Last week, investor confidence in cryptocurrency-related investment products surged thanks to the U.S. macroeconomic situation.

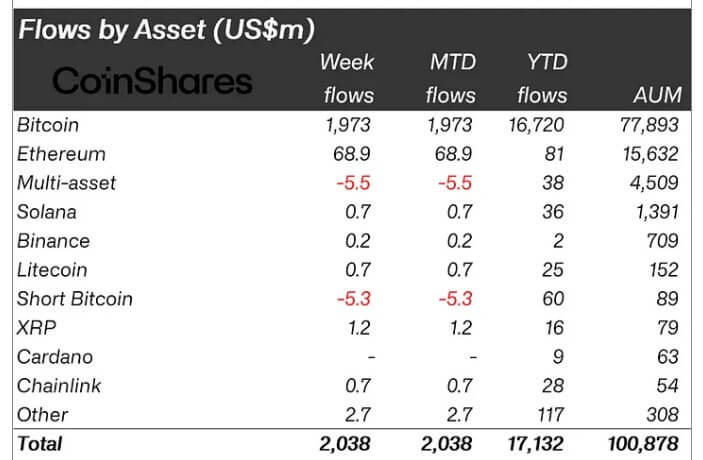

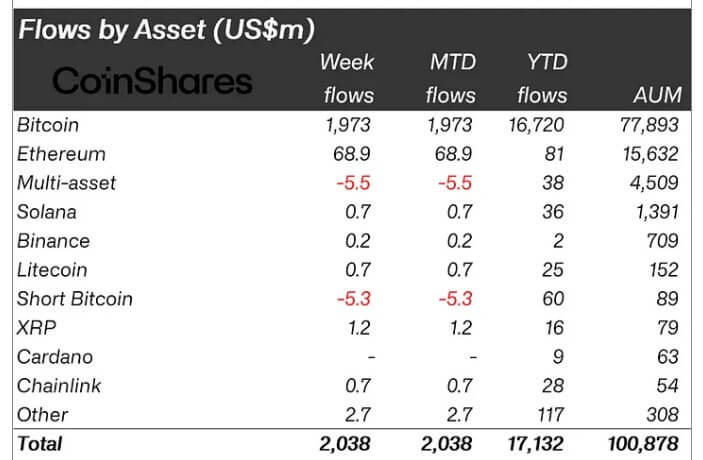

CoinShares said in its latest weekly report that there were $2 billion in net inflows into these financial instruments last week, matching the total inflows recorded in May.

It also marked the fifth consecutive week of positive inflows, with approximately $4.3 billion worth of assets invested during the period. In particular, this is the second-longest continuous inflow since the U.S. Securities and Exchange Commission (SEC) approved a spot Bitcoin exchange-traded fund (ETF) in January.

James Butterfill, head of research at CoinShares, noted that inflows were widespread across providers such as BlackRock, Fidelity, Proshares, Bitwise, and Purpose, while outflows from Grayscale were noticeably reduced.

Butterfill explained that the inflow of funds may have occurred as “weaker-than-expected macro indicators in the United States raised expectations of a monetary policy interest rate cut.” He added:

“(The) positive price action pushed total assets under management (AuM) above $100 billion for the first time since March of this year.”

Meanwhile, trading activity for these investments has surged after several weeks of quiet activity. Last week, trading volume increased 55% to $12.8 billion, significantly exceeding the previous week’s record of $8 billion.

Bitcoin, Ethereum Drive Flow

Bitcoin (BTC) remains a hot topic for investors, with inflows of $1.9 billion. Meanwhile, BTC shorts have experienced outflows totaling $5.3 million for three consecutive weeks.

Ethereum (ETH) saw a significant rebound, recording its best week since March with $69 million in inflows. This increased ETH’s annual flows to $81 million, recovering previous losses before the SEC approved several spot Ethereum ETF 19b-4 filings.

Other important altcoins saw minor activity with inflows of less than $1 million. However, Fantom and XRP stood out, recording inflows of $1.4 million and $1.2 million, respectively.