- At the time of press, the token was trading at a key support level and had broken through a downtrend line.

- On-chain indicators have indicated strong accumulation of SUI by traders, which could push the price higher.

SUI’s price chart has performed impressively, with an increase of 16.6% over the past month. At the time of reporting, SUI appears to have entered another rally, rising 18.57%. This increase resulted in a 93.54% increase in trading volume to $1.1 billion.

The aforementioned upward trend can be interpreted as a signal of high market interest. It may also suggest continued upward momentum.

SUI presents an optimistic outlook

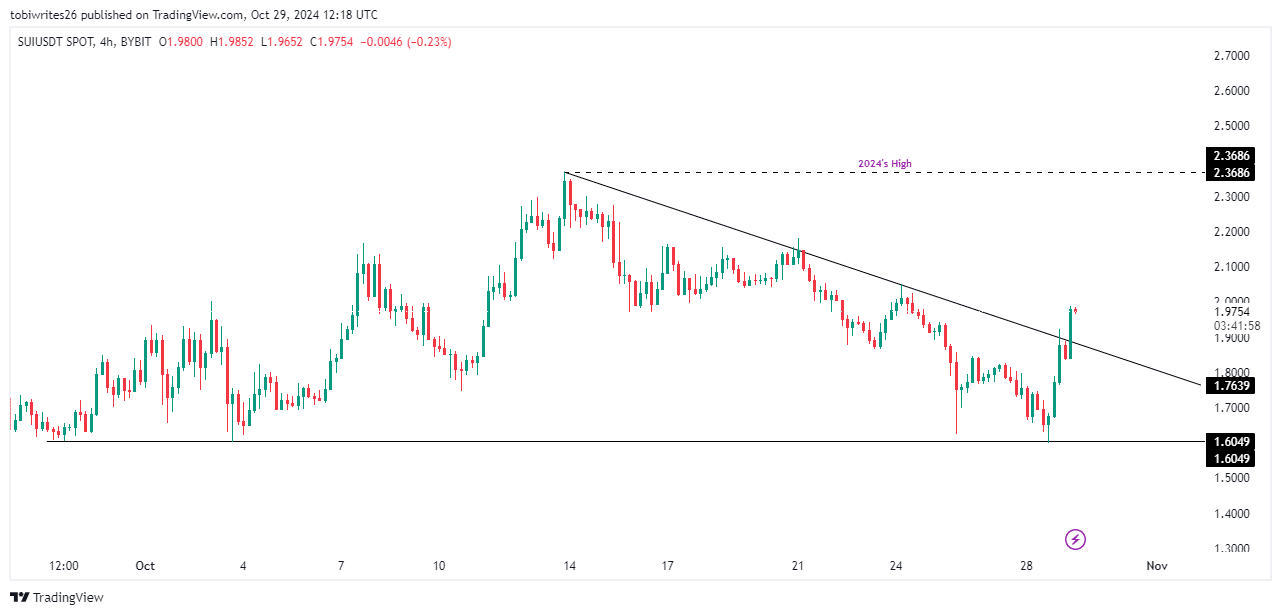

According to the 4-hour chart, SUI was in bullish territory at press time, having broken a downward trend line that began forming on October 13th. The rally was led by a bounce from the support zone at $1.6049.

If the uptrend continues, SUI could rise as high as $2.3686, hitting an October high and the highest trading level of 2024.

Source: Trading View

However, if downward pressure resumes, the SUI is likely to retreat, extending the descending trendline pattern.

Trader activity indicates a strong buy signal for SUI.

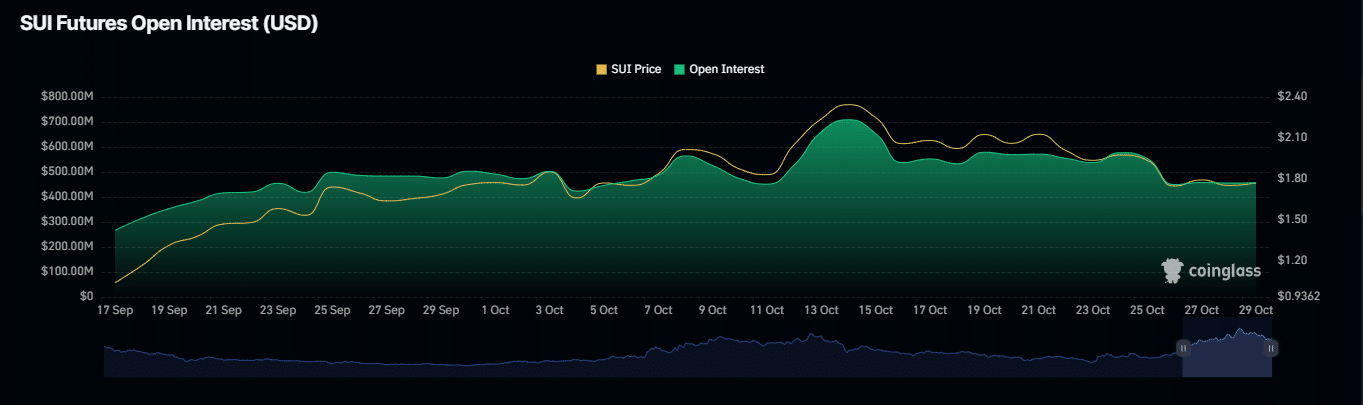

According to AMBCrypto’s on-chain analysis, SUI is likely to maintain its upward trend with no immediate signs of a reversal. Data from Coinglass, including open interest and liquidation indicators, further supports the possibility of a sustained upward move.

Open interest, which represents the total value of active futures contracts, increased 17.22% to $519.5 million. The increase signals high demand for long positions, reinforcing bullish sentiment and pointing to the possibility of continued price rises.

Additionally, more than $4.14 million in SUI short positions were liquidated in the past 24 hours as the market moved against bets for prices to fall.

Source: Coinglass

The combination of increasing open interest and short liquidation strongly suggested that SUI’s upward trend could see great momentum in the next few trading sessions.

Liquidity Flow Findings

Lastly, the Chaikin Money Flow (CMF) indicator, which tracks accumulation and distribution based on liquidity flows, suggested continued accumulation of SUI.

CMF being in positive territory at 0.13 indicates that the SUI price could continue to rise, potentially surpassing the 2024 high.