Cryptocurrency prices remained relatively flat following the FOMC minutes, but US stocks fell as inflation concerns made a hawkish decision unlikely.

Despite the positive consumer price index (CPI) report in April, Fed officials remain skeptical that progress in combating inflation justifies cutting interest rates.

According to minutes from the most recent Federal Open Market Committee (FOMC) meeting, price levels have kept inflation this year well above the Fed’s 2% target.

Some stakeholders who attended the policy meeting suggested considering raising interest rates, but officials, including Chairman Jerome Powell, expressed opposition to austerity economic policies. Federal Reserve President Christopher Waller has previously said the central bank would require several consecutive months of positive inflation data to adopt a dovish approach and ease interest rates.

US stocks fell slightly following the FOMC’s decision to maintain short-term lending rates at 5.25%-5.5%. The S&P 500 was down about 0.27%, according to Google Finance.

However, deVere Group CEO Nigel Green expected the Fed’s outlook to have less impact on investor sentiment in the coming months. “We expect the market’s bull run, which has driven Wall Street’s major indexes to new highs in recent weeks, to continue,” Green said in a note obtained by crypto.news. Interest rate cuts are expected if the U.S. economy makes a soft landing.

A flat cryptocurrency market that does not indicate Bitcoin hedge status.

Bitcoin (BTC) as a hedge against inflation has long served as a rallying cry for the broader cryptocurrency community. The analysis also supports claims about so-called digital gold.

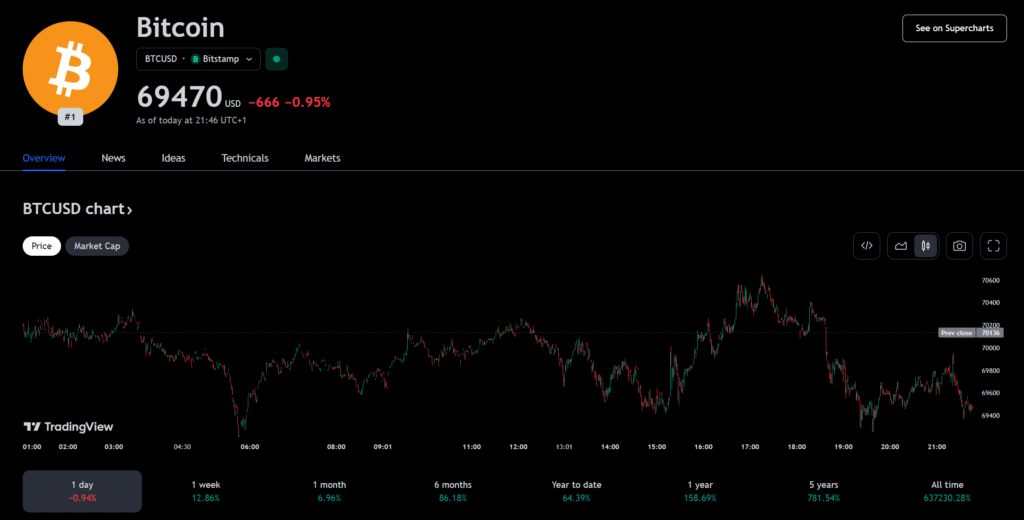

Year to date, the cryptocurrency’s largest token is up about 65%. The asset has seen a boost in demand following the introduction of spot Bitcoin ETFs, with analysts assuming the halving triggered a supply shock.

By comparison, the S&P 500 is up 11.9% during the bullish cycle for U.S. stocks. Extend the period back five years and observers would find an even larger growth gap. While Bitcoin is up 781.3% since 2019, the S&P 500 has managed only 87.7% over that period.

Although Bitcoin spent its first 15 years largely outside of U.S. financial markets, the cryptocurrency has bounced back over the years, establishing itself as an inflation hedge. Wall Street giants like MicroStrategy and BlackRock have jumped into the space.