- Spot Bitcoin ETF recorded historic weekly inflows of $3.13 billion, demonstrating growing investor confidence.

- Altcoins such as Solana, XRP, and Litecoin have witnessed significant institutional inflows amid Bitcoin’s dominance.

The ripple effects of Donald Trump’s presidential victory continue to ripple through the cryptocurrency market, fueling continued growth and activity.

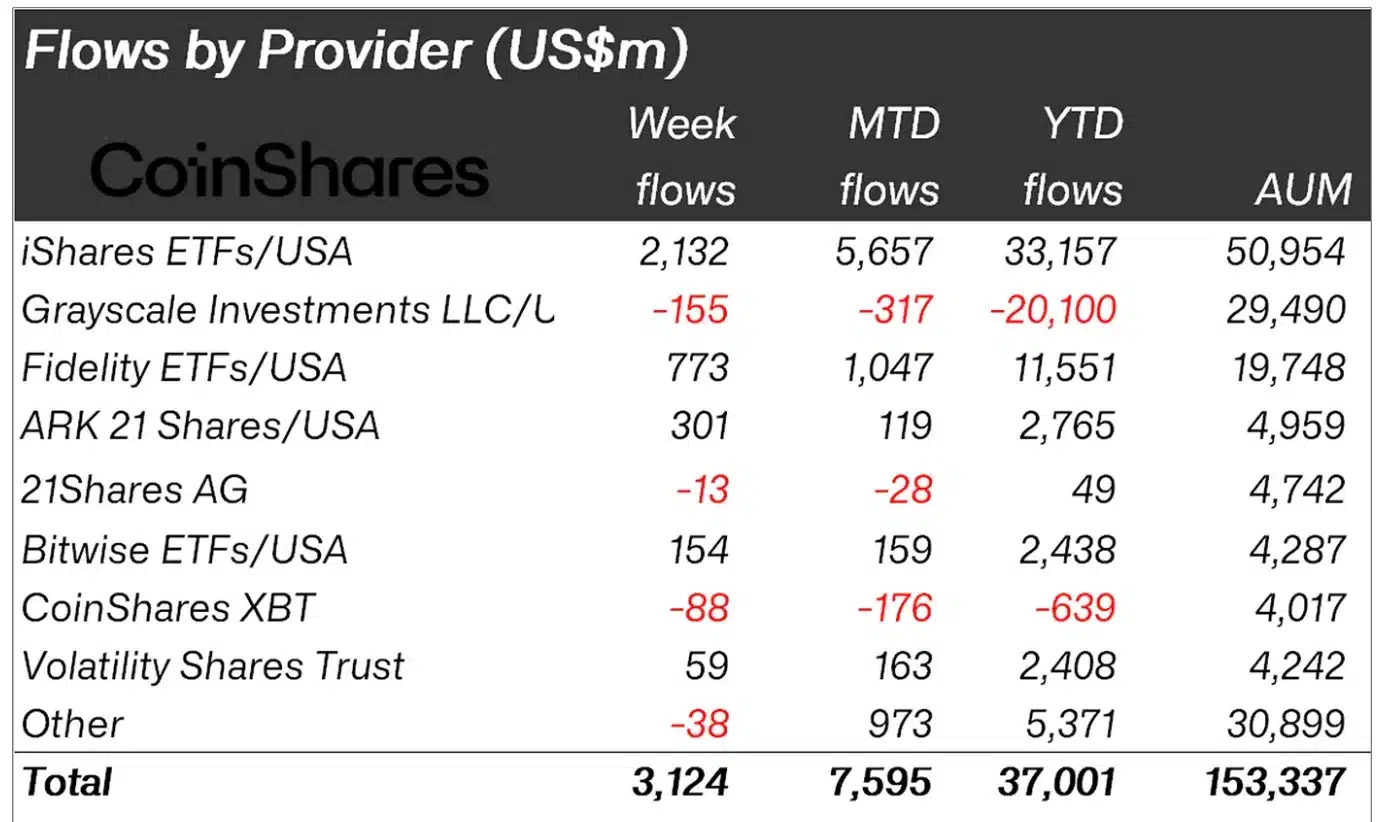

The market reached a significant milestone last week, with net inflows of approximately $3.13 billion into global investment products.

This surge is primarily due to increased interest in US spot Bitcoin (BTC) exchange-traded funds (ETFs), highlighting the evolving dynamics of the market.

Cryptocurrency inflow records broken

According to CoinShares data, these developments highlighted growing investor confidence and the transformative impact of political and economic changes on the cryptocurrency space.

According to the report,

“Digital asset investment products recorded their highest ever weekly inflows, totaling $3.13 billion, and total annual inflows reaching a record high of $37 billion.”

SoSoValue reports that during the week of November 18-22, spot Bitcoin ETFs rose an impressive 102% from the previous week’s $1.67 billion.

