bearish headwinds on March 6, ETH bulls did not move out of their positions. Instead, they doubled down on their bullish positions, pushing their funding ratio to a 2024 high of 0.09%.

High levels of funding rates mean traders are overwhelmingly confident of a near-term price increase and consequently offer higher fees to hold the contract.

Unsurprisingly, the price of ETH skyrocketed to over $3,900 within 24 hours after the funding rate spiked. Historical trends suggest that if this rare market trend continues, it will only be a matter of time before the price of ETH crosses the $4,000 mark.

Ethereum Price Prediction: Is a $4,500 Retest Just a Matter of Time?

Ethereum’s journey to have a US-listed ETF may have suffered a setback. However, given the increasingly bullish confidence in the ETH derivatives markets, the path to regaining the $4,000 price level still appears unimpeded.

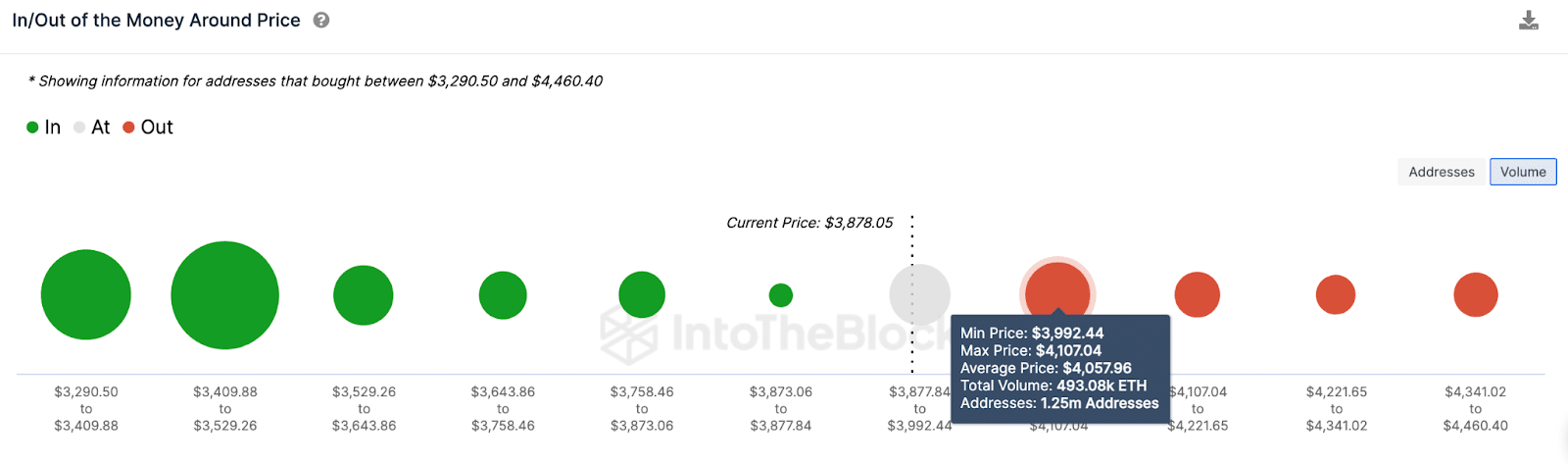

IntoTheBlock’s global fund deposit/withdrawal chart further confirms this position. The recent price rise on March 6th puts the percentage of profitable ETH holders at over 97%.

Profitable holders are often reluctant to sell during bull market phases, so ETH is likely to maintain relatively high support levels above $3,500 as it consolidates into the next phase.

However, if another bullish rally occurs, the bulls now only have the resistance level of $3,992 to break through to new highs above $4,000.

As you can see above, 1.3 million addresses acquired 493,080 ETH at a minimum price of $3,992. So, if Ethereum price can build a stable support level above that range, as expected, a move towards new highs above $4,500 could be imminent.