- HEDERA was able to rise a few days after the short -term SMAS signal “purchase”.

- HBAR can see the potential price reversal after the purchase pressure passes through the Ichimoku cloud resistance.

HEDERA (HBAR) has increased 3.63% over the last 24 hours, as the price of $ 0.18 vibrates in the press time according to CoinmarketCap.

HBAR has been trading since the beginning of this month due to its strong weak momentum.

The price is sitting in core support and demand zones, and the market is wondering if the bulls can be responsible for it.

HBAR technology setting and demand area

If you look at the 4 -hour chart, the HEDERA has been strengthened by falling down to form a triangle pattern. At the time of writing, HBAR traded at $ 0.18396, the main support area.

Coin tested $ 0.182-$ 0.185 support area and protruded several times to prevent further down. This suggests that demand increases in this area as the buyer develops.

According to the X (previous Twitter) of TheCryptoExpress, the brake out or failure of this pattern will check the next direction of HBAR.

Source: X

Will the bull come in?

HBAR has not maintained a significant price increase than the demand area over the last two weeks.

However, the trader expects a rally in this demand area in the triangle structure.

Hedera’s short -term momentum, MACD and Movement Averages, indicates that the purchase pressure increases by sending a “buy” signal as the trading volume rises.

In 40, RSI has more potential for purchasing (low neutral zones), so the bull is cautious.

Increased public interest -can this be reversed?

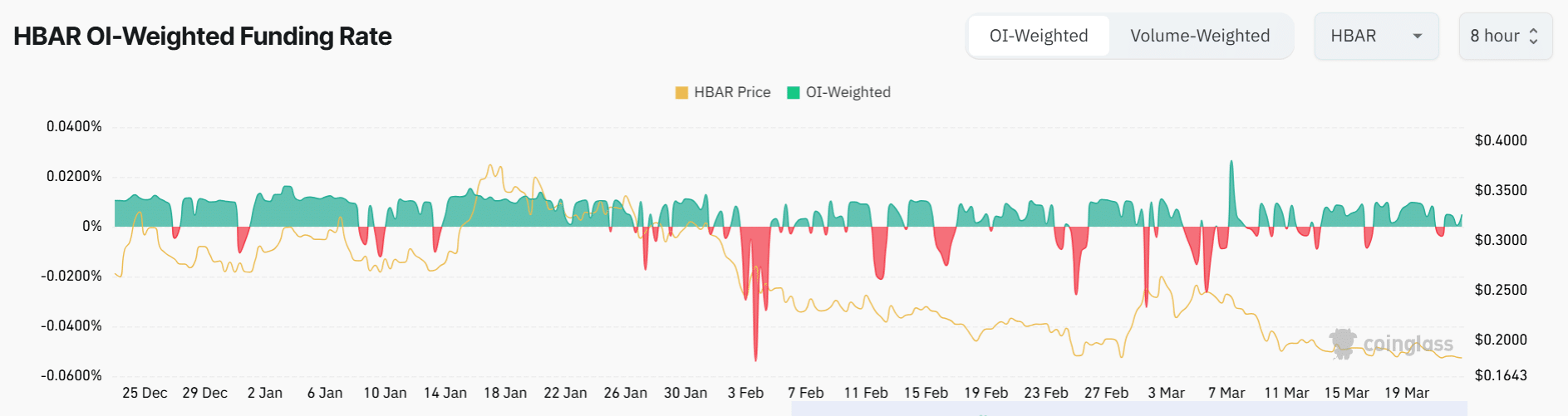

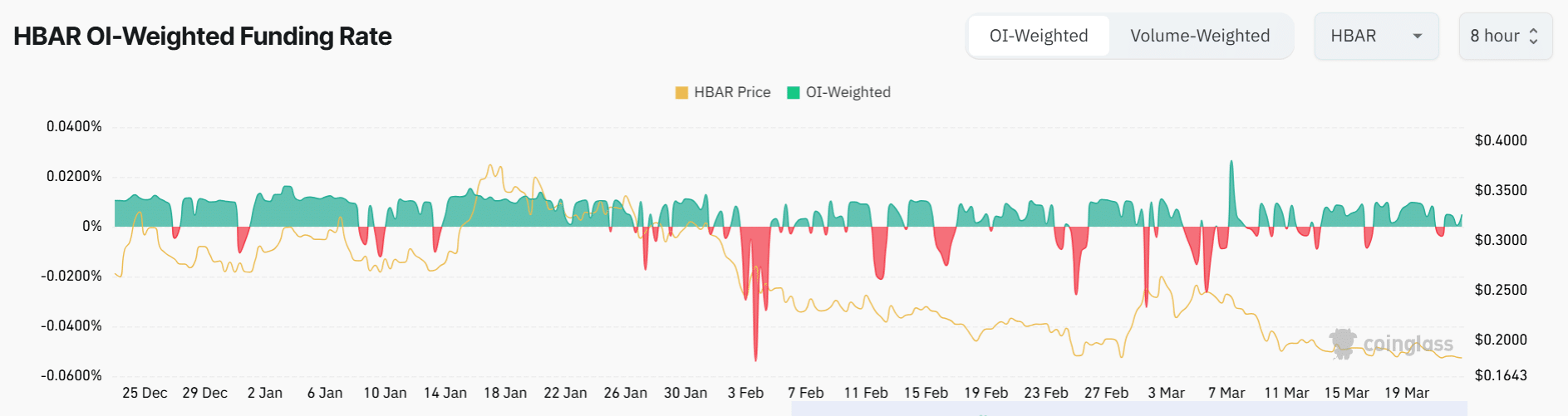

According to the CoingLass data, HBAR’s 24 -hour open interest rate has soared 4.5%, as the rate of positive interest (OI) funding has been positively shifted to prestation time for the last 48 hours.

This informed the new interest and merchant optimism in the main support zones.

Source: COINGLASS

The 24 -hour length/short ratio in the prestation time was standing at 1.7 and rises to 1.9 during the low period, suggesting an increase in demand according to Coinalyze.

So what is next?

The market seemed to be waiting for HEDERA confirmation in the $ 0.18 major support zone. If the coin overcomes the Ichimoku Cloud Resistance beyond the tendency, the trend can be reversed.

Due to strong purchase pressure, the possibility of maintaining HBAR’s mid -term rise can be moved in the middle. Be careful of the following movement of this pattern formation.