- Large holders, or “whales,” who own significant portions of CROs have begun selling their holdings.

- Meanwhile, derivatives traders are increasingly betting on the downside, signaling expectations of a continued downtrend.

After a month-long rally that saw Cronos (CRO) post an impressive surge of 137.39%, momentum now appears to be reversing. The asset recently recorded a weekly loss of 4.78%, indicating a potential trend change.

However, in the last 24 hours, AMBCrypto reported that derivatives traders contributed to a 3.03% price recovery. Despite this brief rise, continued whale activity continues to raise doubts about CRO’s near-term prospects, putting smaller investors at risk of loss.

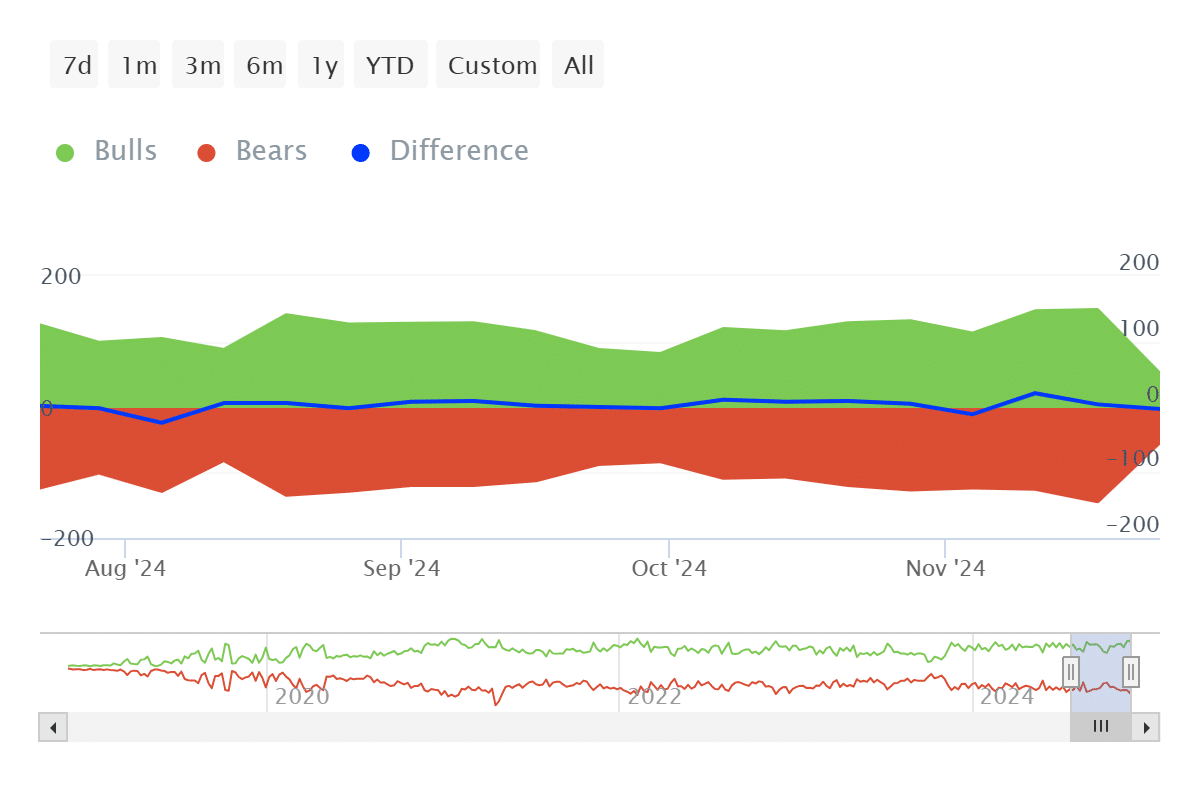

The downside is outpacing the uptrend and indicates a potential downside for CRO.

As of this writing, data from IntoTheBlock shows a bearish trend in the CRO market, hinting at potential downward pressure on prices.

Over the past seven days, there have been 144 bulls and 115 bears, a marginal difference that suggests minimal downside risk. But broader market dynamics raise additional concerns.

