The market has increased rapidly as the market has the biggest impact between Bitcoin, Ethereum and Dogecoin. In the last 24 hours, the total liquidation has been $ 66.3 million, which has influenced more than 224,000 traders.

Bitcoin records the largest share price, with a liquidation of $ 228 million and Ether Leeum $ 188.85 million.

Source: X

Dogecoin suffered the most pain among the top 10 cryptocurrencies, with a decrease in price of $ 227.9 million due to a 13%drop. The largest single liquidation order, worth $ 33.9 million in the BTCUSDT pair, occurred.

Trump’s Bitcoin spells and uncertainty over a wider market situation, the traders have advanced and predicted more volatility.

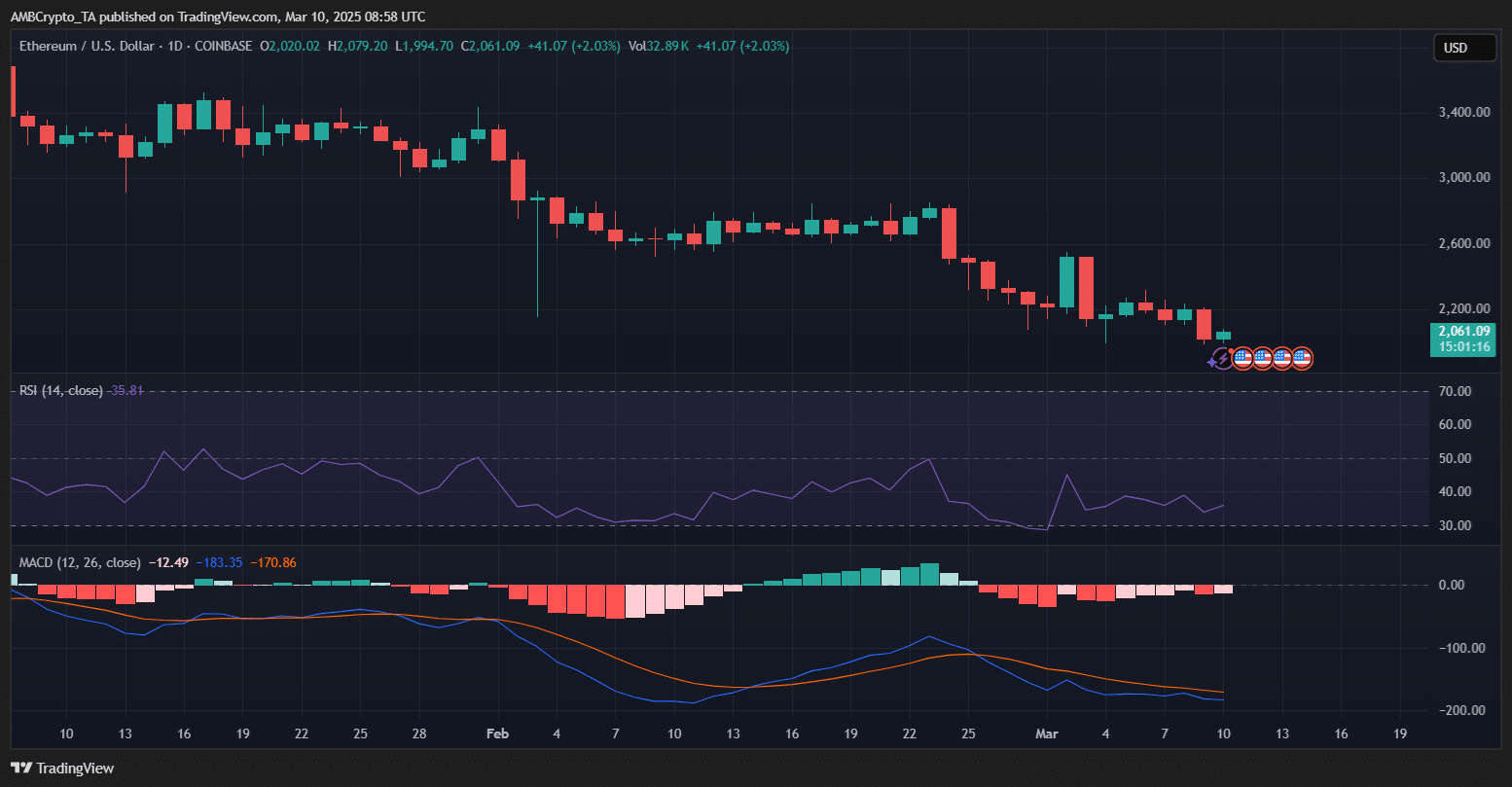

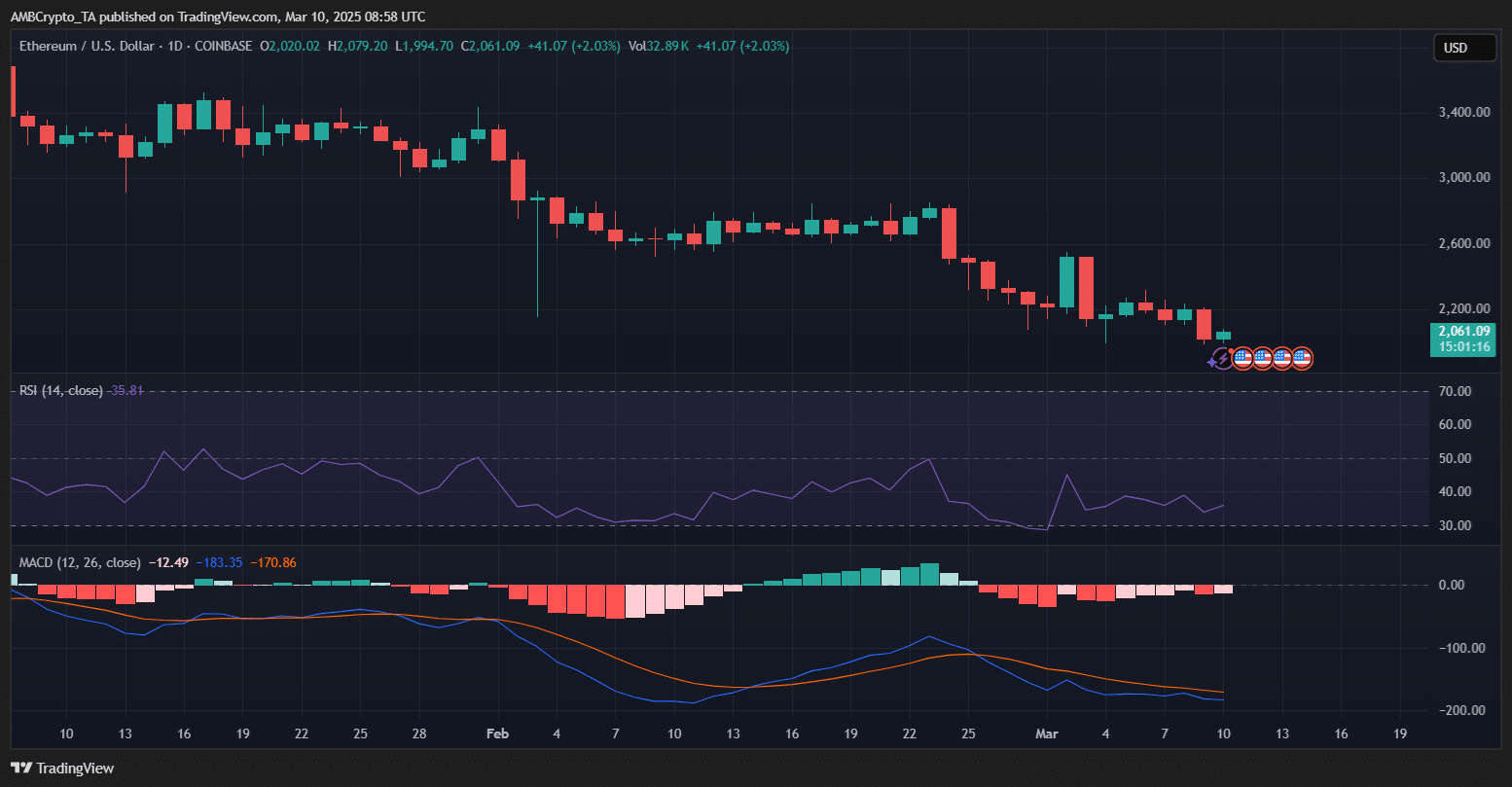

BTC, ETH and Doge struggle

Following the wave of liquidation, major cryptocurrencies are attempting to stabilize, but the weakness is still strong.

