- On July 30, the cryptocurrency liquidation volume decreased to $132 million.

- Liquidation of BTC will push back up to $70 and ETH will rise towards $3,450.

The cryptocurrency market has seen a lot of volatility over the past few days, which can be attributed to several factors. In the meantime, there has been a sharp increase in cryptocurrency liquidations.

This comes as the Federal Reserve is expected to decide on a new monetary policy.

Increase in cryptocurrency liquidations

According to recent data, liquidations in the cryptocurrency market amounted to $170 million. Most of these positions were long positions, which are considered bullish.

The reason could be the price movement of BTC. The price of BTC, the king of cryptocurrencies, reached $70,000 at the time of writing the article, and then long position traders liquidated. This happened at the time of the 7 events.

To boost the growth, the US government sold $2 billion worth of Bitcoin. Also, the Federal Reserve held a policy meeting, which was expected to provide a symbol for the upcoming monetary policy.

According to AMBCrypto’s Coinglass analysis: dataOn July 30th, the liquidation was reduced.

To be precise, the cryptocurrency liquidation volume amounted to $132 million, of which $109.5 million were long positions and $22.74 million were short positions.

Source: Coinglass

Are BTC and ETH affected?

The increase in liquidation also had the following effects: Bitcoin (BTC) and Ethereum (ETH) Prices have turned downward.

According to CoinMarketCapThe prices of both coins have dropped slightly over the past 24 hours. At the time of writing, BTC was trading at $65,980, while ETH was worth $3,311.

AMBCrypto looked at the liquidation heatmap to determine when liquidations might increase again.

According to our analysis, BTC will once again witness significant liquidation surge once the price corrects to $70k. Until that level is reached, BTC liquidations will remain relatively low.

Source: Hyblock Capital

Speaking of Ethereum, if the price reaches 3.45k, liquidation will reach 43.5k. Above that, liquidity of ETH will rise again near $3.80.

Source: Hyblock Capital

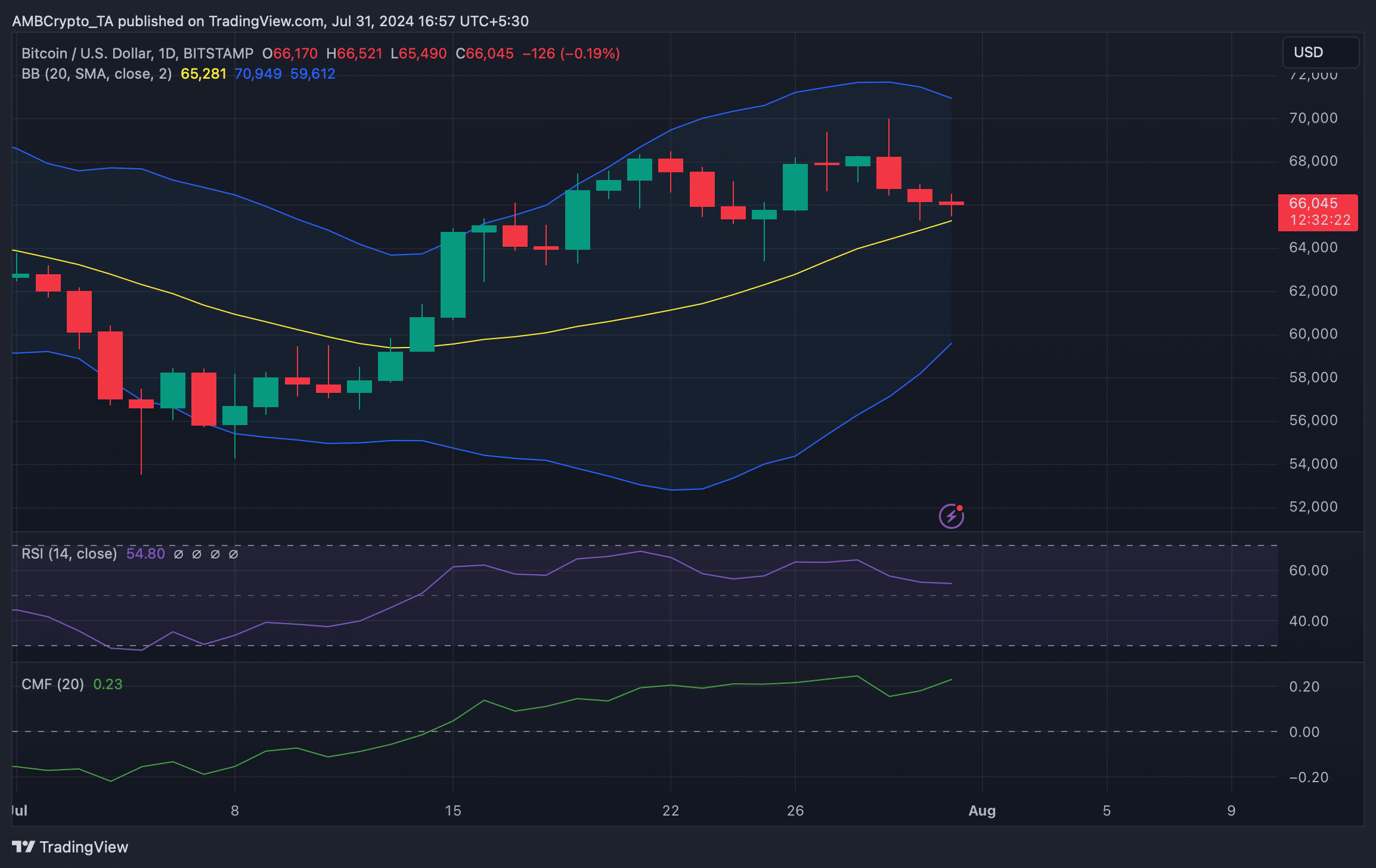

AMBCrypto checked the daily chart to see how likely it is to reach the aforementioned levels in the short term. Bollinger Bands showed that BTC is testing the 20-day simple moving average support.