Source: IntoTheBlock

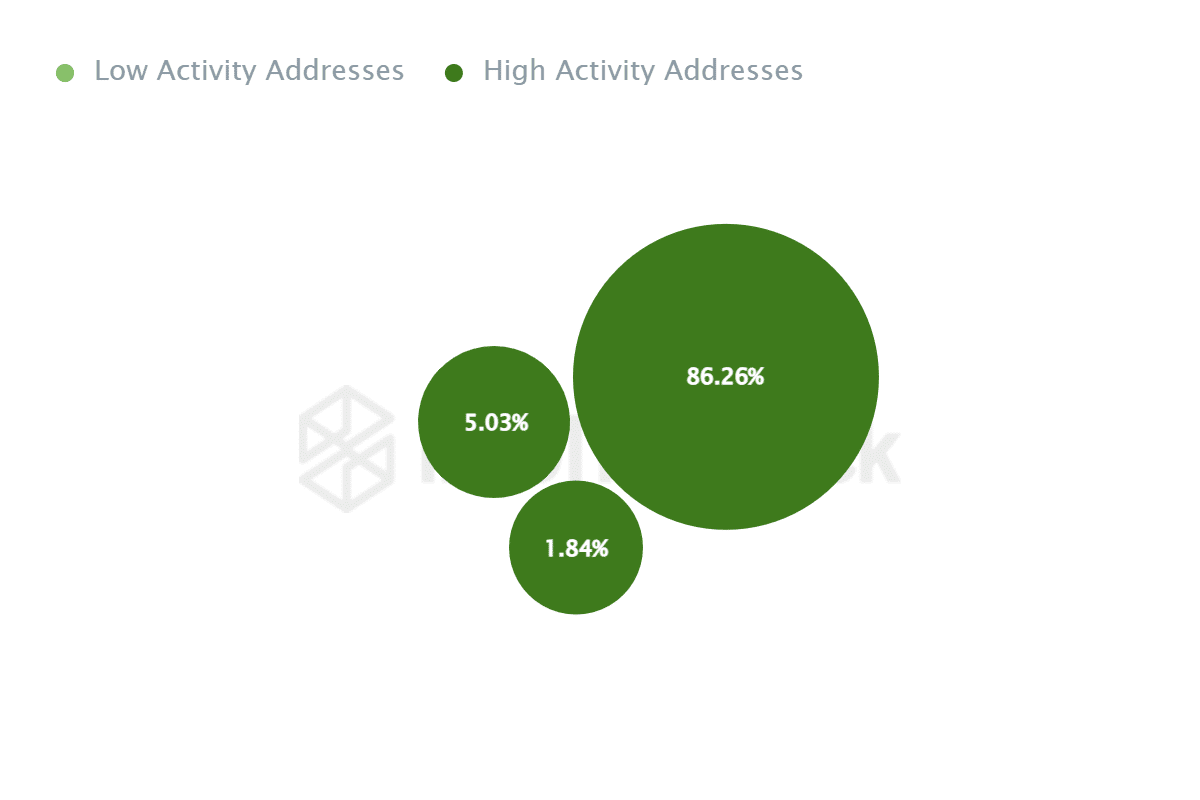

AMBCrypto highlights the severe imbalance in asset ownership as whales dominate the market. This imbalanced control amplifies volatility and leaves small holders vulnerable to sudden price fluctuations.

Whales dominate CRO, increasing downside risks.

Further analysis revealed that three active whale addresses control over 93% of CRO’s circulating supply. As of press time, these whales account for 93.13% of the total supply, with distributions of 1.84%, 5.03%, and a whopping 86.24%.

Their high activity is evidenced by more than 300 transactions performed within a given period, a factor that poses a serious risk to the price stability of CRO.

Source: IntoTheBlock

CRO also saw a surge in trading volume, with 73.16 million CRO traded in the last 24 hours.

This uptrend, combined with the presence of whales and signs of market weakness, suggests that CRO may be losing some recent gains and facing a potential downside.

Why is CRO popping up?

CRO’s recent rise has been largely driven by derivatives traders betting on upward movements in the asset and the price reacting.

The long-short ratio of 1.0912 confirms the bullish advantage, with more long positions leading to higher prices.

However, if whale activity intensifies, CROs can reverse course and nullify the bullish momentum created by derivatives traders.