- CRV has rebounded, soaring 43% from its all-time low.

- But the merchants I am giving up my long position and taking a short position.

Curve DAO (CRV) rose 43% last week as volume increased due to a surge in buying activity.

Over the past seven days, the CRV price has steadily increased from its all-time low of $0.18 to $0.28 at the time of writing. Despite the remarkable recovery, the token is facing additional headwinds as the broader market-wide bearish sentiment weighs on the price.

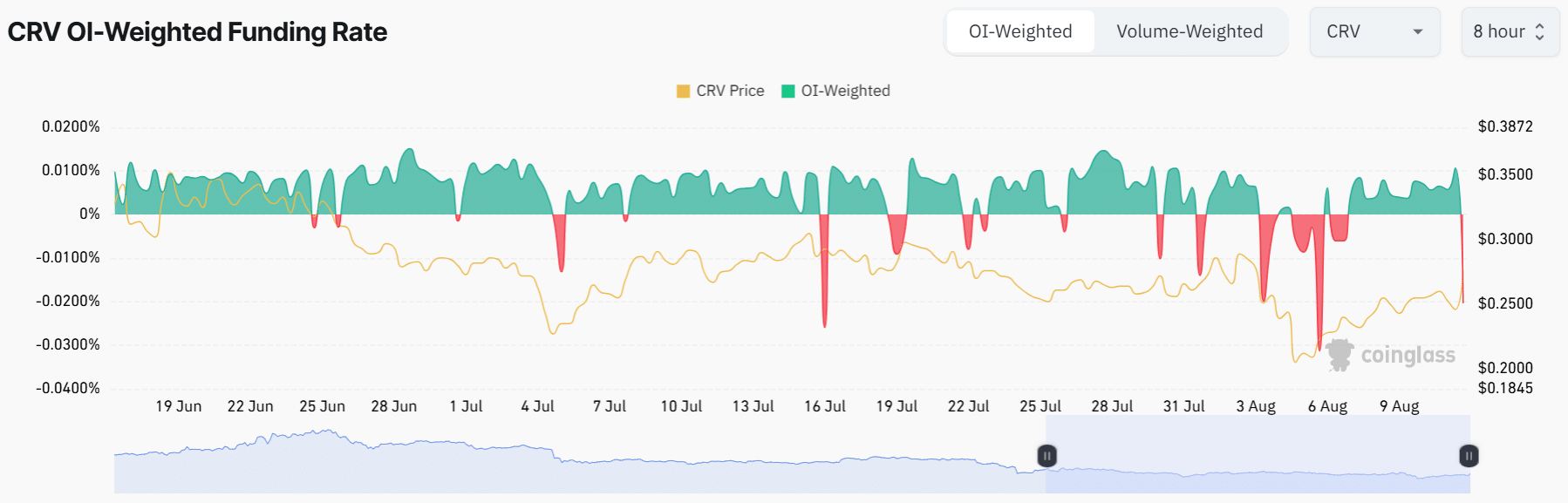

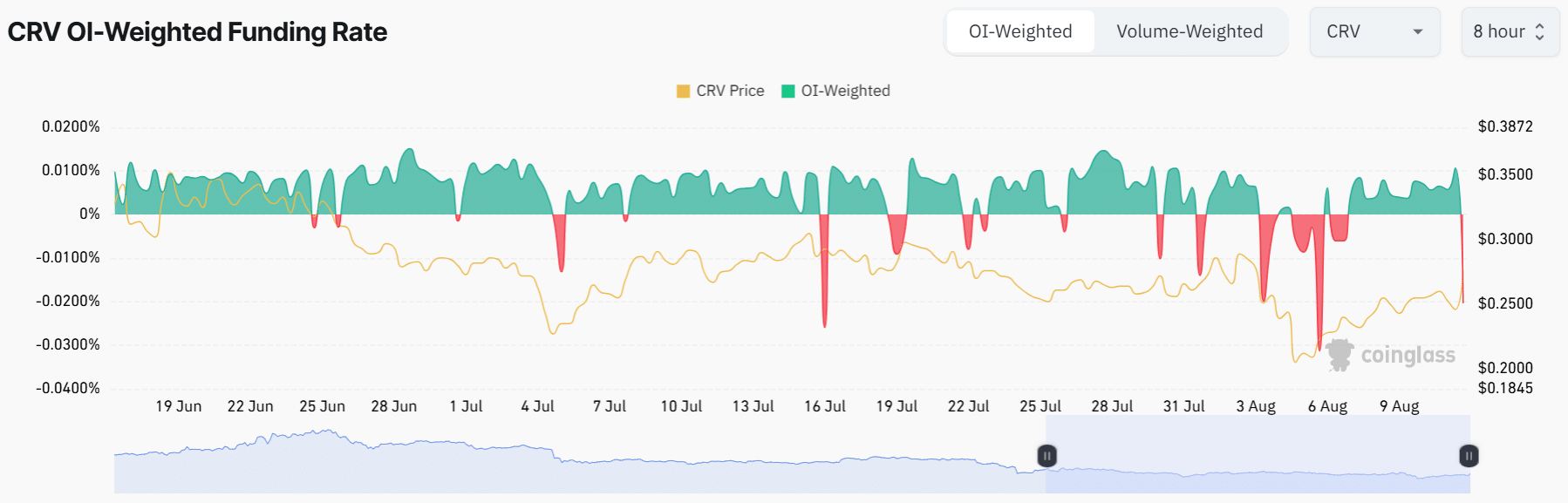

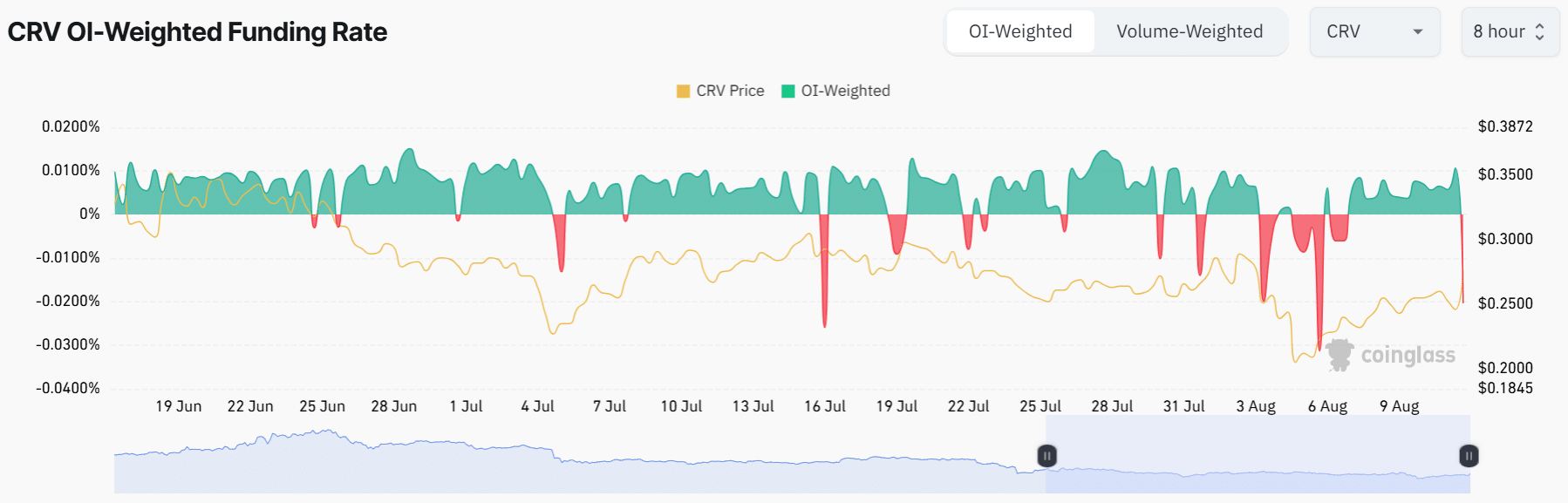

Funding rates plummet

In the data Coinglass The funding ratio has fallen sharply into negative territory, indicating that traders are abandoning long positions and taking short positions.

Changing trader sentiment suggests that CRV may have peaked and prices are expected to correct or consolidate.

Source: Coinglass

A sharp decline in funding rates is also a sign that CRV is cooling off after overheating. A long/short ratio closer to 1 further indicates that the market is not favoring longs or shorts, which reduces volatility.

Source: Coinglass

However, caution is still warranted as the open interest has increased from $67 million to $100 million per Coinglass, which is often considered bullish during an uptrend, but may not be the case for CRV as the funding rate is negative.

High open interest amidst negative funding rates suggests an increase in short positions, indicating growing bearish sentiment.

