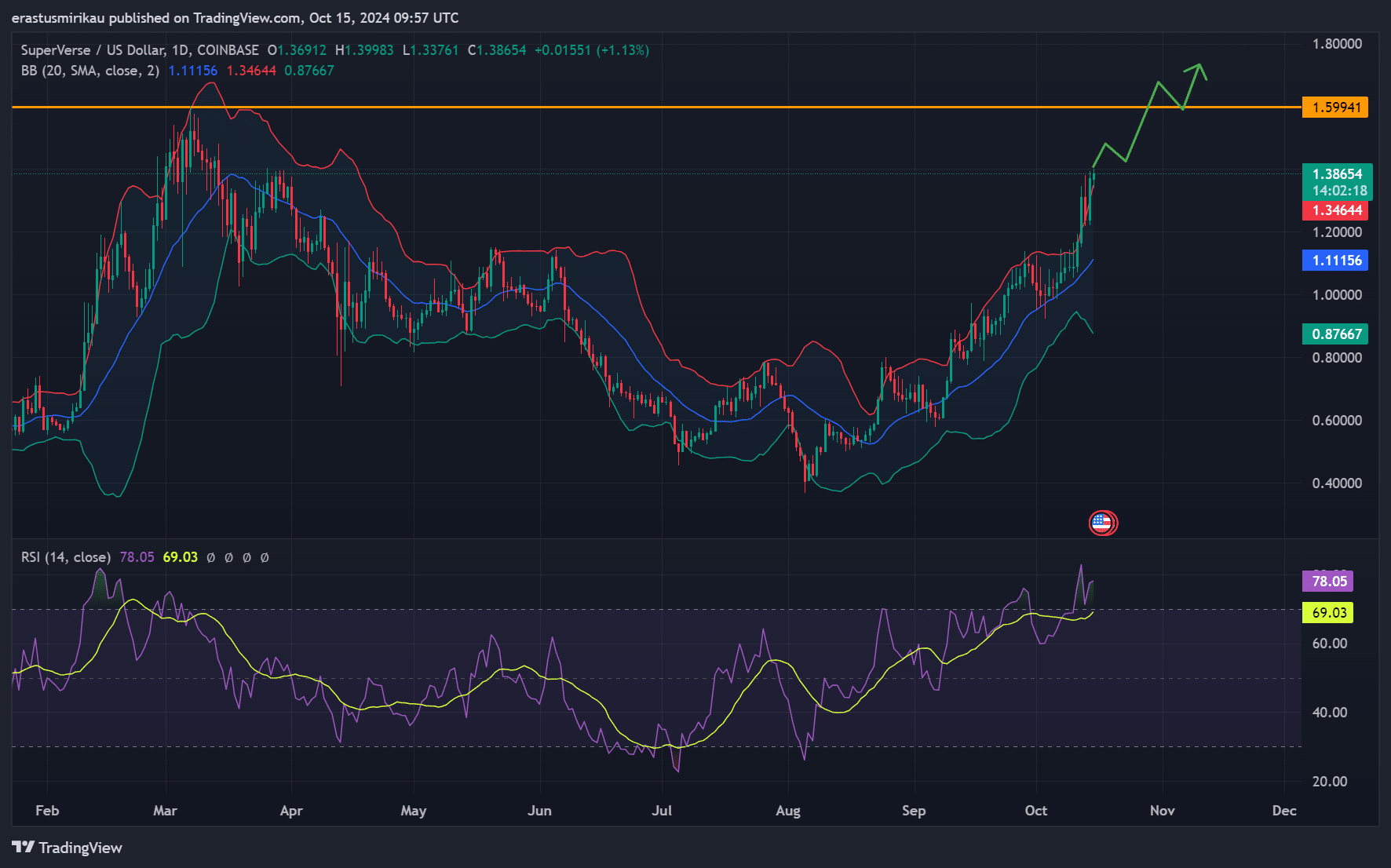

- SUPER broke the $1.11 resistance level, but RSI overbought suggests a potential near-term decline.

