- Bullish sentiment towards Chainlink has risen following the Bitcoin halving.

- Continuous price increases are expected due to high buying pressure.

Chainlink (LINK) recorded The price has been bullish on the charts, making a solid comeback over the past few hours. This happened behind my back. Bitcoin (BTC) It is undergoing its fourth halving. Therefore, it would be a good idea to take a look at the state of LINK and find out whether the upward trend is a result of the halving hype or if the indicators support it.

Chainlink turns bullish.

Like most cryptocurrencies, LINK suffered losses last week, losing more than 9% in value. However, the scenario changed when the Bitcoin halving occurred and sparked the same optimistic mood across the market.

LINK was also affected by this, with its token value soaring by 4% in 24 hours. At the time of writing, Chainlink transaction Its market capitalization is $13.98, which is over $8.2 billion.

However, despite the price rise, more than 43% of LINK investors suffered losses at the time of going to press, according to IntoTheBlock. data. That said, if LINK appears to be breaking out of a critical support area, its statistics may change soon.

Popular cryptocurrency analyst World Of Charts recently shared the following: Twitter Highlights the upward trend of the LINK/BTC pair. This implied that the value of LINK continued to rise.

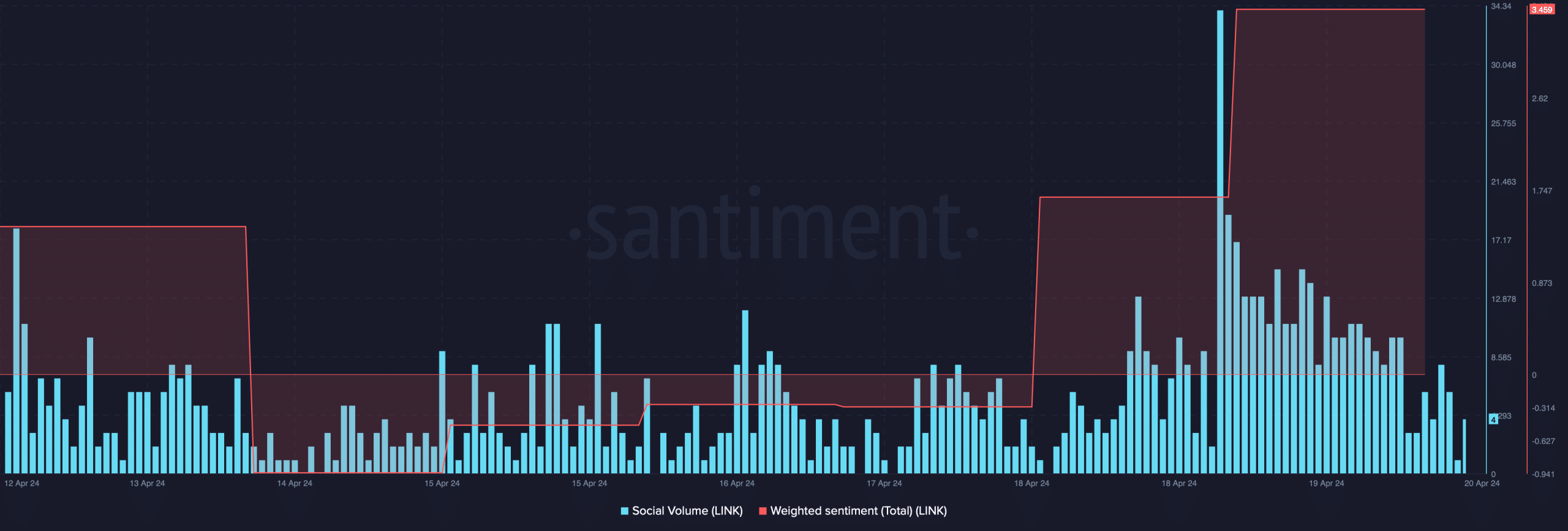

AMBCrypto’s analysis of Santiment’s data also showed increased investor confidence in LINK, which was also evidenced by the sharp rise in weighted sentiment. The token’s social volume has also surged, reflecting its popularity in the cryptocurrency space.

