The Zcash (ZEC) price continued from where it left off last week, reaching a new yearly high on Monday before pulling back recently. On the said date, the privacy coin reached $45.45.

This price is not only the highest ZEC has been this year, but also the highest it has been since March 2023.

Zcash Plans to Switch to Proof-of-Stake, Wants to Reduce Circulating Supply

Zcash (ZEC) has surged nearly 45% over the past 30 days, making it one of the best performing altcoins in early August. On July 15, ZEC was trading at $28.54, but has experienced significant growth since then.

According to BeInCrypto, this rally is not just driven by buying pressure or general market interest. A key factor in the rally is speculation about the possibility of Zcash switching from Proof-of-Work (PoW) to Proof-of-Stake (PoS). ZEC has traditionally relied on a PoW algorithm similar to Bitcoin (BTC).

However, on August 10, the project’s founder, Zooko Wilcox, hinted at a switch to PoS. Wilcox noted that the creation of new ZEC via PoW has contributed to downward price pressure for years, and that the uptrend has recently begun to reverse.

In a statement published on Medium, Wilcox opined that the switch to PoS would alleviate the downward pressure on the ZEC price by reducing the creation of new coins. Explaining how PoS would positively impact the value of the cryptocurrency, the founder said:

“By allowing people to stake ZEC, we will increase the demand for ZEC. We will also lock the staked ZEC, reducing the supply of ZEC.”

Supporting the founders’ concerns about increasing supply, data from Messari shows that as of this writing, Zcash’s new issuance has increased to 157,000. On July 1, this figure was less than 70,000, highlighting the rapid growth in circulating coins.

Read more: How to Buy Your First Zcash

It is important to note that if the transition to proof-of-stake is implemented, it will only be partial. Once complete, a portion of the ZEC supply will be staked, which will likely reduce new issuance and put upward pressure on the price.

ZEC Price Prediction: Another Peak Is Near

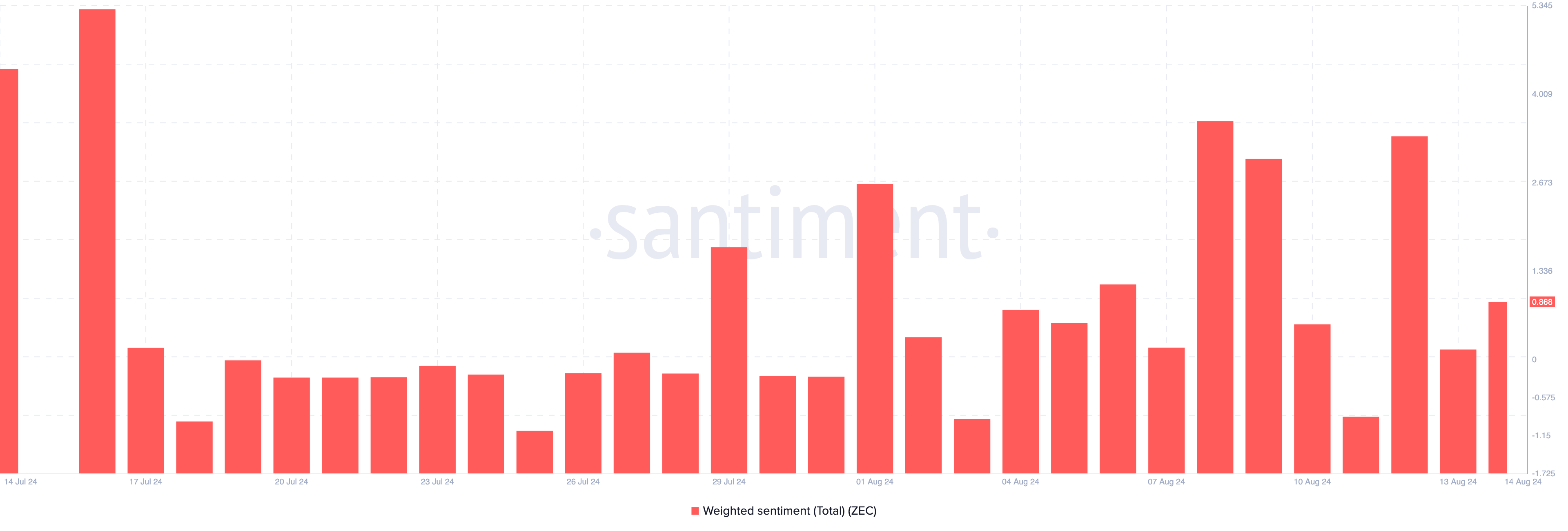

From an on-chain perspective, Sentiment data shows an increase in Weighted Sentiment around ZEC. This metric uses social volume to measure awareness of a project in the market.

If the weighted sentiment reading is positive, most of the comments are bullish. However, a negative assessment means that many discussions are leaning towards the bearish side. In the case of ZEC, the reading first fell on August 13.

However, at the time of writing, it has improved, suggesting that market participants are confident in the short-term price performance of Zcash. If this continues, demand and value for ZEC could increase.

On a technical note, the daily chart shows that the price of ZEC has been forming a Lower Highs (LH) since July. This formation almost always indicates strong support whenever the price moves higher.

Also, the exponential moving average (EMA) provides additional insight into the trend of ZEC. EMA is a technical indicator used to measure trend direction. When the shorter EMA is above the longer EMA, it indicates a bullish trend, while the opposite indicates a bearish trend.

On July 14, the 20-day EMA (blue) crossed above the 50-day EMA (yellow) forming a golden cross. This pattern generally confirms a bullish outlook, strengthening ZEC’s upside momentum.

Read more: Zcash (ZEC) Price Prediction 2024/2025/2030

The short EMA continues to move ahead of the long EMA, suggesting further upside potential. If this trend continues, the price of ZEC could reach $46 in the short term.

However, a bearish crossover could shatter this outlook. If profit-taking intensifies, ZEC’s value could fall to around $36.74.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without prior notice. Always conduct your own research and consult with a professional before making any financial decisions. Please be advised that our Terms of Use, Privacy Policy and Disclaimer have been updated.