Source: TradingView

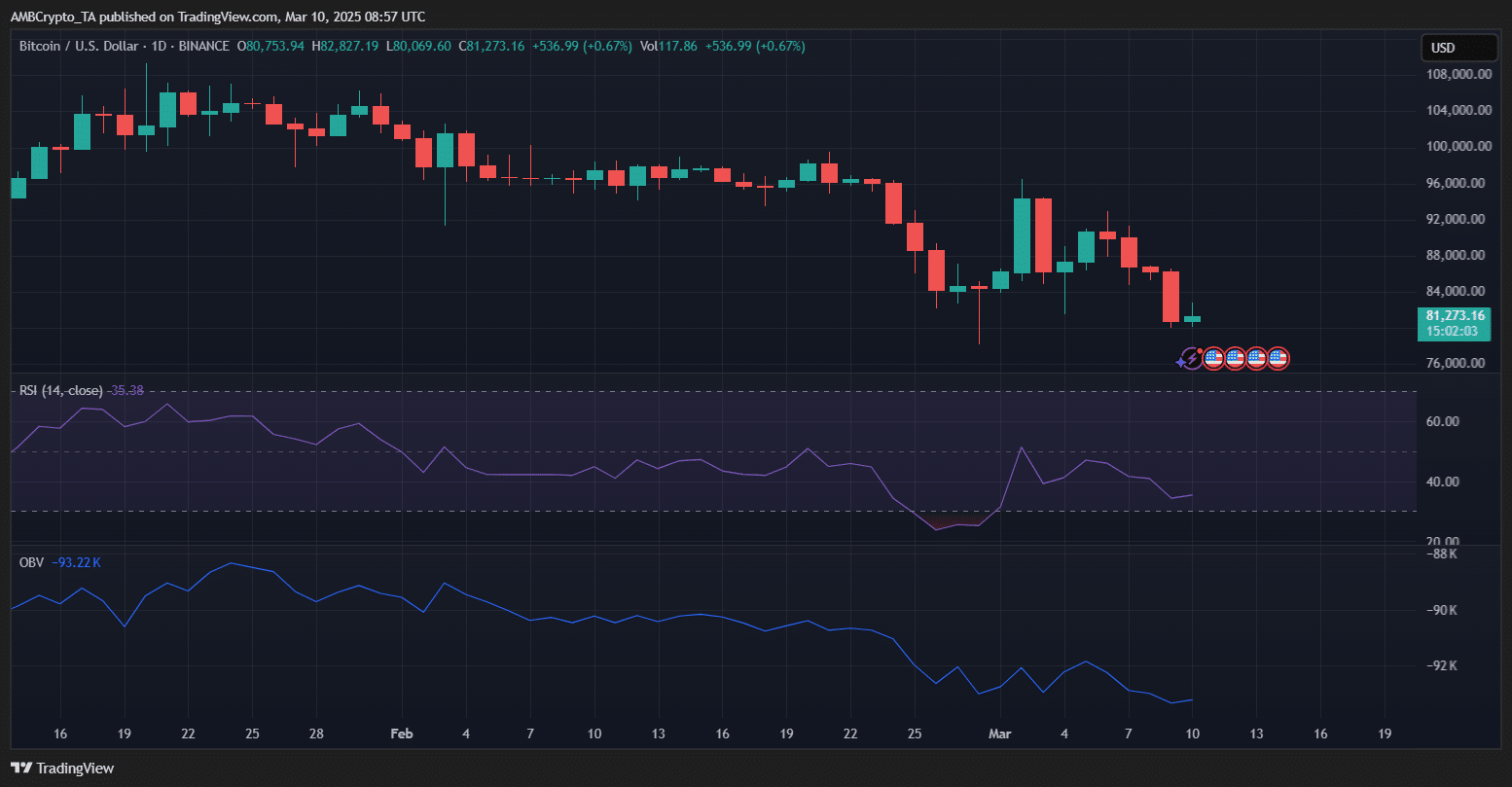

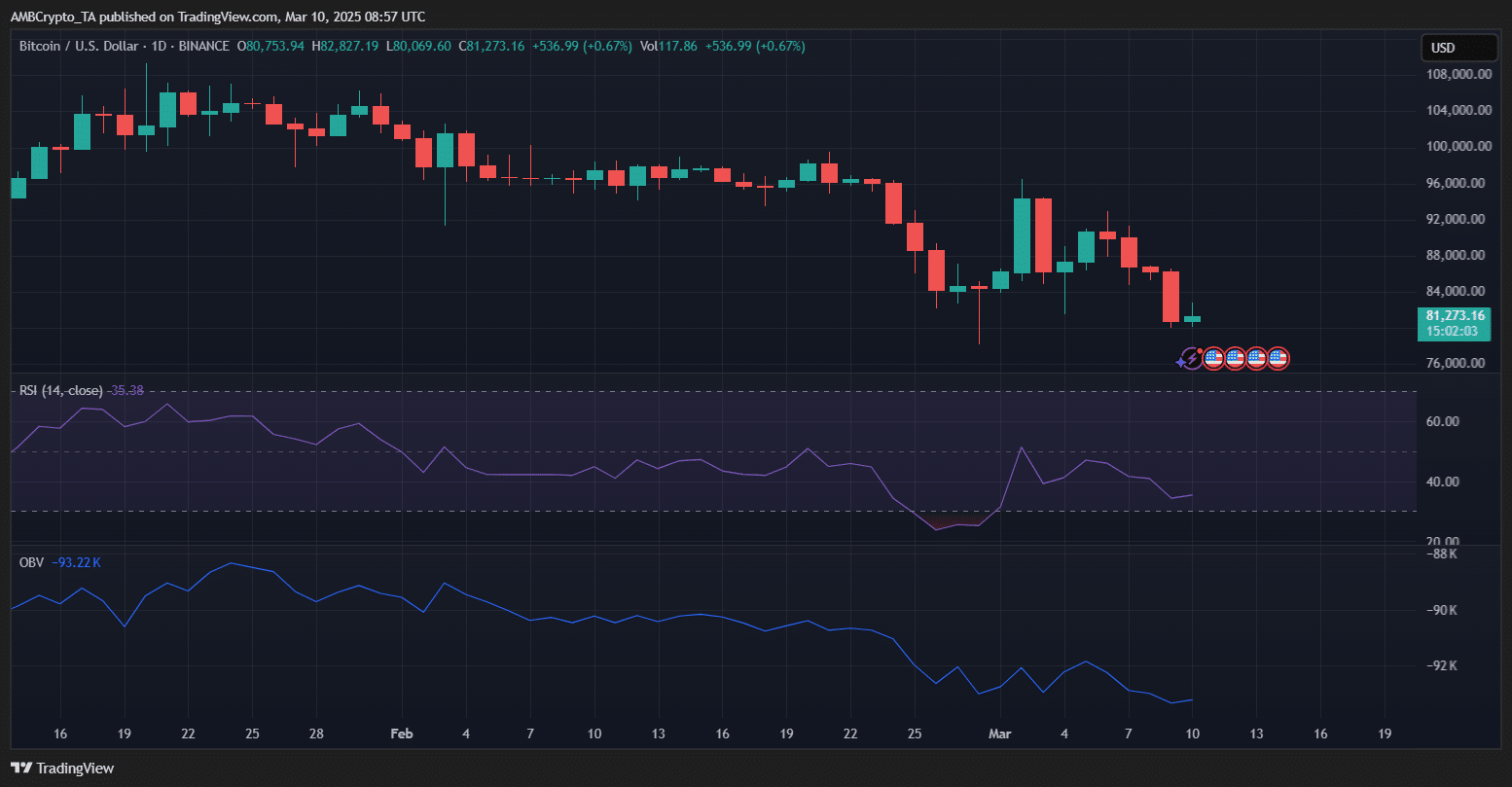

In the press time, Bitcoin traded at $ 81,273 and struggled to regain momentum after the recent decline. The RSI sat at 35.38 to announce the condition of the resale and suggested the potential relief bounce.

However, the downward trend remains intact, and the strong resistance is nearly $ 84,000. The OBV also shows a weak purchase pressure and represents a careful feelings between merchants.

If the BTC does not have more than $ 80,000, there may be more disadvantages for $ 78,000. More than $ 84,000 rest can change the momentum that is favorable to the bull.

Source: TradingView