If a successful test is made, BTC could start another bullish rally. Chaikin Money Flow (CMF) also rose, maintaining its bullishness. However, the Relative Strength Index (RSI) supported the bearishness.

Source: TradingView

read Ethereum (ETH) Price Prediction 2024-25

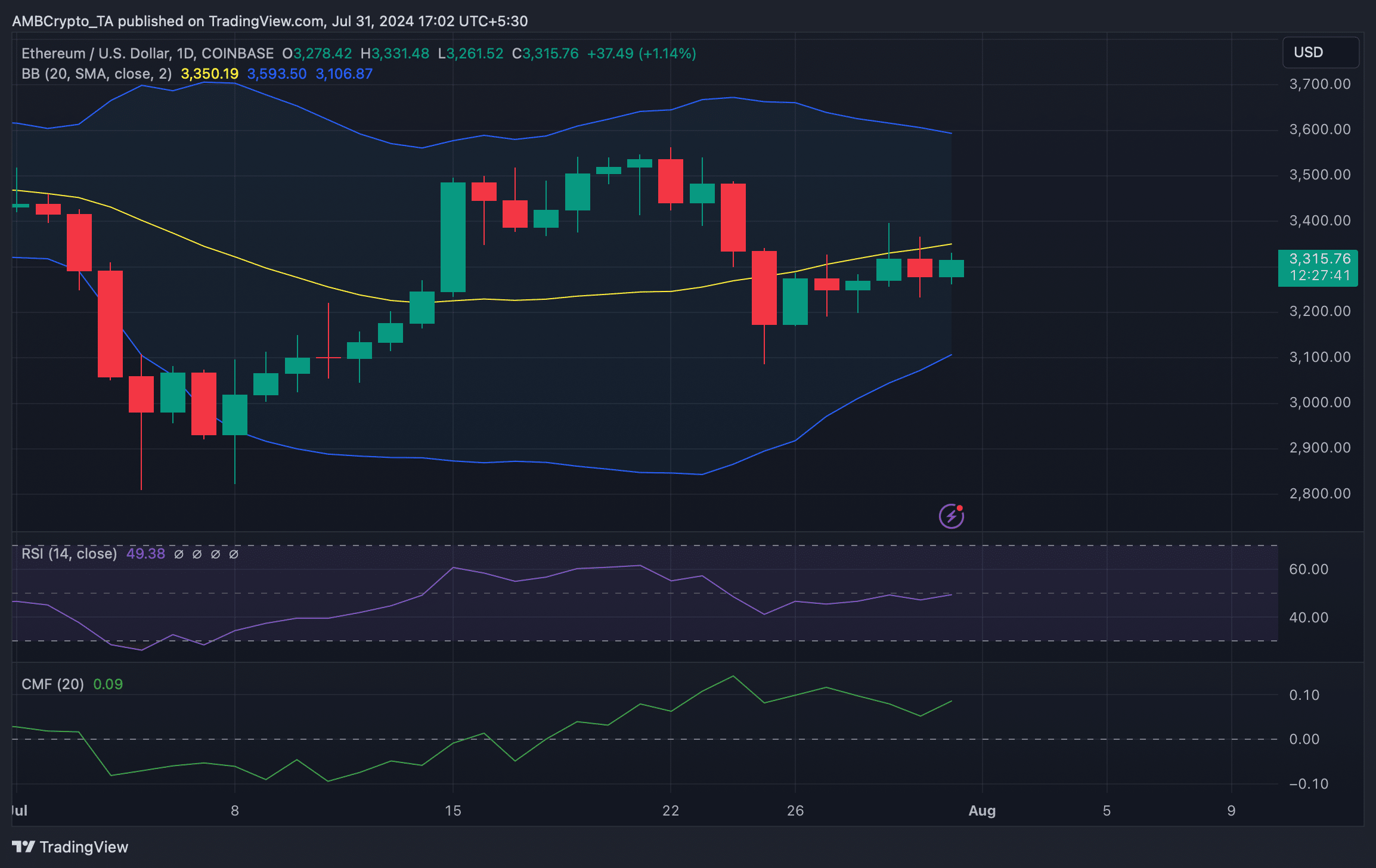

Interestingly, while BTC was testing support, Ethereum was testing resistance at the 20-day SMA. The good news is that the RSI has registered an uptrend.

Additionally, Chaikin Money Flow (CMF) also moved north. Both of these indicators suggest that ETH is likely to turn bullish again.

Source: TradingView