The rise also marks the seventh consecutive week of positive inflows, demonstrating continued momentum and increasing investor enthusiasm. Additionally, total assets under management (AUM) reached an all-time high of $153 billion.

Amid this upward trend, BlackRock’s IBIT continues to dominate the market, with net assets of $48.95 billion and cumulative inflows of $31.33 billion as of November 22.

On the other hand, Grayscale’s GBTC had net assets of $21.61 billion, but faced a fund outflow of more than $20 billion since its establishment.

Source: blog.coinshares.com

Blackrock’s IBIT shines brighter

In fact, deeper analysis shows that a significant portion of last week’s inflows – about $2.05 billion – came from IBIT.

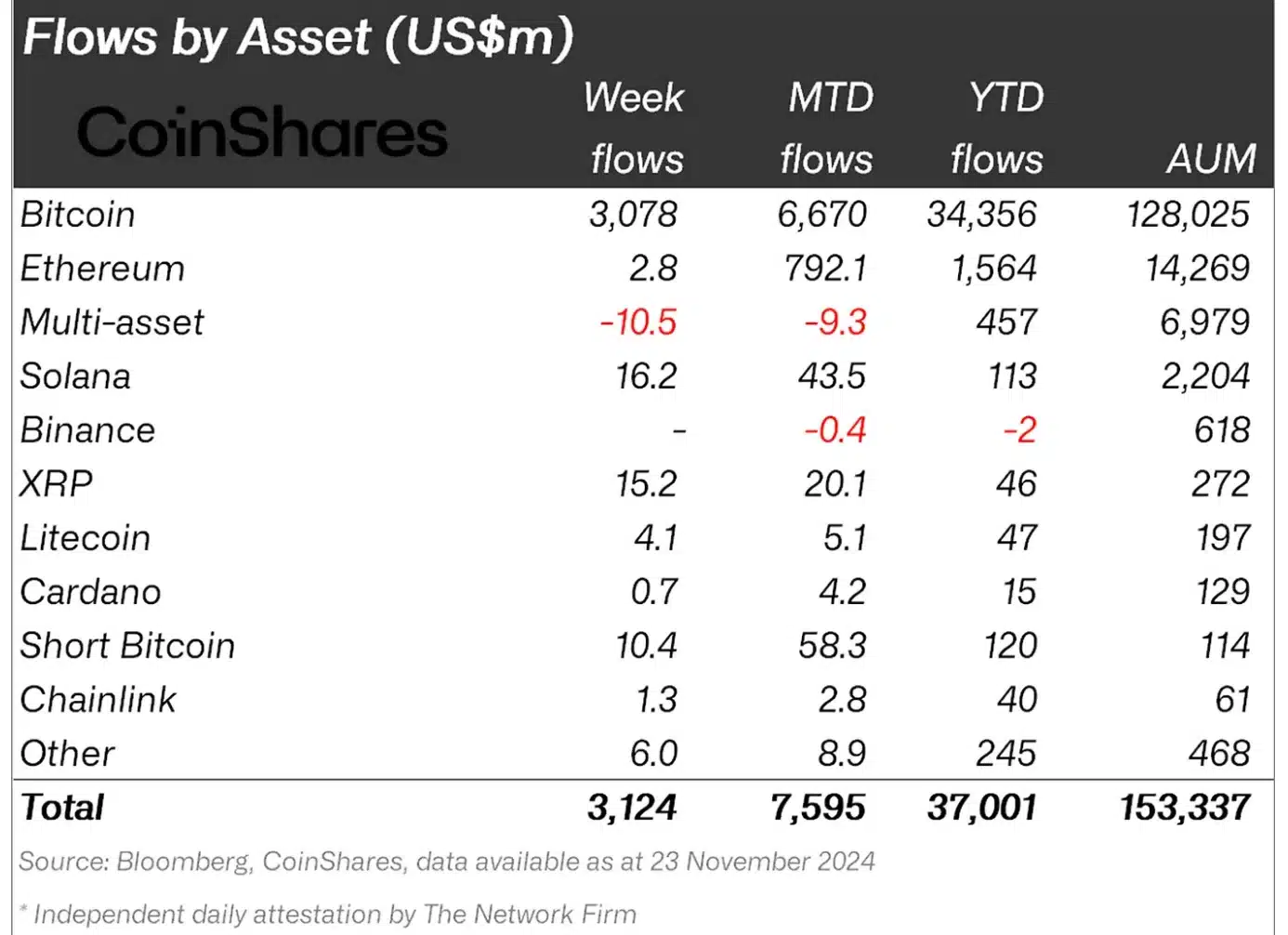

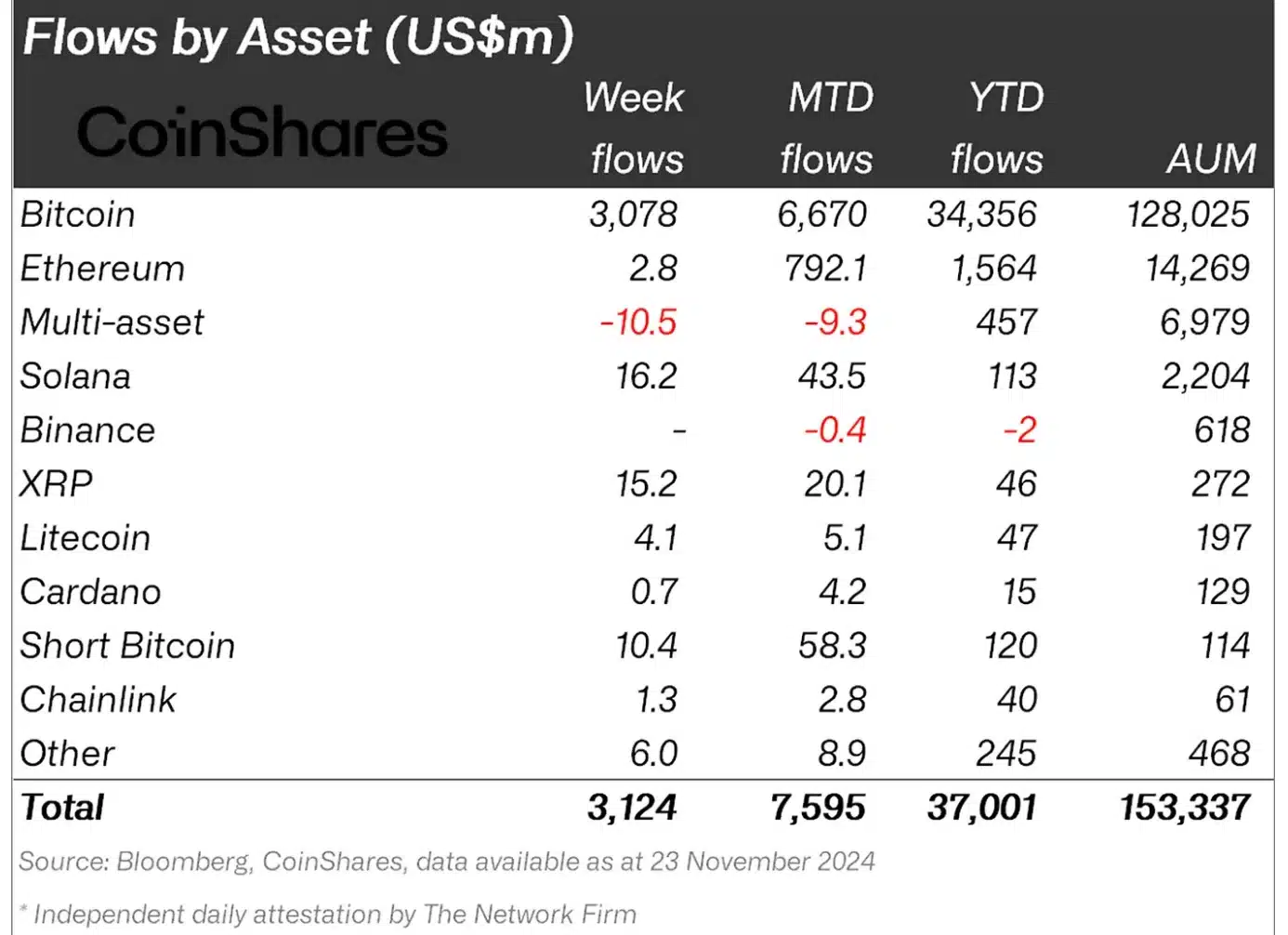

These Bitcoin funds led the charge, contributing $3 billion to the weekly total. This is in stark contrast to the US gold ETF’s first-year inflows of just $309 million.

Bitcoin’s price rise thus continues to attract interest from both institutional and retail investors, while also fueling $10 million inflows into Bitcoin short-term products.

This brought the monthly figure for the product to $58 million, the highest level since August 2022.

Bitcoin is not alone

In other words, while Bitcoin dominated the inflow charts, altcoins also showed themselves to be increasingly attractive among institutional investors.

Solana (SOL), for example, led the altcoin pack with impressive weekly net inflows of $16 million, ahead of Ethereum (ETH) at $2.8 million.

Other notable performers included Ripple (XRP), Litecoin (LTC), and Chainlink (LINK), which earned $15 million, $4.1 million, and $1.3 million, respectively.

Source: blog.coinshares.com

These numbers reflect growing confidence in the altcoin sector due to strong price momentum and growing adoption of these digital assets across a variety of use cases.

Needless to say, these developments have clearly highlighted the massive impact the election will have on the cryptocurrency market.

However, it is important to know that there may be other factors as well. It influenced the trend. James Butterfill, Head of Research at CoinShares, said:

“This recent surge in activity appears to be due to a combination of loose monetary policy and the Republican Party’s landslide victory in the recent US election.”