According to data, more than $1 billion was liquidated in cryptocurrency derivatives markets over the past day as Bitcoin plunged to $52,000.

Bitcoin has fallen more than 15% in the last 24 hours.

Bitcoin investors were shocked when the market opened on Monday, as the cryptocurrency plunged more than 15%, sending prices to as high as $51,500.

References

The chart below shows how the asset has performed recently.

As you can see from the graph, the recent plunge in the BTC price is merely an acceleration of the trend the asset has been witnessing in the last few days of July.

On the 29th, the cryptocurrency was hovering around $70,000, meaning it had fallen more than 26% in just one week. After that drop, Bitcoin is now back to the levels just before the rally in late February, which culminated in a new all-time high (ATH).

While BTC has had a bad day, altcoins in general have fared worse. The three largest coins after the original coin (excluding stablecoin Tether), Ethereum (ETH), BNB (BNB), and Solana (SOL) all saw even bigger losses, with losses of 23%, 19%, and 21% respectively.

With prices crashing across all sectors, it’s no surprise that long-term investors have been hit hard in the derivatives markets.

Crypto liquidations top $1 billion, mostly long-term contracts

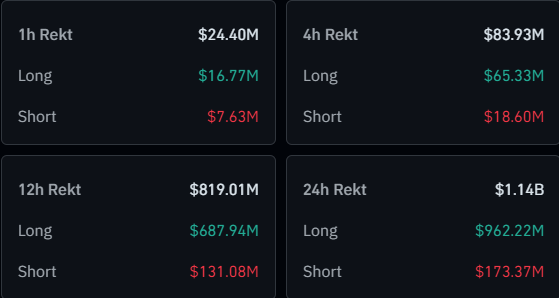

The recent volatility across various assets has caused turmoil in the derivatives markets over the past 24 hours, as evidenced by the data from CoinGlass below.

As you can see from the table, a whopping $1.1 billion worth of cryptocurrency derivatives contracts were liquidated during this period. Liquidation here refers to the natural process by which a contract is forcibly terminated on a platform after it has accumulated some losses.

The vast majority of these liquidations, or more precisely about 85%, involved long-term holders, a natural consequence of the market-wide crash.

But what’s interesting is that despite the sharp decline, $173 million worth of short positions were still liquidated, which is not a small amount, so it seems like many investors were only betting on the bears after the decline was already over.

References

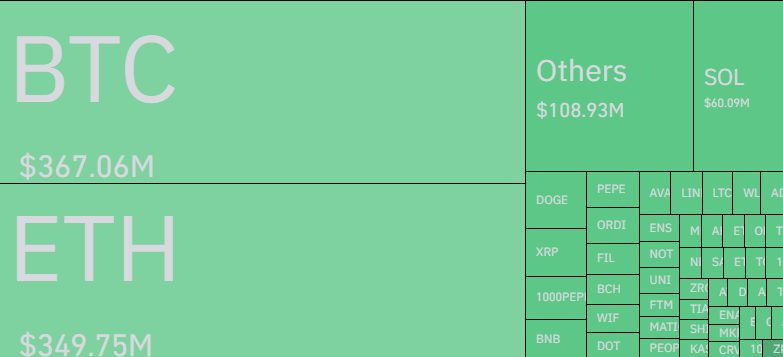

Looking at individual cryptocurrencies, Bitcoin and Ethereum contributed to mass liquidations at roughly the same rate, with $367 million and $350 million liquidations respectively.

Clearly, BTC is still ahead, but usually not, and the gap is very small. The reason for the high liquidation of ETH may be due to the recent launch of a spot exchange-traded fund (ETF), which has drawn more attention to the second-largest coin by market cap.

Dall-E, Featured image from CoinGlass.com, Charts from TradingView.com