- Increasing social dominance and public attention suggest continued momentum, but the MVRV ratio poses risks.

Super Bus (SUPER) It has caught the attention of investors, rising 11.62% in the past 24 hours and trading at $1.39 at press time.

With a market cap of $677.28 million and a 54% surge in trading volume, the token is showing strong momentum.

The problem still remains. Could this bullish trend push SUPER above key resistance levels and trigger a broader bounce in the cryptocurrency space?

Bullish indicator appears

SUPER recently broke the resistance level of $1.11 and rose towards $1.39. Bollinger Bands indicate increasing volatility, which suggests that SUPER may be prepared for further price movement.

The next major hurdle is $1.60, a breach of which could open the door to a rise above $1.80.

However, it is important to note that RSI remained at 78.05 as of press time. This suggests that SUPER is in overbought territory.

As a result, there may be short-term selling pressure as investors try to take profits. Therefore, while the trend remains strong, traders should watch out for potential downsides before the next step up.

Source: TradingView

This supports the growth of SUPER

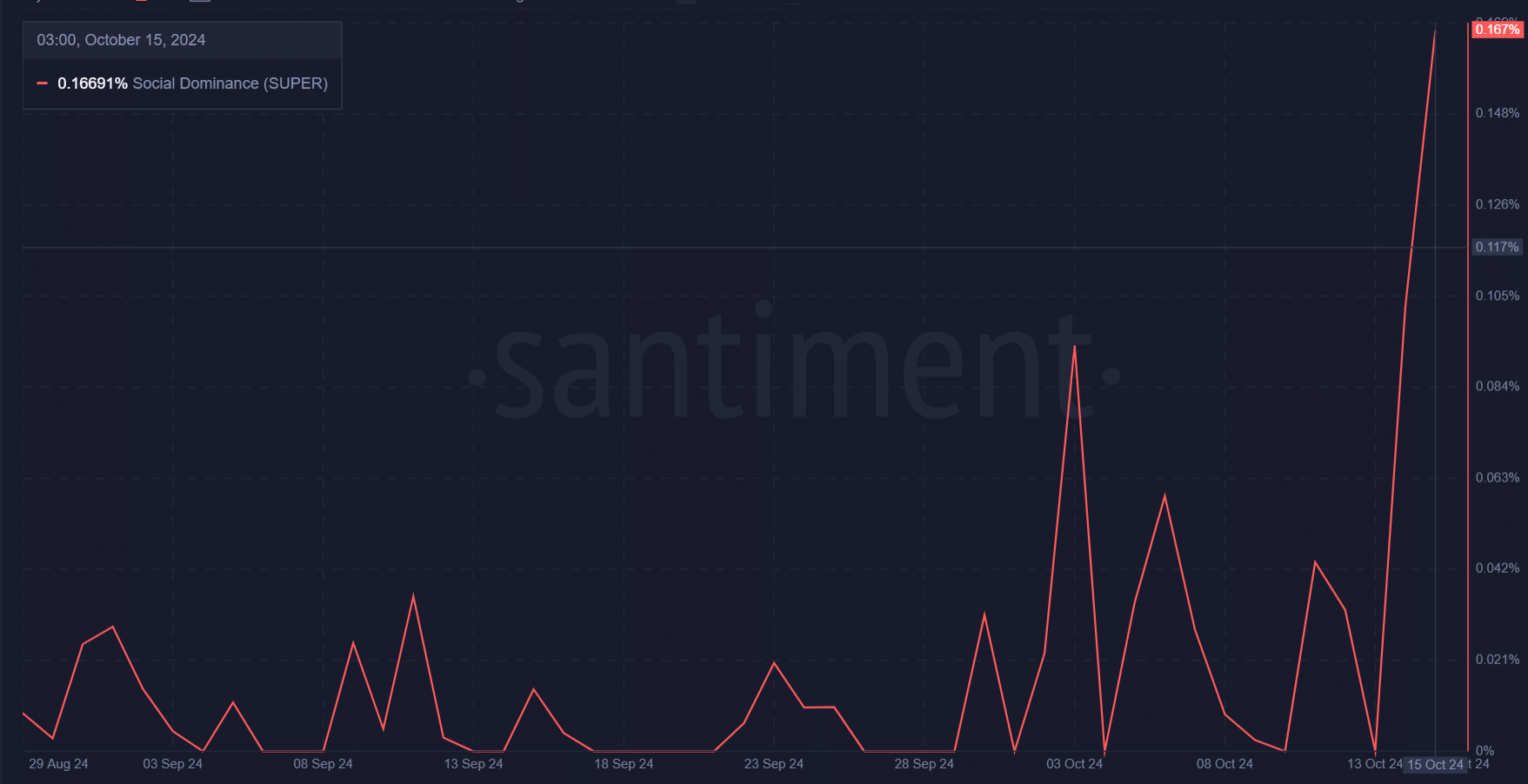

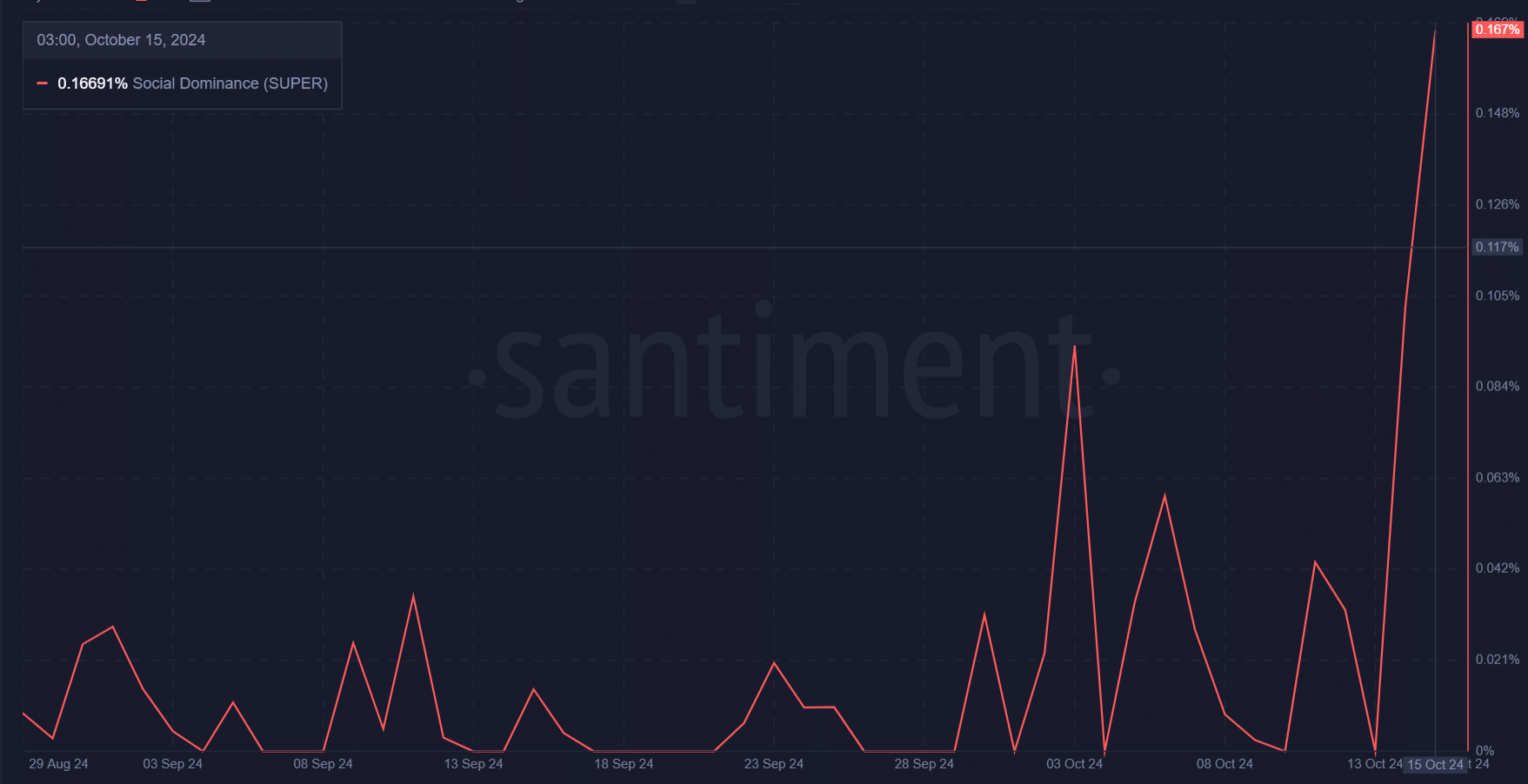

Additionally, SUPER’s social dominance soars to 0.167%, showing that it is trending across social media platforms.

This increased interest from the cryptocurrency community can often be associated with further price movements. As the hype builds, more retail investors are likely to enter the market, potentially pushing prices higher.

But social dominance alone may not be enough to maintain momentum. Therefore, investors should monitor social trends to gauge whether SUPER can sustain renewed interest.