Source: Santiment

LINK’s Rally Will Last Longer

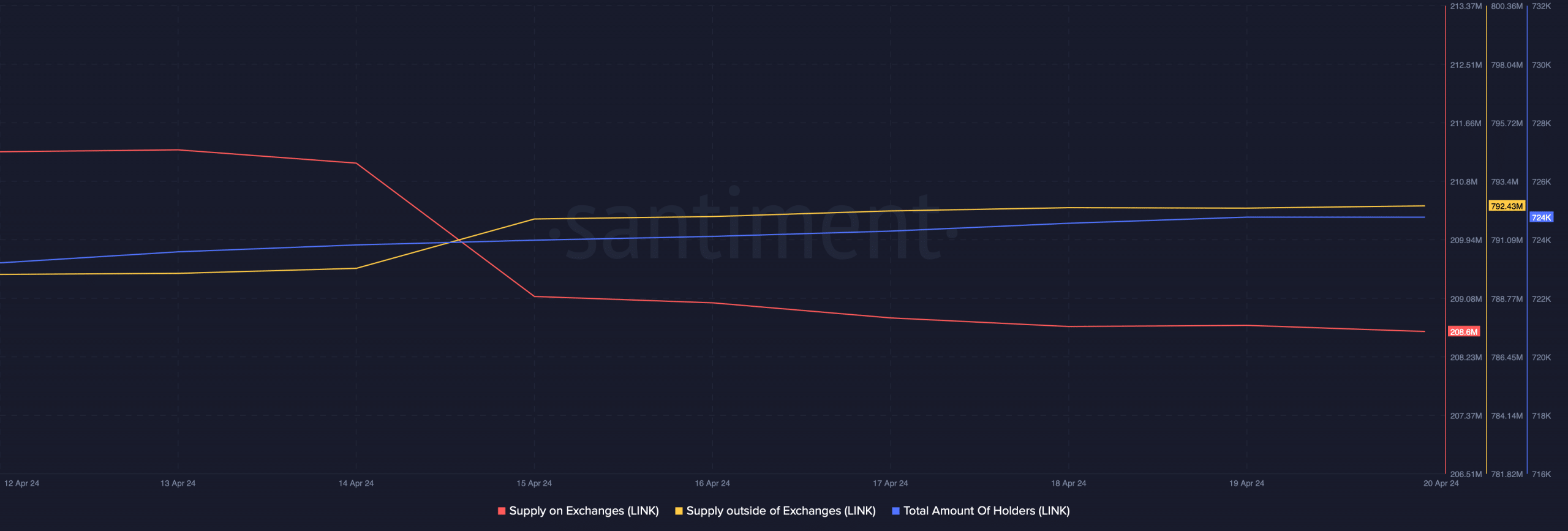

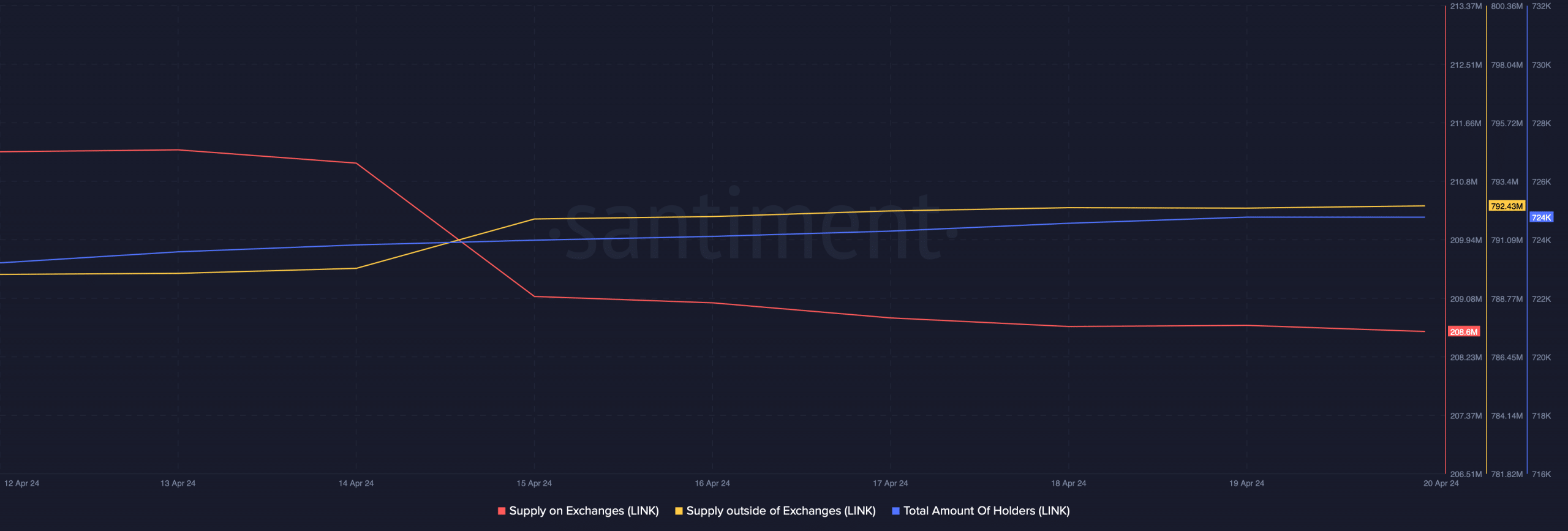

AMBCrypto then analyzed LINK’s metrics to see if this price rise would continue. We have noticed an increase in buying pressure for the token, which is a bullish sign.

While Chainlink’s exchange supply has decreased, off-exchange supply has increased, indicating that investors are accumulating LINK. Additionally, the total number of holders also increased last week.

Source: Santiment

According to data analysis by Hyblock Capital, a move above $14.7 is critical for Chainlink to sustain its bullish rally. At that level, token liquidation could increase rapidly and cause problems moving north.

A successful break above $14.7 could easily allow LINK to retrace the $15 level.

