- World Macroeconomics contrary wind rattle password marketS.

- Encryption price Recovery phase in the second half of the week.

- Macroeconomic factors continue to negatively impact the cryptocurrency outlook.

This week, the cryptocurrency market faced renewed volatility as a wide range of economic factors weighed heavily on digital assets. The sell-off during the week brought the total market cap below $2 trillion, showing that the market is sensitive to external pressures.

However, on Thursday, there was a modest recovery, with the total cryptocurrency market cap surpassing $2 trillion. This provided temporary relief, but it is unclear whether this momentum will continue or whether more volatility is to come, especially with important economic events scheduled for this month.

Cryptocurrency Market Cap Recovers to $2 Trillion

Cryptocurrency markets experienced a significant decline in September, losing $110 billion from peak to trough as macroeconomic pressures continued. According to CoinMarketCap data, the market bottomed out at $1.96 trillion on Wednesday, highlighting the difficulties digital assets face in the current environment.

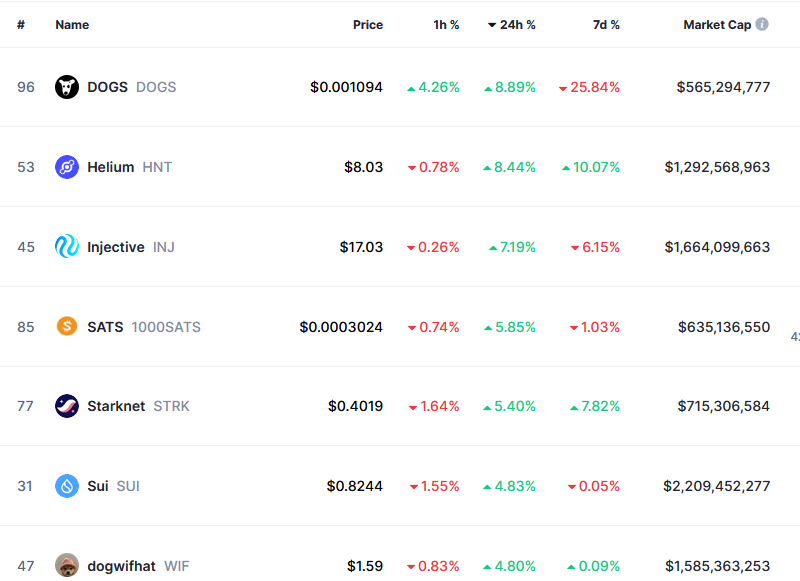

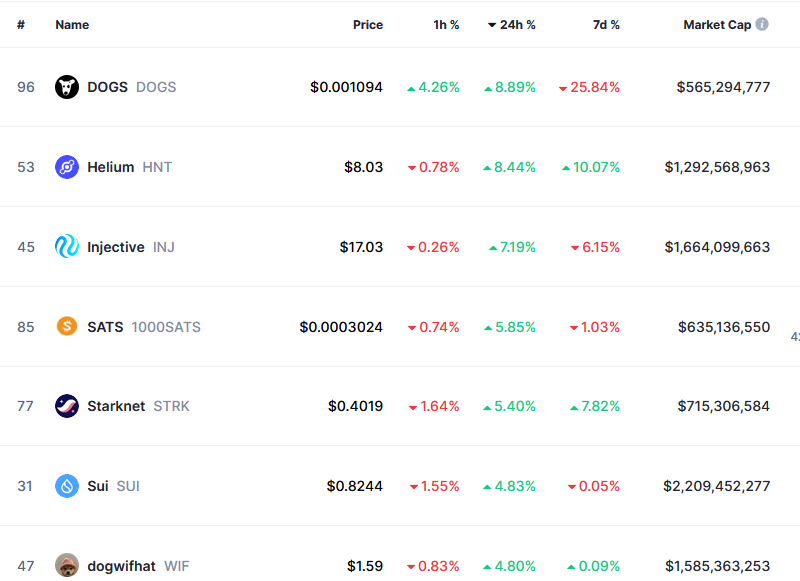

By Thursday morning, the market was showing signs of recovery, recovering $2 trillion. DOGS, Helium, and Injective led the rally, gaining 8.9%, 8.4%, and 7.2%, respectively, over the past 24 hours. However, the top 10 were mostly flat, still struggling to recover from the selloff during the week.

Analysts linked the selloff to further unwinding of the yen carry trade on speculation about a potential rate hike by the Bank of Japan (BoJ). In August, bitcoin plunged to a 26-week low as yen carry traders sold the asset to repay yen-denominated loans following the BoJ’s second rate hike this year.

The recent decline in the U.S. stock market has put further downward pressure on crypto assets, further highlighting the interconnectedness of digital assets, traditional financial markets, and the economy.

Uncertain economic outlook

As the total cryptocurrency market cap recovers to $2 trillion, market sentiment has improved slightly. Cautious optimism is reflected as the fear and greed index has risen from 27 to 29 over the past day. Nevertheless, the possibility of further downturn cannot be ignored due to economic events ahead.

The U.S. economy is set for a busy month. Employment data is due out on September 6th and the CPI is due out on September 11th. The Federal Open Market Committee (FOMC) meeting on September 18th will also be watched closely, with a 25bp rate cut currently looking likely.

Despite the generally positive impact of rate cuts on asset prices, BitMEX co-founder Arthur Hayes has warned that a surge in reverse repo balances could lead to a liquidity crisis, potentially sending Bitcoin’s price to $50,000 in the short term.

On the other side

- Encryption priceTherefore, the total market capitalization is very volatile.

- Downward correction Skepticism grew as the jobs data came out months after the government data.

- Correlation between Bitcoin and Tech Stocks It’s rising.

Why this matters

Despite the market recovering to $2 trillion, macroeconomic uncertainty that increasingly impacts cryptocurrencies remains a concern.

Amid economic uncertainty, investors are sticking with gold over bitcoin:

Bitcoin Struggles as Investors Seek Safety in Gold

Economic factors have a significant impact on the Bitcoin price.

Bitcoin Plunges to 27-Day Low. What’s Causing the Drop?