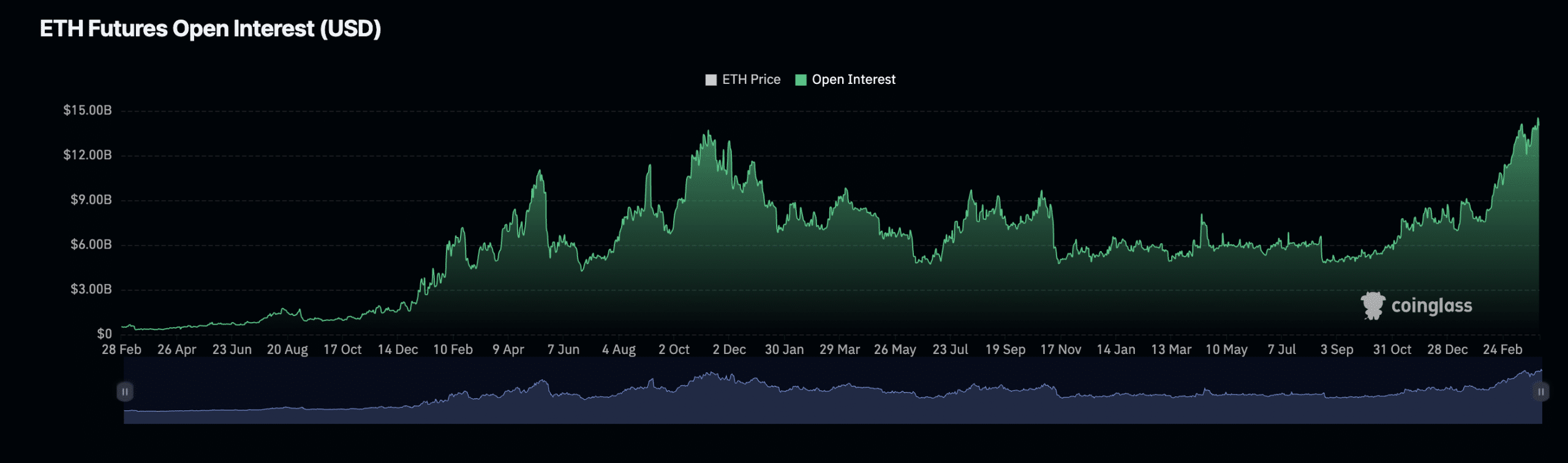

- ETH futures open interest has reached an all-time high.

- Funding rates across exchanges remained positive.

Ethereum (ETH) futures open interest has hit a record high as uncertainty deepens about the possibility of approving a spot Ether exchange-traded fund (ETF) in the United States.

Futures open interest refers to the total number of futures contracts for a coin that have not yet been settled or closed. A rise indicates an increase in the number of market participants entering new positions.

According to analysis by AMBCrypto: ‘Coin Glass’ According to the data, ETH futures open interest totaled $14.53 billion on April 1, up 86% year-over-year.

For context, ETH’s futures open interest was less than $10 billion at the start of the year.

