The Hong Kong Monetary Authority (HKMA) recently issued an important new circular regarding cryptocurrency storage platforms. Aimed at authorized entities (AIs), this guidance outlines a comprehensive framework for providing custody services for digital assets.

As a result, interest in digital asset trading and management service platforms has reached new heights as the cryptocurrency sector has made significant progress in Hong Kong.

The Hong Kong prototype aims to store cryptocurrency.

The HKMA’s circular is a pivotal step towards ensuring strong protection and proficient management of customer digital assets and establishing a set of standards and guidelines for AI to follow.

The key point of this new guidance is that AI must conduct a thorough risk assessment and formulate policies and controls to mitigate the risks associated with storing digital assets.

The circular emphasizes the importance of maintaining distinct governance structures, operating arrangements and effective risk management practices. An important aspect of these guidelines is that they provide protection in the event of bankruptcy by separating customer digital assets from the AI’s own assets.

“In order to properly protect customer digital assets held by AI and appropriately manage the associated risks, the HKMA considers it necessary to provide guidance on the provision of digital asset management services by AI,” the circular said.

Read more: Cryptocurrency regulation: what are the pros and cons?

This move towards greater security is further strengthened by the HKMA’s insistence that AI must adopt industry best practices and international security standards, especially when it comes to managing and protecting the seeds and private keys of digital assets.

At the same time, the Securities and Futures Commission (SFC) has been actively involved in shaping the regulatory environment for virtual asset trading platforms (VATPs) in Hong Kong. By February 29, all cryptocurrency exchanges operating within Hong Kong jurisdiction will be required to obtain or apply for a VATP license.

These developments are critical to creating a regulated and safe environment for virtual asset investors. The SFC’s guidance emphasizes the need to trade through licensed exchanges and highlights the risks associated with unlicensed platforms. This could potentially lead to account closure if the investor does not comply by the set deadline.

Competing for cryptocurrency hub status

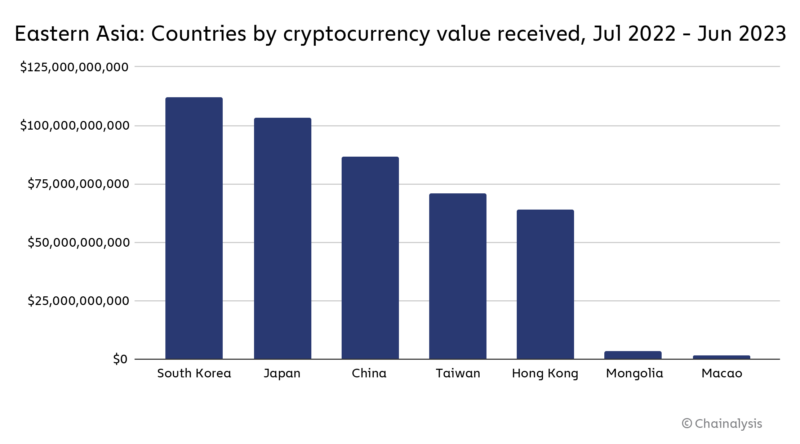

Hong Kong’s cryptocurrency market not only thrives in a regulated environment. Trading volume is also booming. The region traded approximately $64 billion in received cryptocurrencies between July 2022 and June 2023. Active over-the-counter (OTC) markets are largely driving this market activity.

In particular, these OTC desks play a critical role in the city’s cryptocurrency economy, playing a critical role in facilitating large-scale transactions for institutional investors and high-net-worth individuals.

These regulatory actions by the HKMA and SFC demonstrate Hong Kong’s commitment to creating a balanced ecosystem. They aim to promote innovation while ensuring strict investor protection.

Ultimately, these developments will position Hong Kong as a digital asset hub, influencing traders and aligning with global security standards.

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts.

This article was initially edited by advanced AI, designed to extract, analyze and organize information from a wide range of sources. We operate without personal beliefs, emotions, or biases and provide data-driven content. Articles have been meticulously reviewed, edited and approved by human editors to ensure relevance, accuracy and compliance with BeInCrypto’s editorial standards.