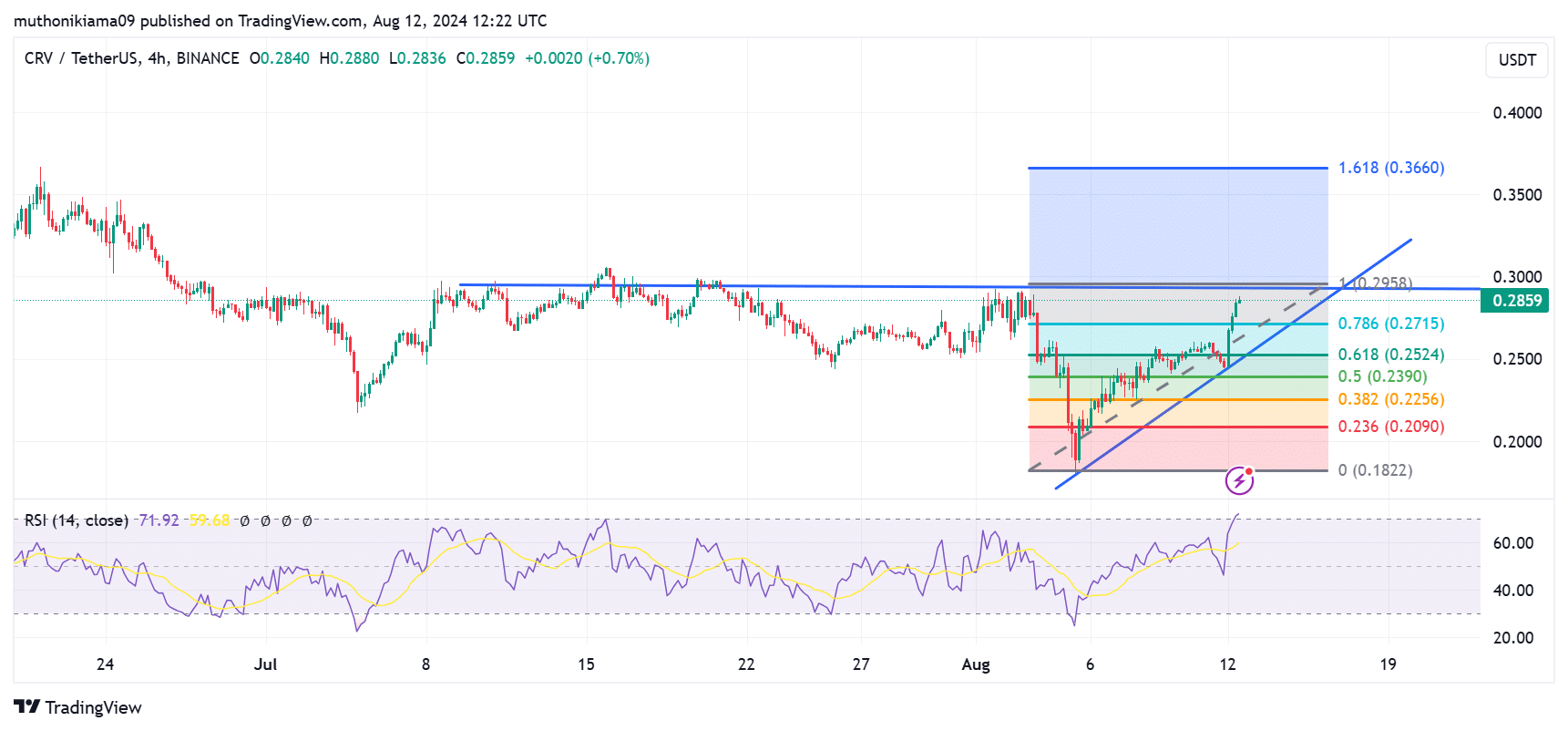

How high can CRV go?

CRV trading volume has surged by 175% in the last 24 hours. CoinMarketCap data.

There is likely a reason for the heavy buyer volume, as the Relative Strength Index (RSI) is at 72 on the 4-hour chart, indicating that CRV is slightly overbought.

However, the RSI line is trending north, suggesting that buyers are not yet out of the market and there is room for further upside.

The price also created an ascending triangle, showing the continuation of the bullish trend if CRV bounces off the breakout price of $0.285. If the bullish trend is strong enough, CRV can reach the next target at the 1.618 Fibonacci level ($0.36).

Is your portfolio green? Check out the CRV profit calculator

According to analysts, Trustworthy Cryptocurrency In X, there is additional yield potential for the token, with the price potentially doubling.

Source: Tradingview

Conversely, the bullish theory may fail if weak hands that bought the recent bottom sell, which would trigger a decline to the 0.236 Fibonacci level ($0.209).