Ethereum Layer 2 network Starknet (STRK) has been struggling since its token launch in February. This problem is one of the reasons why only 8% of STRK holders are making a profit.

Despite the decline, it appears that cryptocurrency holders are determined to test the waters by avoiding selling. Meanwhile, this on-chain analysis reveals more.

Starknet, hoping to reclaim lost property

A few days ago, Starknet announced the successful launch of the Parallel Execution and Block Packing upgrades on Testnet. The upgrades, which aim to reduce gas fees and achieve 2-second block confirmation times, will go live on Mainnet on August 28.

Following the testnet announcement, IntoTheBlock data shows that the number of addresses holding STRK has increased between the last 30 and the last 365 days.

The reason for this is unclear, but the increase clearly indicates that holders are optimistic about the future potential of the token. Likewise, it suggests that they are not prepared to succumb to losses regardless of the downturn they have experienced.

Read more: In-Depth Analysis on Starkware, StarkNet, and StarkEx

This resolution may seem surprising considering the controversy surrounding Starkenet. For example, early adopters of the project were not satisfied with the airdrop distribution in February.

Additionally, the project has experienced a notable drop in user engagement and more recently, the CEO has stepped down. Interestingly, on-chain data shows a notable improvement in network activity.

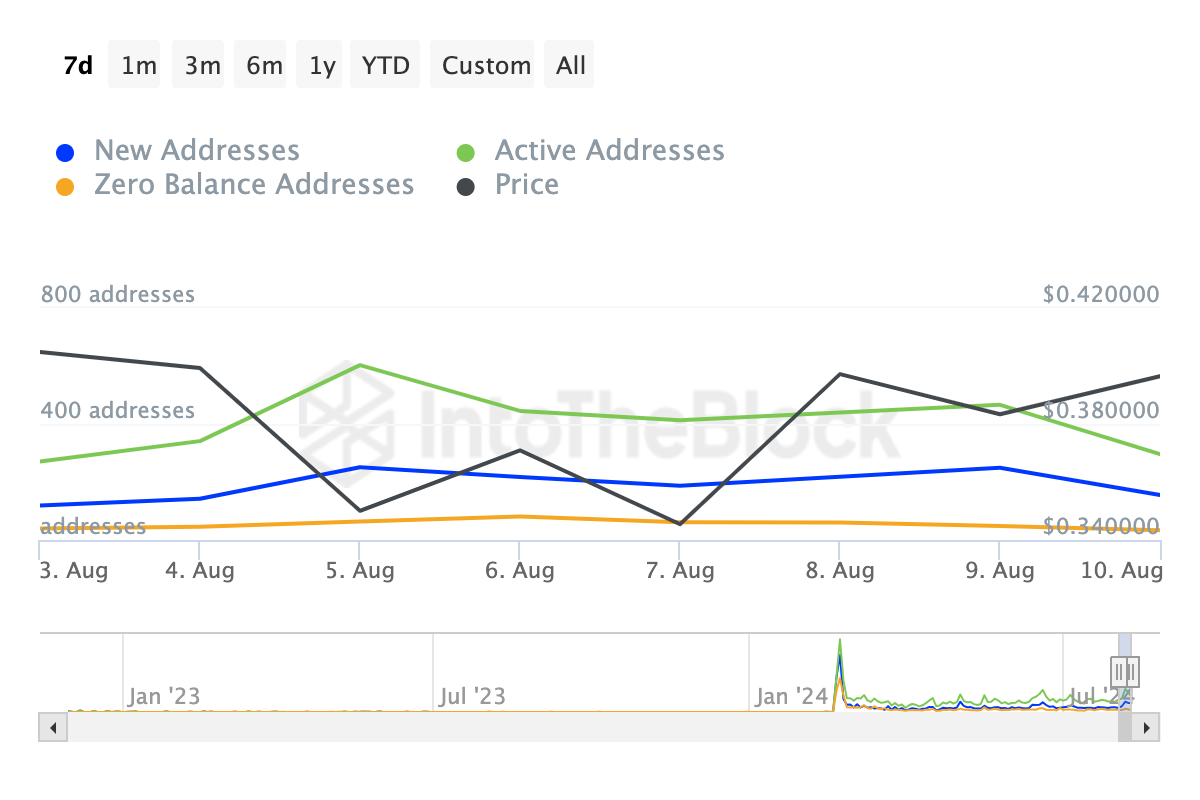

Specifically, new addresses, which represent the number of participants who successfully completed a transaction for the first time, increased by 30.25% last week.

Likewise, the number of active addresses, a metric that measures the number of senders and receivers on a blockchain, has also surged. If sustained, this increase in numbers is a bullish signal for Starknet and its native token.

STRK Price Prediction: Token Targets Upper Resistance

At the time of writing, STRK is trading at $0.39, making it one of the top 100 cryptocurrencies with the biggest gains in the last 24 hours. According to the daily chart, the cryptocurrency formed a descending triangle between June 5 and August 3.

A descending triangle is a bearish chart pattern characterized by a series of lower highs (LH) and a resistance level at the top. Previously, STRK broke below this area, indicating that the downtrend may continue.

However, as of this writing, the cryptocurrency appears poised to break out of the pattern. There are also signs that it is in price discovery mode, with the Money Flow Index (MFI) reading at 16.20.

In addition to measuring buy and sell volume, the MFI also evaluates whether a cryptocurrency is overbought or oversold. A value above 80.00 indicates overbought, while a value below 20.00 indicates overbought.

Read more: ZkEVM Explained: Improving Ethereum Scalability

According to this rule, the price of STRK is oversold and a significant bullish reversal is expected. Therefore, if buying pressure increases, the value of the token may rise towards the overhead resistance level of $0.62 in the short term.

Also, if the Parallel Execution and Block Packing upgrades are successfully completed on the mainnet and demand increases, the price may rise to $0.94. However, if confidence among holders decreases, selling pressure may occur, causing the price to fall to $0.34.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions may change without prior notice. Always do your own research and consult with a professional before making any financial decisions. We inform you that our Terms of Use, Privacy Policy, and Disclaimer have been updated.