Source: Coinglass

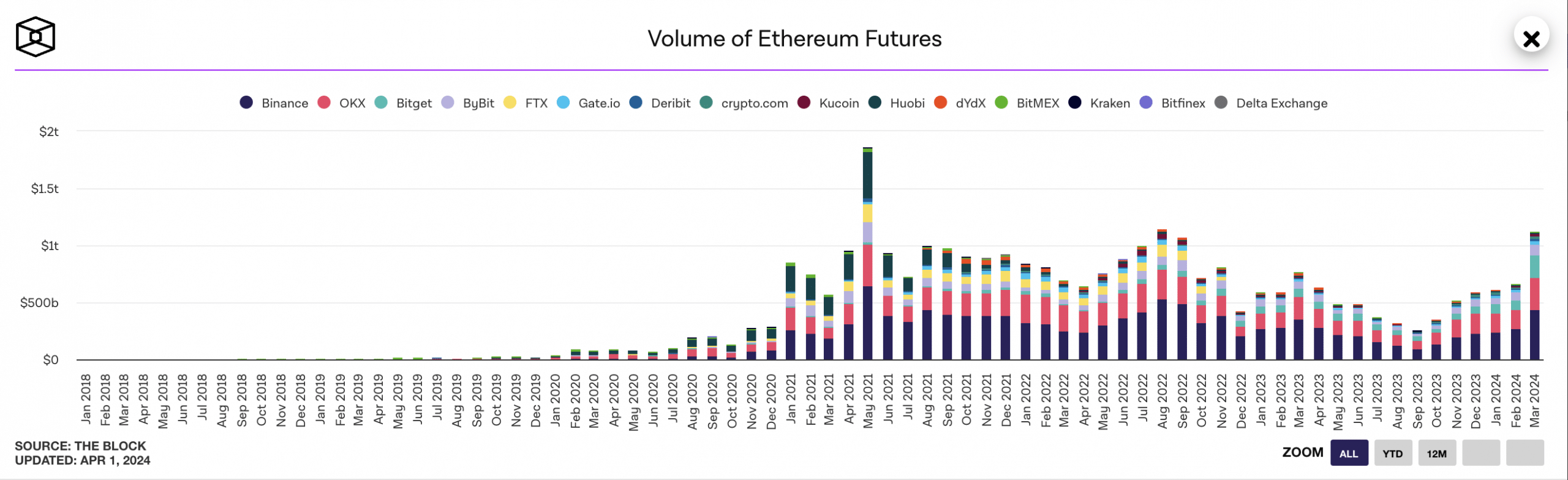

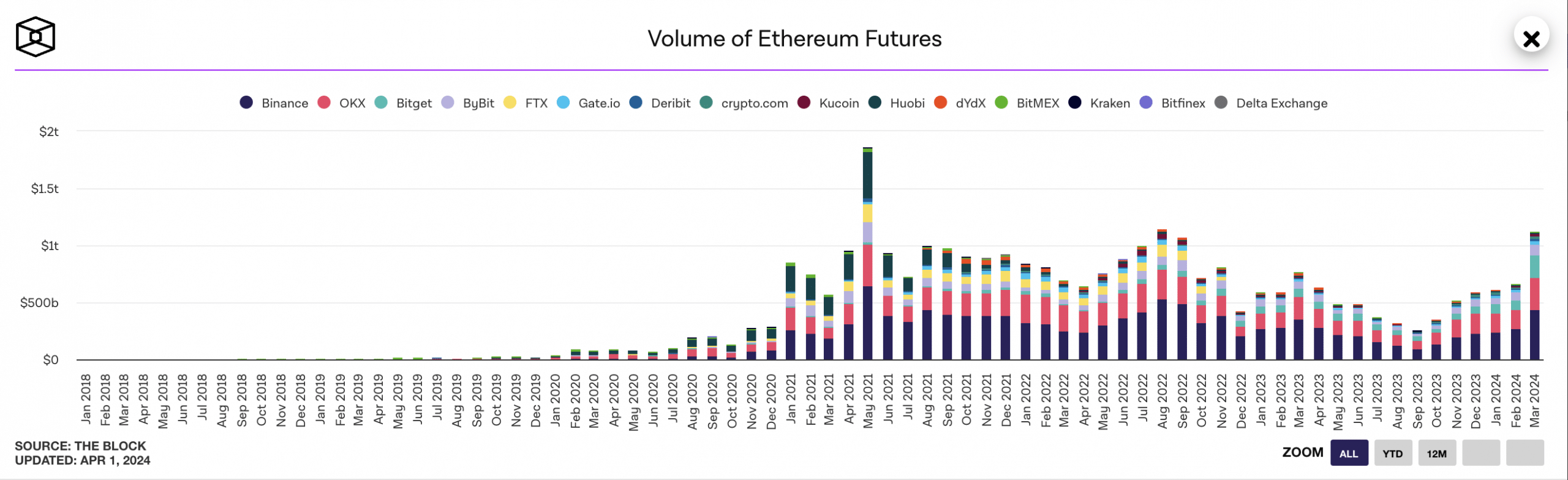

March was a good month for the Ethereum futures market.

According to on-chain data, the futures market for ETH recorded significant success in March.

According to AMBCrypto’s analysis of The Block’s data dashboard, ETH Futures’ monthly trading volume on the largest cryptocurrency exchanges has been consistent for three years over a 31-day period.

A closer look at The Block shows that ETH futures trading volume across these platforms exceeds $1 trillion. The last time the coin had high monthly trading volume was in May 2021.

