- Cryptocurrency investment products saw $305 million in outflows, with Bitcoin and Ethereum ETFs showing mixed performance.

- Bitcoin has seen gains since the launch of the ETF, while Ethereum has struggled to reach expected price levels.

While the overall market is bullish, the global cryptocurrency market cap has increased by 2.79% in the last 24 hours with most coins up by more than 2%, but concerns are growing as the weekly chart shows declines exceeding 5%.

Cryptocurrency Investment Products at Risk

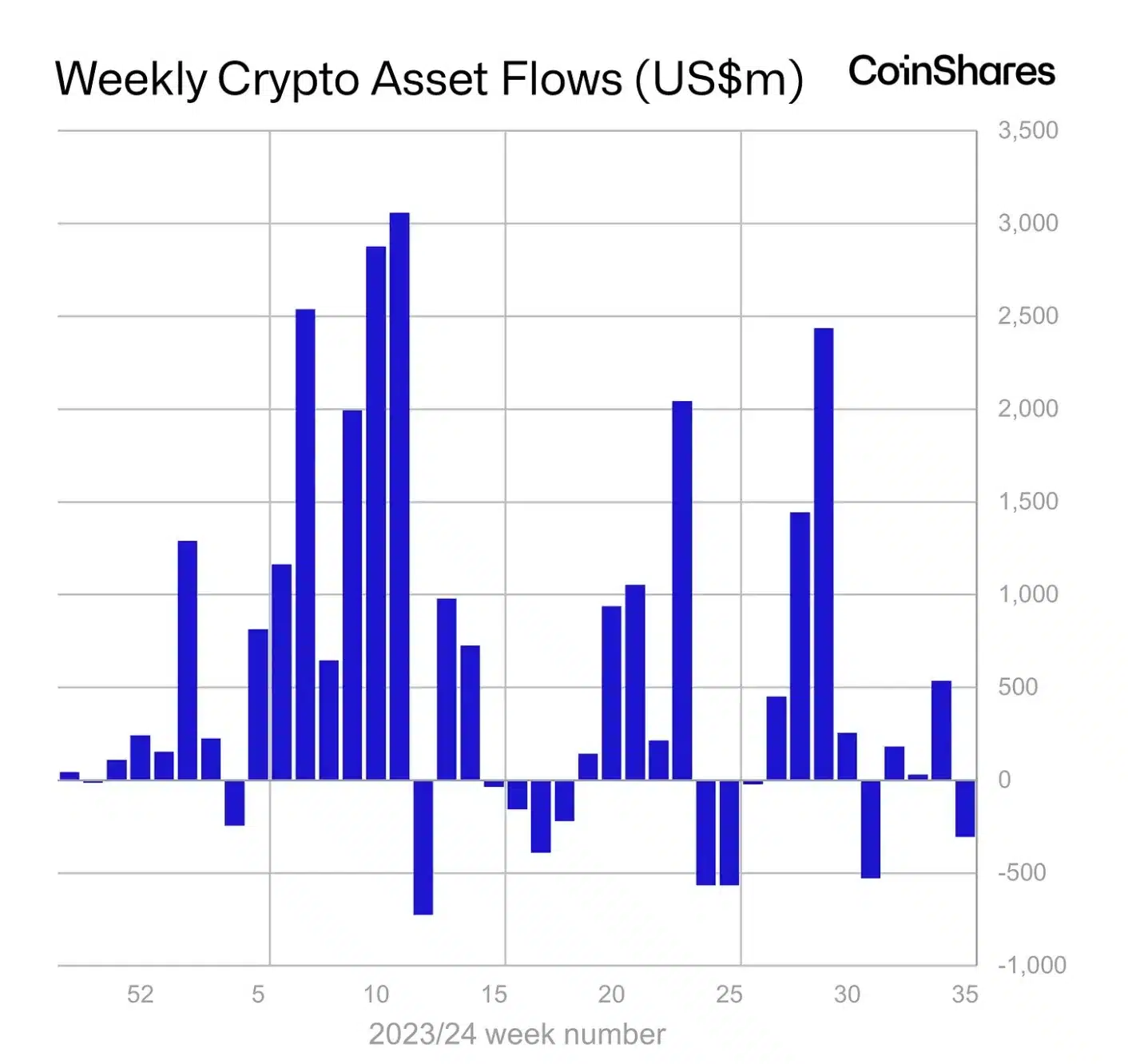

Even more concerning is the significant outflow of funds from cryptocurrency investment products. According to a recent report from CoinShares, a total of $305 million was lost between August 24 and 31.

