- Bitcoin has been holding steady above $60,000 since mid-July.

- There are several positive catalysts lining up. Will BTC go higher?

After staying below $60,000 in the first half of July, Bitcoin (BTC) Trump’s attacks partially restored psychological levels and previous low ranges.

The recovery extended during the week, posting gains of more than 8%, but hit a hurdle near $65,000. By the time of writing, the recovery had cooled and fallen below $64,000.

Will Bitcoin Grow With the ‘Trump Trade’?

According to Charles Edwards, founder of cryptocurrency hedge fund Capriole Investment, BTC Stopped The Nasdaq fell to near $65,000.

“Bitcoin is down because Nasdaq is down. But Nasdaq is down because of impending easing and the plateau in AI earnings. The latter has no effect on BTC, the former is bullish on BTC.”

NASDAQ is heavily focused on technology stocks, but investors According to reports To capitalize on the possibility of a Trump victory, they shifted large tech stocks into small cap stocks, which market experts called the “Trump trade.”

According to some market analysts, Trump’s pro-crypto stance could strengthen the bullish scenario for BTC. For example, QCP Capital analysts copy Trump’s vice presidential nominee JD Vance appears to be a positive catalyst for Bitcoin.

“Trump’s selection of JD Vance as his Vice President provides another positive catalyst. Vance holds BTC and is expected to lobby for crypto-friendly regulations if Trump is elected.”

The firm added that the Ethereum (ETH) ETF, expected to launch on July 23, is another bullish catalyst. On-chain indicators also supported the bullish outlook.

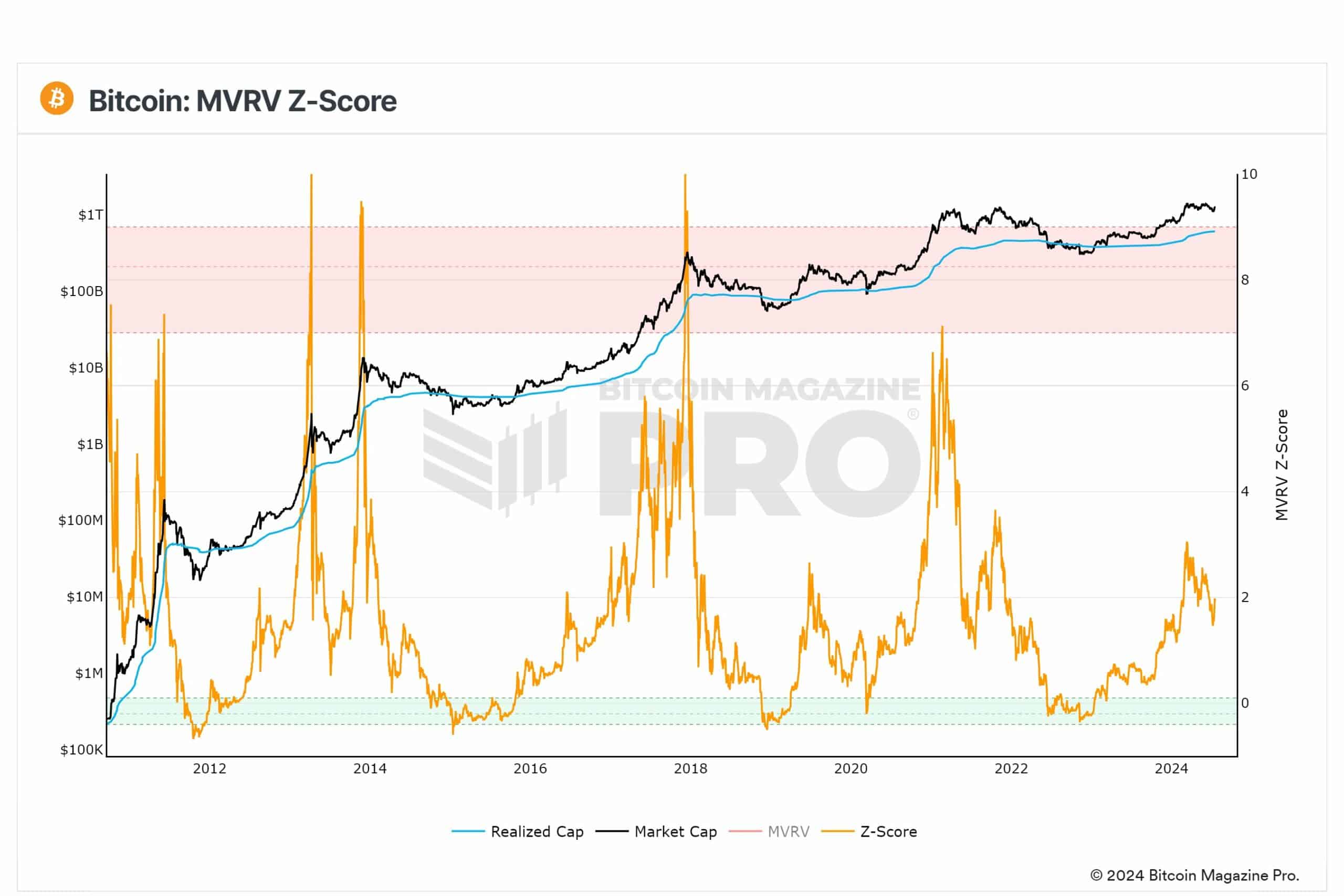

MVRV-Z scores indicate greater upside potential.

Source: X

Philip Swift, founder of Look Into Bitcoin, rebranded as Bitcoin Magazine Pro famous As the MVRV-Z score recovered, the BTC bears reacted in disbelief.

“MVRV Z-Score: There’s more to come from this bullish cycle. The Z-Score has now risen back to 2. The bears are incredible.”

MVRV (Market Value to Realized Value)-Z Score is a BTC market cycle top and bottom indicator. It has accurately predicted past market tops (>7) and bottoms (0).

However, the indicator is not overheated and has not signaled a market top as of the time of writing, which means more headroom for BTC.

also, Cryptocurrency Options According to Deribit data, $1.8 billion worth of options are set to expire on July 19. The largest losses as options expiration approaches for BTC and ETH were $62,000 and $3,150, respectively.

This meant that we could expect BTC and ETH to suffer the most overall declines. However, the possibility of an ETH ETF launching next week may not reverse the rally.