- Cryptocurrency exchange trading volumes have been declining for three consecutive months since March.

- According to CME data, institutional interest in ETH declined significantly in June.

Cryptocurrency exchange trading volumes plunged further in June, continuing a trend that began in March 2024.

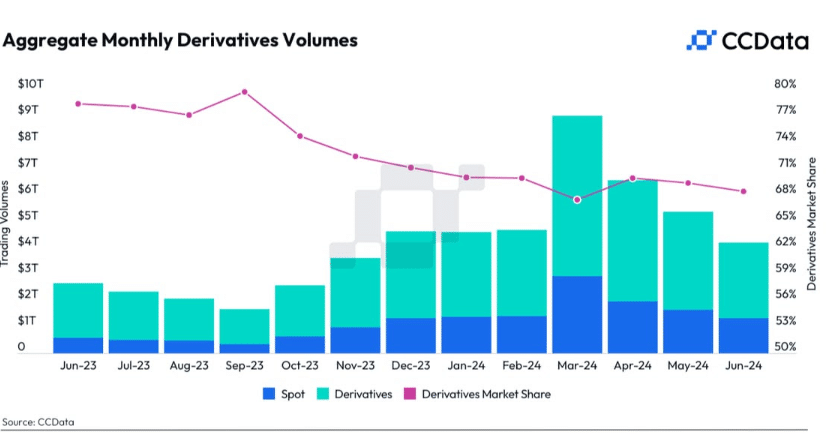

According to CCData reportTotal trading volume declined for the third consecutive month, dropping 21.8% to $4.22 trillion.

The report attributed the decline to broad sideways movement and losses in major assets. Bitcoin (BTC) and Ethereum (BTC).

‘Major crypto assets, including Bitcoin and Ethereum, remained largely range-bound and saw significant declines in June, with overall trading volume down 21.8% to $4.22 trillion.’

ETH falls more than BTC as spot prices eat into derivatives markets

Derivatives trading volumes fell more than spot trading volumes in June, with spot trading volumes down 19.3% to $1.33 trillion, the report said.

This is also the third consecutive month of decline from the all-time high of $2.94 trillion in March.

However, the decline was more pronounced in the derivatives market, where derivatives trading volumes fell 22.8% to $2.89 trillion. The report said that spot trading volumes compared to derivatives trading volumes were:

‘Derivatives trading volumes are also decreasing compared to spot trading volumes, as evidenced by the decline in the market share of derivatives products. The derivatives market now accounts for 68.5% of the overall cryptocurrency market (compared to 70.1% in January).’

Source: CCData

The decline was also reflected in the significant reduction in liquidity in the derivatives markets, as reflected in the Open Interest (OI) ratio.

In June, OI fell by around 10%, with Coinbase taking the biggest hit due to mass liquidations.

‘Open interest on derivatives exchanges fell by 9.67% to $47.11 billion following a series of liquidations triggered by the sharp decline in cryptocurrency prices observed in June and lasting into July.’

Coinbase’s OI fell 52.1% to $18.2 million. However, Binance, despite its OI down 9.93%, still peaked among centralized exchanges with an open interest of $19.4 billion.

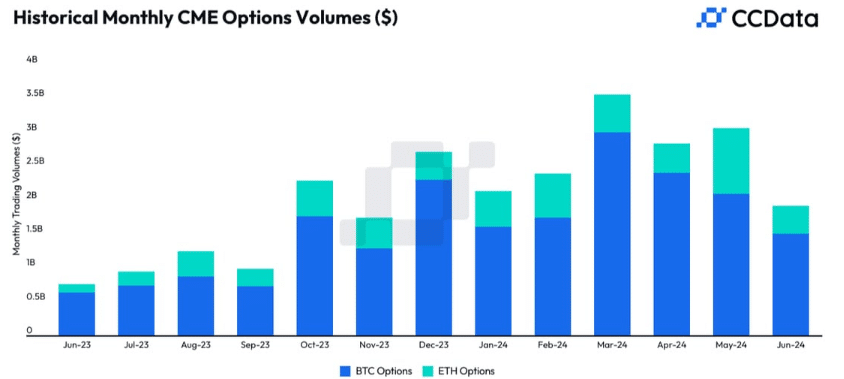

The June decline wiped out the significant options volume that had surged in May. ETH volumes were particularly weak after the unexpected partial approval of an ETH ETF.

According to CME data, institutional interest in ETH as measured by options volume declined significantly in June.

‘BTC options volumes on exchanges fell significantly in June, dropping 28.2% to $1.5 billion. ETH options volumes saw an even bigger decline, plummeting 58.0% to $408 million.’

Source: CCData

However, analysts predict that the final approval and launch of an ETH ETF will happen next week, which could boost trading volume across the spot and derivatives markets.

However, it remains to be seen how the market will react to these developments.