- ORDI, Stacks, and Kaspa were the biggest winners this week.

- Beam, Celestia and Lido DAO top the list of losers this week.

ORDI (ORDI), Stacks (STX), and Kaspa (KAS) were the top gainers this week, while Beam (BEAM), Celestia (TIA), and Lido DAO (LDO) topped the charts on the other side.

biggest winner

ORDI

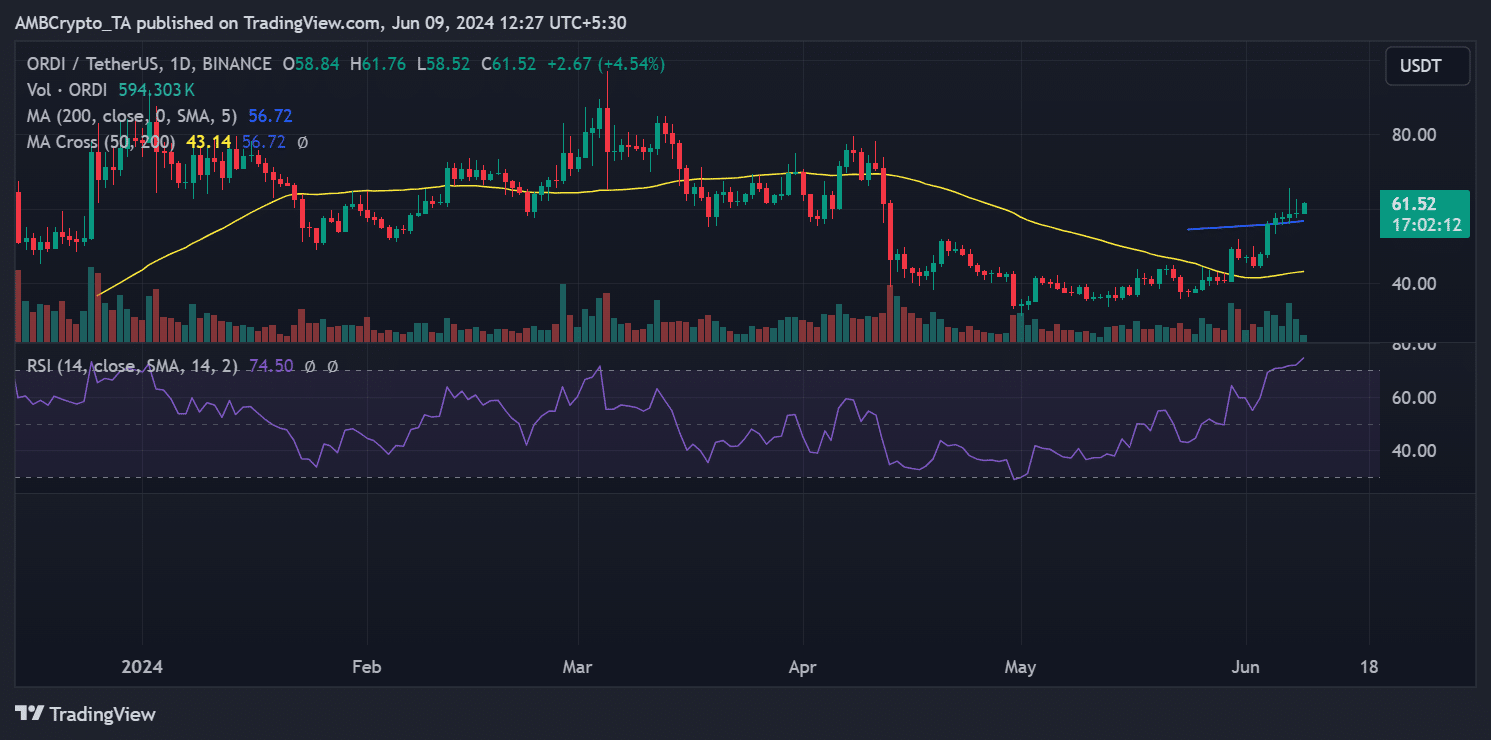

Daily analysis of ORDI’s price trends reveals an interesting positive trend.

