- Digital asset investment products saw $130 million in inflows for the first time after four weeks of outflows.

- Bitcoin remains above $62,000 and saw $144 million in inflows last week.

The digital asset investment product saw inflows last week for the first time in over a month, according to the latest market data, as Bitcoin showed new resilience above $62,000.

On Monday, digital asset manager CoinShares released its weekly report on cryptocurrency investment products.

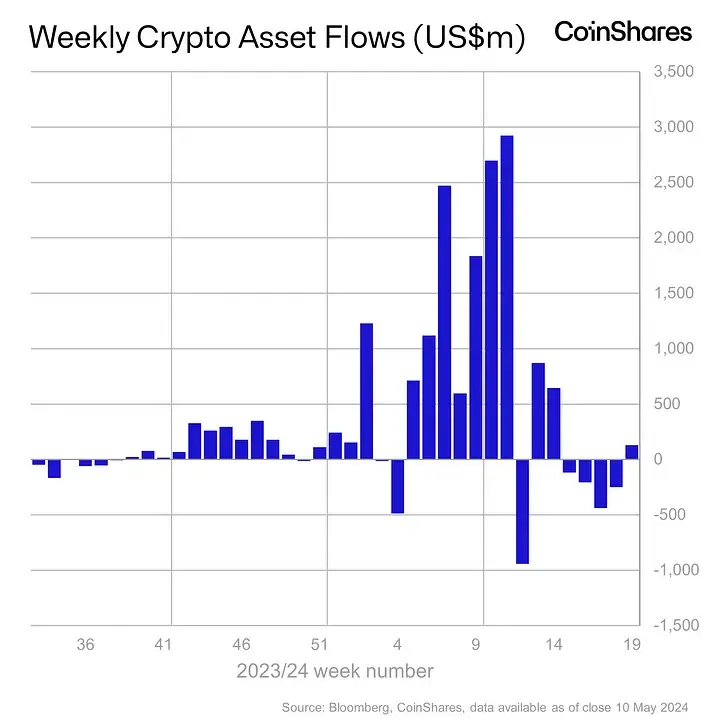

According to details, the industry recorded inflows of $130 million in the week ending May 10. The indicator hit positive readings for the first time since the first week of April, when four weeks of outflows occurred.

In particular, Bitcoin recorded inflows of $144 million, while short-term Bitcoin ETPs recorded outflows of $5.1 million.

The majority of the inflows came from the United States at $135 million. Hong Kong brought in $19 million. Elsewhere, Canada and Germany recorded outflows of $20 million and $15 million respectively.

ETP volume remains low

Although there have been inflows across the board this week, James Butterfill, head of research at CoinShares, wrote on the company’s blog that ETP volume continues to decline.

For example, the market saw ETP trading volume reach $8 billion last week, while in April it averaged $17 billion.

“These trading volumes highlight that ETP investors are currently less engaged in the cryptocurrency ecosystem. This represents 22% of total trading volume on trusted exchanges globally, compared to 31% last month.said Butterfill.