Source: Hiblock Capital

read Chainlink’s (LINK) price prediction 2024-25

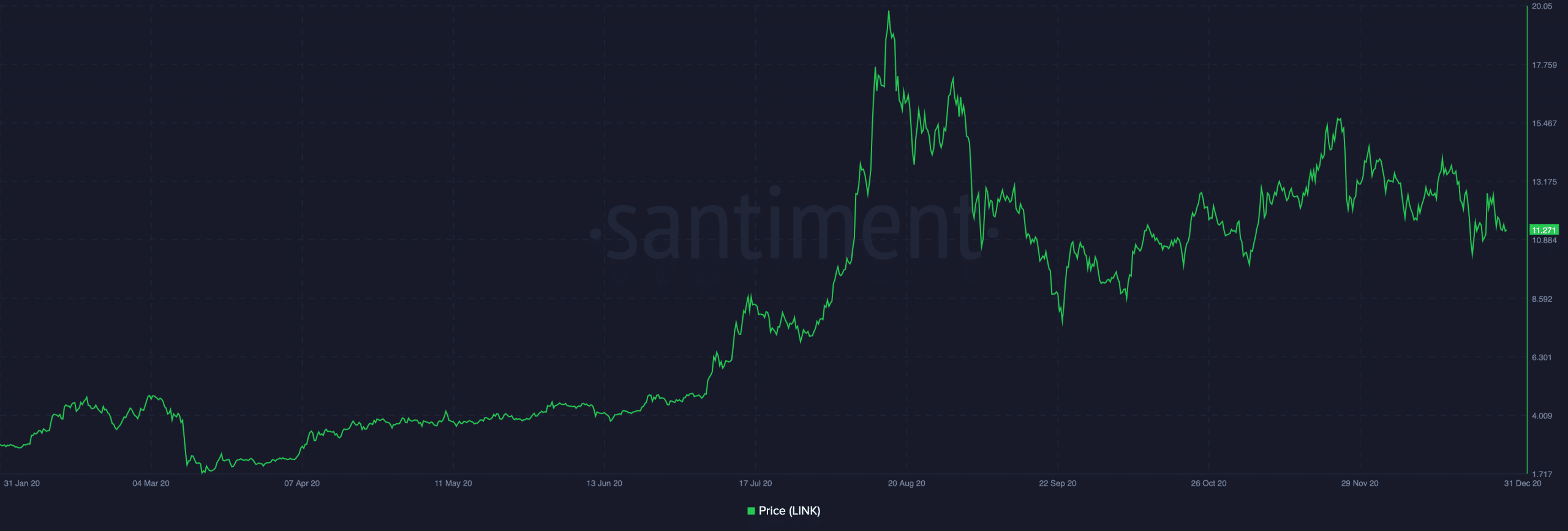

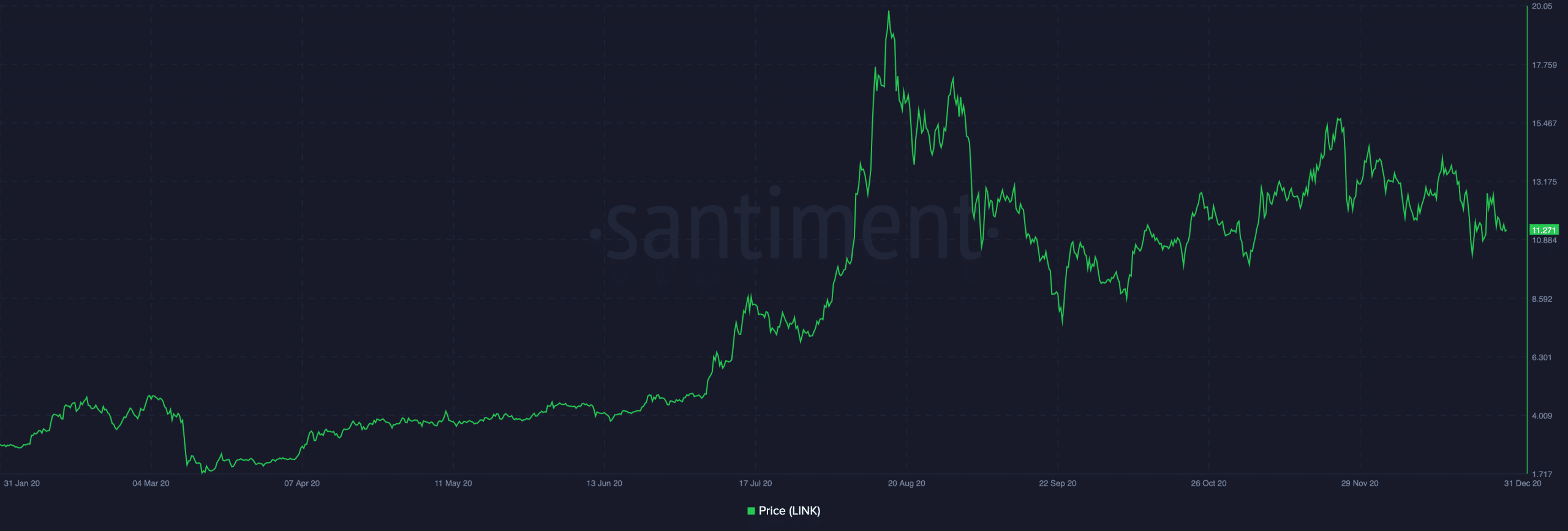

It is also worth looking at historical references here.

LINK’s reaction during the Bitcoin halving in 2020 was similar to now. The price of LINK has been strong, with the token hitting an all-time high in just two months. Therefore, investors may want to watch the performance of altcoins closely in the coming weeks.

Source: Santiment