- The recent cryptocurrency crash is likely to have the same effect as the COVID-19 crash.

- Will the Fed cut rates as many analysts expect?

Kyle Chasse, a popular market analyst for X, said: Advised Investors are urged not to panic over the recent cryptocurrency market crash.

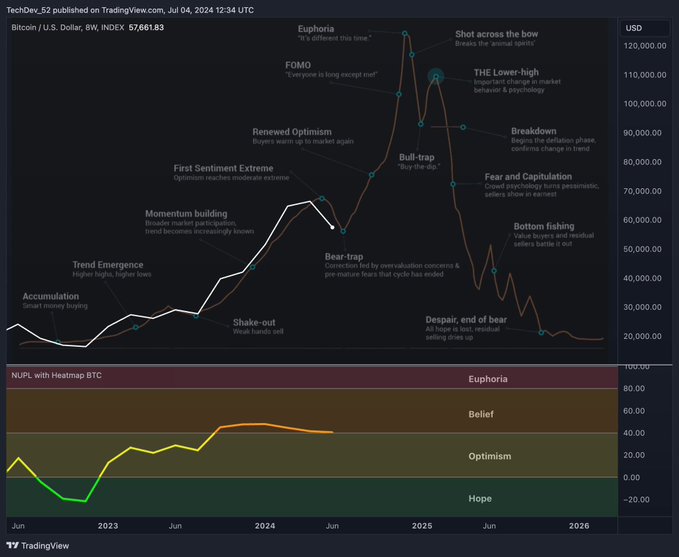

He pointed out that the NUPL indicator, which tracks Bitcoin (BTC) sentiment, shows that the market is still in a belief phase, indicating that we have not yet reached the end point.

Chasse stressed that investors should not fear the possibility of long-term gains, as the market is simply in a bear market and today’s sell-off may be the backdrop to the next uptrend.

Source: TradingView

Could the recent cryptocurrency crash have the same impact as COVID-19?

The recent crash is one of the worst market events, with more than $1 billion in cryptocurrencies liquidated in the past 24 hours.

This crash was similar to the 2019/20 crash that occurred during the COVID-19 cycle that led to the 2021 bull market. The similarity in patterns suggests a potential opportunity for investors.

There are other factors that suggest now is a good time to buy Bitcoin and other cryptocurrencies.

Source: TradingView

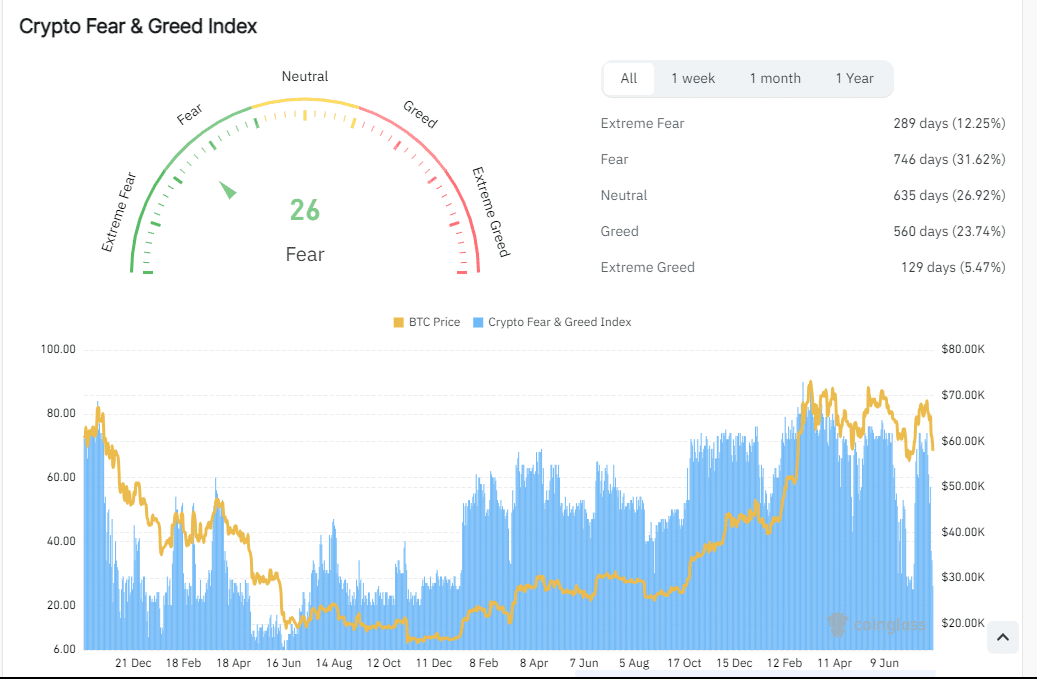

Big companies use the fear and greed index.