Source: Santiment

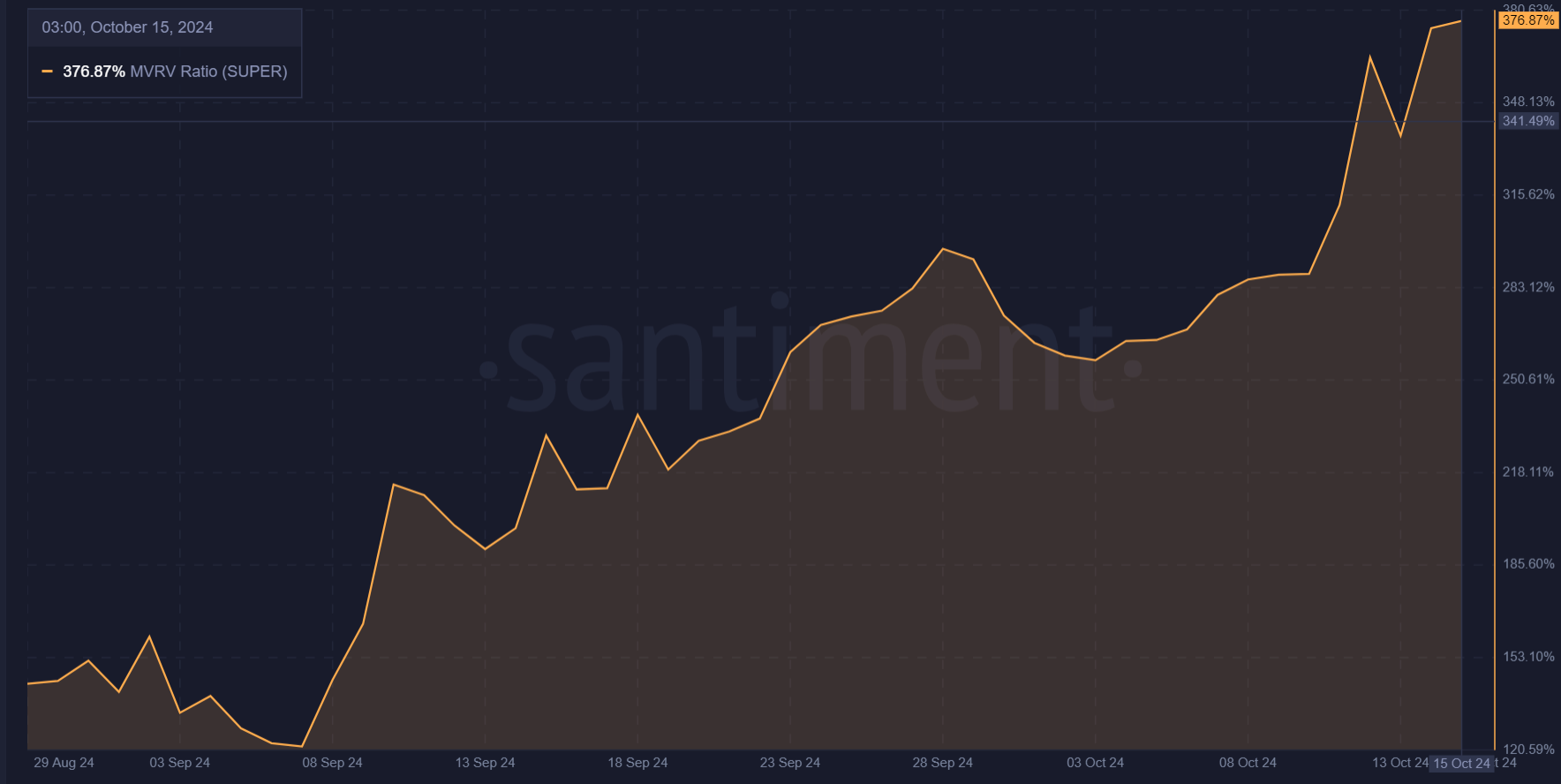

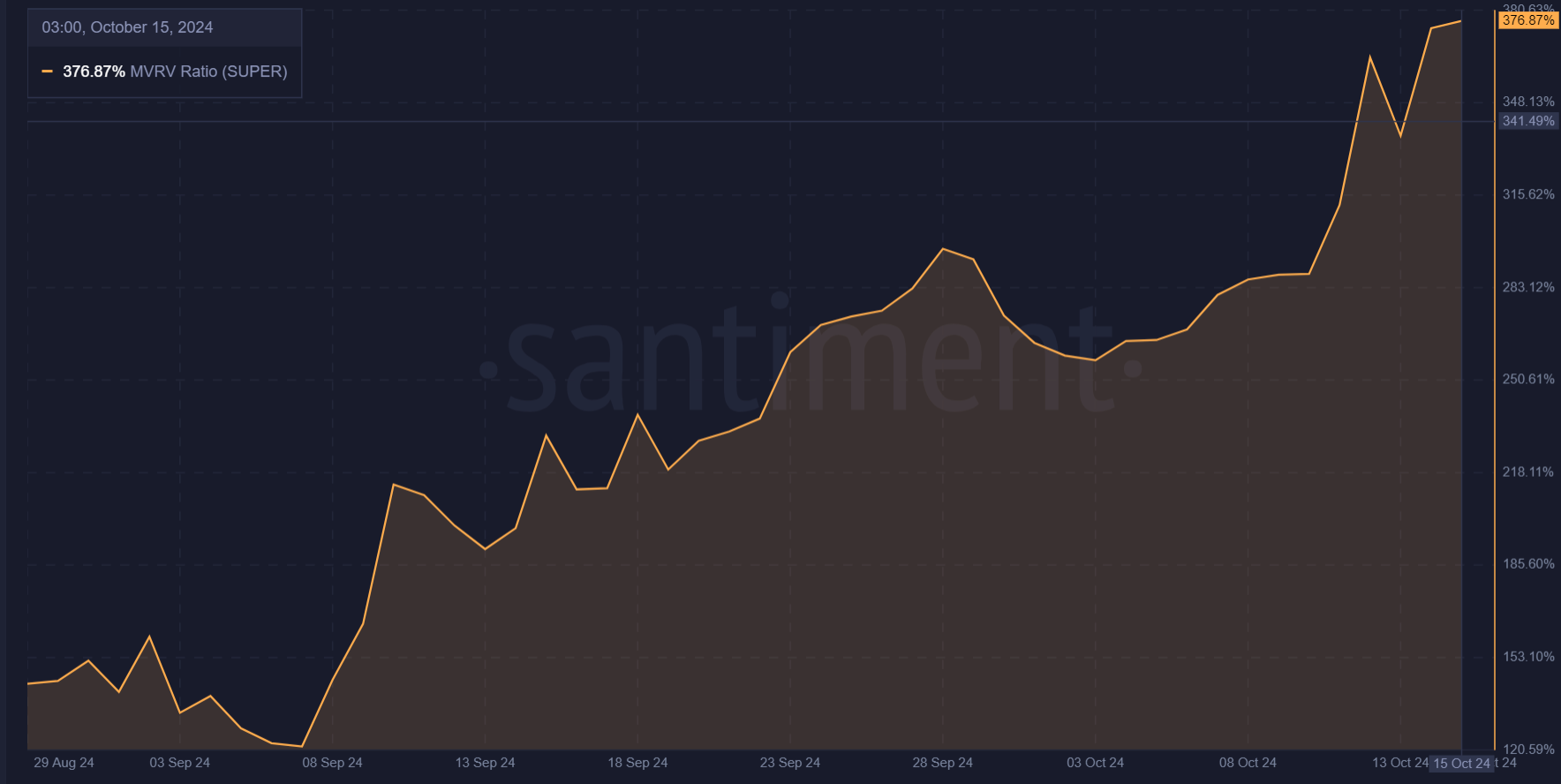

The MVRV ratio indicates potential risk.

Another important indicator to consider is SUPER’s MVRV ratio, which rose to 376.87%. This means that many holders are enjoying significant unrealized profits, which could lead to selling pressure.

