A prominent crypto analyst says a Solana (SOL) competitor could see its stock price surge by up to 30% after updating its outlook on Bitcoin (BTC) and other digital assets.

Cryptocurrency trader Ali Martinez told his 69,600 followers on social media platform X in a new strategy session that one of the key indicators is a buy signal for SUI, the native cryptocurrency of layer 1 blockchain and smart contract platform Sui Network.

“TD Sequential has a buy signal on the SUI weekly chart. A sustained close above the 50-week moving average could see a 30% rally to $1.20!”

The Tom DeMark (TD) Sequential Indicator is an indicator that traders use to predict reversal points in the price of an asset.

At the time of writing, SUI is trading at $0.843, which is up slightly over the last 24 hours.

Moving on to Aave (AAVE), a decentralized finance (DeFi) protocol, Martinez says the altcoin could see a 27% drop as TD Sequential tends to decline after issuing a sell signal on the daily chart. The trader says this has happened recently.

“The TD Sequential last flashed a sell signal on the AAVE daily chart four times, followed by an average correction of 27%. Now the same sell signal has appeared, suggesting a potential downside for AAVE.”

At the time of writing, AAVE is valued at $135.47, down 1.1% over the past day.

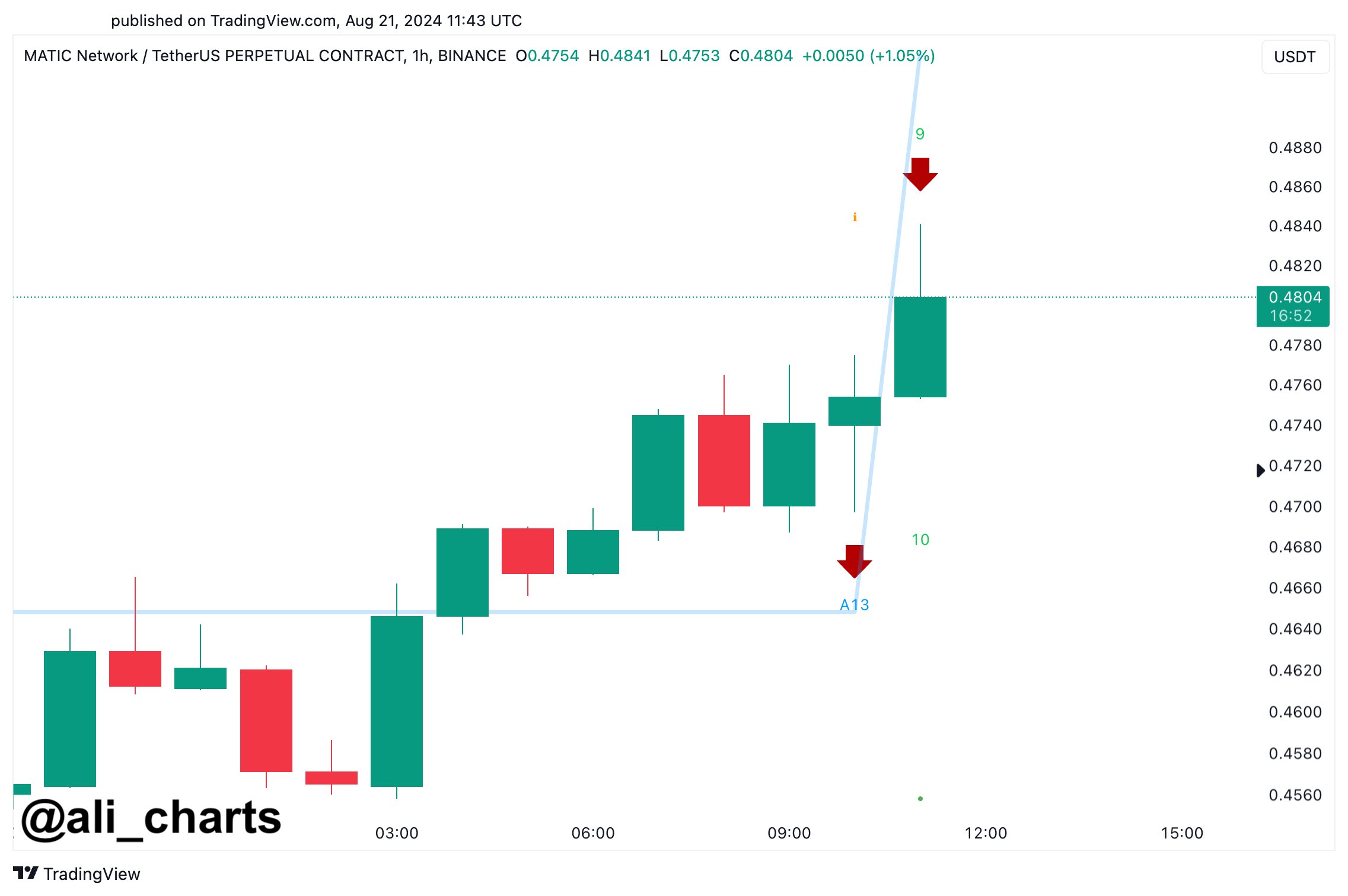

The strategist noted that Layer 2 scaling solution Polygon (MATIC) is also facing a correction after several days of upward momentum.

“Polygon has seen a significant surge in the last few days, but caution is advised. The TD Sequential on the hourly chart is signaling a potential correction for MATIC.”

At the time of writing, MATIC is trading at $0.52, up 8.4% over the last 24 hours.

Concluding his analysis with the king of cryptocurrencies, Martinez says that historically, BTC is still in the early stages of a bullish cycle after the halving. The trader also points out that the digital asset industry tends to rise after large-scale minting of stablecoin Tether (USDT).

“It’s been 119 days since the 2024 Bitcoin halving. In the past two cycles, BTC has peaked approximately 530 days after the halving. If history repeats itself, we’re still early in this cycle!”

As of this writing, Bitcoin is trading at $60,330.

Don’t miss out – subscribe to receive email notifications straight to your inbox

Price check task

Follow us XFacebook and Telegram

Surfing the Daily Hodl Mix

Disclaimer: The opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investment in Bitcoin, cryptocurrencies or digital assets. Your transfers and transactions are at your own risk and any losses you may incur are your own responsibility. The Daily Hodl does not recommend buying or selling cryptocurrencies or digital assets and The Daily Hodl is not an investment advisor. The Daily Hodl participates in affiliate marketing.

Generated image: DALLE3