Source: The Block

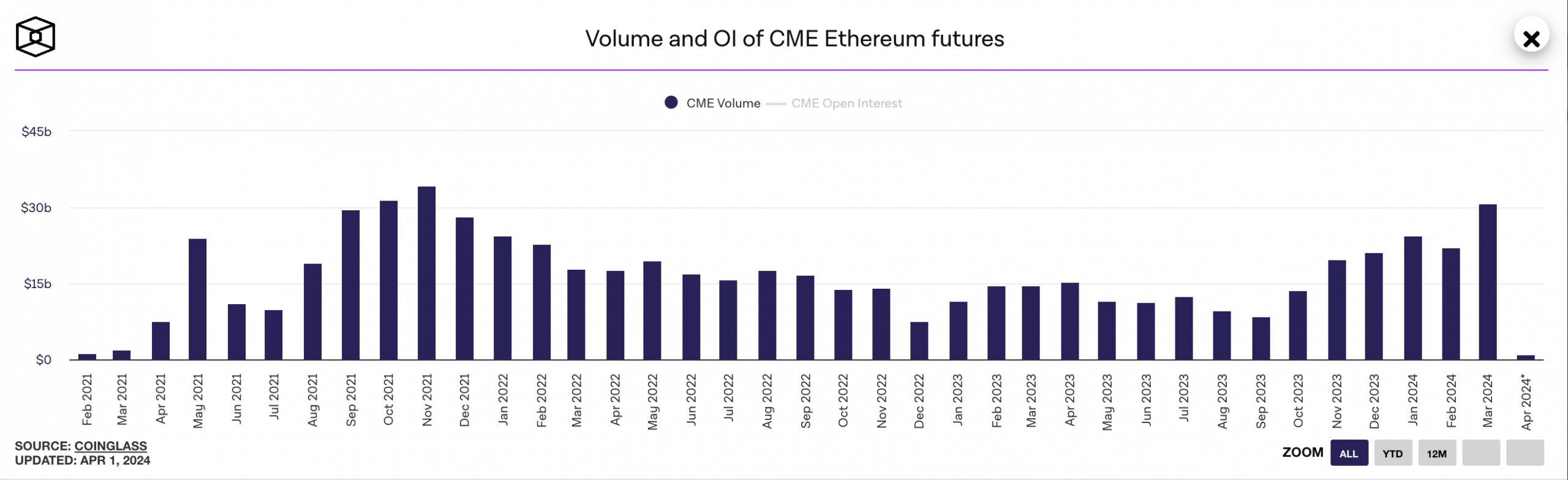

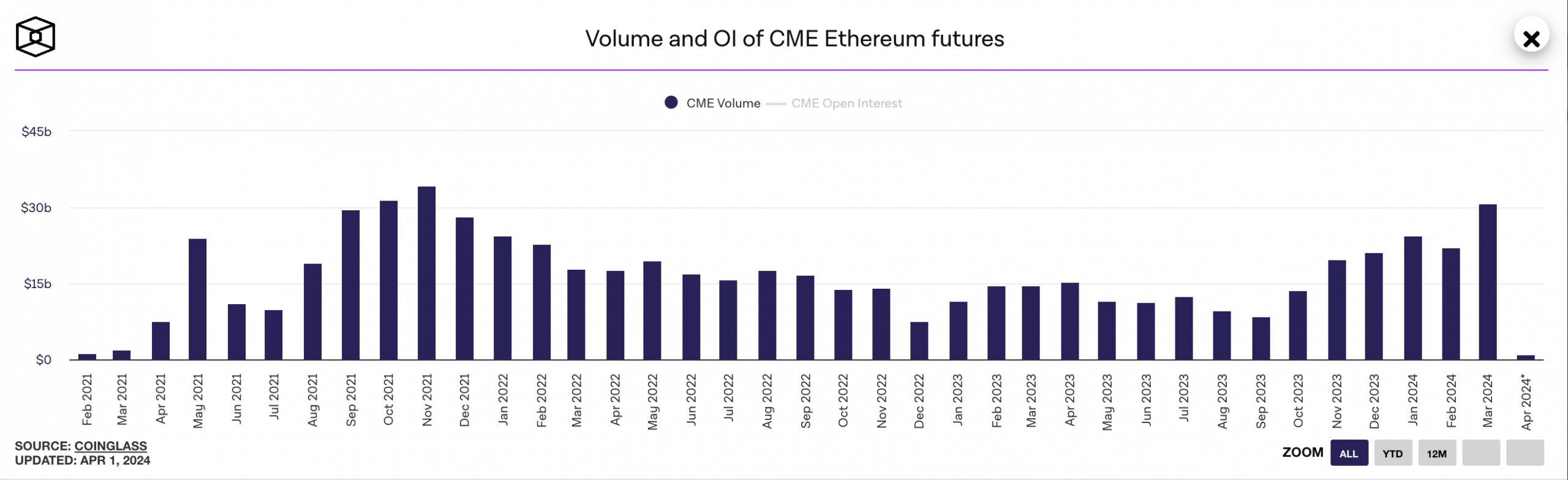

Following a similar trend, monthly coin futures trading volume on the Chicago Mercantile Exchange (CME) market also increased to a three-year high.

With over 120,000 active users across 60 countries, CME is one of the world’s largest derivatives markets.

This increase in exchange trading volume is a sign that market participation by institutional investors such as hedge funds and large asset management companies is rapidly increasing.

AMBCrypto found that total monthly trading volume for CME Ethereum futures over a 31-day period totaled $30 billion. The last time this high was reached was in November 2021.

Source: The Block

Market unwavering despite recent headwinds

The price of ETH has experienced significant headwinds over the past month, with continued resistance near $3,500 at press time.

In fact, on March 20, the coin’s value plummeted to a 30-day low of $3,100 before regaining a trading profit of $3,354 at press time.

Nonetheless, the coin’s funding rate across cryptocurrency exchanges remained positive as of press time.

Is your portfolio green? Check out our ETH Profit Calculator

A positive funding ratio is a good sign as it suggests a surge in market demand for bullish leveraged positions. This means that more market participants are entering trading positions to push the price higher.

At press time, ETH’s funding rate was 0.019%.