As a result, SUPER may experience a short-term correction before resuming its upward trend.

Source: Santiment

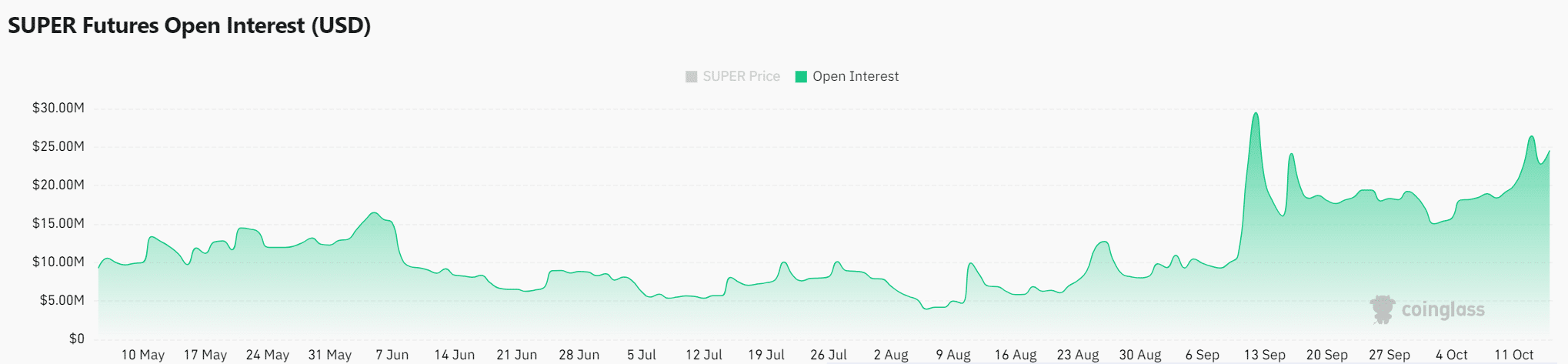

institutional participation

Additionally, open interest on SUPER increased 18.97% to $25.4 million. This increase suggests increased interest in the token by institutional players.

These capital inflows could provide the support needed for a sustained rally, even if a short-term correction occurs.

Source: Coinglass

read Super Bus (SUPER) Price Forecast 2024-2025

In conclusion, SUPER’s current momentum is promising, but the high MVRV ratio and overbought RSI indicate a downside potential.

However, increasing social dominance and increasing open interest could encourage a break above $1.59, potentially triggering the next phase of the uptrend.