While fears of global conflict have destabilized financial markets, some in the cryptocurrency industry believe the crash was due to concerns about a recession.

At the time of writing, the fear and greed index was at 26, indicating that large institutions are likely to buy now to take advantage of low prices and sell when the market reaches its peak.

This situation further highlights that this could be the last opportunity to invest in your cryptocurrency portfolio before prices rise.

Source: Coinglass

The impact of the FED rate cut

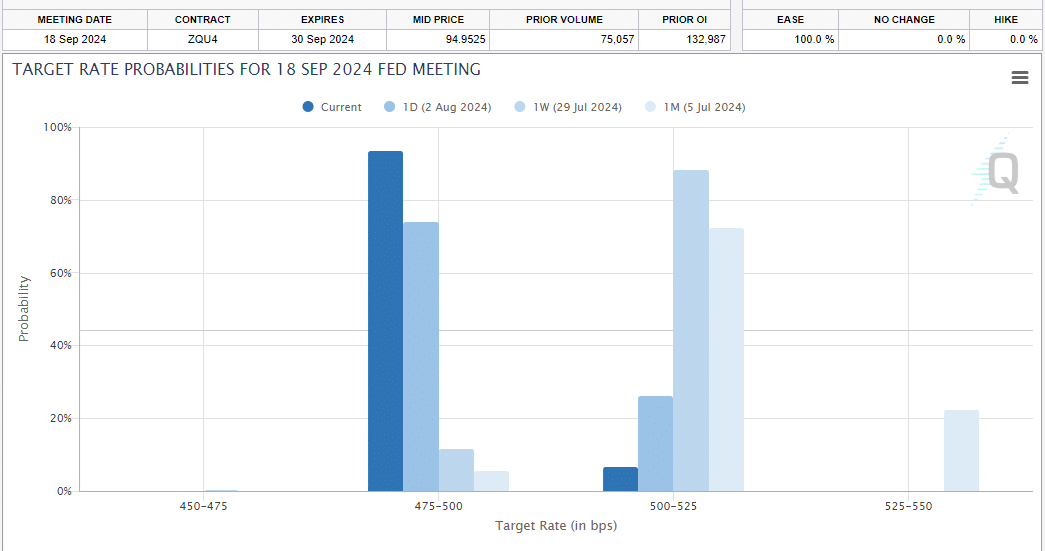

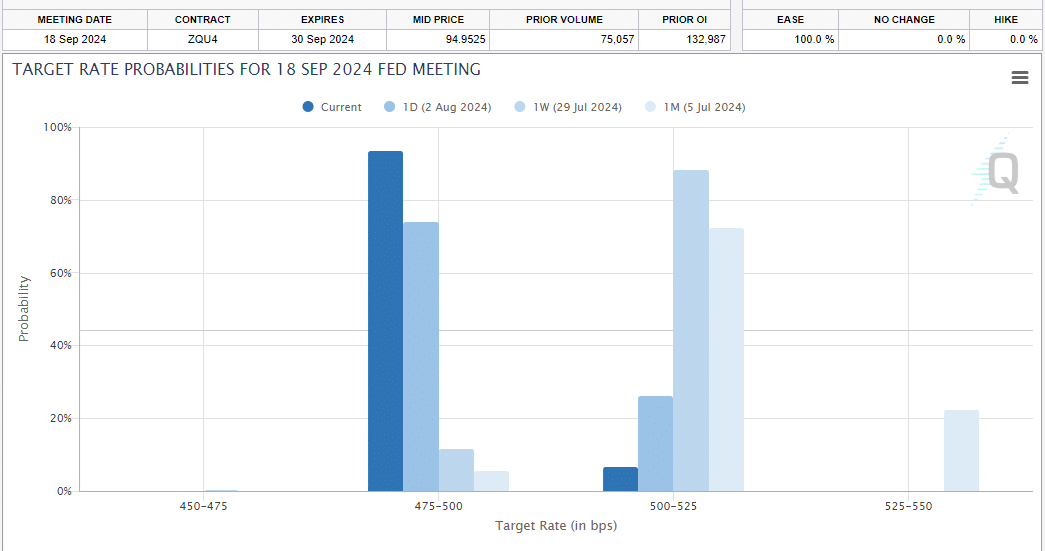

Finally, the Federal Reserve is expected to cut rates in September, with a 93.5% chance of doing so, according to Fedwatch.

This prediction comes after a significant decline in the Japanese stock market. If the Fed cuts interest rates, it could stabilize financial markets and benefit assets such as cryptocurrencies.

Investing now could yield significant long-term gains as the market has potentially reached its lowest point in this cycle, and the current situation may represent the lowest point before a possible recovery.

Source: CME Group