ORDI began to rise positively on the second day of the week, but has continued to rise since the initial price increase.

The week started with a 4.56% decline, dropping the price of ORDI from around $47.50 to around $45.00. However, these setbacks were quickly overcome as the asset began its steady rise.

The chart reveals two significant price movements that triggered an upward trend for ORDI. On June 3, ORDI experienced a surge of more than 6%, bringing the price back to the $47 range.

The next day, it increased by a whopping 17%, bringing the price to over $55.

By the end of the week, ORDI was trading at nearly $59.

Source: TradingView

ORDI was the biggest winner of the week, boasting an impressive gain of over 25%, according to data from CoinMarketCap.

At the time of writing, ORDI has risen another 4%, pushing the price above $61. Its market capitalization reached nearly $1.3 billion.

However, trading volume fell by about 30% to about $314 million.

Stack (STX)

According to CoinMarketCap, STX is the second-highest gainer of the week, with an impressive gain of over 22.5% over the past seven days.

Stacks started the week on a negative note, trading around $1.80, according to AMBCrypto’s analysis. However, it gained momentum from June 3 and showed a continuous upward trend.

According to the chart, STX hit a high of about $2.48 at one point during the week. By the end of the week, it was trading at around $2.24.

As of this writing, STX is up slightly to around $2.27.

Additionally, data shows that at the time of writing, Stax’s market cap was around $3.3 billion, but has declined over the past 24 hours.

Trading volume also fell by more than 50% over the past 24 hours, remaining at about $145 million.

Caspar (KAS)

AMBCrypto’s analysis of KAS shows that it started the week at around $0.14, beginning an upward trend on the first day.

Looking at the chart, we see that KAS continues to rise, reaching the $0.19 range at one point during the week. However, it has since declined and was trading at around $0.16 at the end of the week.

Despite the decline, Kaspa (KAS) rose more than 15%, the third biggest gainer of the week, according to data from CoinMarketCap. As of this writing, it is still trading at a price of $0.16.

The data shows that the market capitalization was about $3.8 billion, but has declined by more than 5%.

Similarly, trading volume dropped significantly by more than 40% in the last 24 hours, reaching around $67 million.

biggest loser

beam (beam)

AMBCrypto looked at BEAM’s price chart and found that it lacks a positive trend. BEAM started the week around $0.27 and continued to decline throughout the week.

By the end of the week, the price had fallen to around $0.22. BEAM had the biggest decline of the week, falling about 20.8%, according to CoinMarketCap.

At the time of this writing, BEAM is trading around $0.23 and is down more than 3% with a market capitalization of around $1.1 billion.

Trading volume fell by more than 40%, reaching approximately $13.8 million.

Celestia (TIA)

Celestia is closer to the ground than to the stars. TIA started the week on a positive note, trading around $11.46, according to AMBCrypto’s analysis.

However, it then began to decline, falling to around $9.10 by the end of the week.

The decline marked TIA’s second biggest decline of the week, losing more than 20% of its value over the past seven days, according to CoinMarketCap data.

As of this writing, TIA is still trading around the $9.10 price range. Its market capitalization has fallen more than 6% in the past 24 hours, reaching about $1.7 billion.

Trading volume also fell by about 50%, reaching about $75 million.

