- Prosshares’ leverage XRP ETF will not debut on April 30 as expected.

- Market data warned of potential decrease in less than $ 2 in May.

Ripple (XRP) The ETF still remained a hot topic and added a lot of anticipated Proshares Future -based XRP ETF launch to Buzz.

Most of them were expected to be released on April 30, but Bloomberg ETF analyst James Seyffart It became clear It will be released soon, but this month.

“We are not that true. There is no confirmed launch date, but we will be released and we will be released in the short term or medium -term release.”

When listed Pro Sharer The product joins TEUCRIUM from the US leverage XRP ETF.

XPR CME FUTURES also increased the possibility of approval of US SPOT XRP ETF, which is scheduled to be released in May.

Forecast site polymarket placement A 78% opportunity GreenLight by the end of 2025.

XRP ETF -Isn’t it good for traders?

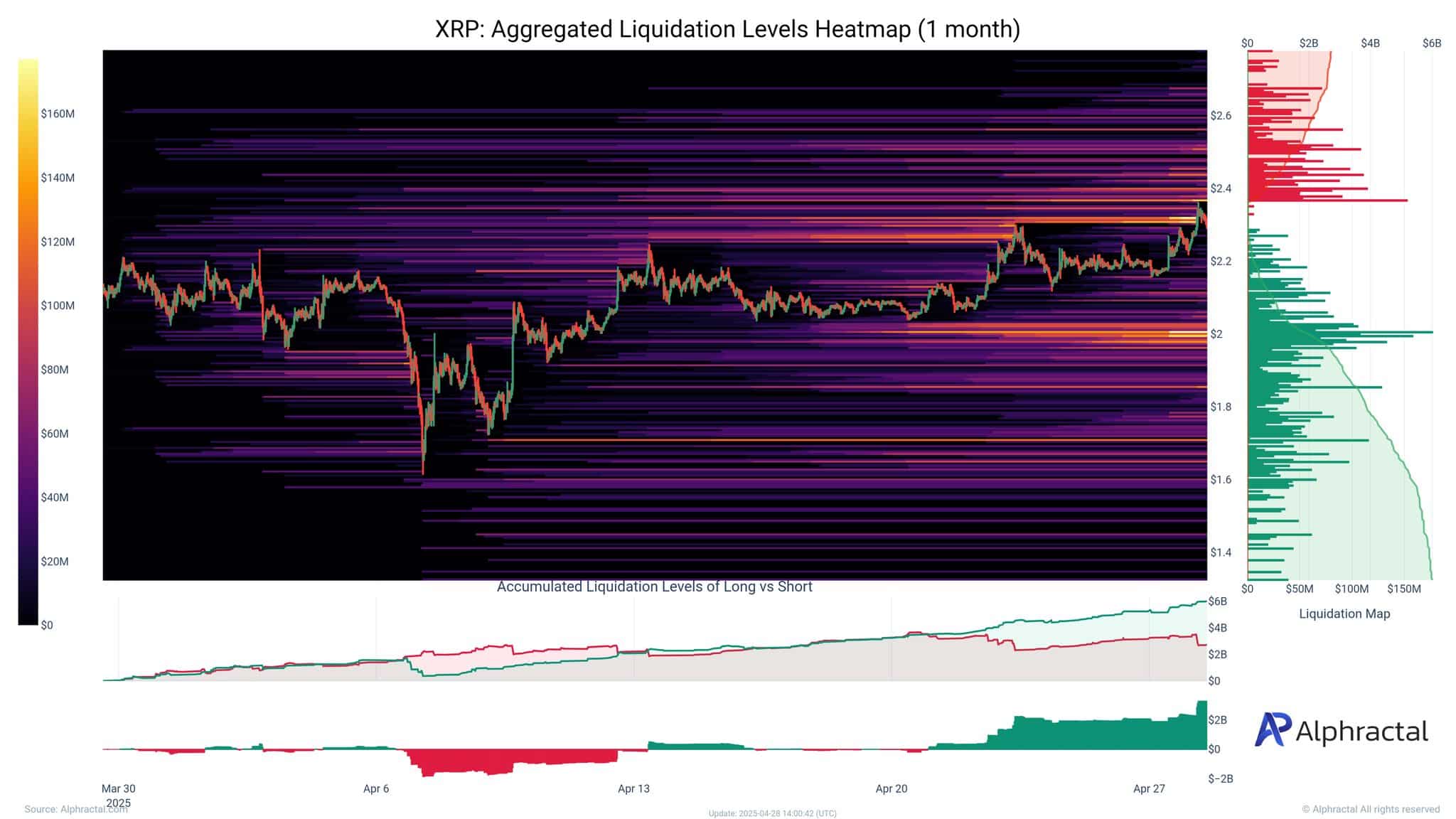

Despite the optimistic outlook for the ETF front, the analytical company, APHRACTAL, was cautious and similar to BTC ETF approval. There was a long -standing large accumulation of about $ 2 or less.

APHRACTAL mentioned that a similar scenario for BTC ETF dragged $ 11K before drawing BTC to 1,100K.

Source: Alphractal

For those who are not familiar, such large liquidity tends to serve as price magnets in a long, short or short position. As a result, asset prices can fall to this level during liquidity -centered rally.

In short, when XRP ETF debuted, the company guessed potential dip of less than $ 2. Similar feelings are reflected in the option market.

According to Deribit, the highest volume of XRP was a foot option (Bear Rish Betting) for the $ 1.4 goal by May 30.

Source: Deribit

The second most traded tool was the $ 2.275 call option on April 30. In other words, the big players hedge the potential reduction of less than $ 2 next month.

In the price chart, XRP defended $ 2.1 short -term support, but has not yet solved the decline. However, the price behavior was higher than the 200dma (daily moving average).

This meant that the bull was in a good place, but it could get a better advantage when pushing more than $ 2.4.

Source: XRP/USDT, TradingView

The rapid decrease in $ 2.1, 200dma or $ 1.4 (main November Integrated Zone) may be suspended.