The reversal comes on the heels of a $543 million net inflow the previous week, which impacted major asset managers such as Ark Invest, Bitwise, BlackRock, Fidelity, Grayscale, ProShares and 21Shares.

Source: blog.coinshares.com

According to the report,

“Negative sentiment was concentrated in Bitcoin, which saw outflows of $319 million. Short Bitcoin investment products recorded inflows of $4.4 million for the second week in a row.”

The analysis also added:

“Ethereum saw outflows of $5.7 million, but trading volumes were flat and just 15% of the levels seen in the week of the US ETF launch.”

Executives’ opinions

Commenting on the unexpected outflow, James Butterfill, head of research at CoinShares, said:

“As the Fed moves closer to the pivot, we continue to expect asset classes to become increasingly sensitive to interest rate forecasts.”

Butterfield explained that this outflow of funds was caused by widespread negative sentiment across regions and suppliers.

This sentiment was fueled by unexpectedly strong U.S. economic data, which reduced the likelihood of a 50 basis point rate cut.

Differences between the two ETFs

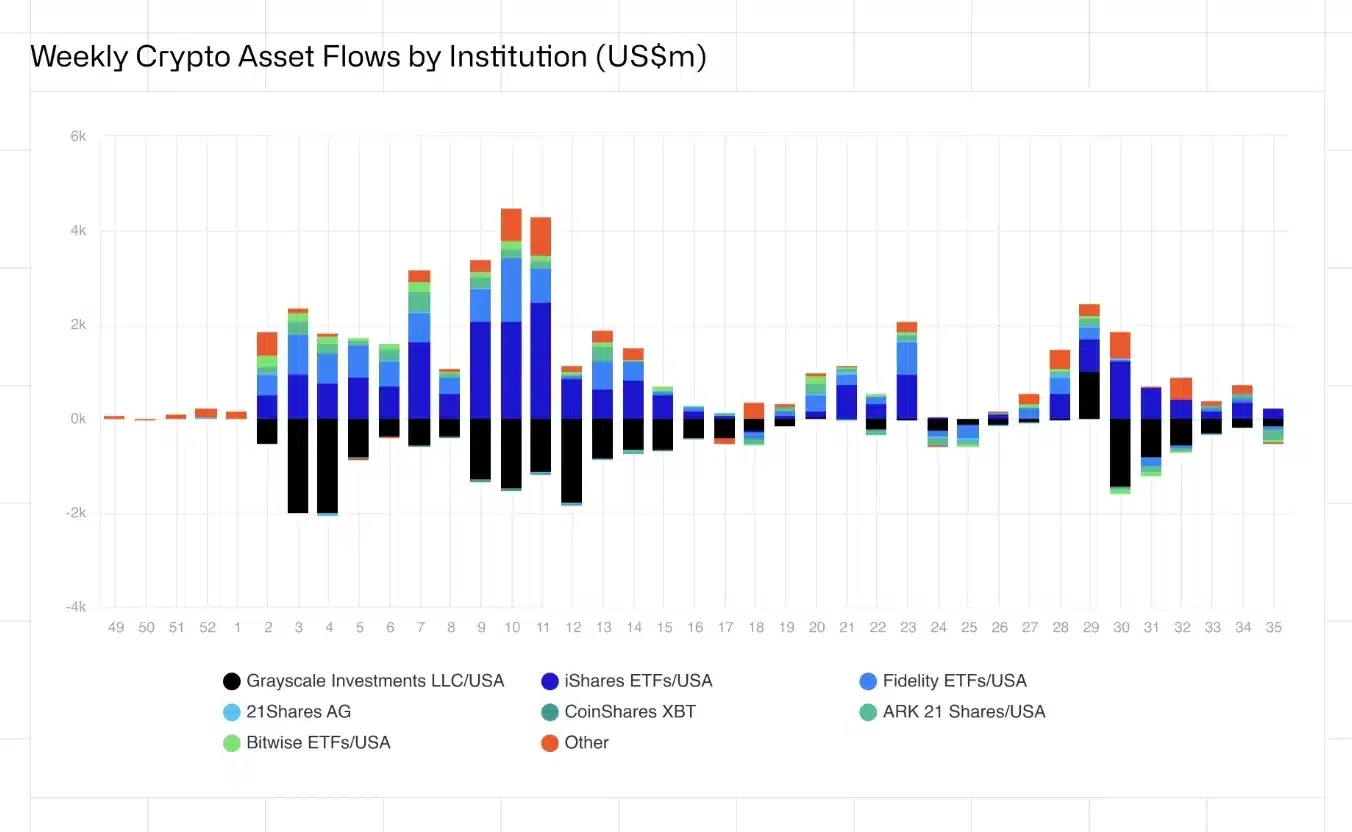

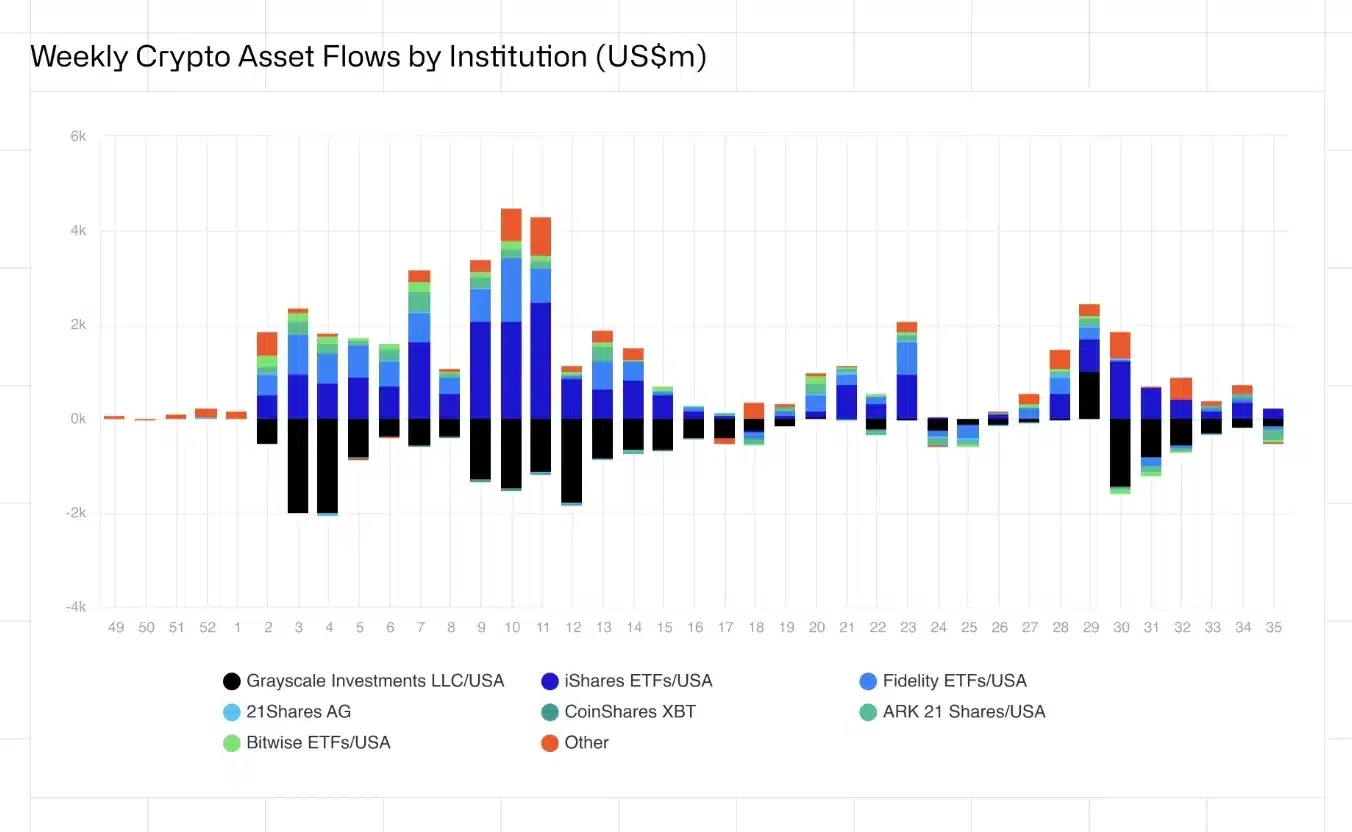

Recent data from Farside Investors confirms this, showing a bearish trend in the Bitcoin (BTC) ETF market, with steady outflows from August 26-30.