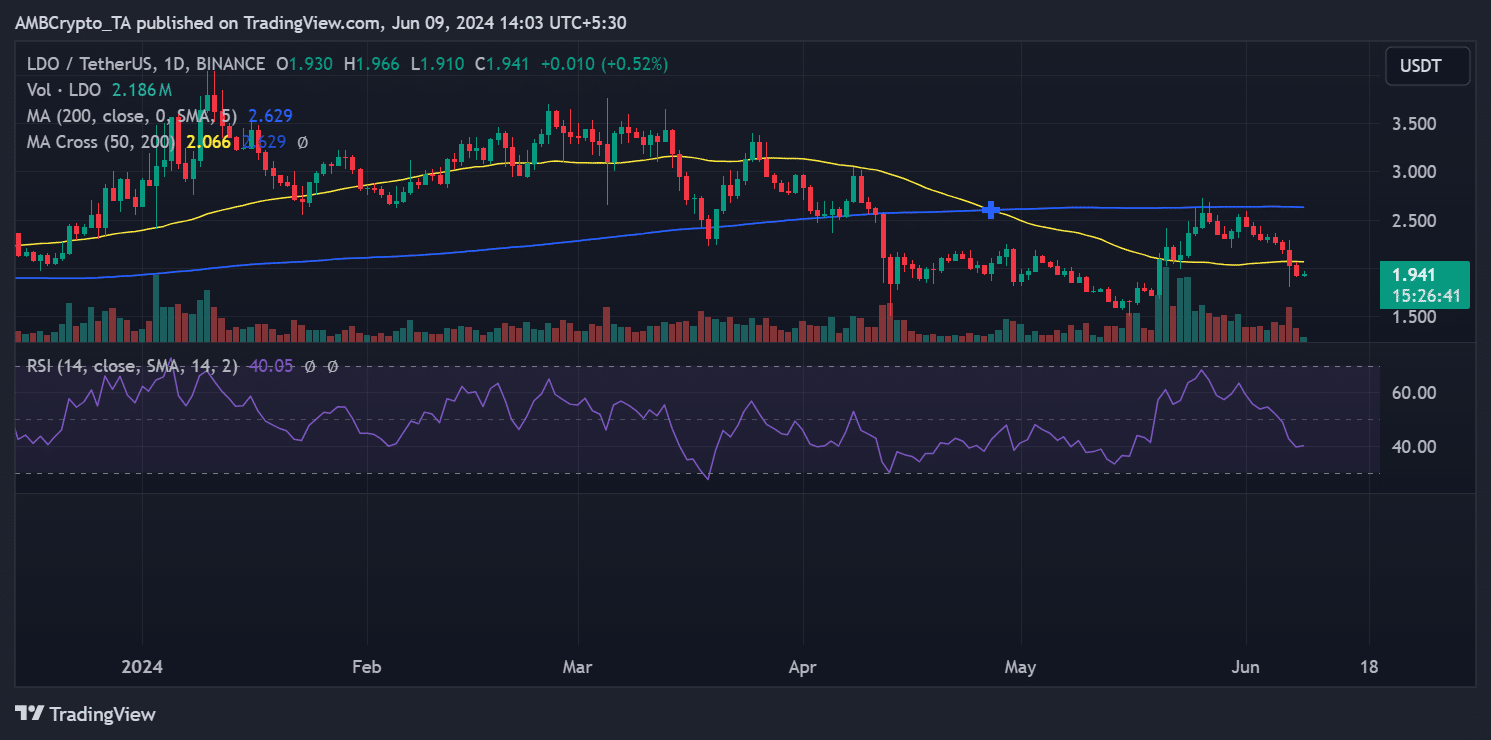

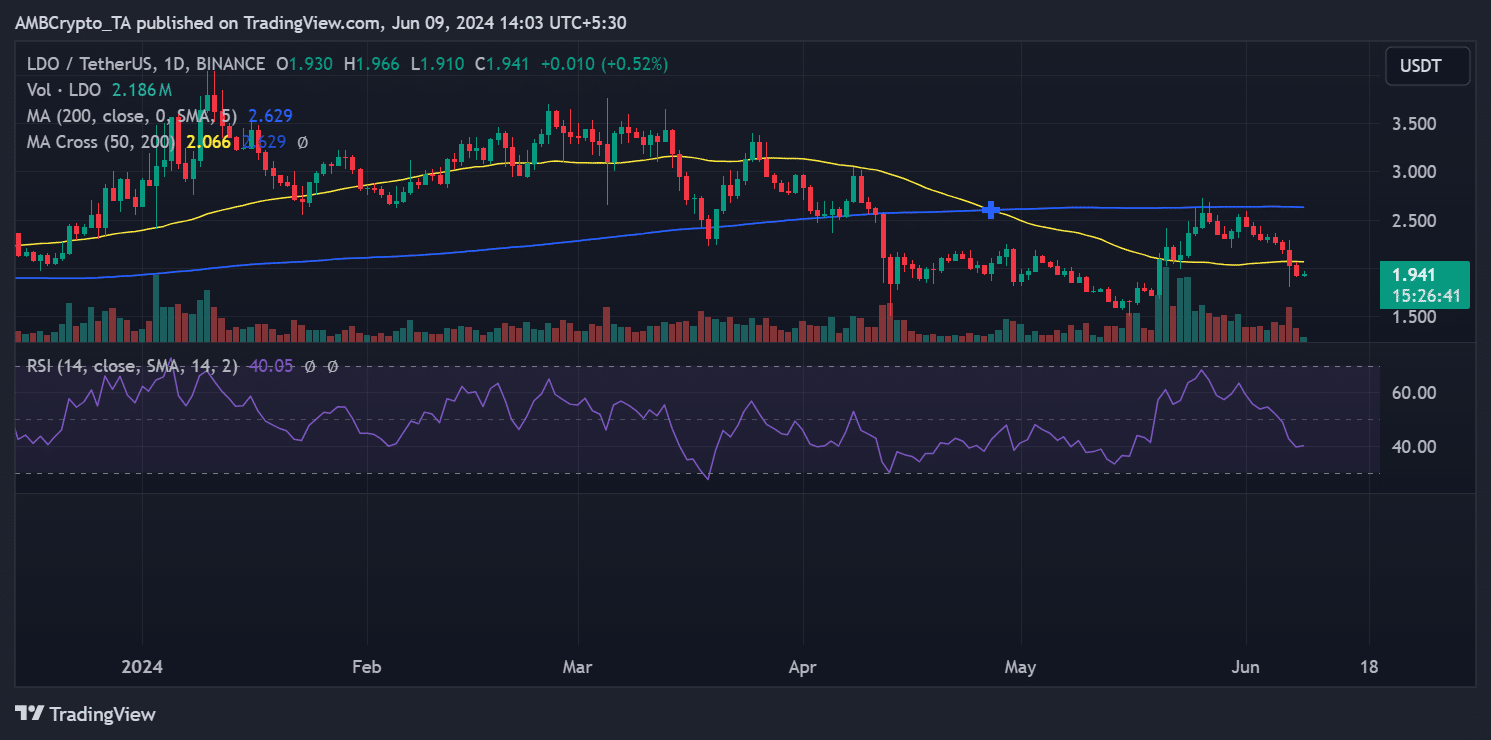

Lido Dao (LDO)

Lido DAO started the week at around $2.30 on daily time frames. According to the chart, it started with a 3.56% decline and continued throughout the week.

By June 7, LDO had fallen to around $2.00, breaking the support line (yellow line). It fell 4.8% over the weekend to trade around $1.90 and is currently trading below support levels.

The decline of LDOs Additionally, the relative strength index (RSI) rose to 40, indicating a strong bearish trend. LDO fell more than 19%, making it the third-biggest loss of the week, according to CoinMarketCap.

Source: TradingView

Its market capitalization has fallen more than 5% in the past 24 hours, reaching around $1.7 billion. At press time, trading volume was down more than 20% to about $143 million.

conclusion

Here’s a weekly recap of who gained the most and who lost the most. It is important to keep in mind the volatile nature of the market, where prices can change quickly.

Therefore, it is best to do your own research (DYOR) before making any investment decisions.