Source: blog.coinshares.com

Conversely, the Ethereum (ETH) ETF showed greater stability.

Despite $12.6 million in outflows over the same period, the ETH ETF is showing signs of a potential rebound.

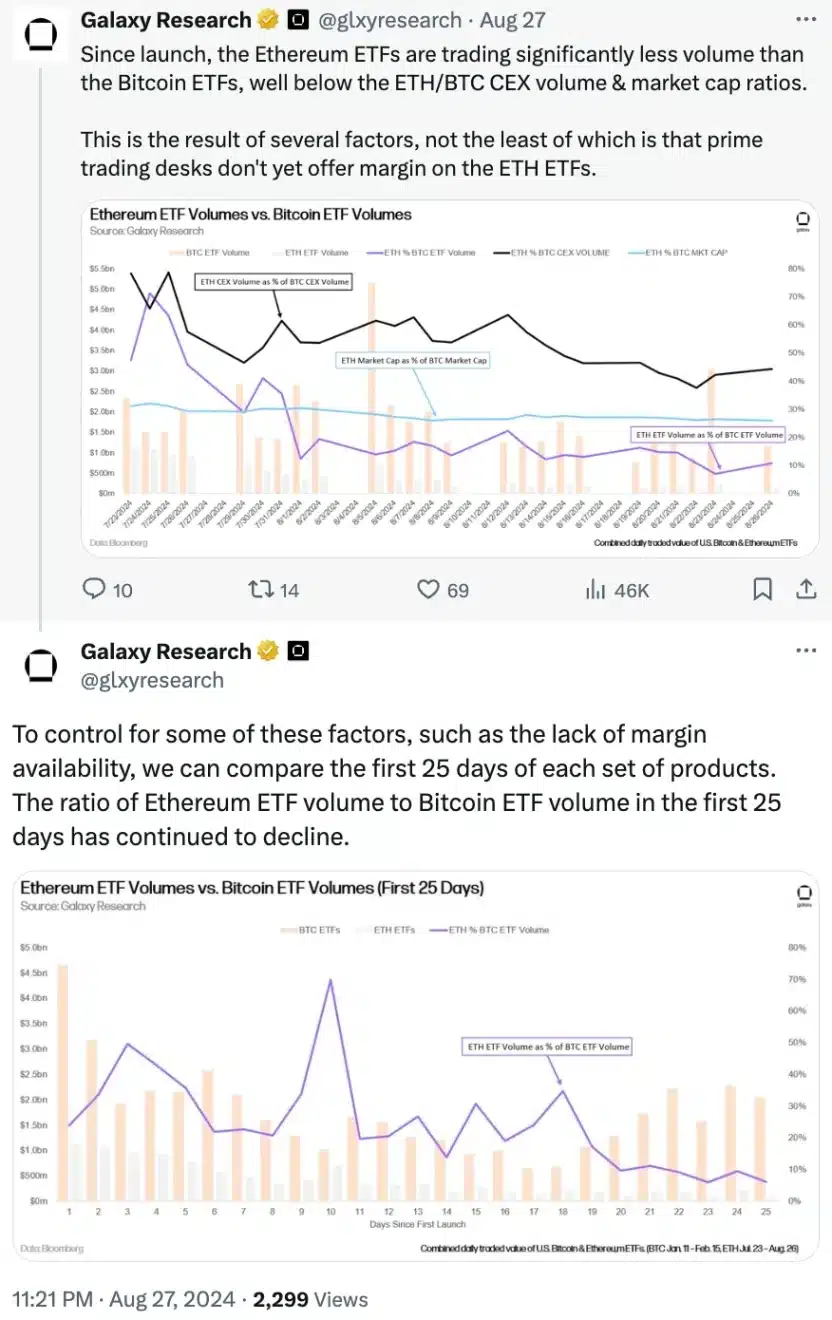

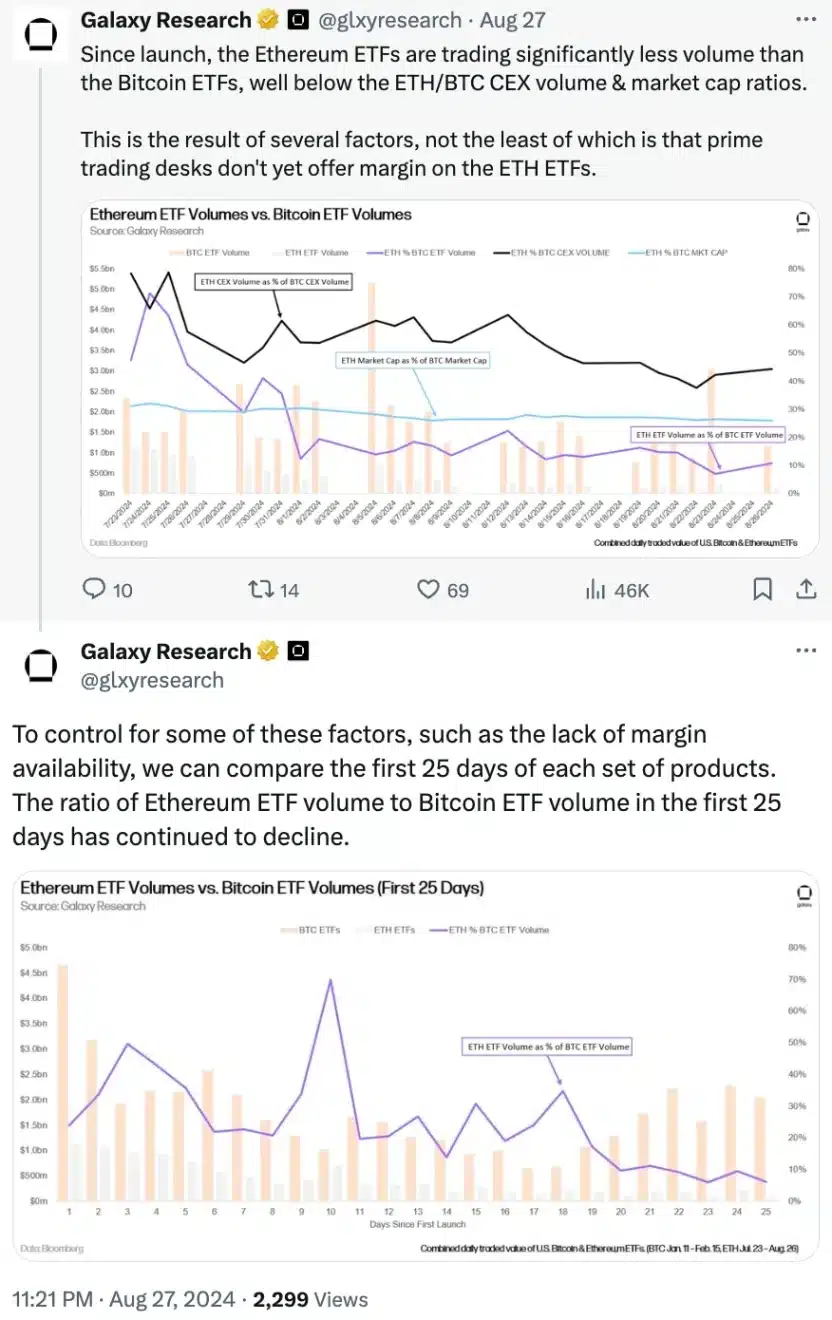

However, it still struggles to compete with Bitcoin ETFs.

Galaxy Research provides insight into this, noting that the recent lower trading volumes for Ethereum ETFs compared to BTC ETFs are primarily due to the lack of margin trading options, which makes them less attractive to institutional investors.

Source: Galaxy Research/X

Impact on price

In terms of price, both BTC and ETH are on an upward trajectory, with green candlesticks appearing on the daily chart.

Over the last 24 hours, Bitcoin is up 2.22%, while Ethereum is up 2.67%.

Despite this gain, BTC and ETH are trading at $59,000 and $2,500 respectively, which are lower than expected following the ETF launch.

It is important to note that following the ETF launch, Bitcoin showed a strong trend, breaking through $70,000 in March.

However, Ethereum struggled to break above the $3,000 level and fell short of the expected $4,000 level.